We are pleased to share TwentyFour Asset Management LLP’s (“TwentyFour”) UK Stewardship Code Report covering the period of 1 January 2023 to 31 December 2023. This document will set out our progress over the calendar year ending 31 December 2023, as well as again setting out our philosophy and culture, which is manifest in our infrastructure, our people and our relationships with our clients. It will also explain how stewardship and the integration of ESG principles play a key role in cementing this culture across the firm.

We believe that incorporating stewardship and ESG into our investment process is not a significant departure from our regular investment process – we look at ESG risks in the same way we do any other risk to our clients’ investments. However, it is important to recognise these are some of the biggest risks facing our world today, and we think they will have a big impact on long term returns.

Against the backdrop of another challenging year for financial markets, stewardship and ESG remained a central topic in 2023 with Sustainable Finance Disclosure Regulations (SFDR) continuing to evolve and the FCA releasing its final Sustainability Disclosure Requirements (SDR) towards the end of the year. A focus for the year was to embed the requirements of SFDR and to ensure investment process remained robust and supported by comprehensive monitoring and oversight.

A big project for our teams this year was the upgrade of one of our Article 8 funds to an Article 9 fund and following investor feedback, introducing a percentage of ‘sustainable investments’ into most of our Article 8 funds; in 2024 we intend to launch another Article 9 fund.

Finally, we have continued to engage with issuers as we seek to drive positive change on behalf of our clients, while always conscious of our fiduciary duty to our clients to create long term value for our clients.

Graeme Anderson, Executive Committee Chairman

Sujan Nadarajah, Chief Compliance Officer

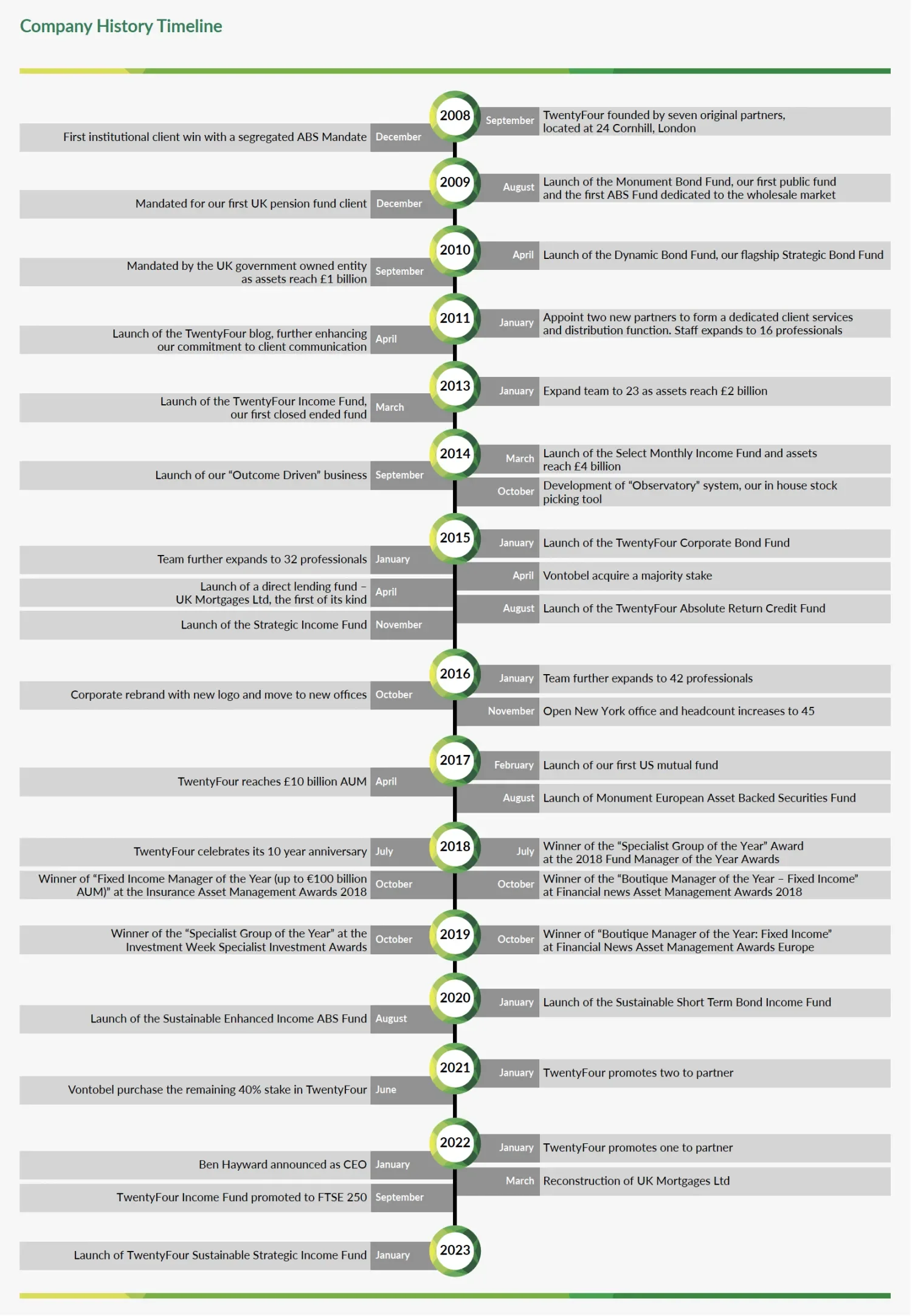

TwentyFour was formed as a Limited Liability Partnership in 2008 in London and is a boutique of the Swiss based Vontobel Group. Since our inception in 2008, we have built a strong reputation for performance, expertise and innovation in our chosen sector.

While the firm is a wholly-owned boutique of the Vontobel Group following acquisition of the partnership interests in 2015 and 2021; TwentyFour remains operationally independent. Vontobel Asset Management is also a signatory of the 2020 UK Stewardship Code.

