Growing signs that the UK labour market is weakening

The labour market has been one of the major headaches the Bank of England has had to deal with in their battle against inflation. Yesterday the ONS released their monthly labour market update and although some of those headaches’ causes are not abating, there are others that are actually showing signs of progress.

The wage inflation data showed that average weekly earnings (AWE) grew at a rate of 8.5% YoY for the whole economy in the trimester from May to July. This does not sound like good news particularly considering that the previous reading was at 8.4%; however, the details are somewhat more encouraging than the headline. The public sector figure was 12.2%, up from 10.7% which was already extremely elevated as a result of the NHS and Civil Service one-off payments made in June and July. The private sector showed a 7.6% increase in the same trimester and if we look at the MoM number, this was 0.4%. Without a doubt the public sector adjustment is a consequence of high CPI inflation and in that sense, it is evidence of second round effects. But we tend to think that private sector dynamics are more reflective of the current underlying pressures in the labour market. Although we cannot state based on one data point that wage inflation in the private sector has peaked, we do think that there is growing evidence that we might be able to state this in the not-so-distant future.

Another interesting part of the monthly data pack that is not as celebrated as the AWE is the “Earnings and Employment from Pay as You Earn (PAYE) Real Time Information”. This is data that comes straight from HMRC’s PAYE system and covers the whole population rather than a sample, as is the case with the AWE calculations. Although the data set is relatively new and in the ONS’s words “the methodologies used to produce the statistics are still in their development phase”, they nevertheless provide interesting insights. They are also timelier than the AWE data, the PAYE latest observation being a month ahead. According to the PAYE database, the median monthly pay at £2,260 in August declined for a second straight month as the data was also affected by the public sector adjustments aforementioned that took place in June and July. The number in May though was £2,263. One could say then that after a couple of one-off adjustments the monthly pay in the UK has not changed since May. The YoY wage inflation number using this data is 6.6% which is still no reason for the Bank of England to celebrate but is definitely more encouraging than the 8.5% the AWE data is showing for the trimester to July.

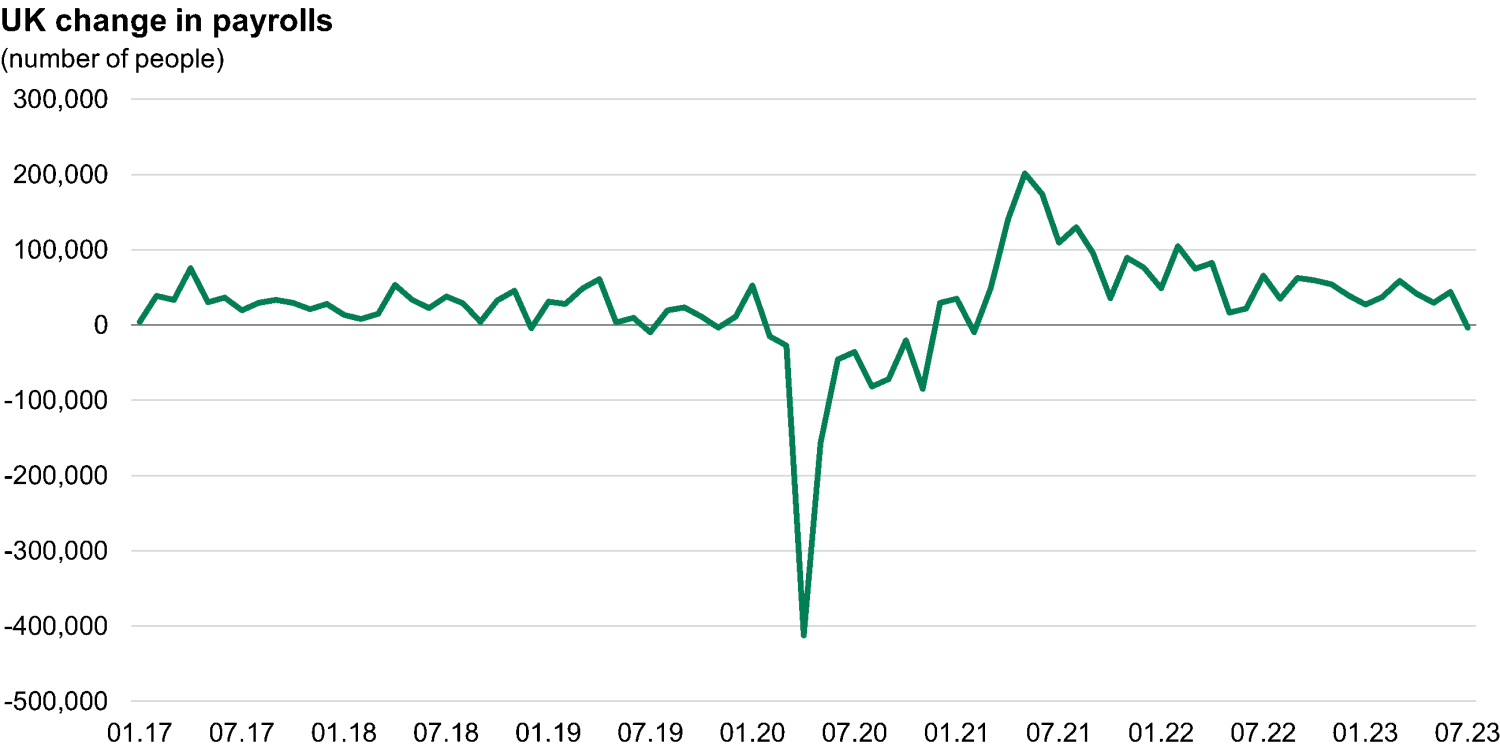

Lastly, we note the change in payrolled employees in the PAYE database totalled a 3.5k decline in July (latest published figure). This is the first monthly decline since February 2021 as the chart below shows.

Office for national statistics: UK Labour market overview, September 2023

In conclusion, we believe there is growing evidence that the labour market in the UK is weakening. This is good news for the Bank of England. There are still developments that remain unexplained, the most important of which is the dramatic increase in people who are not in employment due to long term illness. But despite the pressure that this puts on the supply of workers we would be very surprised if the more widely followed AWE figure does not decline going forward, which of course would take away some of the headwind facing GBP bond investors this year.