Fixed Income 101: Inflation-linked bonds

Inflation is widely understood to be bad for bonds.

Fundamentally, this is because inflation erodes the value of the coupon and principal payments that fixed rate bondholders receive in the future. If you buy a $100 five-year bond today with an annual coupon of 5% at par, then when the bond matures in five years’ time you will have $127.62 (this assumes your coupons are reinvested at the purchase yield). However, if annual inflation has been running at 3% over that five-year period, then the purchasing power of your $127.62 has been reduced to $110.09 at current prices.

From a portfolio management perspective, the more pertinent challenge of high inflation is that it tends to provoke interest rate hikes, which can lead to poor performance in all kinds of fixed rate assets, from US Treasuries to high yield bonds.

On the face of it, inflation-linked bonds would appear to be a simple solution to this problem. As the name suggests, inflation-linked bonds, such as Treasury Inflation Protected Securities (TIPS) in the US or Index-linked Gilts (or ‘linkers’) in the UK, are designed to protect bondholders from inflation by adjusting the principal value of the bond to account for the prevailing inflation rate.

If our $100 five-year bond above was inflation-linked, then both its principal value and coupons would be adjusted upwards by 3% per year, resulting in a real return of 5%. This would be the same as saying a total return of inflation plus 5%.

However, inflation-linked bonds are no silver bullet.

Inflation-linked bonds are still bonds, which means just like conventional US Treasuries, TIPS prices tend to fall as interest rates rise. TIPS have the advantage of their inflation-adjusted principal, but when inflation expectations are high, a fall in price can more than cancel out the positive impact of the principal adjustment.

As an example, in the 12 months to August 2022 US inflation was 8.3%. As you’d expect, conventional US Treasuries performed pretty poorly against that backdrop, with 2022 year-to-date total returns of -10.10% as of August 311. However, TIPS didn’t perform much better over the same period, with YTD returns of -7.14%2. Like most fixed income instruments in 2022, TIPS prices tumbled as investors began to expect increasingly aggressive rate hikes from the Fed; the inflation protection helped TIPS holders versus conventional USTs, but the duration component of TIPS was still enough to ensure negative total returns.

That said, in a developed economy such as the US, rising inflation expectations are usually accompanied by a bear steepening of the government bond yield curve (where long end yields rise faster than short end yields). If the nominal yield curve is bear steepening, then shorter dated TIPS can deliver positive returns as the inflation adjustment is more likely to outweigh the price impact at the short end of the curve.

In general, then, there is no guarantee that the total return on TIPS will be positive in an inflationary environment; they should merely exhibit a positive return relative to the corresponding Treasury note. However, even this statement is not guaranteed as total returns will depend to a large extent on the inflation expectations component at both the beginning and the end of the period in question.

1. ICE BofA US Treasury Index, 31 August 2022

2. ICE US Treasury Inflation Linked Bond Index, 31 August 2022

The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions.

Investors can get income from many sources, from bond coupons and equity dividends to other investments such as mutual funds, exchange-traded funds (ETFs) and investment trusts that make regular payments to investors based on the performance of the assets they manage.

Income is a crucial element of portfolio construction. Without bond coupons or equity dividends, investors would have to regularly sell assets that have risen in price in order to realise capital gains and generate a cash return. If a portfolio has a reliable stream of income, investors can earn a consistent return while holding assets for longer periods.

When markets are volatile, income investing can also help protect a portfolio’s overall returns, since the income keeps coming even if the assets are performing negatively on a mark-to-market basis.