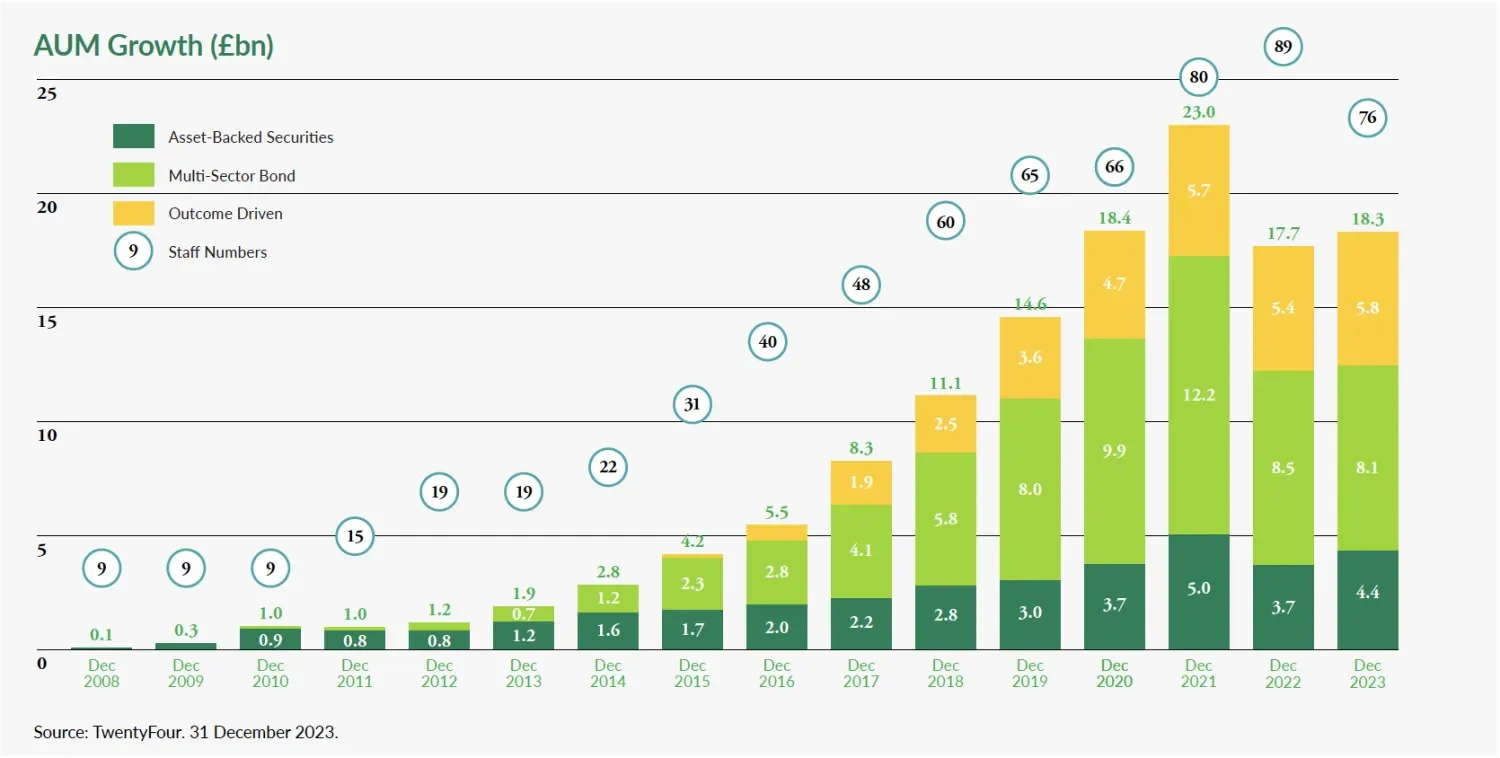

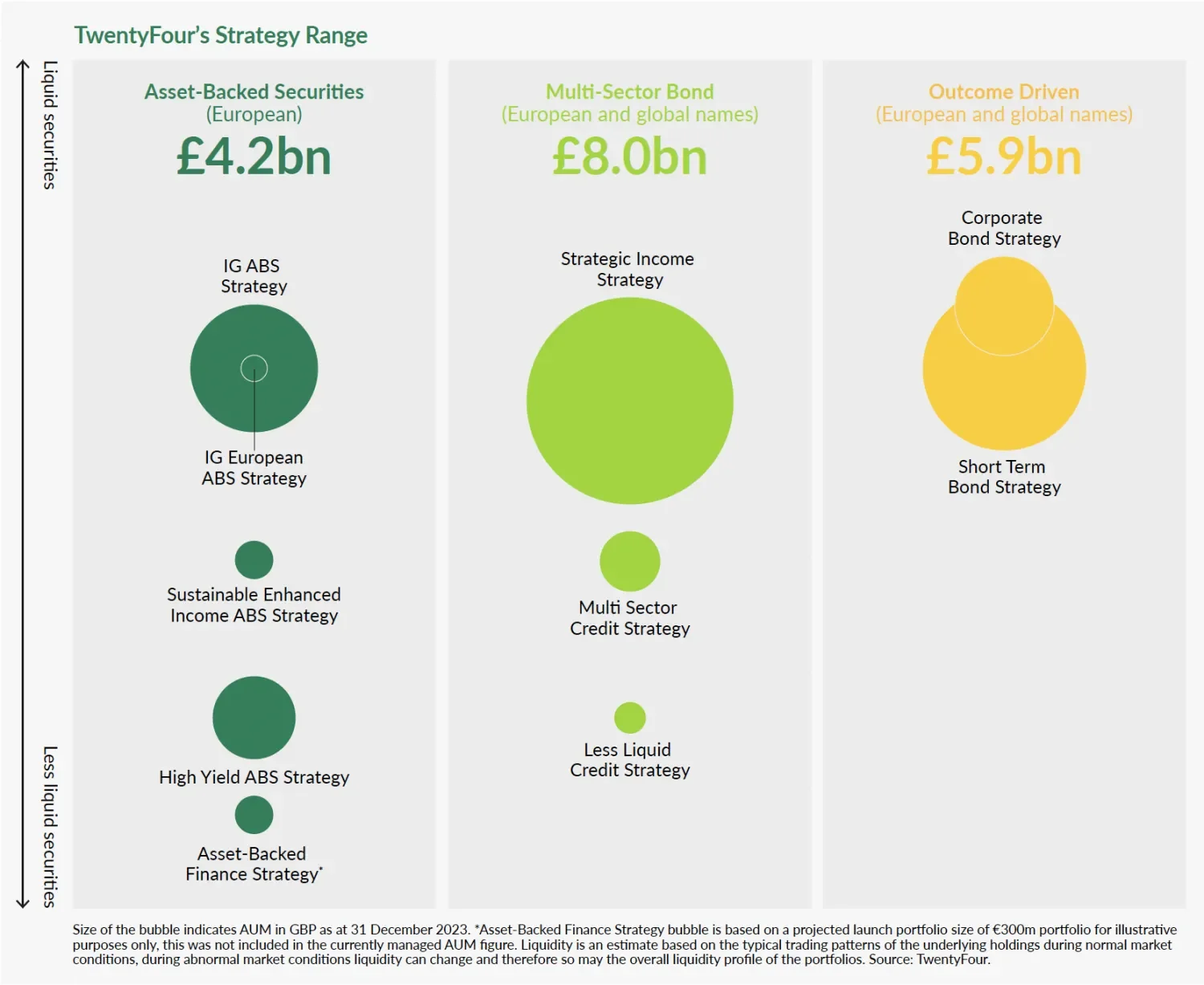

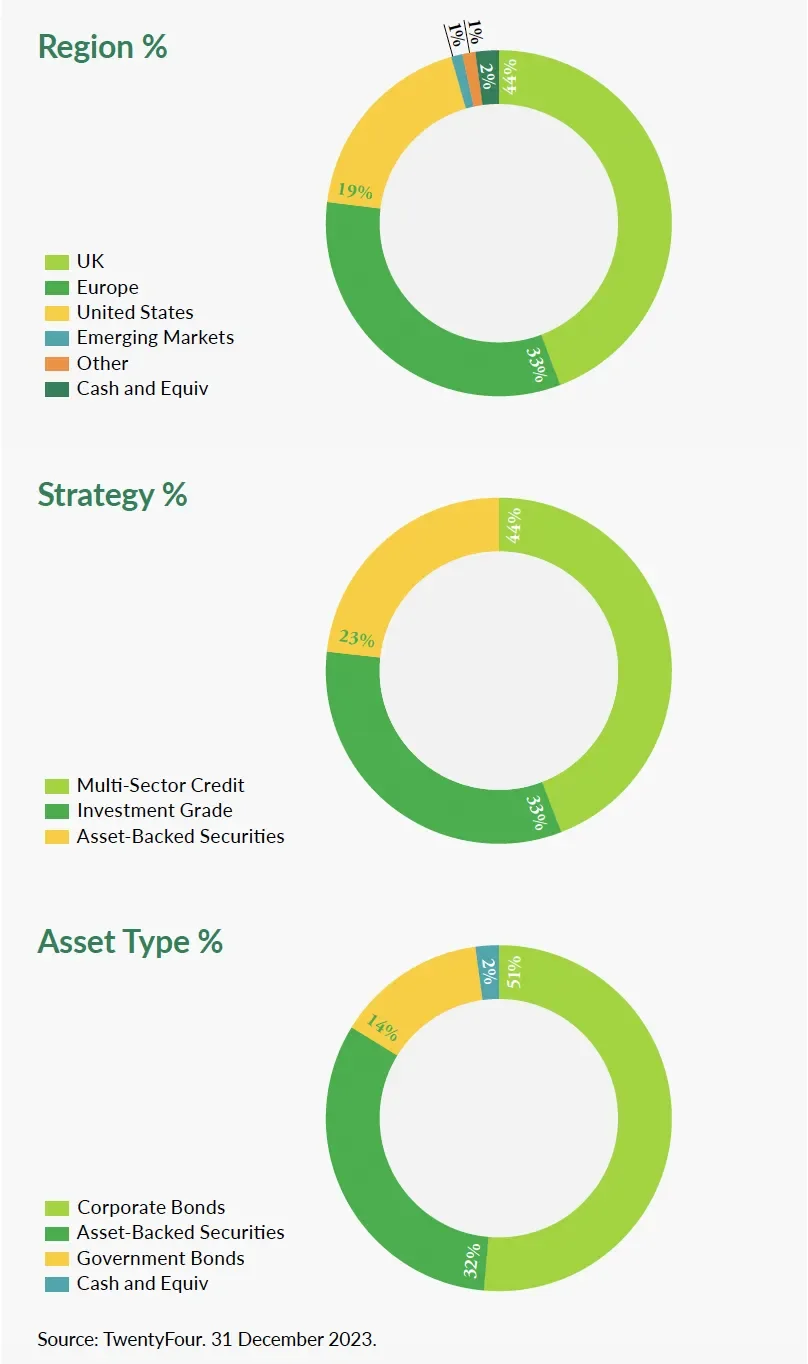

We specialise in fixed income, nothing else. Our product offerings are for both professional and institutional clients, covering open ended funds, closed ended funds, as well as segregated mandates. As at 31 December 2023, we had 77 members of staff and offices in London, New York and Santiago. Our fixed income specialist focus means that all our resources and people are managing one asset class with no distractions, and enables us to continue to build on our extensive experience in this area. While our approach to stewardship continues to evolve and we continue to build on our experience, our approach and philosophy to stewardship has remained the same in 2023; and we have continued to concentrate on delivering the best outcomes for our clients.

We have 32 investment professionals covering three distinct business areas (or strategies), but with a high degree of collaboration. For further information on these individuals visit the Meet our Portfolio Management Teams section above.

TwentyFour utilises Vontobel’s salesforce for its international distribution. Through its relationship with Vontobel, TwentyFour is also able to utilise the wider group’s internal audit functions to ensure accountability. In addition, to further demonstrate our commitment to operational excellence and with it suitable stewardship, TwentyFour has obtained the ISAE3402 Certification to validate the appropriateness of its processes.

As of 31 December 2023 we had over £18.1bn of assets under management from a range of clients, including pension funds, corporates, local authorities, insurers, wealth managers and financial institutions.

As a partnership TwentyFour believes its long-term future is aligned with that of our clients, and consequently we treat our relationship with our clients as a partnership. Our stewardship responsibilities are a key component of this relationship. As a fixed income portfolio manager, our first priority is to be the steward of our client’s capital; consequently, when we purchase bonds on behalf of our clients our key question is whether the issuer can continue to pay the coupons and return the principal at maturity. Therefore, we only want to allocate capital to companies with sustainable business models because any business making short term gains with unsustainable practices would present a significant risk to our clients’ capital, and their long-term investment objectives.

TwentyFour seeks to offer highly transparent actively managed fixed income products covering open ended funds, closed ended funds, as well as segregated mandates. In doing so we have positioned ourselves from the outset as a credit specialist asset management firm; we were founded by experts in fixed income who chose to continue focusing on the area they believe they could add value to clients rather than extending to asset classes where their value add would be less. As such, TwentyFour’s overall philosophy is to function with the culture and infrastructure of an institutional asset management firm whilst at the same time maintaining the flexibility to use alternative investment techniques, where deemed appropriate, and leverage off our expertise to benefit client outcomes, for example through our expertise in Asset-Backed Securities (“ABS”).

Our clients are globally diverse and therefore seek a variety of fixed income investment solutions to meet these varying needs. As such TwentyFour have various investment vehicles across multiple jurisdictions, with a variety of features to accommodate sustainability ambitions, liquidity needs, diversity needs, reporting requirements etc. In this way we seek to differentiate ourselves from other investment managers in the credit sector who typically focus on the UK/European client market and often have limited geographical spread of the investments within their respective portfolios.

Our ambition is to be one of Europe’s leading active fixed income managers and a go-to expert in this field. We also have ambitions to expand our business through organic growth, particularly by increasing our footprint in the US, and by utilising our relationship with Vontobel to make ourselves and our current product offerings known around the globe.

Central to our business’ long-term future lies a high standard of internal and external stewardship. We pride ourselves on our rigorous detail-oriented investment approach, seeking to achieve superior risk-adjusted returns for our clients while retaining a strong focus on capital preservation.

Our people make TwentyFour unique, and attracting, developing and retaining talented people remains at the heart of what we do. Our team’s expertise spans a range of backgrounds and disciplines, with the investment team having a blend of investment banking and asset management skills. We attribute our success to this diversity we have within the teams as they are able to bring their breadth in experience and capabilities to create the very best opportunities for our clients. Our collaborative environment and team-based approach means we reward a culture of knowledge sharing; helping everyone to thrive and work hard towards a common goal, whilst retaining and developing best in class people. During the course of 2023, two of the firm’s founding partners, Gary Kirk and Rob Ford retired, and Chloe Doyle the firm’s Head of Marketing was invited to join the partnership with effect in 2024.

It is important to us that a high level of emphasis is placed on transparency, be that with our clients through regular communications on how we’re seeing markets and positioning portfolios, to accountability should we make the wrong call. We don’t promise clients we’ll get it right every time, but we do promise that clients will know why we’re making the decisions we’re making. We believe our high degree of internal and external integrity with our external stakeholders is something to protect and contributes to our ongoing success.

During 2023 we hosted 59 client events (excluding individual client meetings), 42 of which were in person and 17 virtually, across multiple topics, some portfolio specific, some more macro-focused. Across these events we had 679 virtual attendees and 492 attendees in-person. We always request attendee feedback to enable us to develop future content, for example to cover a topic requested, or follow up on an individual basis on any questions raised that couldn’t be answered directly during the feature.

We supplement our events with video content, for example during 2023 we produced a ‘Spotlight on ESG’ series and a series highlighting certain investment classes, this is in addition to our quarterly market updates.

We also continued to produce our regular and very well received blog posts, publishing 112 blogs during 2023. Particularly during periods of market uncertainty, as we have seen the last two years, we feel that communicating with our clients is paramount to good stewardship.

From an asset management perspective, global fixed income markets are broad and complex, with many areas of specialism. A core tenet of our investment philosophy is that “diversity of experience helps ensure a wide range of views, which in turn helps us to capture returns and mitigate risks”. This has led us to create a portfolio management team with variety in terms of market segment, geographical expertise, background and mindset. This range in experience not only benefits our clients via our business output and influence on portfolio management decision making, but it also feeds into our people driven culture. We actively believe that the most influential person in the room is the person who has the most knowledge of the subject in question, no matter their background, level of seniority or tenure; we actively encourage challenge and input from all and proudly foster psychological safety.

