Rates stability would be a game-changer for fixed income

Fixed income investors have had a bumpy ride in 2022, as central banks’ increasingly aggressive efforts to get inflation under control have driven weakness and volatility in key rates markets such as US Treasuries (USTs), dragging corporate bond returns down with them.

However, with central banks speeding through their hiking cycles, we believe the peak in 10-year UST yields isn’t far away, and a return to rates stability could allow investors to reap the rewards of bond yields that are unusually high for this point in the cycle.

Inflation is still driving the market mood

As we’ve noted for some time, the post-COVID economic cycle has moved unusually quickly. Only 12 months ago economic fundamentals could hardly have looked better, while today global GDP growth is declining rapidly and we are debating whether recession can be avoided in the US, Europe and elsewhere.

The spread between two-year and 10-year USTs has been inverted since early July – historically a reliable predictor of recession – while Europe is facing a winter without gas as Russia’s invasion of Ukraine continues to wreak havoc on commodity prices and global supply chains.

At the heart of all this of course is inflation, which in our view remains the overwhelming driver of investor sentiment and, just as crucially, mutual fund flows.

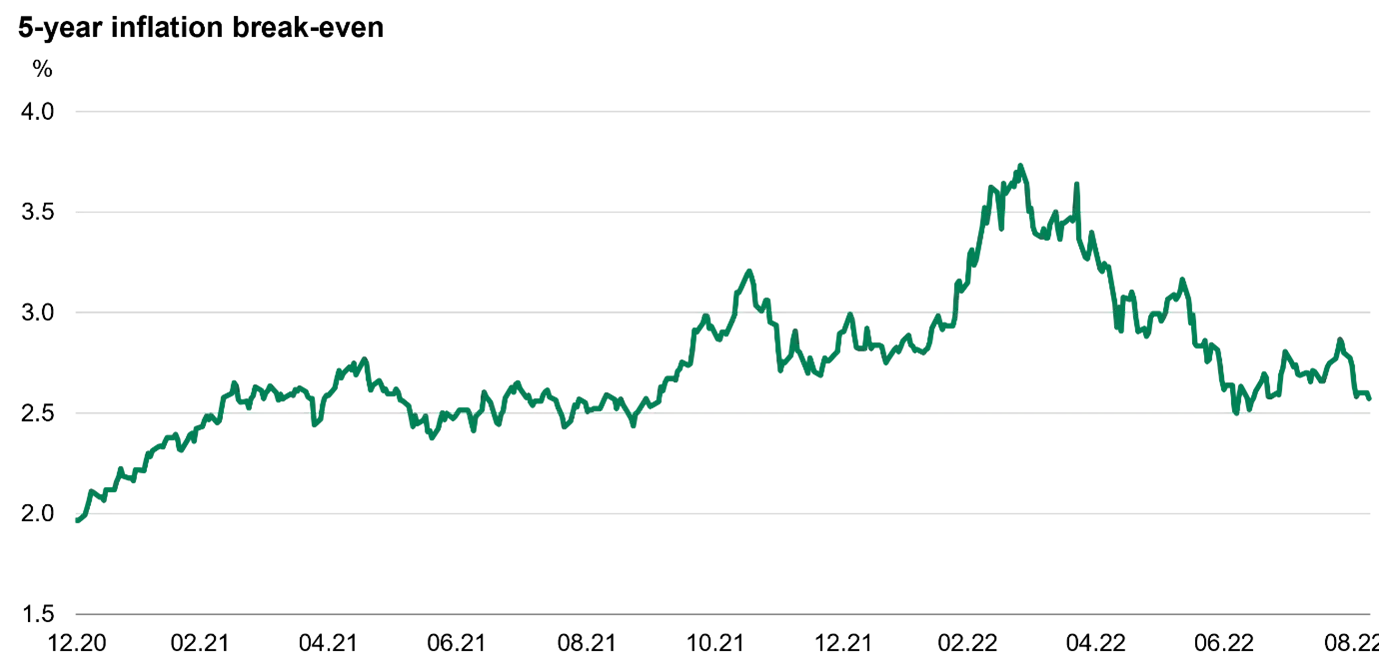

The news on this front has been more positive in recent weeks. US Consumer Price Index (CPI) data suggests annual headline inflation has finally peaked, with June’s 9.1% figure followed by 8.5% for July and 8.3% for August. And as the chart below shows, the five-year break-even (a popular proxy for inflation expectations) shows the market thinks the Fed is gaining the upper hand in its battle with inflation.