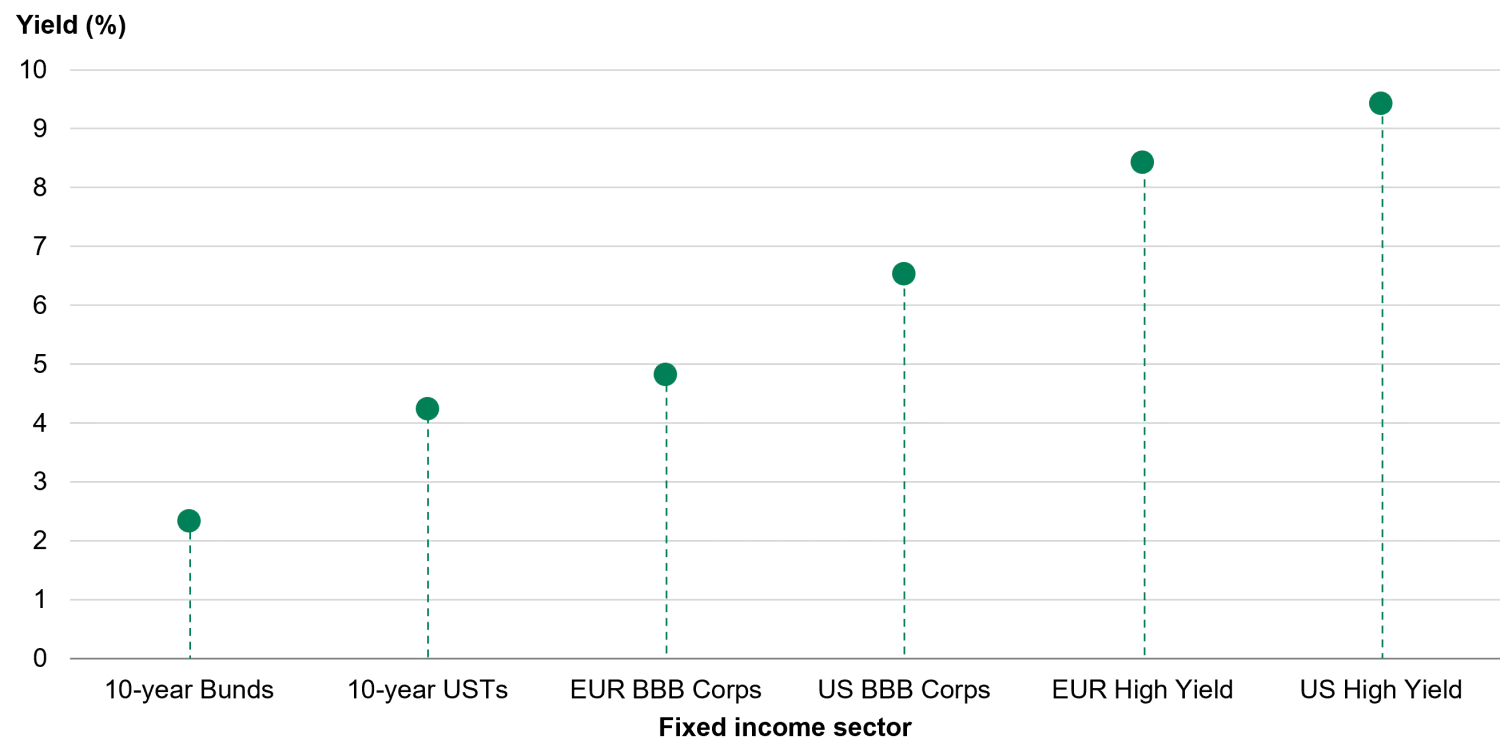

The bond markets offer a full spectrum of risk, from investment grade governments to financials and high yield corporates, across developed and emerging markets, meaning fixed income investors can build an income-producing portfolio calibrated to their desired level of risk.

In equities, investors’ income options are more limited. Not all companies are publicly listed, and it is mostly investment grade, blue-chip firms that pay consistently large dividends. Bonds allow investors to access income from firms with different characteristics, from a wider range of industries and regions.

Source: TwentyFour, Bloomberg, ICE BofA Indices, 27 October 2022

Bond markets are referred to as ‘fixed income’ for a reason. While equity dividends are discretionary – they can be adjusted up or down at the company’s discretion in line with their performance – bond coupons are fixed contractual payments where non-payment would put a company in default.

In the long term, income will likely be the major driver of returns in a bond portfolio, which means fixed income returns tend to be less volatile than other, higher risk asset classes. A global, unconstrained bond portfolio might derive around 70% of its total return from income and only 30% from capital gains.

Bonds possess a very simple feature that make them lower risk than many other assets – a maturity date. In addition to income from coupons over the life of the bond, investors receive their initial investment (their ‘principal’) back on the maturity date.

This means there are only two ways an investor can lose money on a bond; either the bond issuer defaults, or the investor chooses to sell the bond at some point before maturity when the bond is trading below the purchase price.

If you buy a three-year bond yielding 5% today and hold it until maturity, then as long as the company doesn’t default, in three years’ time you will make a total return of 15%, regardless of whether the market price of the bond has fluctuated in the meantime.