Internally, TwentyFour operates a unified, dynamic and open working environment in which staff are encouraged to put forward ideas and opinions, be it as part of our security selection process, through to how we can improve our HR strategy; nothing is seen as off limits and every person is encouraged, in the right way for them as individuals, to contribute and be a part of how the business grows and develops. We believe this collaborative and collegiate approach emboldens staff, builds a level of respect and trust within and between teams, and encourages long-term commitment and enjoyment for work. We are proud to be forward thinking in our support of our people, and continue to transform to changing needs.

In 2023 we ran a specifically designed engagement survey across the business. We were pleased that our engagement score measured higher than the relevant UK benchmark in Financial Services, but we also used the survey to identify areas of strength we can build on further, and also where we should dedicate more time and focus to further improve what it feels like to work at TwentyFour.

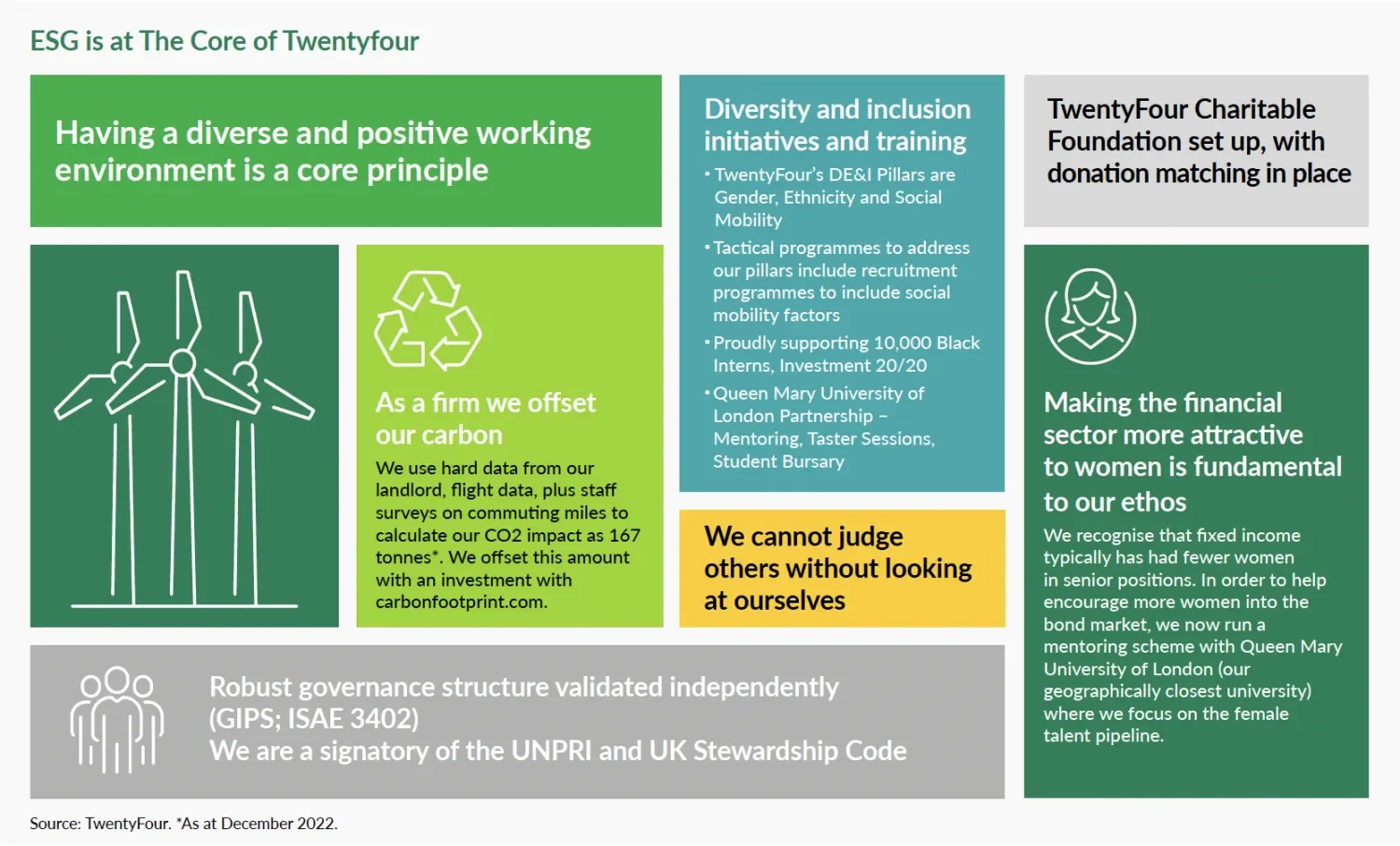

We own a passionate focus on diversity, equity and inclusion (DE&I) working closely on our grass roots influence, recruitment processes, internal promotion, development and awareness programmes. When recruiting new staff, TwentyFour places a strong emphasis on selecting the right person for the job, and we work hard to remove bias and have set firm commitments for ourselves to ensure our actions actively encourage and celebrate DE&I. In 2023, we continued to support the key pillars of focus identified by the DE&I Working Group formed in 2022. We offered paid internship to underrepresented groups and have another two strong candidates due to join us in 2024 via GAIN and 10,000 Interns, again widening industry participation. Additionally, we have continued to broaden our links with our local university, recognised for its high social mobility rate, with the introduction of a new student bursary, ongoing mentoring for students, interview skills workshops, and insight events. We have also run education events for female audiences and sixth form students to again help broaden horizons at an earlier stage.

Internally, we confront our thinking on how we develop, support and promote our own people and seek to partner this alongside empathy for individualisation. During 2023, we ran a number of educational sessions on key topics and were proud to introduce two new practical policies focused on Menopause and Fertility. We also ran a DE&I staff survey to focus on understanding internal perceptions. There were many positive areas, but we also took steps to start to address areas for improvement, including setting up a staff DE&I Forum and developing a coaching programme to be rolled out in 2024 designed for our female and/or our colleagues from an Ethnic Minority

For more information see our Corporate and Social Responsibility Statement.

Our investment process has evolved over the years, though at its core it has remained consistent; an easy to understand monthly top-down and daily bottom-up process, with a bi-weekly ‘validation’ of our asset allocations. Importantly, our process is easily repeatable and can consistently be applied to every company that issues, manages or services any instrument in which we invest, but with the flexibility to pivot quickly should market conditions require. The process itself is not unique, but we believe our key differentiators are our market focus, experience and the talent level of our team. Both our top-down and bottom-up decisions are taken as part of a team-based exercise which we believe benefits team buy-in, general oversight and good governance. No part of our investment process is outsourced and it is based on our own research, which we believe supports good stewardship. Where appropriate, and at TwentyFour’s own expense, third party investment research, including from brokers, is also used.

As more fully described in this document, our portfolio management teams aim to meet the management of every company whose securities we invest in, or who manages or services any instrument in which we invest – both prior to investment and on an ongoing basis. If a company is taking action which we believe is detrimental to the interests of investors or the market as a whole, we have various ways with which we can engage with them on our clients’ behalf. Any engagement is formally recorded by issue, the desired outcome, the form of engagement, the company’s response and any action subsequently decided by us.

As part of our detailed bottom-up credit analysis a potential investment is allocated to one of the portfolio management team members, who will then conduct a detailed analysis of the investment and present it to the portfolio management team for further scrutiny and challenge and, if necessary, further analysis can be carried out. If any senior member of the respective portfolio management team cannot get comfortable with the risk-adjusted return profile, we will not invest.

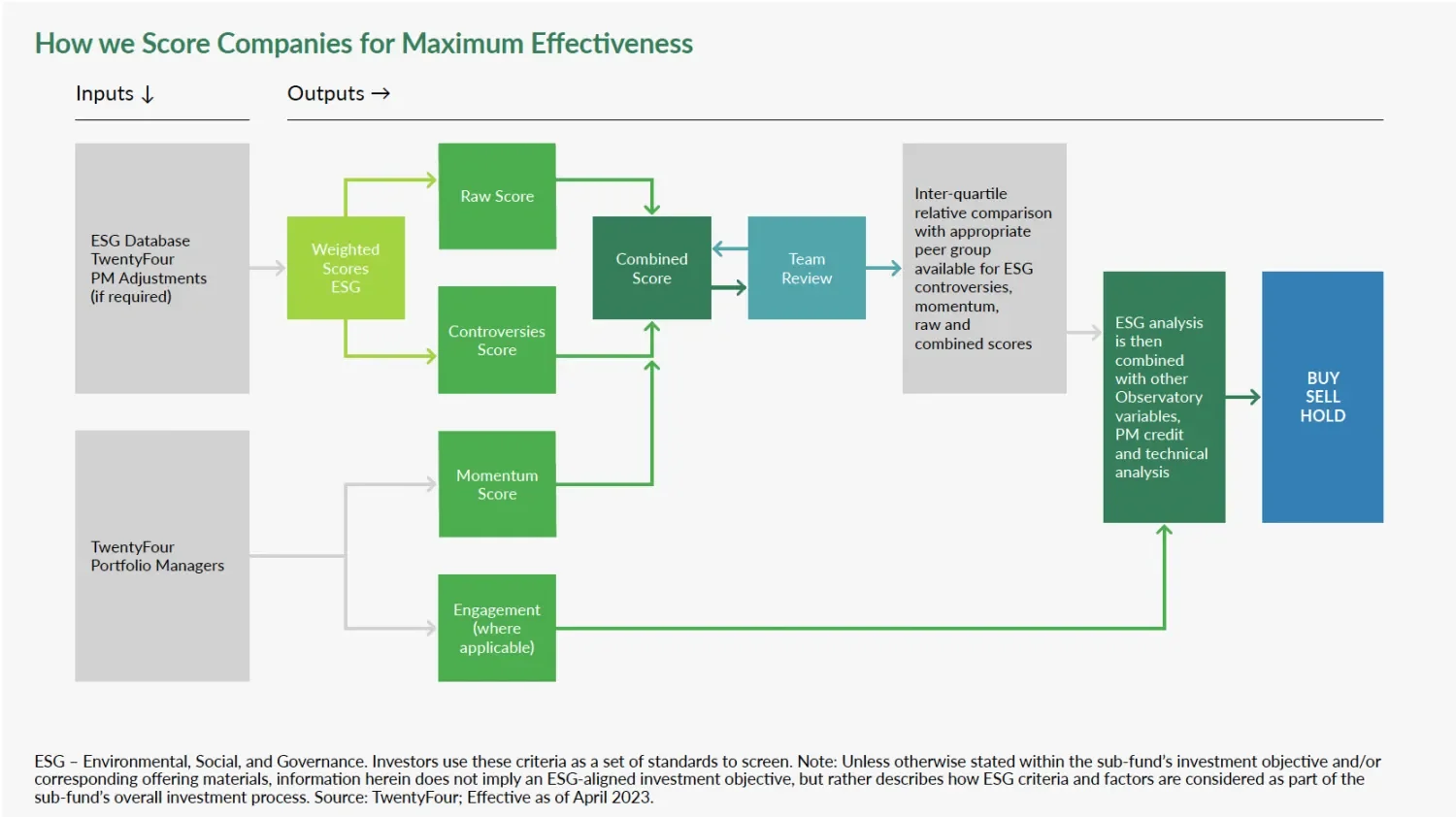

In addition, we believe that ESG factors can have a material impact on the future performance of our investments. As such, explicitly considering ESG factors is embedded, or integrated, in our investment process for all the funds and accounts that we manage. We believe this approach helps us target the maximum risk-adjusted returns for our clients while promoting better societal outcomes. Furthermore, we believe that it is one thing to describe a framework, but for it to be truly impactful it needs to be ‘owned’ by all members of the portfolio management teams rather than through a separate ESG team. The process also has to be robust and easy to use if it is to be truly successful. To that end we have invested considerable resource to extend our proprietary portfolio management system, Observatory, to incorporate a model for ESG factors.

