Are BBBs still the place to be?

As fund managers we are always looking for the optimal place to invest our clients’ money. Our research has shown that BBB rated corporate bonds have historically been one of the best areas within global fixed income for risk-adjusted returns throughout the economic cycle, and in our view the total return potential of this segment is looking particularly attractive today given the rise in yields across the bond markets in recent months.

In 2019 we published a whitepaper titled ‘BBBs and Fallen Angels: Hellish Risks or Heavenly Returns?’, chiefly in response to growing concern in the markets about the increasing volume of BBB bonds and the potential for a rising number of ‘fallen angels’ – BBB bonds that are downgraded and thus slip from being investment grade to sub-investment grade, otherwise known as high yield.

With rates volatility persisting and developed markets likely sliding toward recession, this seems a good time to revisit our analysis of BBBs to explain why we still have a positive view on the sector, and to perhaps offer some comfort to investors given the current macro outlook.

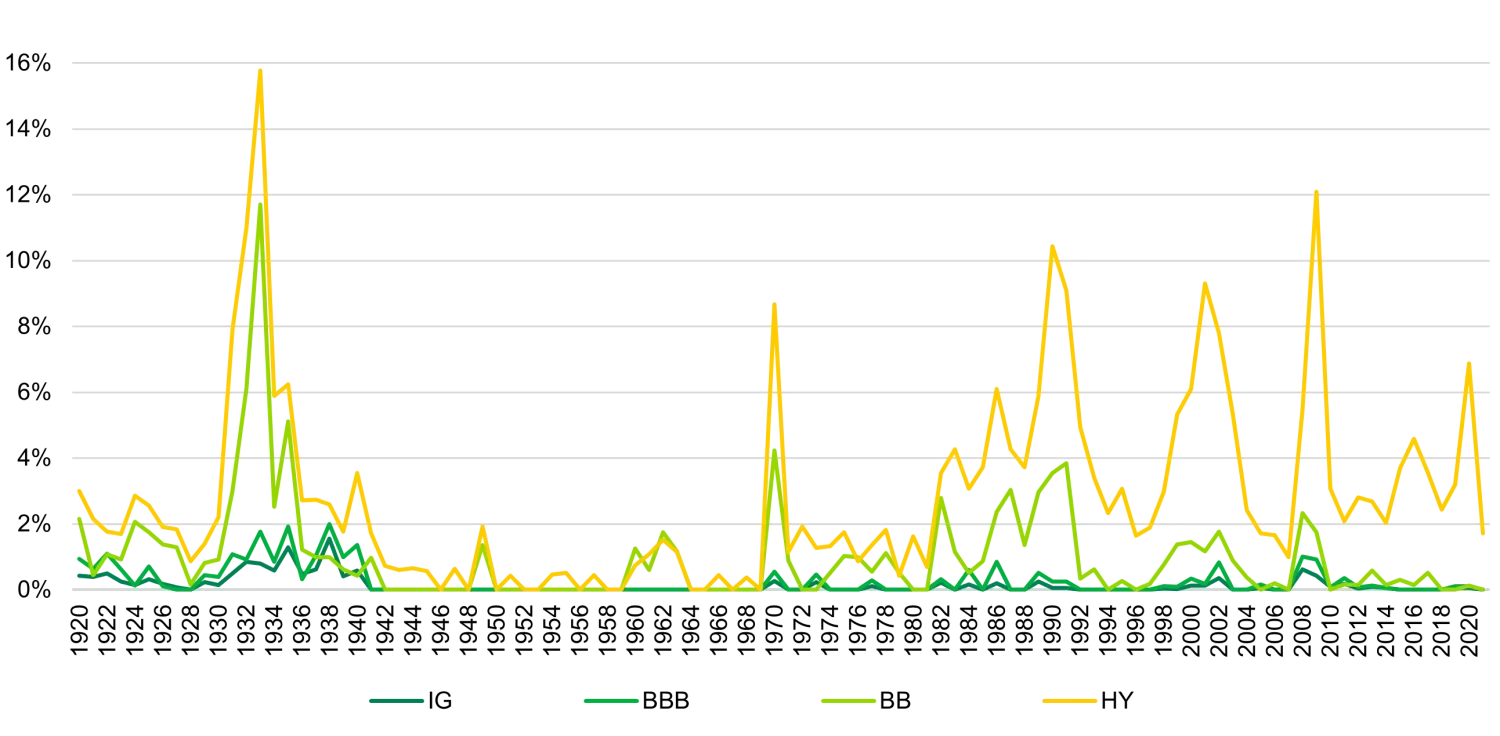

Global Default Rates 1920-2021 Moody’s Default Study

As you can see from the graph above, the annual BBB default rate peaked all the way back in 1938 at just above 2%. Since World War Two, five cyclical peaks in defaults have occurred and the only time BBB default rates exceeded 1% was in 2008 during the global financial crisis; on that occasion, during one of the worst credit environments we have ever seen, BBB defaults reached just 1.02%. During the European sovereign debt crisis defaults only got to 0.4%, and since then the default rate has never gone above 0.1%.

Using Moody’s data we have now looked at the average migration data over five-year periods between 1970-2021, capturing bonds that were downgraded from BBB to BB and B as well as the total cumulative default rate for BBs and Bs. The rate of ‘fallen angel’ downgrades (BBB to BB) was just under 8%, and from BBB to B it was 2.4%. We then combined the probability of downgrade and probability of default for a hypothetical portfolio 100% passively invested in BBBs, with the result being that total expected losses were only 60bp or 0.60% over a 5 year period (12bp per year). This portfolio assumed no hedging, no active management, no selling of downgraded bonds and zero recoveries if a bond defaulted, all of which can be improved through being actively invested and reducing the expected losses. This reinforces our confidence in the sector, and explains why we tend to maintain a significant allocation to BBB rated credit in our investment grade strategies.

Another reason for comfort in the investment grade universe generally, and the BBB universe specifically, is that during the later stages of 2020 and throughout 2021 the majority of firms prudently took the opportunity to extend their debt maturities using what at that time remained a low interest rate environment. This puts companies in a strong position, with fewer upcoming maturities to refinance and more room to focus on their core business models to drive growth and performance. This has helped drive corporate default rates to all-time lows over the last couple of years across both the investment grade and sub-investment grade universes. As we have seen interest rates rise and the possibility of a potential recession across geographies increase, we would expect default rates to increase, particularly in the high yield space. However, we believe investors can have considerable confidence in the BBB space given the very low default history of the sector.

In summary, BBBs have generated and should continue to generate significantly higher returns than other subsets within investment grade, in large part due to the higher spreads available and their historically very low default rates. We do not see any reason for this to change in the future, even through a recessionary environment, given the strength of the financial system and the improved capitalisation of banks and insurance companies.

We believe being actively invested in BBB bonds throughout the cycle is a smart allocation for any fixed income investor, with the active element intended to avoid potential fallen angels and allow the portfolio to capitalise on what we consider to be one of the most attractive risk-adjusted return opportunities available in global fixed income.