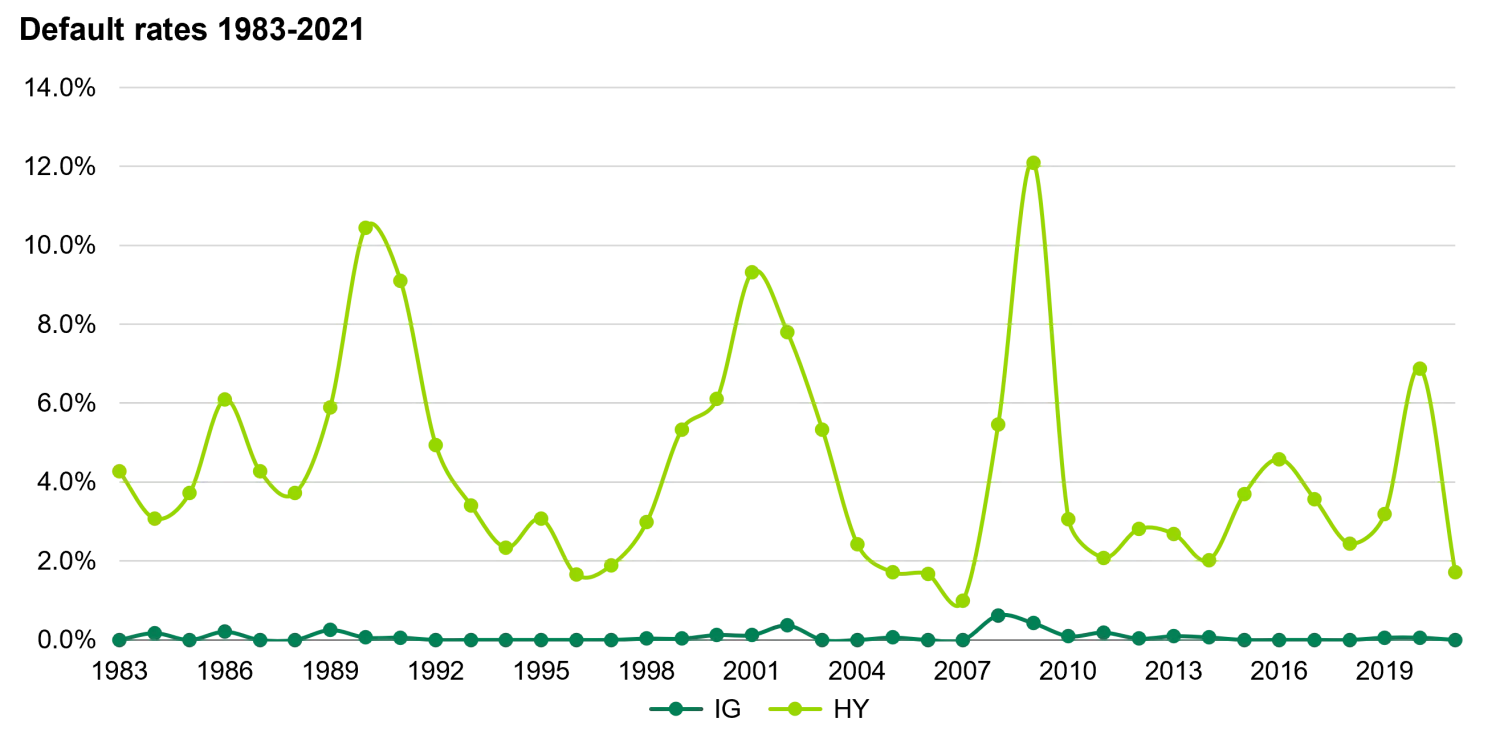

Defaults are extremely rare in investment grade bonds; the historical average is just 0.1%. As the chart below shows, in sub-investment grade bonds (also known as high yield) default rates tend to spike higher in times of severe economic distress, but the historical average default rate is again relatively low at 2.8%. The job of an active manager is to conduct detailed research on high yield bond issuers to avoid the defaults that do occur in the sector.