We are strong believers in assessing a company’s ESG momentum, or transition to improved ESG performance. That is, does a company have a demonstrable plan to improve key areas of ESG weakness? If so it may be better to support a company through its transition rather than to make improvements more difficult by starving it of capital; we take the view that better future outcomes are surely more important than blunt rules.

We believe transparency with regard to our funds’ objectives, performance and construction is a crucial part of our relationship with, and responsibility and accountability to, our clients. We seek to achieve this through face-to-face meetings as well as multiple forms of media engagements including monthly factsheets, semi-annual fund reports, investor roadshows, investor group updates, an annual conference, website content, whitepapers and blogs.

As mentioned above, we believe our clients shouldalways be kept informed of the products they hold and our general market opinions, especially in challenging years. Accordingly, we seek to utilise our experience and expertise in the area of fixed income to impart thought leadership on specific aspects of the fixed income market through whitepapers, blogs and educational teach-ins, where we are able to educate clients on the more complex parts of the asset class. This in turn will not only help increase their understanding but should assist in more informed decision making on their part.

We believe strong corporate governance structures and processes start with ourselves and this has played an important role in encouraging the high standards of corporate governance that have underpinned TwentyFour’s history of success. These governance principles remain in place to ensure our future growth.

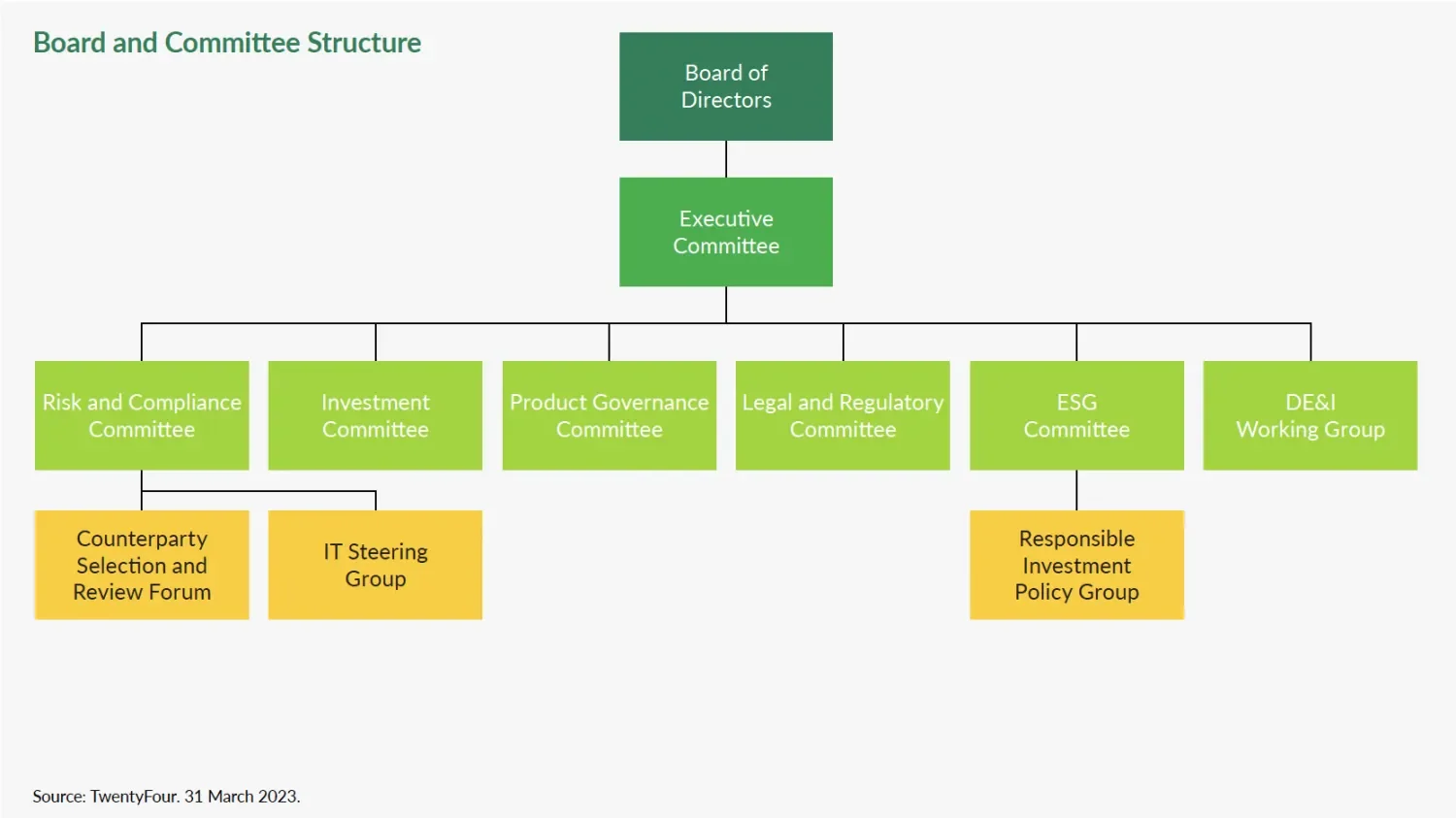

TwentyFour’s Board of Directors manages the overarching business strategy for the firm and while the ultimate responsibility remains with the Board, the day-to-day governance and management has been delegated to TwentyFour’s Executive Committee (“ExCo”). To help ensure greater oversight of the issues facing the business and the decision making processes that underpin our business, ExCo has established committees to oversee certain aspects of the business.

The committees report monthly to ExCo and in addition hereto, at least one member of ExCo sits on each of the underlying committees that report into it. We believe having presence on these committees as well as direct reporting lines into ExCo greatly improves the transparency and accountability of the committees and ensures ExCo maintains oversight. We believe this structure enables us to respond quickly and efficiently in the ever-changing external environment.

In 2022, ExCo formed the DE&I Working Group, mandated to fulfil our commitment to providing a truly diverse, equitable and inclusive workplace in which all staff are treated with respect and have equal opportunities to reach their full potential and feel valued for their contribution to TwentyFour’s success. During the course of 2023 we defined the firm’s DE&I commitments to Gender, Ethnicity and Social Mobility and we also formed a DE&I Forum to assist the DE&I Working Group. The forum is intended to be the staff voice for DE&I and to create greater awareness of DE&I focuses at the firm.

In addition to ensuring at least one member of ExCo sits on every committee, on an ongoing basis ExCo closely monitors policies, systems, controls and resource within the firm, and in particular the membership of each reporting committee. While the committees may propose policies, ExCo reviews and approves all of the firm’s policies and the Terms of Reference of the committees. The committees are authorised to approve procedures and rules, albeit these decisions are minuted and presented to ExCo on a monthly basis maintaining that chain of oversight. Additionally, ExCo approval is required for all fees offered, and each new product or product amendment, including changes to ESG strategies.

The composition of ExCo is kept under review to ensure it adequately represents all aspects of TwentyFour. Our ExCo currently has six members, Ben Hayward (CEO), Nick Knight-Evans (COO), Graeme Anderson (Chairman, Portfolio Manager), Sujan Nadarajah (CCO), John Magrath (Head of Distribution) and Eoin Walsh (Portfolio Manager). Detailed information on each of the members of ExCo can be found on our website.

As TwentyFour has expanded in size and taken on more staff, the membership of the reporting committees has also tended to expand as a consequence, given the desire for as broad an input as possible across the firm within the parameters of that specific committee; members of the committees are empowered and encouraged to bring challenge and are chosen for their complementary expertise.

We believe that having the flexibility to amend the Terms of Reference of a committee, or indeed to create a new committee or working group, with immediate effect helps to ensure a quick identification and response to the various issues that face an asset management company in the current and future climates. The DE&I Working Group and Forum are examples of this.

TwentyFour’s ESG Committee has been tasked with continually developing and implementing the firm’s ESG and stewardship process across the business. The Committee is headed by Graeme Anderson (ExCo Chairman) and Sujan Nadarajah (ExCo member, CCO) with members and invitees from functional areas across the firm. The permanent members of our ESG Committee comprise senior members of portfolio management, marketing, sales, compliance, risk, product and legal. The Committee has been deliberately made up of senior members of each business division within TwentyFour to ensure fair representation, diversity of opinion and uptake of the initiatives proposed; ultimately this ensures ESG is implemented and embedded across TwentyFour. The Committee meetings are open to all members of staff that are interested, and it is not uncommon to have over 20 attendees – a quarter of the firm attend. We believe this transparency within our organization further supports how ESG is embedded and encourages transparency towards our clients. The Head of Vontobel’s ESG Centre is also invited to attend the meetings so TwentyFour can benefit from the wider Vontobel Group’s insight. Equally, representatives from TwentyFour also attend Vontobel’s ESG Investment Forum and various other ESG Working Groups.

As described more fully in this report, every member of the portfolio management team at TwentyFour is responsible for their own ESG analysis on every investment they make and this work is part of their performance appraisal ensuring accountability in the application of our ESG process; we believe this ensures accountability for not only implementation but also embedding ESG across all our funds and mandates on an ongoing basis.

Within TwentyFour we operate an inherently flat structure with limited focus placed on job titles as we believe each staff member’s opinion is as important as the next. We believe that having a flat structure with reporting committees greatly increases transparency across the firm, which helps to negate any key person risk pervading business as usual. To this point, there is still a high degree of interaction between all of the teams as a consequence of having a collegiate approach and the ability for anyone to challenge a process or decision if they feel it can be improved.

This open structure and the benefits it can bring is fundamental to how we approach our Investment Committee whereby at any meeting, as well as members from each portfolio management team, members of our Risk, Compliance and Sales teams for example are welcome to attend. By having this wider attendance, should a direction be proposed that could potentially breach a regulatory restriction, a portfolio’s risk parameters or indeed how we think a client wants us to manage their monies, that proposal can be challenged there and then. This structure and approach have been deliberately designed to empower the staff we have as we firmly believe that when our staff feel valued they will be motivated to deliver the exceptional performance we strive for, and our clients expect.

Equally, good stewardship is a central belief at TwentyFour and this is brought to the fore by how our staff are incentivised to support our business strategy, objectives and values. We utilise the HR system, Workday, to record goals and monitor staff performance throughout the year ahead of an annual performance review. Staff are encouraged to set their own goals in agreement with their line manager so that they can be tailored not just to their current role but importantly towards their future career planning within the business. As part of the goals staff will set themselves, line managers will also set overarching goals which will ensure stewardship is upheld as a central determinant of performance, for example by ensuring staff have adhered to TwentyFour’s various policies and procedures. Importantly staff have regular one-to-one sessions with their line manager to discuss their progress and raise any concerns they may have in an open and encouraging forum, regardless of subject matter.

