European ABS: yield, inflation protection, and sustainability

In fixed income today there are three market forces becoming ever more prominent.

One, we remain in a low yield environment where income is scarce. Two, strong and persistent inflation across developed economies means central banks are expected to raise interest rates. And three, investors are increasingly demanding sustainable strategies that that can ensure their capital is invested responsibly.

Fortunately, we believe there is one asset class well-suited to tackle all three of these challenges – European asset-backed securities (ABS).

A yield premium over corporate bonds

The spike in yields that accompanied the COVID-19 crisis in early 2020 proved to be short-lived as governments and central banks unleashed unprecedented support for the global economy and the markets. As a result, credit spreads in many sectors are touching their tights of the previous cycle and income remains a scarce commodity.

Given this backdrop, we think investors should not be ignoring opportunities to pick up additional yield where they can. As more specialist sectors, European ABS and CLOs have historically offered investors an attractive premium relative to other fixed income assets for any given rating.

The spread on a typical BBB rated UK residential mortgage-backed security (RMBS), for example, is currently around 90bp higher than the BBB euro financials index; for a BBB rated European CLO bond, the spread premium over the BBB euro non-financials index is over 250bp1.

In addition, European ABS has been far less impacted by direct support from central bank asset purchases than other areas of the bond markets. We have seen considerable spread tightening across the board since the onset of the COVID-19 crisis in early 2020, but in European ABS’s case this has all been driven by private investor demand. Sectors that have enjoyed the most official support, such as investment grade corporate bonds and US mortgage-backed securities, look far more vulnerable to volatility and underperformance as central banks being to taper.

Inflation-busting bonds

Inflation is back. After more than a decade of anaemic price growth in the UK, Europe and the US in the wake of the global financial crisis, data from all three regions suggests inflation could remain well above central bank targets for months to come.

As a result, we have seen expectations for interest rate rises have increased markedly, with current US Treasury and UK Gilt yields showing investors predict multiple hikes from both the Fed and the Bank of England in 2022. Markets may well be getting ahead of themselves with the implied pace of these hikes, particularly since we expect interest rates to peak lower in this cycle than they did in the last, but we believe investors should certainly consider building some rates protection into their portfolios over the next few months.

This is a problem for fixed rate bonds – which account for the vast majority of the global fixed income universe – since their fixed coupons are eroded by interest rate rises. Persistent inflation can also lead to net outflows from fixed rate markets, which adds widening credit spreads to pain of rate hikes.

By contrast, European ABS as an asset class is almost entirely floating rate, with coupons that adjust to future changes in interest rates. As a result, the market tends to be less volatile and outperform more traditional fixed rate alternatives such as corporate bonds in periods where investors anticipate rising rates.

A natural home for sustainable capital

The unerring growth of sustainable and ESG investing strategies shows asset owners are increasingly committed to ensuring their capital is invested responsibly, and for a number of reasons we think European ABS is a strong solution to this.

Fundamentally, ABS has a critical advantage over assets like corporate, financial and government bonds when it comes to ESG because ABS transactions fund a defined pool of loans, whether that is residential mortgages, car loans or credit card lending. Because each ABS funds this specified pool of assets and nothing else, greenwashing is much less of a problem here than it is in more mainstream markets. Most of the ‘green’ bonds issued by companies and banks don’t give investors that clarity; the bonds can be tied to ESG targets but the proceeds can often leak into other activities.

Beyond this, there are three major reasons European ABS as an asset class is very well suited to sustainable investing.

First, many of the more common ESG themes like controversial weapons, polluting industries, or nuclear and coal-fired power stations don’t exist in the European ABS market, which is more focused around mortgages and other types of consumer and corporate lending. This also contrasts favourably with US ABS, which does feature securitisations of more carbon-intensive assets such as aircraft.

Second, as an ABS investor you have complete data transparency into the pool of assets backing the transaction. CLO bondholders, for example, can access data on every single corporate loan in the pool backing their deal line-by-line; what the terms are, who the management team at the business is and so on. If we do have ESG concerns, the information we need to conduct our analysis is readily available to us, meaning ABS issuers cannot hide any issues from investors.

Third, ABS are relatively short dated with typical maturities of around three years. Before making an ABS investment an investor knows exactly who the lender is and which assets the transaction is funding; they can conduct a thorough ESG analysis on day one and be confident their results are very unlikely to change over the course of the investment. In comparison, the use of proceeds from a corporate bond is entirely at the borrower’s discretion; that firm’s strategy, culture or use of resources can easily change over time.

Underlying all this is a strong regulatory framework around risk retention, with ABS issuers required to retain at least 5% of the economic risk of their transactions, a very attractive governance feature that ensures alignment of interest between issuers and investors.

Finding the right vehicle

We launched our first sustainable ABS strategy (TwentyFour Sustainable Enhanced Income ABS) in August 2020 and it has been the fastest growing strategy in our history, reinforcing our view that European ABS addresses three big requirements for investors today – yield, inflation protection, and sustainable characteristics.