Source: Moody’s Annual Default Study, 8 February 2022

Another natural advantage of bonds, particularly short term bonds, is ‘pull-to-par’. Pull-to-par reflects the reality that as a bond approaches its maturity date, it will begin to ‘pull’ to its par value as default risk becomes increasingly negligible and the cash price of the bond amortises to 100. Pull-to-par occurs whether a bond has risen or fallen in price since the investor’s purchase, as in both instances the bond would repay at 100 regardless.

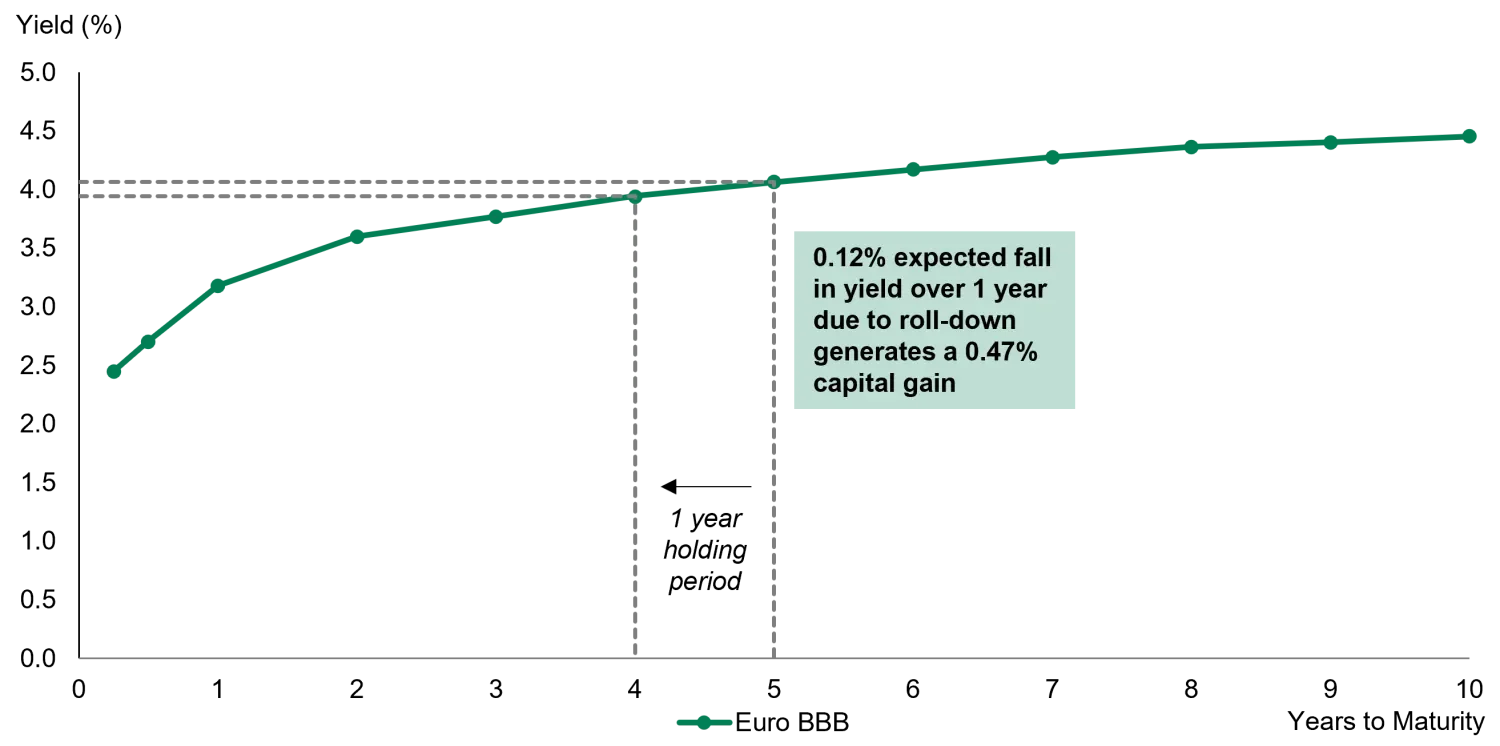

Roll-down is the capital gain created by the natural fall in a bond’s yield as it approaches maturity. The steeper the curve, the bigger the potential for roll-down gains, since the bond’s yield has further to fall (generating a bigger capital gain) with each passing year of maturity. Roll-down potential is generally much larger in short term bonds than in longer maturities because yield curves tend to be much steeper at the short end.

Source: TwentyFour, Bloomberg, 27 October 2022