The annual appraisal feeds into the remuneration review performed at the same time of year, and one of the factors used in determining the compensation review and any discretionary bonus to be paid is how the staff member has performed in regards their objectives and stewardship activities. The nature of this will depend on the role they fulfil within the business, for example for members of the portfolio management team this will typically be how they have embraced and enhanced our ESG process within our portfolio management decision making (see Principle 7 for further details on this process), whereas for members of the risk team this will usually be how they’ve contributed to ensuring the framework within which portfolios are managed and in which the business more generally operates is effective and in line with client and other stakeholders’ expectations. By embedding good stewardship within the HR and performance development framework we believe this promotes accountability and ensures TwentyFour’s own business direction is driven with this philosophy at the forefront.

TwentyFour is also committed to investing in systems and personnel to ensure the appropriate processes and resource are in place to enable the firm to meet its objectives of effective corporate governance. Building on the work completed in 2022, during the course of 2023 additional enhancements were made to ESG model in our proprietary portfolio management system, also enabling improved reconciliations between systems (supporting better oversight). Alongside this enhancements were made to TwentyFour’s pricing process to reduce the time spent on pricing by the firm.

In regard to resource, as TwentyFour’s assets under management have grown, we have not only invested in front office staff but significantly expanded the firm’s Operations, Compliance and Risk functions to ensure that we maintain the integrity of our institutional framework helping to ensure good stewardship.

TwentyFour recognises situations can occur that would lead to concerns over possible conflicts of interest, either with ourselves, with our clients or between clients via the portfolios we manage.

TwentyFour is committed to identifying, preventing and, where prevention is not possible, managing conflicts of interest to the maximum extent possible at all times. Although TwentyFour will also be under a regulatory obligation regarding its approach to conflicts of interest, this is done to ensure the highest degree of professionalism, integrity and ethics within our operations and ultimately to treat our clients in a fair and consistent manner by safeguarding their interests. It is important to note however that conflicts of interest may arise even where no improper or unethical behaviours have occurred and will just be a consequence of operating within the investment management industry.

TwentyFour has established a variety of systems and controls to address this including the Compliance function maintaining a formal Conflicts of Interest Policy and Conflicts Record, which is presented to our ExCo and the Board of Directors on a quarterly basis, or more frequently as the Chief Compliance Officer (CCO) deems necessary.

All staff receive training in respect of conflicts of interest both when joining the firm as well as part of an annual refresher training session. This training covers amongst other things the firm’s Conflicts of Interest Policy, how to identity potential conflicts, the guiding principles on how we look to manage them, including those conflicts related to stewardship, as well as describing how we manage specific conflicts that are particularly relevant to our business. It will also lay out the escalation process to follow when a potential conflict has been identified.

TwentyFour’s Conflicts of Interest Policy is reviewed at least annually, and the most recent version is publicly available on our website. It is also circulated periodically to all staff via e-mail as well as being made available on a shared drive accessible by all staff. Additionally, staff are periodically required to attest that they are not aware mof any conflicts of interest that have not already been disclosed to the firm’s Compliance function. Failure to adhere to TwentyFour’s policies may be held to be a breach of an employee’s contract and may lead to disciplinary action being taken; staff are specifically made aware of this via both their periodic training and the policy document itself.

TwentyFour’s Conflicts of Interest Policy also extends to the personal activities of staff members outside of the firm, for example through disclosing to TwentyFour’s Compliance Officers any outside business interests such as directorships, involvement in public office or public affairs and trusteeships. Those too can then be assessed for conflicts of interest, or potential conflicts of interest, and appropriate action taken where deemed by the Compliance function to be necessary. An example of such action would be where an identified conflict cannot be managed appropriately the staff member will typically be asked to terminate the conflict by stepping down from that outside business interest, and/or the client is notified of its existence.

As set out in the Conflicts of Interest Policy, TwentyFour recognises the provision of investment management services to our clients could potentially give rise to situations where a conflict arises. Accordingly, TwentyFour has put in place measures, some of which are set out in further detail below, to ensure that TwentyFour, and where applicable its staff members, must not place its own interests unfairly above those of its clients.

Senior management within TwentyFour are responsible for ensuring that systems, controls and procedures are adequate to identify and manage conflicts of interest. TwentyFour’s Compliance department assists in the identification and monitoring of actual and potential conflicts of interest, and in addition to the reporting set out above, reports on this to TwentyFour’s monthly Risk and Compliance Committee.

Where conflicts, or potential conflicts, are identified TwentyFour is committed to ensuring that they are effectively and fairly managed so as to prevent these conflicts from constituting or giving rise to a material risk of damage to the interests of clients.

Where it is not possible to prevent actual conflicts of interest from arising, and those that have arisen to be resolved, TwentyFour will use best endeavours to manage the conflicts of interest by, among other things:

An example of where TwentyFour has managed a conflict is how TwentyFour manages its relationship with the other entities within the Vontobel Group; TwentyFour being a wholly owned boutique of Vontobel but also delegated investment manager for several of Vontobel’s sub-funds on its Lux SICAV platform. While the Vontobel Group is not involved in the day-to-day management of TwentyFour, we recognised this as a potential conflict of interest, and have implemented decisions to accommodate this, such as choosing not to use any other Vontobel Group entities as a trading counterparty or to hold any of Vontobel’s issued debt in any of the TwentyFour-managed portfolios, both those managed for Vontobel as well those managed for other asset owners.

A further example was managing the inherent conflicts of interest involved when one of the listed funds that we are the delegated portfolio manager to acquired the assets of another listed fund managed by TwentyFour. This required various measures being taken and in particular around ensuring personnel involved in managing the respective funds only had access to information relating to their side of the proposal; that they were informed of the proposal only as and when it was deemed necessary resulting in different people being bought ‘over the wall’ at different times; as well as effectively communicating to the respective fund boards, stakeholders, regulators and ultimately the respective shareholders. The process also required us to ‘bring over the wall’ portfolio managers from another team who manage two unrelated funds that held shares in one of the affected funds, and would therefore require making an independent assessment of what was in the best interests of the respective fund managed by them.

The below conflicts represent some of those TwentyFour have identified that specifically relates to our stewardship responsibilities; details of the safeguards TwentyFour has put in place to manage these potential conflicts are set out in the TwentyFour’s Conflicts of Interest Policy but can be summarised as follows:

TwentyFour has in place a Proxy Voting Policy which sets out that when voting as proxy, or acting with respect to corporate actions for investments we manage for clients, TwentyFour’s utmost concern is that all decisions are made solely in the best interest of the client and we will act in a prudent and diligent manner intended to enhance the economic value of the assets of the client’s account(s). When a conflict of interest, or potential conflict of interest, is identified ahead of voting, TwentyFour will follow the following hierarchy:

During 2023 we submitted 64 proxy votes with the above hierarchy being followed on all occasions.

Conflicts may arise when clients are also companies that issue bonds which TwentyFour may hold or where such issuers are associated with a client (for example as their company pension scheme trustee). In these circumstances, contentious issues are discussed with the relevant fund managers as part of TwentyFour’s investment due diligence process and then with TwentyFour’s Chief Compliance Officer. TwentyFour will always look to act in the best interests of the funds/clients who hold those bonds, using the principles of Treating Customers Fairly (TCF) in line with TwentyFour’s Treating Clients Fairly Policy.

Where another portfolio is a holder of shares in listed funds that TwentyFour manages, or indeed where senior managers hold shares in a personal capacity, a potential conflict may arise. In order to manage this conflict, TwentyFour and its senior managers do not, as a matter of policy, vote on any actions or resolutions in relation to these listed funds. The same applies where Vontobel shares were held in a personal capacity or on a staff member’s behalf as part of a Long-Term Incentive Plan.

Where a staff member or their connected party wishes to trade in an affected security (as defined in the TwentyFour’s Personal Account Dealing Policy but includes trading in funds TwentyFour manages and securities those funds could trade in with the exception of securities issued by major governments) they must first request consent from TwentyFour’s Compliance function setting out details such as the security, the quantity and the rationale for the trade.

TwentyFour’s Compliance function will then assess if any conflict of interest is present including by liaising with the applicable portfolio management team(s) to assess whether the request could have a negative impact on the funds/ accounts we manage. If approved, the trade will normally need to be instructed within 24 hours unless agreed otherwise in advance. Should the trade not be instructed within the agreed time, a new request would need to be sought.

TwentyFour’s Compliance function maintains a record of all requested trades and a summary of this is reported to the Risk and Compliance Committee on a monthly basis, as well as the ExCo and the Board of Directors on a quarterly basis.

TwentyFour is required by regulation to put in place arrangements to enable it to deliver best execution for its clients, and to ensure that this is adhered to by all staff members permitted to place client orders. Details of how this is applied are set out in TwentyFour’s Order Execution Policy which is publicly available on the Regulatory section of our website .

It is TwentyFour’s policy, therefore, to have a process which ensures every client order is treated in a way that aims to maximise the chance of getting the best set of results when trading. To ensure this is being met, TwentyFour’s Compliance function performs monthly monitoring of a sample of trades which will be no less than 10% of those executed, and in doing so will review the process, the terms of execution and the trade rationale. Where a trade appears not to have been executed at the best price or the rationale does not align with TwentyFour’s Asset Allocation Committee outputs, the Compliance function will request further explanation from the relevant portfolio management team. Any anomalies after such explanation are raised to the Risk and Compliance Committee.

Similarly, from time-to-time TwentyFour may choose to enact a ‘cross trade’ which is a process whereby buy and sell orders are executed between accounts each of which are managed by TwentyFour. Cross transactions have to balance the benefit between these accounts so that neither are treated preferentially. To ensure portfolios are treated equitably this is governed by a formal Crossing Policy and overseen by the firm’s Compliance function.

TwentyFour’s allocation and aggregation of trades is governed by its Trade Aggregation and Allocation Policy, which says all investment opportunities will be allocated on a basis believed to be fair and equitable; meaning no portfolio will receive preferential treatment over any other. At all times TwentyFour aims to:

To do this the portfolio management team will take steps to ensure that no client portfolio will be systematically disadvantaged by the aggregation or allocation of trades with the prime determinants being the portfolio’s market and credit exposure, its asset class/sector exposure, cash availability, liquidity, and with regard to the suitability of such investments to each portfolio.

Same as for TwentyFour’s client order handling process, the Compliance function performs monthly monitoring of a sample of trade allocations/aggregations which will be no less than 10% of those executed, and in doing so will review the process, the terms of allocation/aggregation and the rationale. Where a trade appears not to have been allocated/aggregated on a pro-rata basis, or the rationale does not align with TwentyFour’s Asset Allocation Committee outputs, the Compliance function will request further explanation from the relevant portfolio management team. Any anomalies after such explanation are raised to the Risk and Compliance Committee.

Prior to placing a trade in a portfolio managed by TwentyFour to invest into any of the listed funds that TwentyFour also manage, the respective portfolio management team must first obtain approval of TwentyFour’s Compliance function. This applies to both purchases and disposals and the Compliance function retain a record of such transactions, any TR-1 Forms and relevant supporting evidence.

All staff members are strictly prohibited from engaging in insider dealing and regular training is provided to all staff members to reinforce their knowledge and understanding of the restrictions TwentyFour has put in place. When a staff member becomes aware of inside and/or confidential information they must report this immediately to TwentyFour’s Compliance function, who will then record the details and ensure sufficient restrictions are in place and ensure appropriate information barriers are formed to prevent disclosure to unauthorised persons. Such barriers can include both physical and systematic barriers as deemed appropriate. Persons are only “wall crossed” on a strictly need to know basis and should only be exposed to inside and/or confidential information for the shortest possible time.

