How UK mortgages are weathering the storm?

The UK mortgage market has received significant publicity in recent months, as concerns surfaced over UK borrowers' capacity to manage their mortgages amidst a perfect storm of soaring inflation, a deepening cost of living crisis, and a notable 5% jump in interest rates since 2022. Notably, research by UK Finance has shown that the proportion of UK residential mortgages on variable rates has declined over the past decade to ~17% with borrowers clearly favouring the certainty of low fixed rate mortgages – typically for a period of 2 or 5 years after which most will refinance into another fixed rate product with a minority reverting to a floating rate. Among those on fixed rate mortgages, it is estimated that 12% of them face a refinancing decision in the second half of 2023 with a further 23% in 2024 and although these groups will have been underwritten by their lenders at higher rates, a number of them will be particularly vulnerable to the impact of rising rates. For example, a non prime borrower who took a 5yr fixed mortgage in 2018 would have typically been paying around 3-4% since but would be looking at refinancing today into another fixed rate product at ~6% if refinanced with a bank and over 7% if they go through a specialist lender.

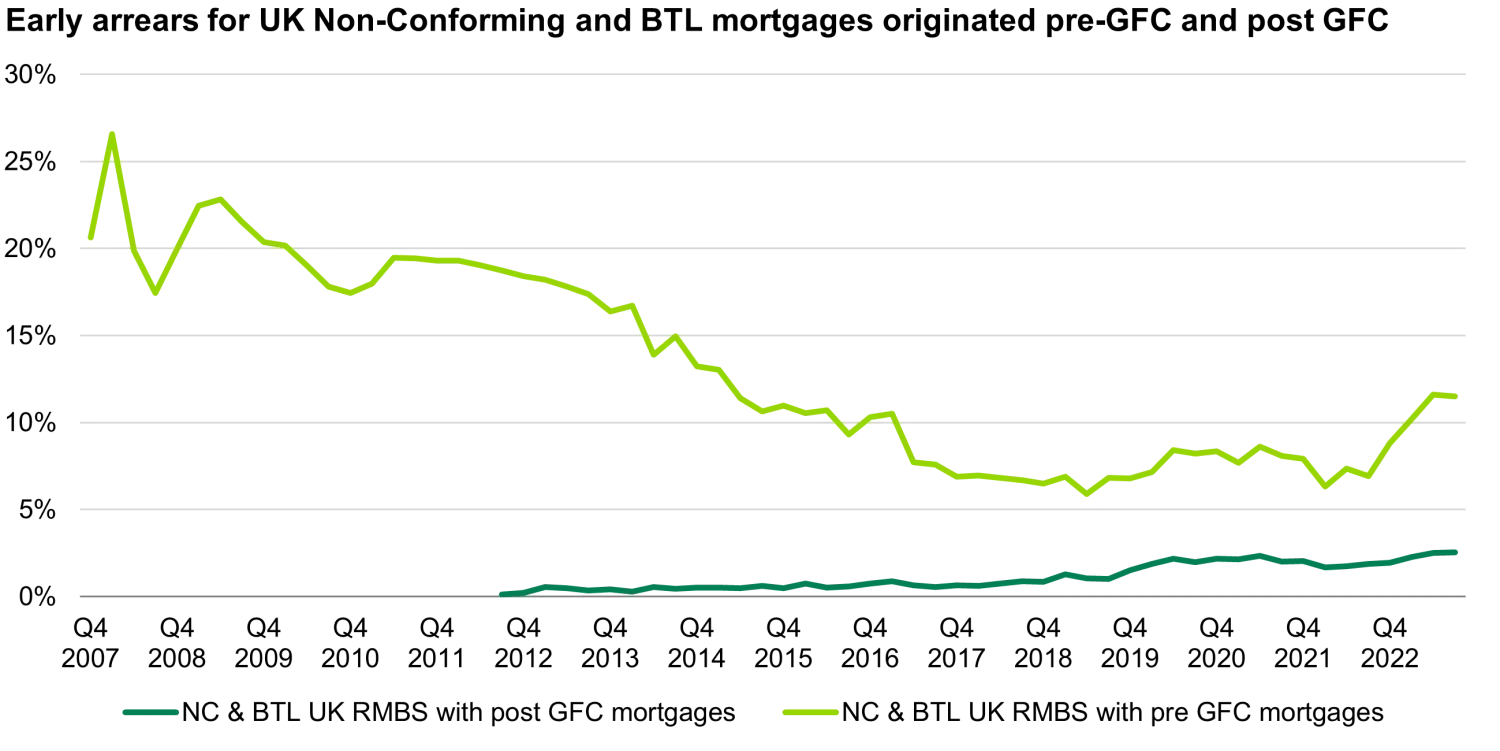

But has the surge in rates impacted the performance of non-conforming and buy-to-let UK RMBS? An important distinction emerges when comparing mortgages originated before and after the Global Financial Crisis (GFC). Following the GFC, the UK’s Mortgage Market Review in 2012 introduced substantial reforms leading to stricter affordability checks, the elimination of self-declared income, the decline of interest only mortgages and improved risk management from lenders. These reforms contributed to lower Loan to Value (LTV) ratios and have resulted in significantly tighter lending standards.

Mortgages from the pre-GFC era are generally on variable rates, as their fixed rate periods ended over a decade ago and often represent borrowers who have either not been able to refinance or have chosen to enjoy low floating rates for the past decade, but either way are most susceptible to interest rate fluctuations now. As rates have begun their upward trajectory, some borrowers have taken the opportunity to refinance or have used their pandemic savings to pay down their mortgage in an effort to avoid the burden of higher rates. Yet, it's this segment where we’re seeing performance deterioration being most pronounced due to the direct impact on affordability from rising mortgage payments but also due to the negative selection of these mortgages pools as they have been amortising over the last 15+ years.

In contrast, post-GFC mortgages predominantly feature fixed rates providing protection against immediate rate fluctuation until refinancing is needed. In addition, these mortgages were originated under tighter lending standards, with lower LTVs and affordability was assessed under a stressed scenario with elevated rates. This has resulted so far in a small tick up in early arrears (arrears of more than 30 days).

Source: Morgan Stanley, Q3 2023. Pre GFC and Post GFC indices include all relevant BTL and NC UK RMBS. Pre GFC index data excludes AIREM deal.

