BoE stress test shows resilience of the UK RMBS market

A couple of weeks ago the Bank of England released the UK banking sector stress test report and, as we wrote in our blog , the results showed the very strong resilience of the sector. One of the objectives of the test is to assess the bank’s capacity to support households and businesses and the impact of mortgages and loans on lenders’ balance sheet.

The UK mortgage market has been in the spotlight in the last couple of months due to the spike in interest rates and inflationary pressure on consumers’ savings, and we think our readers might be interested in understanding “what can go wrong” in a more than severe hard landing scenario. As a segue to the BoE’s bank stress results we tried to re-create the stress test from a mortgage default and loss point of view and applied it to a benchmark UK RMBS BBB-rated bond. For those less familiar with RMBS deals, the BBB-rated tranche is an investment grade tranche typically fourth in the stack – three layers junior to the senior AAA tranche.

Many assumptions in the BoE scenario are more severe than experienced during the GFC; UK inflation in particular peaks at 17% and averages 11% in the first three years of the simulation, monetary policy rate peaks at 6%, GDP contracts by 5%, unemployment doubles and residential property prices fall a massive 31%.

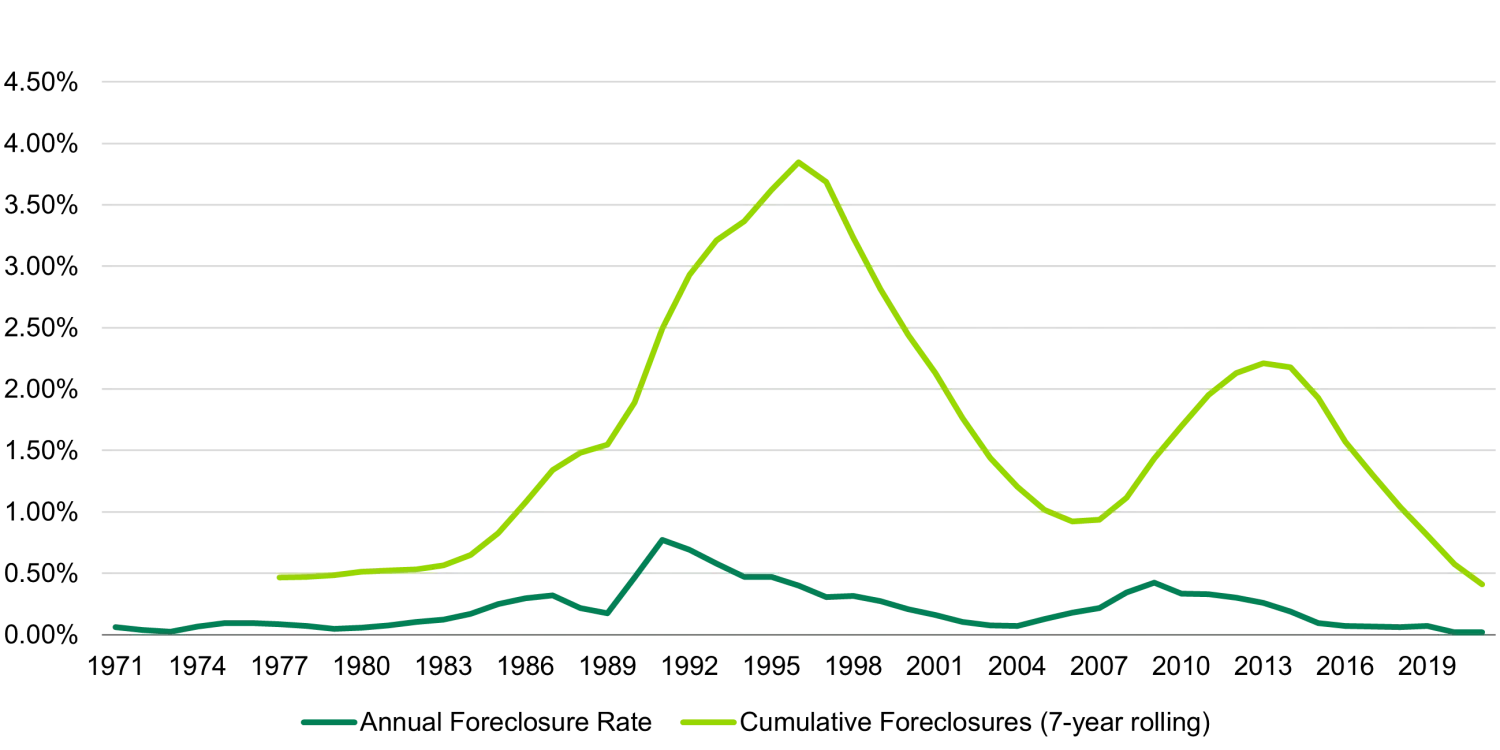

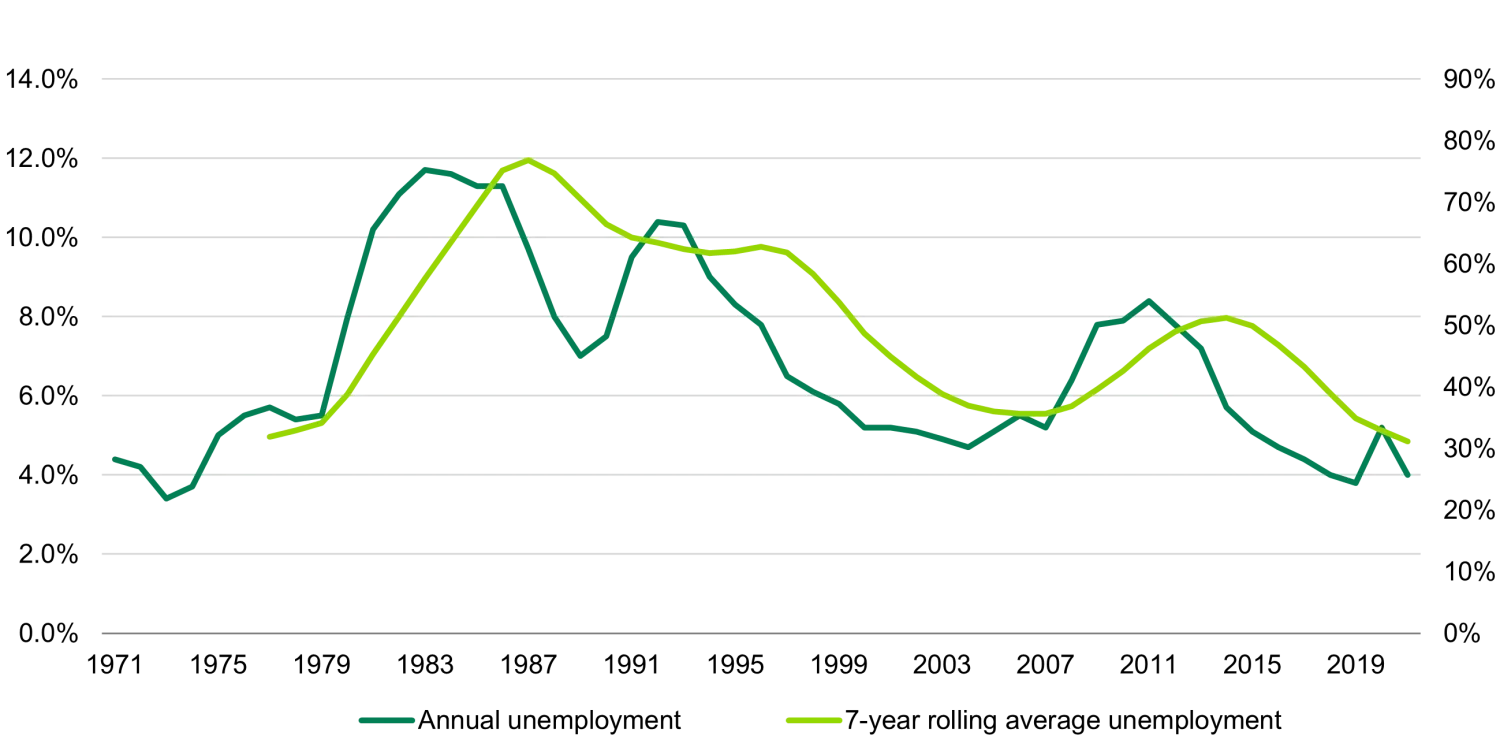

For our stress test we looked at the historical peak in cumulative foreclosures when unemployment was at its highest level. On a rolling 7yr basis (typical peak-trough or trough-peak), the historical peak in cumulative foreclosures was in 1996 at 3.85%, versus a 7yr average unemployment number at the same time of 9%. Rounded up to 4% then, this therefore seems like an appropriate level to apply given it is a bit more penal than the BoE’s unemployment doubling scenario.

UK Mortgage Market - Historical Performance

(Source: Bank of England, UK Finance, ONS, Bloomberg, TwentyFour)

UK Unemployment

(Source: Bank of England, UK Finance, ONS, Bloomberg, TwentyFour)

In order to derive a “benchmark” UK RMBS transaction we looked at the deals issued so far this year. An average deal has been around £450m in size, with an average mortgage rate of about 4% and an average LTV of just over 70%, while at the BBB level, the average credit support has been 2.3%. As you might know a positive feature of securitisation is the deleveraging that occurs, i.e. as the senior notes pay down the credit support (protection from losses) across all the non-senior tranches increases and the bonds typically get upgraded. We don’t give any benefit to this in our analysis but it’s worth bearing in mind that the credit risk diminishes as the credit support increases over the life of the deal.

