Why credit is the only game in town for bond income

To mark the fifth anniversary of his firm’s Strategic Income global bond strategy, TwentyFour Asset Management chief executive, Mark Holman, looks at how the COVID-19 crisis has transformed the bond markets in 2020, and where he believes investors should be looking for value heading into 2021.

Coming out of the COVID-19 crisis, we think the biggest problem bond investors face is a global scarcity of income.

Central banks’ bond market intervention and monetary policy has driven cash and sovereign yields to a point where in our view they are not currently viable asset classes. Selective central bank purchases of non-financial corporate debt look to be quickly condemning swathes of the investment grade universe to a similar fate.

With cash and rates such unattractive options, investors aiming to maximise returns will need to get their credit allocation right at this very early phase of the new cycle.

For us, that means:

- A global approach to access remaining pockets of value in credit

- A focus on higher quality credits with robust balance sheets and visibility of earnings

- Embracing pro-cyclicality in the right sectors and at the right time – we see upside in high quality bank capital, corporate hybrids and emerging markets

The death of risk-off

The COVID-19 crisis has left fixed income markets fundamentally unbalanced, with returns on cash in the major markets either zero or negative, and government bond yields so low as to offer precious little protection to a fixed income portfolio.

Bellwether 10-year US Treasury yields have ticked up in recent weeks with the passing of a contentious US election and positive COVID-19 vaccine news, but at just shy of 0.9% they remain far, far below where they began 2020 (1.91%). We expect this modest drift higher to continue through 2021 as growth accelerates, but it is very hard to see yields surpassing 1.5% by the end of next year.

We are at a very early stage of a new economic cycle. It bears repeating that the last time the Fed slashed US interest rates to near zero in December 2008, it was seven years before the first hike and a further three years before the cycle high of 2.5% in December 2018.