It is also worth keeping in mind that borrowers have seen a rise in wages, albeit this rise varies significantly across sectors, and on the most part have accumulated significant equity in their property after having benefited of over 15 years of house price appreciation. Both of these act as a buffer to losses following any foreclosures. Equally, a mortgage is typically the last debt borrowers will default on, primarily triggered by unemployment or life events such as divorce, illness or death, all of which help keep arrears numbers in check.

In this challenging environment, for those vulnerable borrowers struggling to pay, mortgage servicers have a number of mechanics to assist. Support measures include budget coaching, product switches, term extension and voluntary sales, with foreclosure as a last-resort measure. The UK government, alongside the FCA, also released recent guidelines to help owner occupied mortgage borrowers such as ensuring a 12-month grace period on repossessions as well as allowing temporary switches from repayment mortgage to interest-only for 6 months to help reduce the monthly mortgages costs without impacting the borrower’s credit score. While the delinquency rate has historically looked much higher for pre-GFC mortgages, the payment plans in place mean that while these borrowers are not paying 100% of their mortgage payment, the majority pay what they can afford, with a significant proportion are paying more than 75% of their monthly payments, and showing a willingness to pay makes the foreclosure route less likely.

Our focus has always been on due diligence and it has been no different this summer. We are mindful of deals dominated by pre-GFC mortgages, anticipating their underperformance relative to newer origination cohorts. As we brace for further deteriorations, we remain assured that mortgage servicers possess the tools and intent to shield vulnerable customers and limit losses. The historical resilience of the UK mortgage market provides a context for our confidence. As an example, mortgage losses peaked only at an annualised rate of 11bps in Q1 1994, even when unemployment soared to 10%. While we expect an increase in unemployment numbers we don’t foresee a hard landing in the UK, as seen in the GFC, and expect UK mortgages to continue to perform well, as they did during that period, with low levels of losses for UK RMBS. Our analysis and modelling of UK RMBS give us assurance that they can weather the storms of recessionary periods and are able to withstand much higher defaults than we’ve observed historically. Even looking at pre crisis deals, they benefit from low loan-to-value pools of mortgages and have been deleveraging for the past 15 years meaning bondholders benefit from the large cushions built up in the RMBS structure over time.

We favour high quality lenders that we think are well set up to dealing with borrowers that could face payment problems and would work with borrowers to find the most sustainable payment plan strategy for them, and in general are best in class when underwriting borrowers. Dealing with affordability isn’t new - neither is an increasing cost of living and unemployment – and ultimately European ABS transactions have been created with safeguards to help them deal with deep recessions; given the strong historical performance these structures have proven to protect rated bond holders and we see no reason why this should change.