Break-even suggests Fed is winning inflation battle

Source: Bloomberg, 7 September 2022

Significantly though, European governments are now moving to stem the alarming rise in energy prices on this side of the pond. The UK’s roughly £150bn package is forecast to cut inflation by 500-800bp and bring its peak forward by several months, and the announcement of a coordinated EU plan is imminent.

However, despite this positive news, the grip inflation still has on investor sentiment was laid bare on September 13, when month-on-month core inflation in the US came in well ahead of expectations for August, and its stickiness sparked an immediate sell-off in USTs and the worst day for US stocks in two years.

Central bank uncertainty is the root of 2022 woes

The sharpness of market reactions to inflation surprises is borne out of uncertainty around central bank policy. With inflation repeatedly trumping expectations, markets are left wondering just how high central banks will have to hike rates before they get it under control.

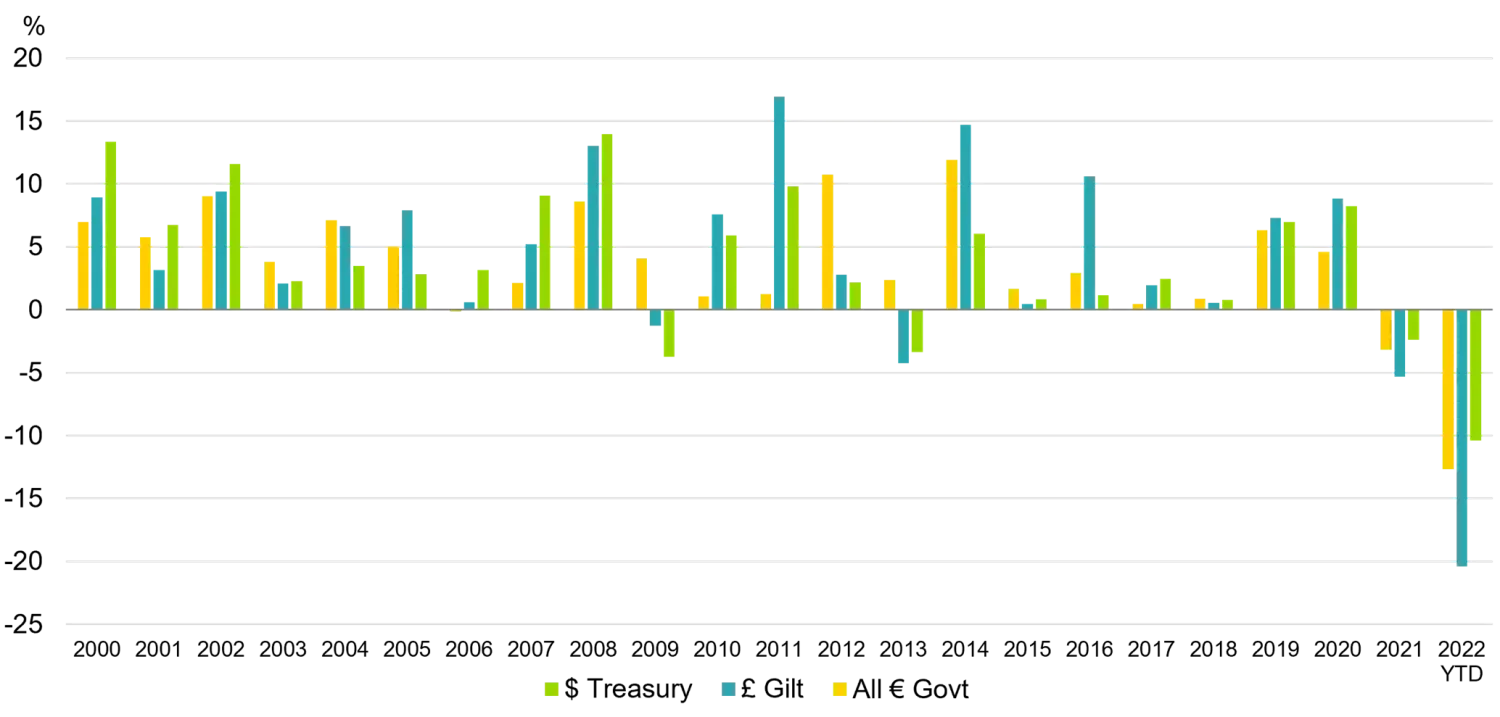

It is this dynamic that has driven the torrid performance of major government bonds (‘rates’ in bond market parlance) over the course of 2022; the longer inflation has stayed elevated, the more investors have repriced government bond yields higher to account for more aggressive rate hikes.

Government bond indices – total return ($, £, €)

Source: Bloomberg, 7 September 2022

This weakness in rates markets has left investors with nowhere to hide, as rising government bond yields have overwhelmed the relatively slim spreads on investment grade corporate bonds, and risk-on assets such as high yield bonds have also suffered heavy mark-to-market losses due to spread widening as fears of recession have increased.

