What are AT1 bonds, and how do they work?

The remarkable pace of change in the markets as the global economy reopens points to opportunities in higher yielding bonds, with financials in particular set to benefit, says CEO and portfolio manager Mark Holman.

I have worked in the fixed income markets for over 30 years, and in all that time I have never seen a market cycle move as quickly as the current one.

After suffering an unprecedented shock in 2020 as a result of the COVID-19 pandemic, an equally unprecedented response from governments and central banks has driven an increasingly rapid recovery in 2021 fuelled by the successful rollout of vaccines in many developed economies.

For fixed income investors, the pace of change in credit has also been blindingly quick, such that barely 12 months on from the market capitulation in early 2020 spreads are now threatening their tights of the previous cycle.

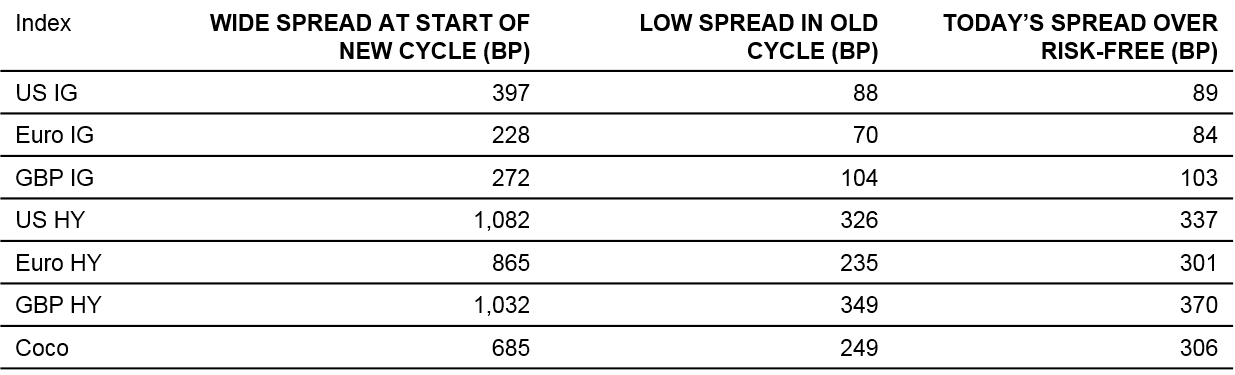

Source: TwentyFour, ICE Indices; 30 April 2021

We expect many of the credit sectors shown in the chart above to break through those tights before the end of 2021, a process that usually takes several years following a recession. “This time is different” is a dangerous phrase in financial markets but I am happy to use it here; in my view the sheer weight of fiscal and monetary stimulus deployed to help combat the effects of COVID-19 have made this a cycle unlike any other.

If anyone were in any doubt about the pace of this cycle, an $18.5bn bond deal from tech giant Amazon this month confirmed to me that having flown through the recovery phase and into mid-cycle, we are already seeing what we might call classic late-cycle bond issuance. Among Amazon’s eight (yes eight) tranches sold to investors on May 10 was a two-year bond priced at just 10bp over US Treasuries; remarkably cheap funding for Amazon and arguably funding the company didn’t need, having reported a staggering $67.2bn of trailing 12-month operating cash flow in Q1.

To me this deal was more evidence of the lofty valuations now in place across many parts of global fixed income, and such welcoming conditions for borrowers are normally a sign for investors to sit back and wait for market dips to buy in at a more attractive entry point. However, waiting for dips has generally proved to be a poor strategy in the last several months as this rapid cycle has progressed, and I don’t expect that to change in the remainder of this year. In fact, I think investors will be more wary of being left behind.

This point in the cycle – strong economic growth, strong job creation, strong corporate earnings – tends to be the right time for fixed income investors to be well invested in credit.

In my view, top of the list is financials. It is hard for me to overstate how much the banking sector’s fundamentals have strengthened in the years since the global financial crisis, and they proved the resilience of their balance sheets through the turmoil of 2020. As a result, we believe bank debt is currently undergoing a deserved re-rating in the investor community, with subordinated bank bonds such as Additional Tier 1s (AT1s) in particular looking set for further gains. Going back to our spread chart, in the coming months I expect AT1 spreads (as measured by the ICE BofA COCO index) to tighten through their January 2018 low of 249bp, and given the increase in credit quality and ratings we have seen across European banks since then, we think this cycle’s low for AT1 spreads could be significantly through that mark.

Another sector where we anticipate further spread contraction is high yield bonds. The shift higher in government bond yield curves appears far from over given growing inflation concerns, which means investors will likely want to steer clear of longer dated, lower spread assets that are typically more sensitive to these moves, such as investment grade corporate bonds. High yield bonds are generally tied to the shorter and mid points of the yield curve, and should therefore be less hampered by further rates weakness. We think the best HY opportunities now are likely to be rated BB or lower; in our view investors are rightly wary of going too far down the credit spectrum early on in the cycle, but with upgrades already outnumbering downgrades in the US by two-to-one1, they could now be looking for individual credit stories that they think are able to ‘ride’ the economic recovery back up the ratings spectrum, delivering still attractive yields as well as an expectation of some capital gain.

The biggest threat we see for fixed income investors currently would be a second wave of selling in US Treasuries (USTs). Earlier this month 10-year yields spiked up to around 1.7% for a second time in 2021 after stronger-than-expected inflation data from the US, but in my view even at this level they are not pricing in much of the persistent inflation that would likely push Treasury yields even higher and eventually cause the Fed to change course on monetary policy. In the event that investors do start to price in more of this ‘non-transitory’ inflation, Treasuries look to have little protection at current levels and the next wave of selling could push yields sharply higher again; this would hurt returns in the more rates-sensitive sectors of credit just as it did in Q1.

Another threat we see is a potential policy misstep from the Fed, which has stuck firmly to its guidance around quantitative easing (QE) and rates in the face of improving US economic data this year. While in my view the Fed has communicated its message very clearly so far, it is fair to question whether it can pull off tapering without causing the sort of market ‘tantrum’ we witnessed in 2013. In addition, while it is perfectly sensible for the Fed to say it will not react until it sees firm evidence of more permanent inflation, there is a chance the central bank will end up behind the curve while it is waiting for that evidence to arrive.

Ultimately, if this is a cycle like no other that is because this is an economic recovery like no other; investors are not used to seeing annual GDP growth estimates of 6-7% in developed economies such as the US. April’s US non-farm payrolls data coming in at 266k jobs created versus estimates of around a million was the latest reminder that this recovery may continue to be uneven, especially given the anticipated resurgence of the labour market appears to be being complicated by large-scale welfare programmes.

However, with economic fundamentals looking so strong and credit fundamentals in many higher yielding sectors looking equally so in our view, I remain convinced that this is no time for fixed income investors to play contrarian. Targeting the most robust credit stories in sectors with low duration and higher yields looks to me to be an attractive way to combat any rates-related uncertainty across the rest of 2021 and avoid being left behind.