Where are CLOs trading after the Truss Tantrum?

Over the last week or so we have seen unprecedented selling of certain assets amid the fallout from the UK’s ‘mini-Budget’. UK government bonds imploded, leaving pension funds running liability driven investment (LDI) strategies facing hefty collateral calls and prompting the Bank of England to step in to shore up an increasingly disorderly Gilt market.

Asset-backed securities (ABS) have traditionally been popular with LDI funds given the high quality and floating rate nature of the asset class. Collateralised loan obligations (CLOs) represent a large part of the investment grade European ABS market, and they were therefore not immune to significant selling. Liquidity rapidly decreased as last week went on, and the cost of what liquidity there was increased every few hours as spreads were rapidly adjusted to the new situation.

With post-crisis regulation making bond dealers more capital constrained in recent years, they have not been well positioned to provide fixed income investors with much-needed liquidity in times of stress. In ABS, however, post-crisis we’ve grown accustomed to a concept known as Bids Wanted In Competition, or BWICs, which is effectively a public auction for a list of bonds an investor would like to sell. While transparency of traded levels was relatively poor last week, the volume of bonds made available via BWICs tells its own interesting story.

Last week the total volume of CLOs listed via BWICs was over €1.5bn, and we’re hearing that close to another €1bn may have traded away from the broader market. Selling has continued this week, with €400m of predominantly AA rated CLOs listed on Tuesday alone. All told, sales in the last week-and-a-half could total more than the previous three months combined.

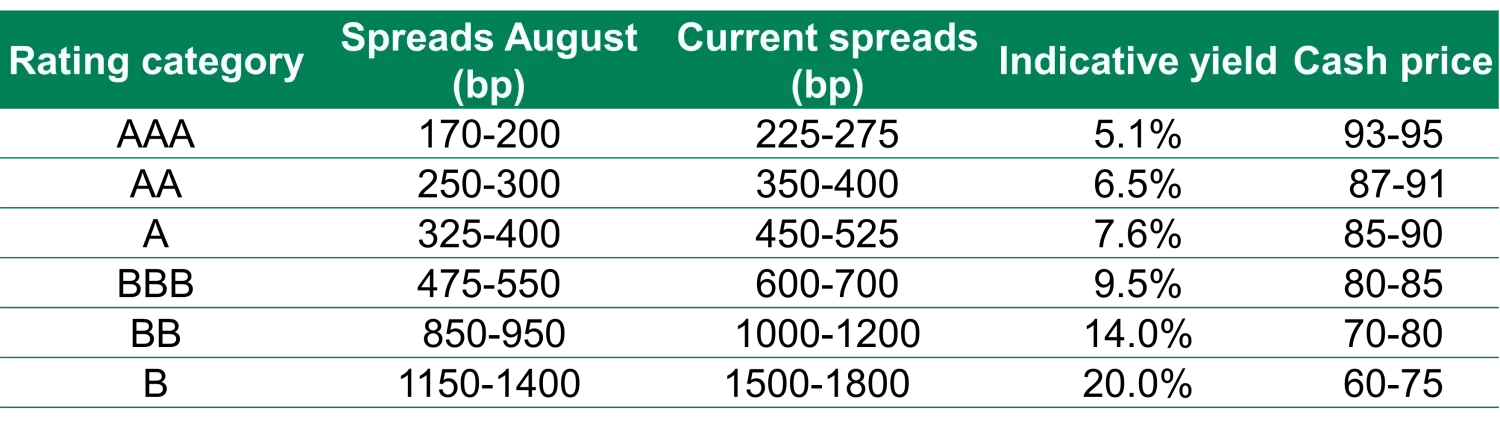

What is very clear is the majority of paper was rated either AAA or AA; both have risen in popularity with pension funds in recent times, and it’s no surprise to see large allocations to these assets in LDI funds. BBB and BB rated notes also traded, likely as a consequence of global credit funds facing outflows, but they were dwarfed by what was happening in the AAA and AA space (this is arguably as it should be). Last week was something of a price discovery process as some sellers seemed to have no choice but to sell in order to meet liquidity needs, meaning prices dropped quickly and almost all AAA and AA CLO bonds that were auctioned traded. For BBs and Bs it was a different story as a large number of bonds “didn’t meet reserves”, with these sellers perhaps more opportunistic or just looking for clearing levels.

While spreads were wider it was good to see that bonds actually traded; even in times when liquidity was deemed to be virtually non-existent, large volumes changed hands in a relatively short period of time. We’re being told the buyers were mostly US investors seeing value in European CLOs, hedge funds (using cheap leverage for IG assets), bank treasuries for AAAs and European insurance companies also reportedly becoming more active at these levels. Later in the week we started to see more bids for BBB and BB rated bonds, but clearly at more opportunistic levels. We are not seeing big volumes trade in sub-IG assets at present, though with current depressed valuations we would expect to see more buyers emerge.

As is typical in these conditions, we have seen the degree of spread ‘tiering’ between the best and worst regarded CLO managers increase, and longer deals are also trading wider than shorter transactions, though in this market things are mainly dictated by cash price; however high the coupon was on a AA bond, the cash price bid would likely still be in the 80s.

On Tuesday we saw an improvement in execution and dealers are reporting broader client engagement, so it looks like we have found the bottom for now in valuations. In our view, the widening in both ABS and CLOs has left an interesting set of opportunities for non-LDI investors looking for high quality income. At almost 10% in euros, BBBs are now yielding almost as much as CLO equity did at the start of 2022.