Is High Yield Weakness a Risk to CLOs?

On Monday my colleagues on TwentyFour’s Multi-Sector Bond desk published a blog on rising default risks in high yield credit. Dummen Orange, Douglas, Boparan, Moby, Galapagos and CMC Ravenna are some of the obvious under-pressure names held in loan funds and CLO portfolios that are trading at a significant discount in the market.

Should CLO investors be concerned about a potential rise in default rates? The short answer is: it depends where you are sitting in the capital structure.

Let’s take Italy’s CMC Ravenna as an example, mainly because its credit deterioration has been so fast and significant. The infrastructure group’s 2022 and 2023 notes dropped to 14 and 13 cash price respectively on Monday, a full 80% down from the previous month, after it announced it would miss a coupon payment on its 2023 bonds due to “cash flow tension”.

These positions are only held by two CLO managers across their platform, Accunia and GLG. Clearly the expected recovery is materially worse than the typical 60-80% that we have seen in the sector historically. The CMC debt is senior unsecured –typically CLOs need a minimum of 90% senior secured – and its troubles show why recoveries in high yield credit can vary materially.

Clearly, none of this is good news, but as an investor your level of comfort with these headlines will differ depending on whether you are invested in the debt or the equity portion of the CLO.

First, for people not familiar with CLO products, the structures include different coverage tests (OC Par Value Tests) at each tranche level, which represent a sort of minimum required credit support for the debt investors. If the test is breached, the interest proceeds which would otherwise be used to pay interest on the equity and other notes must be redirected to redeem the rated tranches, shortening the life of the deal. Typically a Single B tranche at closing will offer a 4% cushion between the trigger and the actual credit support level.

Taking as an example the GLG 2 CLO, which has a 1% exposure to CMC, if the company were to default the OC Par Value test would drop by around one point, which is not enough to breach any trigger considering the 4% cushion on the Single B tranche. The CLO would need at least a 6% position in this name with a very low market value or recovery rate before debt investors would suffer delayed interest payments and potential early amortisation. With 1% current exposure an equity holder, on the other hand, would fully absorb the loss which would be a 9% hit to the equity value.

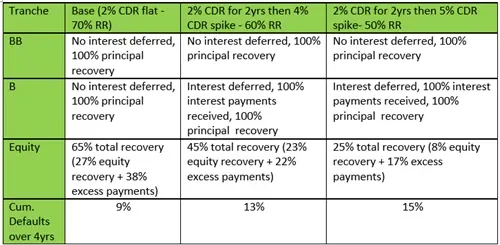

Getting slightly more technical (apologies but this is important), if CMC and the other four distressed names we mentioned at the beginning were to default, we would already have a 4% loss in the pool in the first year. If on top of that we add a 2% annual default rate base case scenario, and throw in a spike in the next two years for good measure, we get the following results:

The outcomes above show how the equity looks pretty uninvestable even in the base case scenario. If we were to compare apples with apples, the benefit of having exposure to high yield names via a structured product like a CLO versus having direct exposure to these names, even if unlevered, is massive. The unlevered loss would be 6.5% under the base case scenario and around 13% in the bear case.

At TwentyFour we continue to believe that manager selection and debt friendly documentation is key at this stage of the credit cycle, and we don’t think the risk-adjusted returns in CLO equity are compelling against holding rated debt at similar potential yields, but with the added subordination to protect you in a downturn.