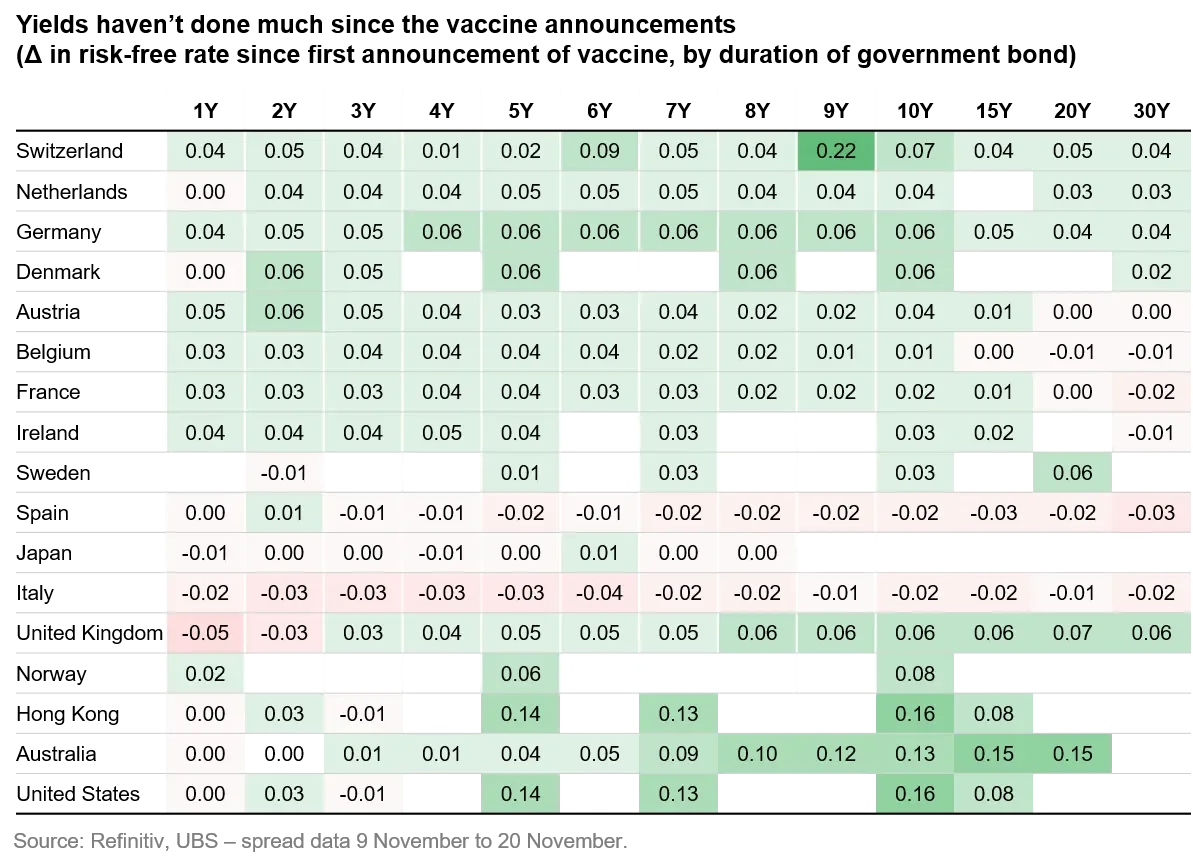

The first vaccine announcements raised the prospect of a return to normality in 2021 and sparked an enthusiastic rally in equities and corporate credit, but the muted reaction of government bond yields in the period since is a good demonstration of how investors expect central bank policy to dominate yield curves for the foreseeable future.

The major central banks should remain guarded and keep rates anchored close to zero for a prolonged period, even allowing for inflation to exceed the target rate of around 2%. This, combined with asset purchases running for at least the next year, means we expect demand for fixed income – from sovereigns through to speculative grade credit – to outstrip supply, resulting in yield becoming an ever scarcer commodity.

Credit – the only game in town

So where can bond investors get their income?

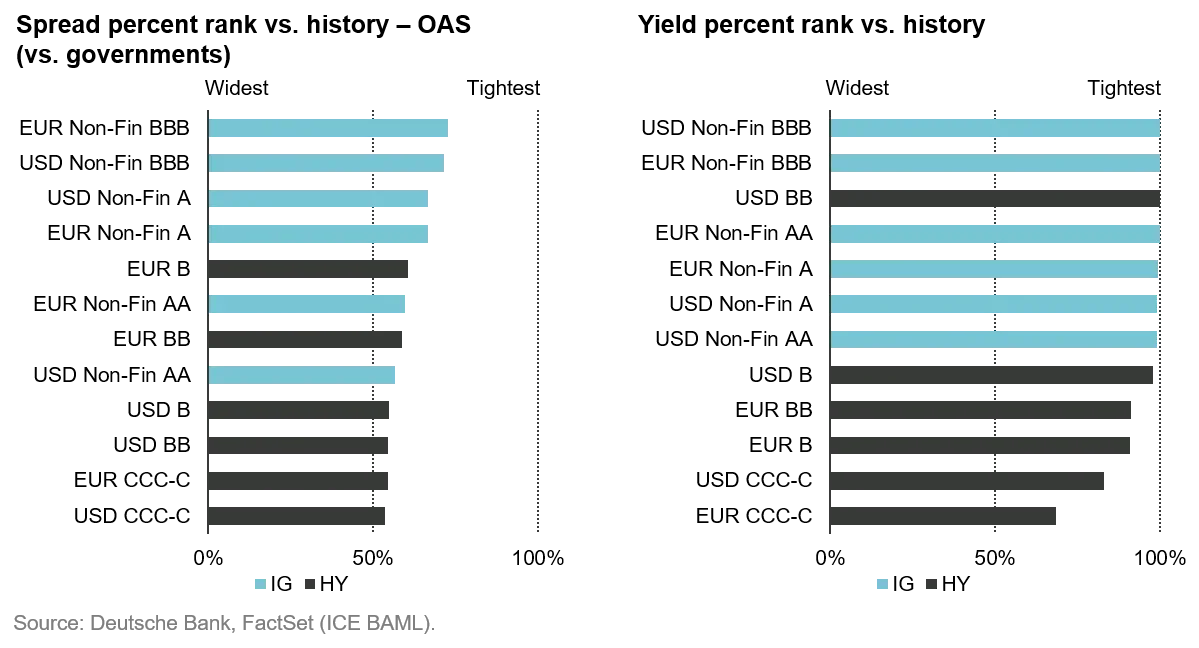

With cash and rates markets looking useless (and without even the compensation of adequate downside protection) the obvious answer is credit, where the turmoil of Q1 did give investors a brief period to source high quality bonds at attractive spread levels. Between January 1 and March 31, for example, US investment grade spreads tripled from 99bp to 302bp, while the spread on the CoCo index doubled from 291bp to 588bp and the EM index jumped from 266bp to 644bp.1

However, this opportunity closed fairly rapidly as markets became emboldened by the swift and decisive action of central banks and governments, with spreads in some sectors now touching pre-COVID levels and yields in many areas of the credit spectrum at record lows.