Following the adoption of a hybrid working environment (as described further in Principle 1), TwentyFour has taken additional measures to help manage information, particularly where staff members are working from shared locations and are therefore at increased risk of information leakage. Such measures include encouraging staff to work in an isolated location within their home/remote environment where possible, using headphones when discussing sensitive subject matters, and additional reminders to secure paperwork/computers when the member of staff is away from the home desk/setup. Regular refresher training on this is carried out by the firm’s Compliance function or external compliance consultant.

TwentyFour’s ability to identify and respond to market-wide and systemic risks is driven by the effective design, implementation and oversight of a risk management programme that aims to embed a culture of risk management across the firm.

The effective identification, measurement and management of risks within the business coupled with a disciplined and risk-minded approach to our engagement with other market participants helps to promote the effective functioning of the overall financial system.

Risk management is a key consideration for TwentyFour across all our activity, from the management of our business to the investments we make on behalf of our clients. As more fully set out in Principle 2, ExCo is responsible for the day-to-day management of TwentyFour’s business to ensure that it achieves its strategic objectives and the associated risks that arise as a result of our business activities. ExCo has put in place an independent Risk function and appointed a Chief Risk Officer (CRO) who has day to day responsibility for the risk management of the firm. The Risk function is functionally independent from portfolio management and the CRO has direct reporting lines to ExCo and the Board.

Given its partnership history, TwentyFour employs a cautious and risk averse philosophy. However, we acknowledge that risks do exist as a result of normal operating activity and cannot always be completely mitigated. The effective identification and management of these risks within the firm and across related business counterparties, including service providers, market counterparties and regulators help ensure that TwentyFour support the effective safe functioning of the financial system.

At firm level a Risk Management Framework has been implemented that enables TwentyFour to effectively identify, monitor, communicate and manage risks across two key pillars: the Business Risk associated with the operation of the firm and the Investment Risk we assumeon behalf of clients when investing in financial markets. Under the two pillars, each risk is identified and quantified or measured through a combination of qualitative and/or quantitative measures. TwentyFour employs the core risk management objectives (RMOs) of independence, analysis, monitoring and understanding as the principles across the firm when considering the risk of our activity.

The Risk Function, headed by the CRO, oversees the Business Risk and Investment Portfolio Risk Management Arrangements. Areas of potential risk or vulnerability in excess of TwentyFour’s risk appetite are identified and associated controls and mitigants are considered. Realised risks are identified, managed and resolved and/or escalated for review and decision as appropriate. This is achieved by regular risk reviews as part of the effective implantation and operation of an overall risk management programme that is designed to ensure that the firm’s risk philosophy, RMOs, and business objectives are embedded into every aspect of its ongoing operating activity through its systems, processes and procedures.

Risk and Compliance Committee – The TwentyFour Risk and Compliance Committee, co-chaired by the CRO and CCO, meets on a monthly basis and includes representation from across the firm. The Committee serves as the focal point for reviewing both portfolio investment risk and compliance; and firm-level Risk including operational, technology and compliance and regulatory risk. The Committee reviews the efficacy of the control environment, realised operational risk events and any emerging systemic risks/risk landscape changes that may impact client portfolios and the broader financial system. The Committee reports into ExCo on a monthly basis.

Identifying and Responding to Market-Wide and Systemic Risks and Promotion of a Well-Functioning Financial System

Firm Risks

TwentyFour seeks to manage all risks that can affect its ability to function as a going concern. By ensuring that the firm minimises its operational (including technology) and balance sheet risks, it can continue to function as an effective part of the financial system. At the highest level, TwentyFour seeks to achieve this through a combination of a disciplined approach to modelling and managing of the firm’s finances and capital adequacy, together with the effective implementation of its operational risk framework and cybersecurity risk management programmes.

The principal risks faced by TwentyFour include:

1. Business/Capital Risk

An annual capital adequacy assessment is performed which attempts to quantify the risk to TwentyFour’s ability to continue as a going concern and considers market-wide/potential systemic risk scenarios which might be significantly detrimental (‘stress scenario’) or indeed a wind-up scenario (‘reverse stress test’). By ensuring that the firm is sufficiently positioned from a business strategy and capitalisation perspective to effectively navigate the impact of the former and prepared for an orderly wind down in the event of the latter, the potential risk of detriment to the financial system is reduced. TwentyFour’s market, liquidity and credit risks are assessed on an ongoing basis in order to ensure that the Risk to the firm and market counterparties is within appetite thus contributing the overall effective functioning and stability of the financial system.

2. Operational Risk

TwentyFour’s operational risk framework lays out our approach to the identification and quantification of risks that arise as a result of operating the business coupled with a set of controls and oversight processes which are designed to eliminate any unnecessary associated risks. The set of risk assessments and associated mitigating controls are codified into our Risk and Control Assessment (RACA) matrix which is updated on an annual basis. The RACA effectively functions as: a catalogue of all operational process risks identified (usually on a self-assessment basis) across the firm; the associated controls implemented to reduce their inherent risk; and measures of the residual risk materiality after application of controls. The set of processes and associated controls directly related to its outsourced portfolio management activity are subject to independent third-party audit as part of an annual ISAE 3402 assessment.

3. Cybersecurity Risk

TwentyFour is exposed to the risk of a successful cyberattack through a breach of the cyber defences maintained by the relevant service providers. To mitigate this, TwentyFour requests of its service providers that they have appropriate safeguards in place to mitigate the risk of cyberattacks (including minimising the adverse consequences arising from any such attack) and that they provide regular updates to us. On a monthly basis TwentyFour’s Head of IT meets with its outsourced IT provider and cybersecurity is one of the key topics discussed. A cyber risk assessment is prepared by the Head of IT for review by the Risk and Compliance Committee on a monthly basis. Additionally, TwentyFour maintains the Cyber Essentials Plus certification and all members of staff complete annual cybersecurity training. Naturally we closely monitor the developments in this space and report to clients on our cybersecurity measures.

Our trading system as well as our dedicated risk systems and tools provide the necessary functionality to enable the Risk department to monitor and manage the risks associated with the investment portfolios managed on behalf of clients. This includes the ability to ensure compliance with any relevant investment restrictions and to manage the associated Investment Risks. Performance is also monitored and reported on an ongoing basis to provide a holistic picture.

The Risk department is engaged in the independent identification, measurement and management of investment risks within portfolios with a particular focus on any potential for adverse impacts arising from systematic or market-wide risks.

The principal client portfolio investment risks managed include:

1. Market Risk: including overall market risk, leverage risk, risk factor sensitivities, concentration risk and scenario risk. We ensure that all portfolios are invested in line with their legal limits and an agreed set of additional internal risk-based guidelines. Our funds do not take material leverage risk and avoid the use of exotic derivatives thus reducing any potential impact from overall market declines/negative systemic issues which might be magnified by excessive leverage taken through direct exposure or highly geared derivatives. We actively hedge a range of risks including currency and duration such that the market risk we take is as intended and we believe adequately compensated for rather than being a result of unintended consequences. Our philosophy is such that by ensuring we take risk commensurate with our disclosed investment programme and return objectives, the chances of contributing to risks arising as the result of systemic biases is minimised. TwentyFour performs scenario analysis to understand how portfolios will react in the event of a realised systemic risk such as a global pandemic or crash in a specific market sector. A firm-wide derivatives risk management framework ensures that any exposure is taken in a risk-controlled manner by suitably qualified investment staff.

2. Counterparty Credit Risk: We aim to minimise all forms of counterparty risk which includes both direct and contingent risks:

The aforementioned reduces the chances of contagion in the event of market-wide stress associated with an increased frequency of failed trades, or elevated financial stress amongst market participants.

C. Liquidity Risk: TwentyFour has worked with a third party liquidity software provider to enhance our analytical capabilities resulting in an improved representation of likely fixed income security trading dynamics when compared with standard historical volume-based measures; particularly for areas of the market that trade infrequently and off-exchange. Through these enhancements we believe the models employed better reflect our ability to sell securities into the market under various market scenario assumptions. This improved liquidity insight enables us to positionportfolios conservatively such that they should not be unnecessarily forced into a position of attempting to sell at a greater volume level than the market can accommodate, which can lead to systemic impacts on realised sale prices and consequently portfolio security valuations and volatility across the market. We work closely with related market participants including fund management companies and depositaries in conducting liquidity stress testing and to support the implementation of any liquidity contingency processes (e.g., swing pricing, anti-dilution levies etc.) in the event of market liquidity dislocations.

D. ESG Risk: As more fully set out below TwentyFour has developed and embedded throughout its investment process a comprehensive approach to the management of ESG and Sustainability risks. Our Investment Risk management programme acts as an independent quantitative codification of our process to ensure that the portfolios are managed in such a way that the investment process complies with our stated ESG and/or Sustainability objectives. Acting to deliver an integrated, controlled approach to ESG risk contributes to the reduction of the systemic ESG risks and the associated realised Principal Adverse Impacts (PAIs) as part of a concerted effort across the industry.

Case Study TwentyFour’s response to the period of market turmoil following the UK ‘mini budget’ in September 2022 that resulted in sharply higher inflation projections and interest rate expectations that directly impacted LDI pension funds, we believe provides a positive demonstration of how our effective management of liquidity supported the continuing operation and stability of financial markets. A number of LDI pension plan investors simultaneously required significant cash injections to support increased margin requirements associated with leveraged market exposure. To meet these cash requirements, systematically material levels of redemption requests were made to asset managers across the industry. TwentyFour’s ongoing management of liquidity incorporates a strong focus on stress testing (of both security liquidity and investor redemption behaviour) and thus portfolios were well positioned to meet these client cash requirements over the requested time frames. We were also well positioned to ensure that liquidity management tools (single swing pricing and anti-dilution levies) were applied appropriately to ensure all investors achieved the right outcome in terms of pricing where trade volumes were large. Furthermore, our systems and pre-trade liquidity analysis ensured that the residual portfolios’ liquidity profile were not negatively impacted by material redemptions. The redeeming investor redemptions were all met over the expected contractual timeframes at a price that was fair to remaining and departing investors. Thus TwentyFour’s liquidity risk management arrangements ensured that all market system participants engaged in the activity were treated equitably and were able to operate as anticipated during a period of stress. |

The Risk department manages risk on an ongoing basis and provides strategy plus portfolio level investment risk analysis and reporting to the Risk and Compliance Committee on a monthly and ad-hoc basis as required. Risk reporting along with any escalation from the Risk and Compliance Committee is also reviewed by our ExCo on a monthly basis. Quarterly reporting of operational risk including RACA) information and Investment Risks is also provided to TwentyFour’s Board thus ensuring full senior management oversight. Our conservative approach to the management of risk that mitigates unintended exposure to the principal investment risks coupled with a disciplined approach to managing our clients’ exposure against, and interaction with, other market participants thus contributes to the ongoing orderly functioning of the financial system.

We believe it is self-evident that ESG and Sustainability are significant contributors to long term investment returns.