For years investors have got used to central banks solving problems, rather than creating them, either by holding base rates at record lows or supporting asset values with quantitative easing. Central bank policy was previously a source of certainty for markets – now it is the opposite.

But rates stability is getting closer

However, this uncertainty is now receding with every rate hike, since central banks are rapidly moving toward their ‘terminal’ rates – the highest point they will hike to in the current cycle.

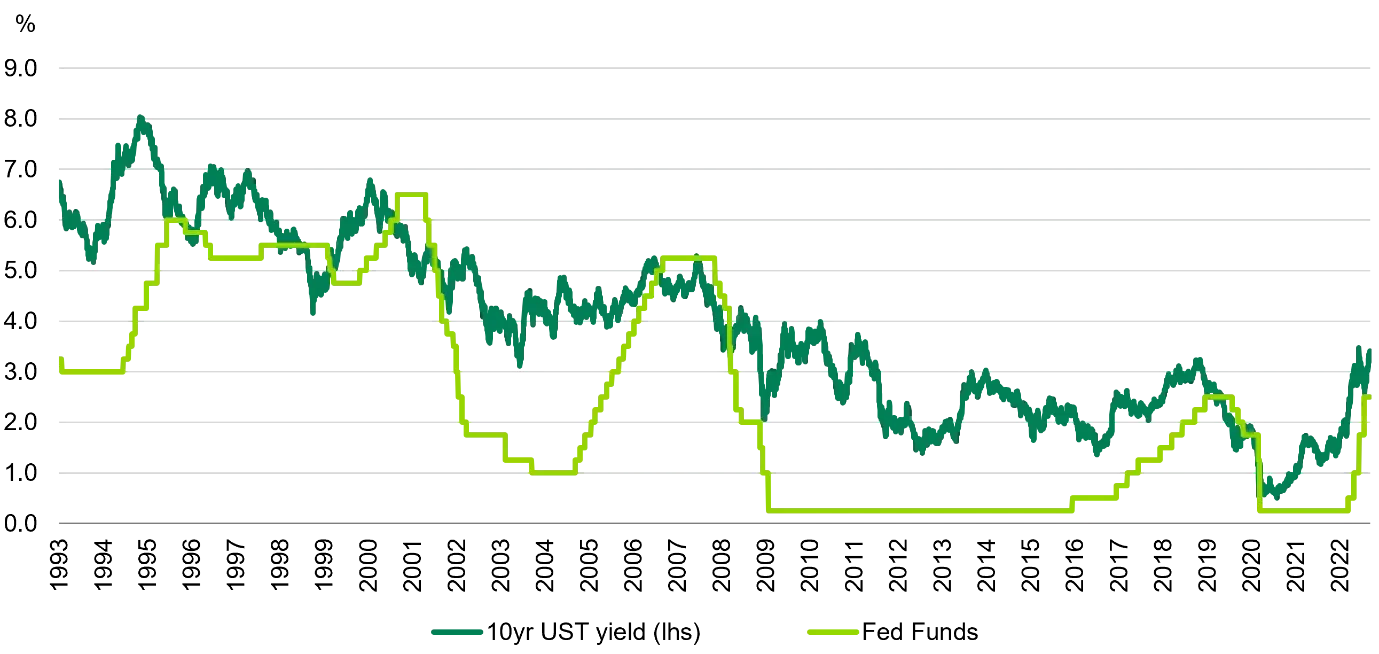

The Fed’s 75bp hike on September 21 took the base Fed Funds rate to 3.25%, well into restrictive territory for the US economy. It looks likely that rates will get to 4.25-4.5% by year-end, and this is a level where the Fed could pause while it waits to see the full impact of its tightening.

At the current level of 3.25%, then, we are likely just a hike or two away from the Fed’s terminal rate. History tells us longer dated UST yields typically peak towards the end of a hiking cycle; so at just under 3.5%, we think 10-year USTs are not far from their peak either. However, with base rates likely to increase towards 4.5%, the inversion between the 10yr Treasury and shorter dated maturities, is likely to increase further.

Treasury yields tend to peak before the ‘last hike’

Source: Bloomberg, 20 September 2022

And investors are being paid well for their patience

The return of rates stability would be a game-changer for market conditions and a potential turning point for risk assets, in our view.

The yields we see now – 4-5% in investment grade bonds and 8-9% in high yield1 – are unusual for this late stage of the cycle, when an economic downturn is expected. Typically late-cycle conditions can persist for a long period of time, during which valuations start to look very expensive. So as recession approaches, investors normally don’t want to hold risk-on credit assets, firstly because they expect credit fundamentals to deteriorate, but secondly because yields are low.

