ESG's tipping point

The definitions of what ESG really means are still blurry and there is no one-size-fits-all approach to sustainability. If anything, the growing popularity of these funds has highlighted the differences in the expectations of both individual investors and institutions when it comes to ESG.

One question is being asked with increasing frequency: is it really possible to create a truly sustainable fund using a passive strategy?

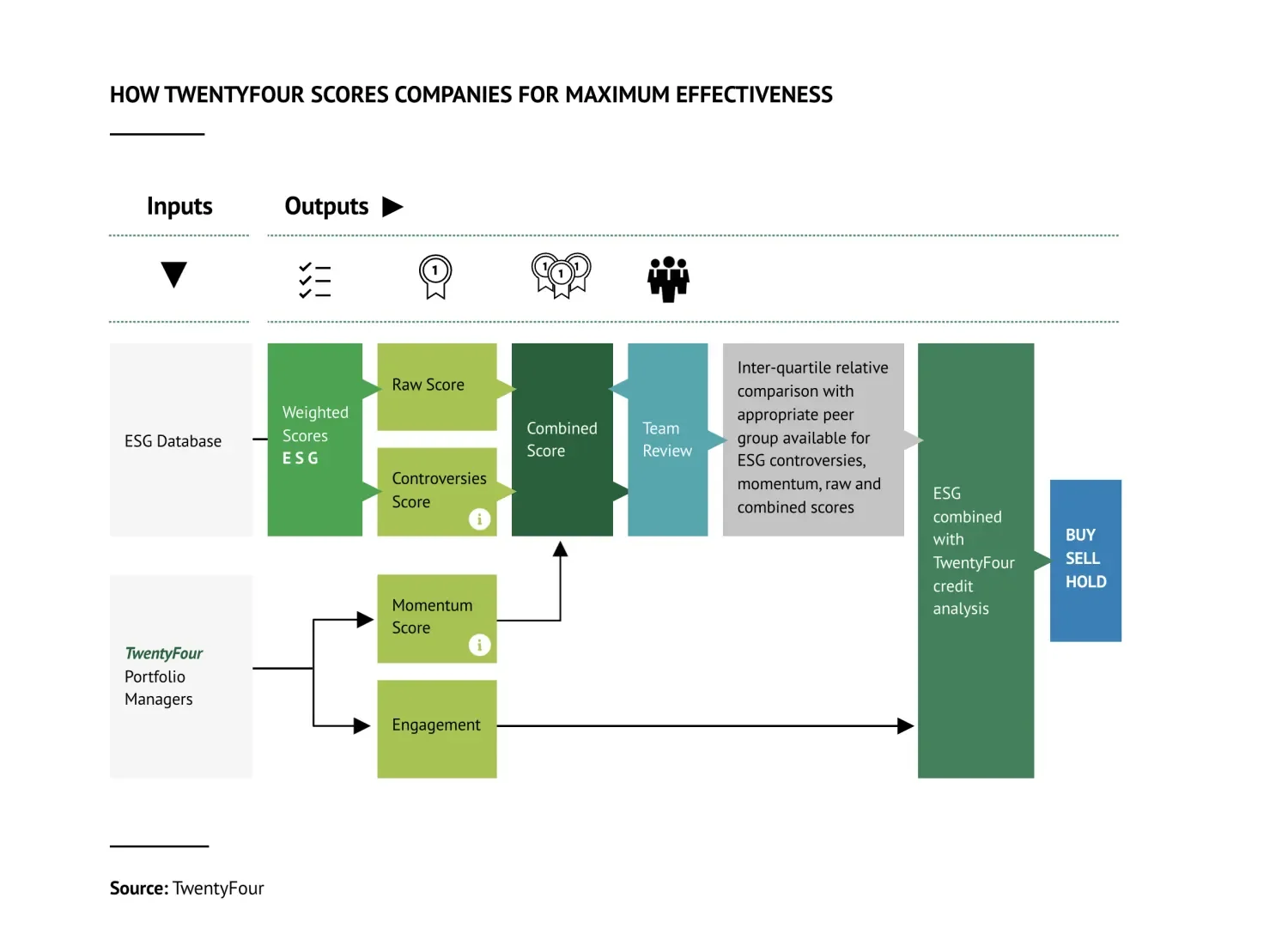

Raw score: The scoring process starts with each company being given a raw ESG score which takes into account various E, S and G risks based on around 400 ESG data points. The weighted average of Asset4 and TwentyFour’s own research is what determines the raw score. This drills down into each area of ESG, covering everything from emissions levels to human rights and treatment of staff.

Controversy & Momentum score: Each company is then assigned a controversy score, which reflects any poor behaviour that could result in future risks; and a momentum score, which shows a company’s willingness to improve and how much progress it has made in this direction. In aggregate, these three scores make up the combined ESG score for each company. The database has handy colour-coded markers (green, red and white) that denote strong, middling and poor ESG performance, and allows portfolio managers to compare scores with the median to provide context.

For any investor in this area, third party ESG data is typically not enough, and often does not match expectations. But a combined scoring approach allows the team to place greater importance on engagement with issuers, which they believe is the best way to bring about positive change as a bond investor. The importance of engagement also means it can allow the managers to override a score if they believe a bond issuer is making positive changes.

The Observatory database holds records of any engagement activity conducted with each company as well as an archive of any score changes or score overrides implemented by the portfolio management team, which must always be independently verified by another team member. This ensures transparency and accountability and is constantly updated to reflect the results of engagement and validate investment decisions.