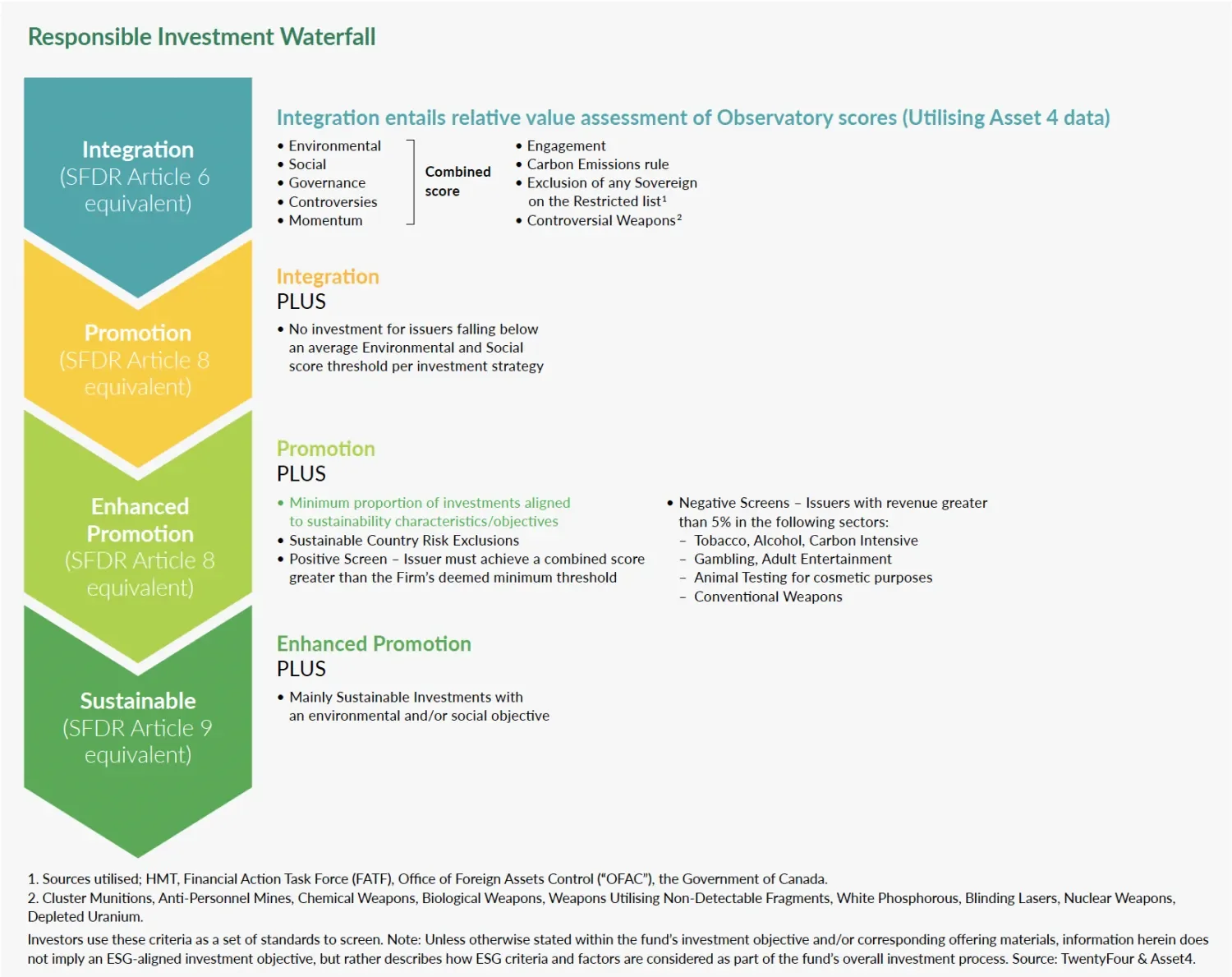

Every strategy at TwentyFour is run to a core ESG standard, an approach known as ESG integration. This means ESG risk analysis is embedded into our regular investment process whereby our portfolio management teams are responsible for performing a thorough ESG analysis on every investment they make. For true ESG integration we believe portfolio managers must be accountable for judging how ESG factors will impact the value of their investments over time which is why ESG is not just a consideration when purchasing a bond but will be considered throughout our period of holding.

We see this more active hands-on approach to ESG scoring as particularly important in fixed income where commercial ESG data coverage is not as comprehensive as it is in the equity markets. As such we spend time engaging with certain issuers just to obtain data. The TwentyFour ESG Score is therefore a unique measure that combines inputs from our ESG data partner with our own analysis.

We have built a robust investment and control framework which maps each portfolio to its regulatory categorisation (e.g. under SFDR), and any additional client or internal guidelines and restrictions, which may include country restrictions and ‘sin sector’ exclusions (e.g. controversial weapons) where applicable. For our highest ESG commitment level, our portfolio management teams will manage portfolios to meet specific ESG as well as investment objectives and will analyse underlying securities to ensure they meet specific sustainability standards/ requirements. The relevant oversight and monitoring have been designed in conjunction with the firm’s Risk and Compliance teams and assessments are subject to ongoing independent review and verification by those teams.

As more fully described in the ‘Collaboration’ and ‘Rights and Responsibilities’ sections, we believe acting collaboratively with other investors and market participants can lead to better outcomes for clients and the market in general. Consequently TwentyFour takes part in various industry initiatives with the objective of this collaboration being particularly focused on supporting the ongoing development of the regulatory framework for securitisation, given our specialism and unique insight into this relatively niche area of fixed income. Our aim is to ensure market participants and policymakers alike work together to develop and maintain the most suitable regulatory environment for the ultimate benefit of investors. This takes up a significant amount of our time, but we feel it is in the best interests of not only our clients, but the industry as a whole.

The investment landscape in this area has been one of the fastest moving in the investment world. Indeed, we believe this area of risk analysis has been the biggest shift in investing for generations. It is no surprise therefore that the range of activities from data collection, sustainability enhancements to reporting is an ongoing process. Today all of our funds utilise our Integration model to analyse ESG risks. We also manage funds dedicated to promoting ESG and sustainability combining positive and negative screens. We have at times engaged with asset owners to present them with the merits of moving farther towards sustainable models and are encouraged to say that currently all our European funds are classified as Article 8 under SFDR and we applied for one of our Article 8 funds to be upgraded to an Article 9 fund with effect from January 2024.

During the reporting period our focus has continued to be on climate change mitigation and we have implementedour Carbon Emissions Engagement Principles, which encourages us to identify issuers with elevated emissions with whom we have an influencing relationship with. We also have an ongoing project around alignment with Net Zero initiatives which has played an important role in determining our approach to ‘Sustainable Investments’ as defined by SFDR.

When thinking about introducing new ESG or sustainability rules or about signing up to industry wide initiatives, like whether to make a Net Zero commitment, we ask ourselves the following questions to ensure we understand the implications for clients:

These are key questions which can take time to answer correctly but we feel provide us with the confidence to continue to evolve in a responsible manner. Before any decision is made, this will also need to be presented to and approved by ExCo. The rapid growth in ESG’s popularity has been accompanied by confusion around the breadth of definitions, the constantly evolving regulatory landscape, which in turn has led to diverging approaches being deployed by asset managers; we are therefore committed to educating investors about our process and giving transparency on our engagements with firms on ESG and sustainable issues.

Review of Policies and Processes

Policies are reviewed on an annual basis, as and when required or where deemed appropriate, for example following the implementation of new regulation, to bring into line with newly released industry best practice guidance or where we identify a gap through internal mechanisms such as a result of a breach review. A simple example of this that occurred during 2023 would be where, following engagement with our external compliance consultant, we expanded the definition of 'Reportable Securities’ as part of our staff personal account dealing reporting.

In relation to ESG developments, during 2023 we continued to embed our Engagement Policy, Carbon Emissions Engagement Principles, Arms Manufacturing Exclusion Principles, and ESG Sustainable Country Risk Rules. As we manage European funds, we reviewed our policies and procedures to ensure compliance with the EU’s SFDR legislation and similarly began the process of mapping the UK’s new SDR text to the funds in scope. During the reporting year we developed our proprietary definition of a ‘Sustainable Investment’ and enhanced our systems and controls such that we would ensure Risk and Compliance oversight of this, as more fully described in Principle 7.

In 2023 we continued our engagement with our clients regarding the area of sustainability with the aim of understanding our clients’ requirements and obligations and how we can best provide support. One of the outcomes of this engagement with our clients is that we have introduced a commitment to including a percentage of sustainable investments (as defined in SFDR) in all our Luxembourg Article 8 aligned funds. We also continued to focus on client reporting during the course of the year.

Paying due regard to the interest of clients and how we treat them fairly is enshrined within TwentyFour’s Treating Clients Fairly Policy, which is designed to ensure that at all times TwentyFour and its staff members bear this overarching principle in mind throughout their activities, Including when writing and reviewing policies, helping to ensure that treating clients fairly informs internal decisions as well as when more directly interacting with clients TwentyFour is fully committed to the principle of treating clients fairly and having good quality relationships with clients is vitally important to our business.

Ensuring this ethos is embedded right from the top of the firm, whenever any policy is proposed or amended, TwentyFour’s ExCo will review and approve it and as part of this will consider our commitments to both treating clients fairly and ensuring effective stewardship have both been considered and applied. They can then be reassured that this tone from above successfully infiltrates all areas of the business including those to which a particular policy and/or process applies.

TwentyFour utilises an external compliance consultant in regards to both UK and US regulation and whom on an annual basis conduct a mock FCA and SEC exam in order to review and test our processes. In addition, as previously referenced, we seek external independent verification and validation of our processes through ISAE 3402 certification.

TwentyFour further benefits from the wider Vontobel Group relationship and internal audit function. Our ESG principles and process have been presented to the Vontobel ESG Committee for scrutiny and comment. During the course of the year internal Audit focused on ESG across the Group. These measures give additional support to ensuring TwentyFour’s processes and policies are robust and effective, including in the areas of stewardship discussed throughout this report.

We have always believed good, effective stewardship goes hand-in-hand with the Financial Conduct Authority’s 12 Principles for Businesses; these Principles are set out in the FCA’s Handbook and are general statements of the fundamental obligations placed on firms, and in particular express the main dimensions for what the FCA consider the ‘fit and proper’ standard required from industry participants:

i. Acting with integrity – because of the inherent societal benefits available;

ii. Conducting business with due skill, care and diligence – the additional investor benefits we expect having incorporated ESG and related factors into our investment process are described further in Principle 7;

iii. Managing risk – both those faced by the firm and those within the portfolios we manage;

iv. Maintaining adequate financial resources – so that clients and other stakeholders can have confidence in our ability to deliver over the long term as well as the short term;

v. Observing proper standards of market conduct – both through our interactions with clients and stakeholders and through our interactions with issuers and other market participants, for example being able to use our influence with issuers to create better protections for bondholders as described further in Principle 9;

vi. Understanding better our clients and their interests – and where appropriate reflecting these in the objectives or guidelines with which their portfolios are managed;

vii. Improving our communication with clients and other stakeholders – in particular, for the pooled funds that we manage where individual client factors cannot so easily be accommodated, we believe it is important to make clear how we ourselves see ESG and other stewardship factors so that they can make a fully informed decision whether to proceed because they believe the same;

viii. Identifying and controlling conflicts of interests – as described in greater detail under Principle 3;

ix. Making decisions within portfolios which we believe are suitable – which we apply both from a top-down and bottom-up perspective as described in greater detail under Principle 7;

x. Protecting client assets – as a fixed income manager we firmly endorse the unwritten rule of fixed income which is ‘capital protection at all times’; and

xi. Building and maintaining a strong relationship with regulatory bodies – for example our work in the European Asset-Backed Securities universe as a founding partner of the Prime Collateralised Securities (PCS) initiative as more fully discussed under Principle 4.

xii. Acting to deliver good outcomes for retail investors – for example through our product governance arrangements ensuring an appropriate target market is identified when launching and reviewing a fund to ensure those identified as appropriate for retail investors are simple to understand and provide good value for money.