Despite this, it appears credit assets will have to fulfil the income demand for much of the next decade, and thus we believe the long term opportunity here remains a strong one.

Pro-cyclicality a must, but timing critical

So with credit an increasingly crowded trade, where can we find value?

As a result of the rapid recovery, investors are now being forced to search for yield in more speculative sectors of the fixed income world, and this is where we think a healthy dose of caution is required.

The vaccine news has helped investors look through the current second wave of the virus to the prospect of more normalised global economic activity in 2021. But there is plenty of ‘bad news’ still to come in the form of deteriorating economic data, such as unemployment, as government support rolls off in the coming months.

For us it is too early to be fishing at the lower end of the ratings pool, where the lingering effects of COVID-19 disruption will hit the hardest. History shows us we need to embrace pro-cyclicality in credit to maximise returns as the cycle progresses, but timing is critical.

We must not confuse cyclical downturn with structural change and disruption in certain industries. We remain wary of the retail, automotive, travel and commercial property sectors, for example. Instead, we favour companies with robust balance sheets and greater visibility on future earnings.

In our opinion there are much better sources of pro-cyclicality available at present:

Bank capital – Banks needed to prove their resilience through the economic cycle for the investor community to regain full confidence in the sector post-2008, and in our view this resilience is now being illustrated. The scale of the bad loan provisioning applied in 2020 has been comforting and the increase in CET1 ratios and buffer capital should ease the concerns of even the most sceptical market participants. The considerable recovery in bank capital spreads since the spring has left many questioning how much upside is left. In terms of outright yield the recovery looks complete, given the Coco index was showing an effective yield of 4.08% in January and it is 3.87% today. However, in pure credit spread terms, which we would argue is a better gauge, the Coco index is showing 364bp today versus just 290bp back in January (OAS spread vs government bonds). In a world where spread is becoming an ever scarcer commodity, this implied 74bp premium looks attractive.2

Corporate hybrids – We like corporate hybrids as a play on our theme of sticking to higher credit quality, but in this case we are buying the subordinated bond of the same entity, taking advantage of the large spread differential between the two that typically exists at this stage of the cycle and then tends to narrow as the market embraces pro-cyclicality.

Emerging markets – We have kept a higher exposure to hard currency emerging markets than would perhaps be expected at this early stage of the credit cycle. EM corporates typically lag their DM counterparts in a recessionary environment, but the indiscriminate nature of the Q1 sell-off across risk assets created some very attractive relative value opportunities in the highest quality EM names. Looking forward we see more upside in the names we have previously focused on in this sector, especially in the context of a weakening US dollar in 2021, which would likely foster further inflows into EM in general.

Global, flexible approach helpful

We believe our Strategic Income strategy’s global, multi-sector mandate has been a considerable strength over the course of this extraordinary year.

The COVID-19 shock in Q1 prompted what was by far our quickest and most comprehensive shift in asset allocation in the five-year history of this strategy, as we looked to take advantage of the sudden end of the credit cycle and a subsequent recovery in asset prices.

Between mid-March and October 31, we added some £1.91bn equivalent of credit assets to the portfolio (equivalent to 51.62% of the strategy’s assets).

Our yield-to-worst in GBP terms went from just 2.67% at the end of February to 6.74% by the end of March while the average rating remained at BBB+, a remarkable shift that demonstrates how attractive some of the spread levels reached at the onset of the COVID-19 crisis really were.

As of October 31, the market recovery has seen that yield-to-worst figure fall back to 4.55%, with the average credit duration in the strategy at 3.63 years and the average rating at BBB. If I were a bond investor looking for income, a 3.63-year BBB rated bond yielding 4.55% would be a strong candidate for my portfolio at this stage of the cycle.

1. TwentyFour, Bloomberg, 24th November 2020

2. TwentyFour, ICE-BofA Coco index, 24th November 2020