If we look at that average 70% LTV mortgage in our benchmark deal, the BoE assumption of a 31% house price decline (as a reminder, the worst drops seen in the UK market were 20.6% in 2009 and 19.5% in 1993, source: Nationwide house price index, peak to trough ) would have hardly any impact on losses. Example: a house is valued at 100, the borrower buys it with an interest only mortgage of 70 and 30 of their own equity, shortly afterwards house prices decline by 31% so the new value of the property is 69, the borrower defaults on its mortgage, the bank sells the house and recovers 69 which means the loss given default on the mortgage is 1. To make our analysis more sensible we apply a 20% loss given default which implies a house price decline of 50%, >2x the historical worst case GFC scenario and we also assume that it takes 12months to foreclose on a property. This higher number also means we are amply stressing any loans with a higher LTV than the average – for context we rarely see loans above 85% but some deals have a small amount in the 80% to 85% range.

Keeping the numbers simple, 4% cumulative defaults over a 3y period (typical life of a RMBS deal) on a £450m pool gives us £18m of defaults, which leads to £3.6m of losses when applying the 20% loss given default; this £3.6m is just 0.8% of the £450m pool. If we consider the average credit support of a BBB rated RMBS bond, this analysis tells us that our benchmark bond with 2.3% of credit support could withstand almost 3 times the BoE stress test. If we make it more punitive and we add the lost interest on the defaulted loans for one year then losses go up to 1% of the pool, which would still give us 2.3x protection. This is just a simplistic analysis but we ran the same assumptions on our far more complex modelling tool using various actual bonds and we got very similar results.

Overall, this type of analysis gives us confidence that the UK RMBS market can withstand stresses beyond those applied by the BoE and never seen in history. So considering a BBB RMBS bond currently yields over 9% we believe this asset class continues to be one of the most attractive in the fixed income market at the moment.