We think today’s yields are pricing in too much bad news, and credit valuations look attractive when we look at the fundamentals – though careful stock selection is, as usual, paramount.

Corporates in both the US and Europe have used the low rate environment of the last few years wisely, terming out their debt at cheaper levels so the bulk of the outstanding doesn’t come due until 2025 or later. Interest coverage, while on a downward trend, is still comfortably above the long term average.

We do expect to see corporate defaults rise as the economy slows, but nothing like to the extent markets are pricing in. The iTraxx Crossover index, a widely used proxy for European high yield bonds, currently has an implied five-year default rate of around 32%. The average five-year default rate going back to 1970 is only 15%, while the worst ever five-year period going back to 1970 had a default rate of 30%. Given the strength of corporate balance sheets now, it seems unlikely to us that we are at the start of the worst five-year period since 1970.

Portfolios should lean towards short dated bonds

What does all this mean for portfolio construction?

We do think volatility will remain elevated in the short term, as investors remain nervous about inflation overshooting and Russia’s war in Ukraine will continue to generate headlines, particularly around energy supplies to Europe as winter approaches. As a result, we think portfolios should be more cautiously positioned.

With a yield of around 3.5%, we think 10-year US Treasuries have a lot to offer a fixed income portfolio right now. Treasuries and other rates markets have been a big source of risk to investors for much of this year as yields have climbed, but given 3.5-3.75% is where we see yields peaking, Treasuries are a valuable risk-off asset again.

In general, we think the bonds with the best risk-reward profiles are at the shorter end of the curve. We are seeing 2-3 year investment grade bonds at yields of 7-8%, significant reward for such short term risk. Short term bonds also benefit the most from pull-to-par; an investor might be holding a bond that has given them negative returns on a mark-to-market basis, but as long as the bond doesn’t default then any negative performance is wiped out on the maturity date; as a result, bond prices trend back towards 100 (or ‘par’) as their maturity date approaches.

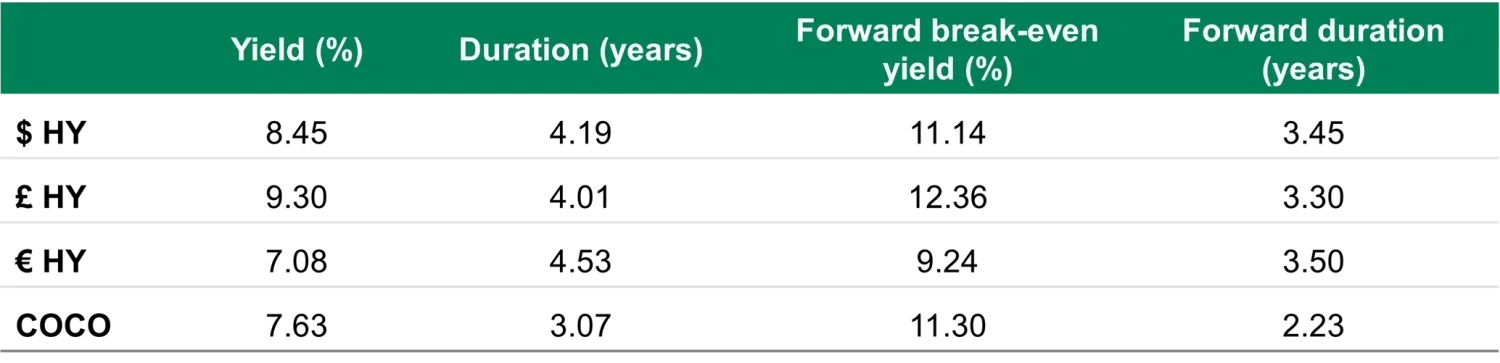

Break-even yields help demonstrate the current opportunity, in our view. The chart below shows that for the USD high yield index (yielding 8.45% today) to record a negative return over the next 12 months its yield would have to rise above 11.14%. With so much bad news already being priced in, we think it would take something extraordinary for yields to reach that level.

It is not possible to invest directly into an index and they will not be actively managed. Source: Bloomberg, 7 September 2022

It is clear to us that inflation has been the key driver of investor sentiment and asset allocation in 2022, and negative fund flows into fixed income have reflected this. With inflation coming under control and more certainty around monetary policy, we could see that trend reverse quite strongly.

We may still have some time to wait for rates stability, but staying patient is a lot easier when bond yields are as high as they are right now.

___________________________

1 ICE BofA Indices, 2 September 2022