Five things to consider when investing in IG credit

Fixed income investors globally face a daunting environment in 2019, with a deteriorating credit cycle, heightened political volatility and increased uncertainty around global monetary tightening.

However, with his volatility-constrained Absolute Return Credit strategy, TwentyFour Asset Management’s Chris Bowie has been proving that even within investment grade credit, there is a mix of assets that can help mitigate these risks without giving up the potential for absolute returns.

Here, Chris outlines five things he believes every investor should know about investment grade bonds.

1. The UK is the place to be, because of Brexit

Brexit has been a constant source of troubling headlines for investors over the last three years. Just after the shock result in June 2016, sterling denominated corporate bond spreads widened versus corporate bonds in other currencies, and they have remained wider since. In simple terms, they have become cheaper – they are paying investors more income each year than similar bonds in euros and dollars.

The Brexit process has been rumbling on so long now that some of our favourite UK bonds have actually matured – and we have earned that excess income over euros and dollars along the way while many investors unhappy to accept Brexit risks have foregone these juicy spreads. We would argue by selecting yield curve positions very carefully, and remaining vigilant on name selection, investors can capture this Brexit premium without many of the longer term Brexit risks.

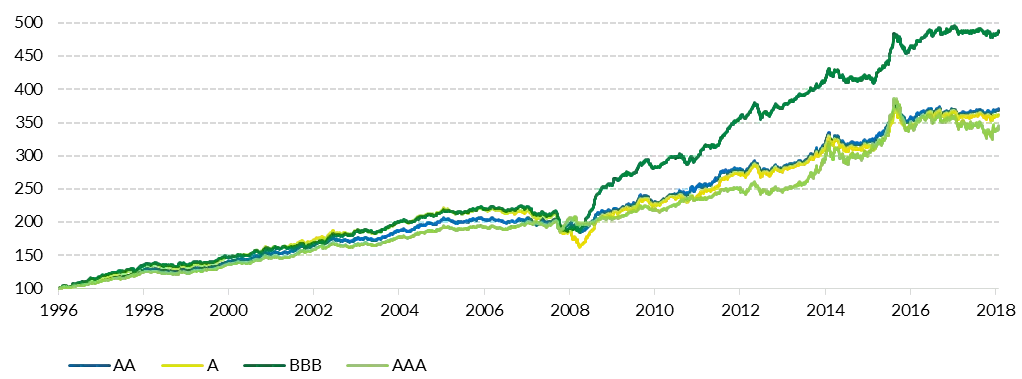

2. BBBs produce heavenly returns, not fallen angels

Much has been written in the last six months about the risks of BBB rated corporate bonds being downgraded to high yield (so-called ‘fallen angels’) and that a wave of downgrades could lead to mass defaults and mark-to-market capital losses for investors. Given our IG portfolios have favoured BBBs for many years, we firmly believed these fears were overdone and wrote a whitepaper explaining why.

In summary, using default data going back 100 years, and combining the chance of downgrade over a five year period with the probability of default over a further three years, we found the expected annual losses for passive BBB investors would be 14bp per annum. The additional spread you expect to receive in BBBs is far greater than 14bp. Our conclusion: Ignore them at your peril.

Total Returns from IG Ratings Bands - 1996 = 100

Source: TwentyFour, BAML. 28th January 2019.

3. Unrated bonds are mark-to-myth

Unrated corporate bonds are no better or worse than rated bonds from a pure credit risk perspective, but in our view they carry additional risks which make them unsuited to daily priced openended funds.

First, unrated bonds are never included in corporate bond indices, giving them a ‘mark-to-myth’ nature when it comes to the daily valuation of the funds that own them. These funds can choose to price their unrated bonds in various ways, but usually they are modelled on some other corporate or government bond, with an assumed spread differential to either, resulting in prices that often do not reflect market reality.

Second, because many institutional mandates eschew unrated bonds, secondary market liquidity in these instruments is normally far lower, making them much harder to sell, especially in periods of market volatility. Certain funds liquidated in 2018, for example, while holding significant weightings to unrated bonds, suffered sharp drawdowns during the process as the true market value of the assets was realised.