On the back of this demand we have now converted an investment grade ABS fund (Vontobel Fund – TwentyFour Monument European ABS) into a sustainable portfolio, which enables investors to access the benefits of European ABS through a robust ESG credit process that deploys a careful mix of negative and positive screening. Our negative screen rules out any investments attached to common ‘sin’ industries, while our positive screen excludes investments that we give an ESG score lower than 34 out of 100, actively rewarding the highest-scoring two-thirds.

While the quantity and transparency of data available to ABS investors is impressive, there are few commercial ESG data providers covering ABS and market wide ESG scoring is of lower quality than it is in the more developed equity and corporate bond markets. We anticipate the demands of investors and regulators in this area are also likely to change rapidly in the coming years, so we believe ABS managers need to have their own comprehensive and adaptable process in order to give investors the clarity they need.

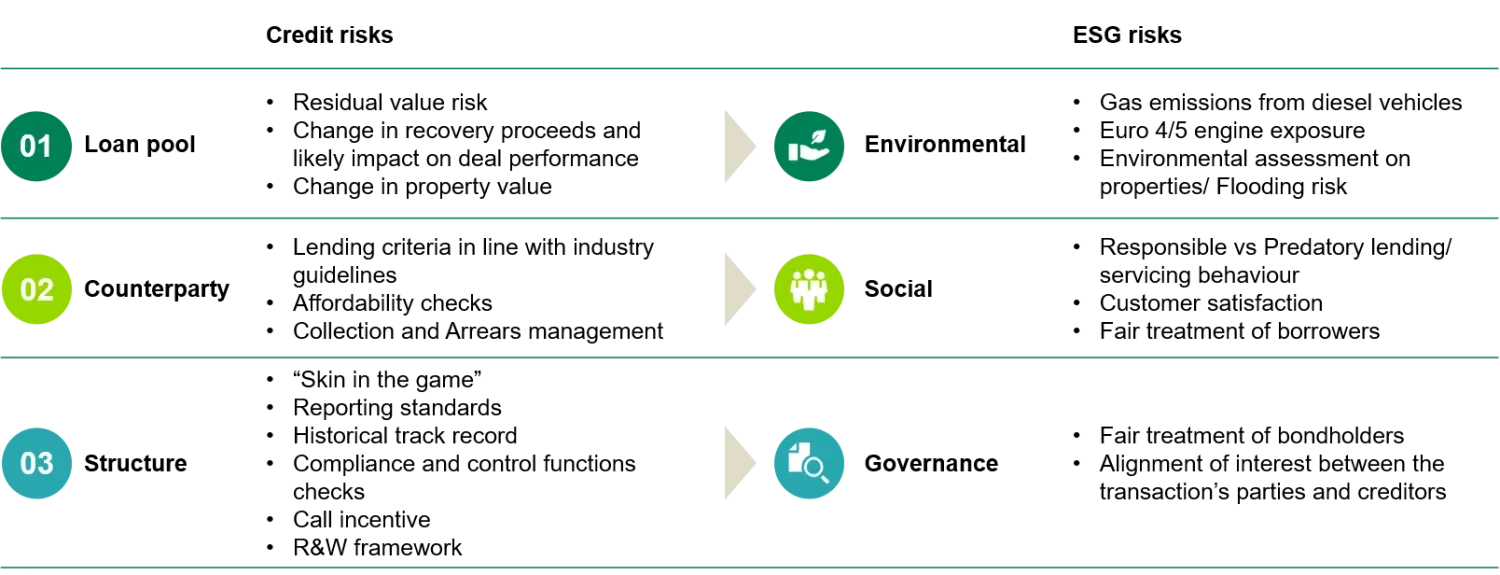

TwentyFour has developed a proprietary ESG scoring system tailored to European ABS. Underlying this strategy is our proprietary ABS ESG scorecard, which allows the TwentyFour team to overcome the specific challenges ABS presents to ESG-conscious investors.

TwentyFour’s three pillars of ESG in ABS

One challenge is that there are multiple counterparties involved in every ABS deal – sponsor/issuer, warehouse provider, loan originator, loan servicer – each of which needs to be assessed as part of an effective ESG analysis. At TwentyFour, we have developed asset type-specific questionnaires for each of these multiple counterparties.

TwentyFour is one of the most prominent investors in European ABS, and one of the very few that invests across the entire spectrum of asset types and ratings. We are a significant stakeholder in the market for the long term, and have worked closely with major central banks, finance ministries and regulators to promote a better functioning market. Right now we are participating in an industry initiative led by ICMA that brings together buy-side investors to discuss the need for more ESG disclosure in ABS and to identify the sustainability metrics most relevant to the asset class.

We strongly believe European ABS is a natural solution for those that want to invest sustainably, while the extra yield and inflation-resistance on offer should make this asset class a strong contender for any fixed income portfolio in today’s environment.

1 TwentyFour, Bloomberg, ICE Indices, 16 November 2021