TwentyFour’s client base is limited to professional clients only.

While TwentyFour is not authorised to market its funds directly to retail clients, we categorise our wealth management, discretionary fund management, family office and global bank clients as wholesale. Our institutional clients include UK and non-UK pension schemes, insurance companies and charities, as well as bank, university and local authority treasury mandates. We have dedicated Wholesale and Institutional client servicing teams Generally, our clients have medium to long term time horizons (three years plus) and we are committed to establishing excellent relationships with our clients along with the pooled fund investors to ensure that our funds, services and reporting meet their expectations both currently and as they evolve over time.

As a client-orientated firm, TwentyFour carries out extensive consultation with its clients and their advisors about their expectations and requirements regarding stewardship and ESG, and we take these views into consideration when formulating and reviewing our policies.

We endeavour to ensure our clients’ needs and expectations are met by creating open dialogues. Our focus on responsible investment is driven internally by our recognition that it is both the right thing to do and can potentially provide even better financial outcomes for our clients. Feedback we receive from clients, give us a good idea of which specific areas of ESG and stewardship they likely find most important and highlight areas for the firm to focus on. Following feedback from some of our European clients, we decided to include a commitment to a percentage of ‘Sustainable Investments’ (as defined in SFDR) in all the Article 8 funds managed by TwentyFour on the Vontobel Luxembourg fund platform.

During the course of 2023 we again reached out to clients to see what additional reporting would be valuable to them and as a result of this feedback, we made some changes to our Wholesale and Institutional reporting.

Institutional Clients

Our pension scheme clients have been dealing with changes to their regulatory requirements for some time, initially by describing how ESG factors are included in their investment decisions within their Statement of Investment Principles and more recently, their requirements to report in line with the Task Force on Climate-Related Financial Disclosures (TCFD), with a larger portion of our clients now in scope for this reporting. We have supported our clients throughout these changes by providing information to help them cover their new and more detailed reporting requirements in the climate change and ESG space.

In addition to the regulatory requirements, many pension clients and other institutional clients who don’t yet have to report on TCFD are keen to have regular updates on ESG metrics within their fund holdings and we address this through our quarterly investment reports and responses to client specific requests. All our UK pension clients are advised by investment consultants, and we maintain conversations with both parties in order to ensure that we are providing what the clients require. The consultants have a broader view of the types of reporting required by clients than any individual client and we have found them to be very useful sounding boards for discussing improvements to our service.

The Investment Consultants Sustainability Working Group (ICSWG) has provided templates for both ESG metrics and engagements and we are confident that these reflect what our consultant-advised clients require, although we are continuously in touch with consultants and clients about any additional requirements they have and work with them to enhance our reports. Following consultant and client feedback we can now report what proportions of bond issuers in our funds have Science Based Targets initiative (SBTi) approved carbon reduction targets. We now also include carbon emissions data in all our pooled fund quarterly reports for institutional clients, as well as numbers and examples of ESG engagements, and for relevant funds, the portion of holdings that have committed to the ‘Climate Action UN’ SDG. Clients investing in our range of funds with enhanced promotion of ESG also receive additional ESG data and we will continue to enhance the ESG sections of these quarterly reports as more data becomes available and taking into account client and consultant feedback.

Wholesale Clients

Our wholesale clients are also becoming increasingly focused on climate impacts within the funds that they invest in. In response to this, we have updated our factsheets as described above, and have made changes to our quarterly ESG reports to provide further transparency on environmental metrics within funds. TwentyFour’s quarterly ESG reports for our Wholesale clients provides examples of engagements carried out over the defined time period. Engagements are split between ‘environmental’, ‘social’ and ‘governance’ and includes further detail on the engagement, including the result of the engagement and any further action that was taken. In addition to the engagement report, we provide a specific ‘fund overview’ report with key ESG metrics, including ESG scores for each bond and carbon emissions data.

Segregated Mandates

TwentyFour’s institutional segregated account clients typically carry out the same type of due diligence on our stewardship activities as pooled fund clients, and some have asked us for wording on our ESG policies which is then included in their ESG statements or Responsible Investment policies. Other segregated clients have sent their own policies and asked us to confirm we comply – in all cases TwentyFour has been able to comply with or exceeded what clients required.

Segregated pension scheme clients for example were the first to request reporting in order to assist with their own TCFD reports and it has been interesting to work with those who have now completed their second year of reporting as well as those completing it for the first time. Given the bespoke nature of their mandates, segregated clients have the additional option to exclude any specific sectors or stocks from their portfolios and a small number do so; for example we have clients excluding tobacco and thermal coal extraction or include our additional positive ESG screens on their portfolios.

Transparency

In addition to the regular ESG reports we make available to clients (which include not only the number of overall engagements, but also specific examples of where we have engaged on environmental, social and/or governance issues, and the outcome of those engagements), TwentyFour also hosts live demonstrations of our ESG scoring system for clients, which gives them a better understanding of the ESG metrics we feel are important for our funds. In addition, we have held roundtable discussions with industry leading specialists in the field of sustainability, which has been thought provoking and influenced our view on not only how we incorporate ESG into the funds we manage, but also at a firm level. In 2023, we launched our ‘Spotlight on ESG’ webinar series, designed to educate our clients on a number of relevant sustainable topics, including how we approach ESG withinsectors such as ABS, and how sustainability within fixed income has evolved. We also hosted a session which looked at how we analyse company CSR and ESG reports, using a case study as an example.

As mentioned above, we are very keen to share our work on stewardship and responsible investment with ourclients, and we have a video available on our website which gives an overview of how ESG integration works at TwentyFour. We have held a number of events where our wholesale and institutional client base have been invited to hear about our ESG process and watch demonstrations of our ESG module within our Observatory system. The feedback from these sessions is that seeing the system in action really brings to life how the portfolio managers can easily incorporate ESG factors into their investment decisions, and how individual bonds are scored from an ESG perspective. In our regular research meetings with clients and consultants, we also discuss how ESG isintegrated into our process. This year we also created a number of short videos, including one looking at recent ESG examples and another looking at temperature alignment within portfolios.

As referenced in Principle 1 and previously, we have produced and distributed to clients a number of insight pieces, videos, blogs and whitepapers on responsible investment, some at firm level (describing our overall approach) and others specific to an asset class in which we invest.

These are also available to clients and prospective clients through the Insights section of our website, as well as being included in ESG reports.

Our website makes our blogs, policies and whitepapers available to all our clients and also shows numbers and examples of engagements with bond issuers on a quarterly basis as part of our commitment to the UK Stewardship Code. We are continually developing the content of our Sustainability website page and are constantly looking to increase the scope and the quality of our ESG reporting in response to the level of data available, and to ensure that it is meeting our clients’ requirements.

For institutional clients, we include a page on ESG engagements occurring during the quarter within our quarterly investment report for each of our three main business lines. This page is also included in the wholesale client report and we have had good feedback from clients who find the engagement examples particularly interesting and informative.

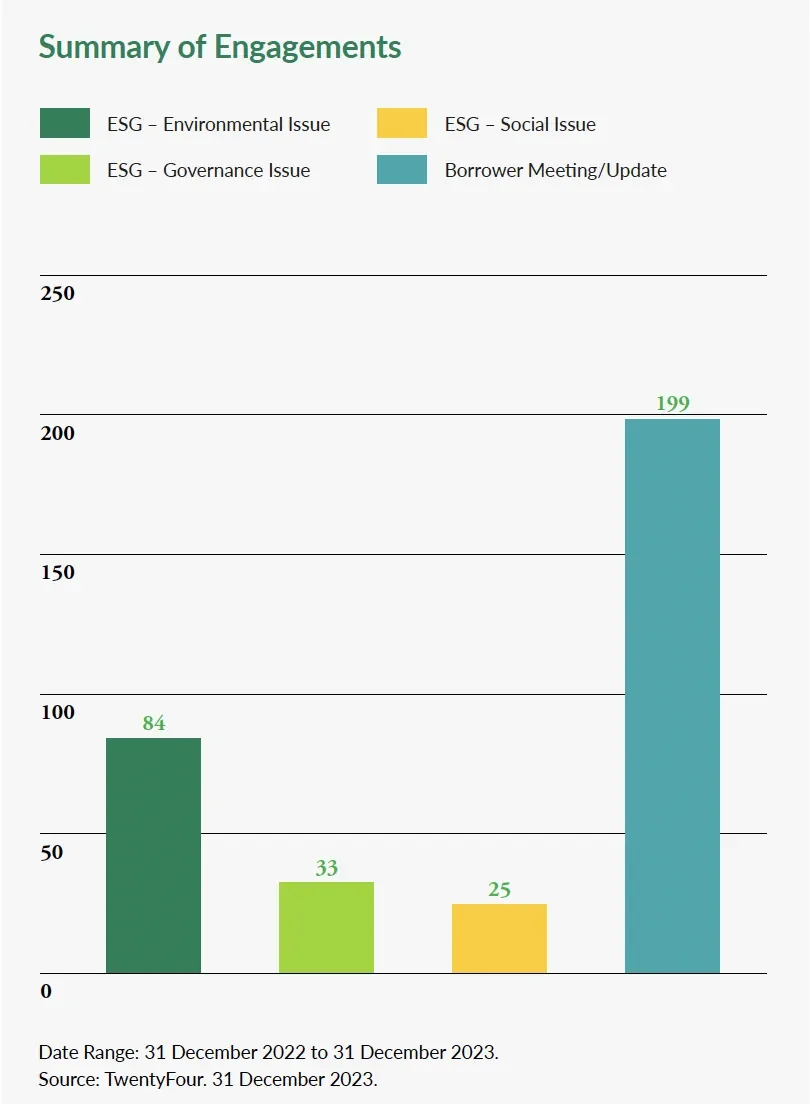

Our investment process has evolved over the years, though at its core it has remained consistent, with an easy to understand monthly top-down and daily bottom-up process, with a bi-weekly validation of our asset allocations. Importantly, our process is easily repeatable and can consistently be applied to every company that issues,manages or services any instrument in which we invest, but with the flexibility to pivot quickly should market conditions require. The process itself is not unique but we believe our key differentiators are our market focus, experience and the talent level of our team. Both our top-down and bottom-up decisions are taken as part of a team-based exercise which we believe benefits general oversight and promotes good governance. No part of our investment process is outsourced, and it is based on our own research; where appropriate, and at the TwentyFour’s own expense, third party investment research, including from brokers, is also used to supplement our own research and/or decision making. During the period we had 199 borrower meetings and updates. These statistics do not include monitoring activities the various teams have had with individual firms over email or telephone.

We do not constrain ourselves to a thematic investment style but rather believe that by taking a holistic view of individual investments we can weigh our analysis of risk and reward by focusing on the most relevant drivers at the time for a particular bond. For example, value may be driven by the underlying markets a company trades in, or it could be the state of its balance sheet, or a technical issue around a bond’s covenant or call feature.