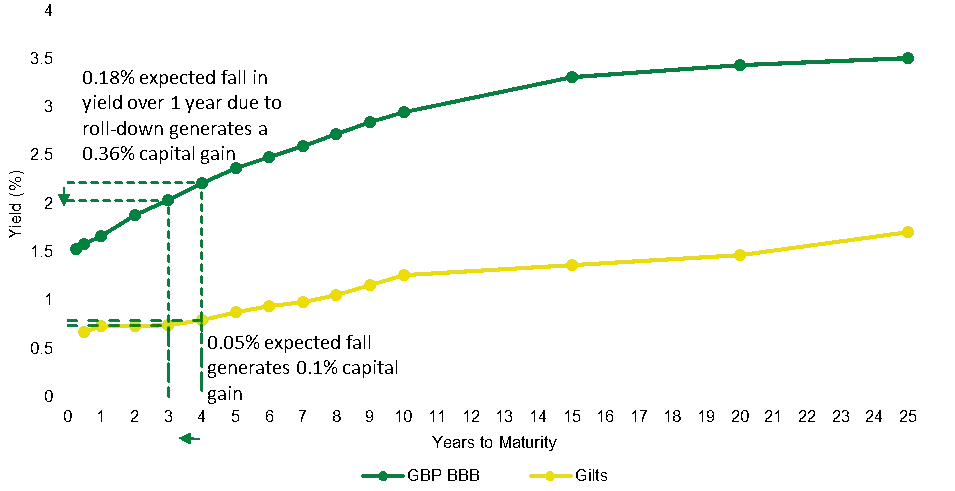

4. Roll-down is your friend, with benefits

In a low yield environment, enhancing total return without taking significant additional risk is a very welcome prospect.

One attractive feature of the UK credit curve (in addition to the Brexit premium), is its relative steepness, especially at the front end. The yellow line confirms how flat the UK government bond curve is by comparison. Buying a four-year Gilt and holding it for one year means a drop in yield of 0.05% (5bp) as your four-year Gilt becomes a threeyear Gilt, generating a pretty modest 10bp of capital gain. Holding a four-year BBB-rated corporate bond (the green line) on the other hand, generates a capital gain of 36bp, as the extra steepness results in an 18bp fall in yield as the four-year bond becomes a three-year bond.

Further, you can see that because the curve is steepest in short dated bonds, as an investor you do not have to be exposed to the capital risks of higher duration bonds in order to benefit from this. By staying in short dated BBBs, investors can keep spread duration low, benefit from better earnings visibility over the short period to capital redemption, and get very healthy yield curve roll-down until principal is repaid.

BBB vs. Gilt yield curves*

Source: TwentyFour, Bloomberg 3rd January 2019

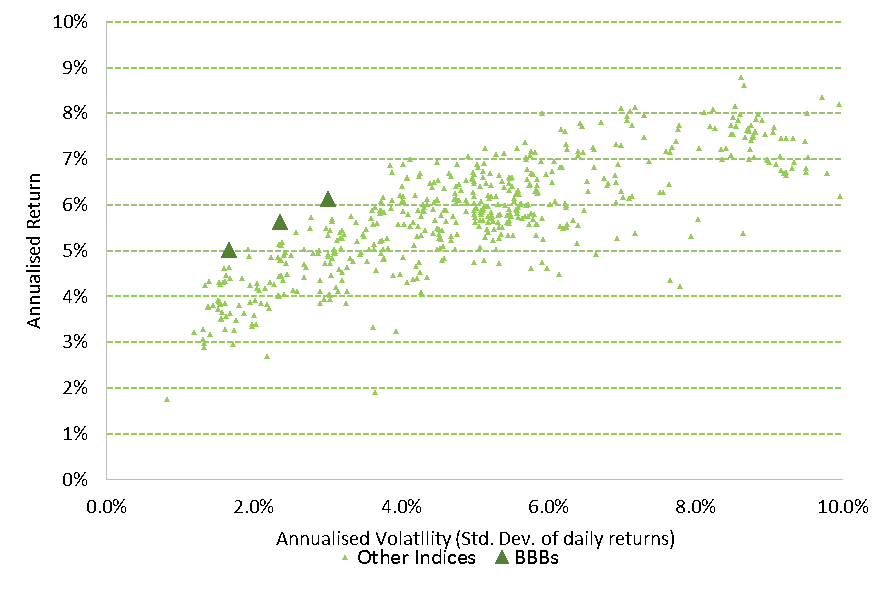

5. Short dated BBBs maximise risk-adjusted returns

The third leg of the BBB story (after returns and roll-down) is that historically they have also generated the best risk-adjusted returns.

Back-testing work we did before launching our volatility-constrained strategy proved that short dated, BBB-rated bonds produced better risk-adjusted returns than anything in fixed income over reasonably long time frames, and even over periods that saw exceptional volatility in credit. Specifically our research found that you would have maximised your Sharpe Ratio (a measure of risk-adjusted return) where you had two-thirds of your portfolio in short dated BBBs.

The chart below shows 560 Bank of America US bond indices, from government bonds through to high yield, from 1991 to 2017, plotting annualised return against the volatility of that return. The dark green triangles are BBBs, consistently generating more return per unit of risk than anything else.

US Bond Indices 1991-2017: Volatility and Returns

Source: TwentyFour, underlying data BAML

Downloaded daily data back to 1st January, 1991 up to 31st December, 2017