ESG and ABS at TwentyFour

Over the last couple of years TwentyFour Asset Management has seen a material increase in appetite from institutional investors to understand our approach to Environmental, Social and Governance (ESG) issues.

Our clients have wanted to know how we consider these topics as part of our investment philosophy, how we incorporate them as part of our underwriting process, and how our three distinct investment teams – Asset-Backed Securities (ABS), Multi-Sector Bond and Outcome Driven – tailor their approach to suit their respective remits.

The increased importance of ESG factors to investors across the asset management industry will likely increase their impact on financial markets in the next several years, and will require our process to develop alongside what is still a relatively new discipline, despite assets being managed under sustainable investment strategies having risen from $5 trillion in 2005 to $30 trillion in 2018[1].

To give just one example, the third party provision of ESG data continues to evolve – will the market get to a point where bond issuers have an ESG rating, along with a credit rating?

This paper addresses how we think about ESG factors in relation to ABS investments at TwentyFour in more detail, given the unique nature of the asset class, but within the established framework that is in place across all the investment teams.

Where do we start?

When we think about ESG at TwentyFour, we consider it an integral part of our investment process, rather than a separate stream of analysis, and we don’t limit it to being a separate product. It runs through everything we do, and it always has done. Our approach is outlined in our paper “ESG at TwentyFour” which is available on our website.

The approach is an ESG framework which we feel strikes an effective balance between some of the key approaches to ESG investing, and has been incorporated into all of our investment strategies and funds.

At a high level we believe an integration approach gives the greatest bang for your buck, and is increasingly becoming the ‘new normal’ in our industry. However, we believe it is both possible and desirable to go further. We also incorporate controversies, momentum and engagement in our investment process. At its core the framework is a combination of qualitative and quantitative analysis, which dovetails with the portfolio managers’ overall relative value decision.

By integrating this framework into our existing proprietary Observatory relative value system (using Thomson Reuters data covering over 400 ESG metrics), ESG factors are embedded in a tool already used on a daily basis by the portfolio managers. This is an important point as we do not feel that a separate ESG team, or outsourcing ESG analysis to a third party, would effectively embed our ESG principles into the investment decision.

ESG factors are only one part of the overall decision to invest, but this methodology gives us a rational starting point. Moreover, having this framework as part of our investment process, we make sure that we actively and consistently incorporate ESG factors into the investment decision.

That is where we start with ESG. It is one of the first considerations during our initial underwriting process, and part of the ongoing monitoring of positions, whether or not the strategy in question has been labelled with the ESG acronym.

ESG analysis at TwentyFour is the direct responsibility of all portfolio managers, it is a factor in our investment decision, one driver of risk alongside a number of others, all of which we must try to ensure our investors are being compensated for.

ESG and ABS

The ABS market hasn’t explicitly embraced ESG considerations to date because the more common ESG themes of corruption, environmental issues, employment considerations and corporate governance are less immediate issues for an ABS investor. However, in hindsight the origins of the financial crisis in the US subprime market was a collection of failures relating to ESG factors.

While hindsight is a wonderfully accurate tool, ESG analysis in 2006 might have pointed out the following issues, among others:

- Appropriateness of the structure and underwriting quality of subprime mortgages, for example the large step-up in the mortgage interest rate at a relatively early stage, questioning the affordability checks done by the lender. (Social)

- Lack of alignment of interest between the originator of the loan, the structurer of the RMBS transaction and the owner of the subprime RMBS led to lack of engagement with ongoing performance, and the requirement to continually originate new, weaker credit products to replace fee income. (Governance)

- Lack of appropriate governance at a banking group level to ascertain the true level of exposure to a single asset class. (Governance)

Before ESG became such a widely discussed theme, we were already looking at emissions scandals, corporate governance, and the social impact of our asset class, since we had plenty of evidence that this affected the creditworthiness, liquidity, and potential returns of our positions.

ABS vs. corporate bonds

When we start thinking about the specifics of ESG within ABS, we need to start by considering the main differences between an ABS deal and a corporate bond.

A typical corporate bond is issued by a company, and the bondholders’ exposure is to that company’s ability to generate cash flows on an ongoing basis, its access to finance, and the quality of its balance sheet in a reorganisation or wind-down if the worst were to come to the worst.

An ABS deal differs in that there is a defined asset pool that generates the cash flows each period to pay interest. These assets are typically debts of a homogenous type which mature, and so principal return is driven by that maturity happening. There might also be an optional call that to a limited extent depends on the cost of refinancing that asset pool. Importantly, these assets are held in a Special Purpose Vehicle (SPV), rather than on the company’s balance sheet.

What does all this really mean for ABS investors?

- The issuer of an ABS deal is not the issuing corporate itself, it is a Special Purpose Vehicle (SPV), making the ABS deal ‘bankruptcy remote’ from the issuer. We typically refer to the corporate as being the sponsor or parent of the deal. Does this bankruptcy remoteness mean the sponsor falling foul of ESG standards has no impact on the ABS deal?

- The nature of the set asset type and deal structure means there are usually various external counterparties involved, including loan servicers, swap counterparties on interest rate hedges and so on. They are needed because the SPV doesn’t have the capacity to assume the other side of these roles, given its purpose is only to hold the assets and receive the cash flows. These counterparties could present ESG considerations, but again they are well defined in comparison to a corporate issuer.

- The payment of interest and principal on the ABS deal is driven by the performance of the assets and the structure of the deal. This means a bondholder’s exposure isn’t to an opaque balance sheet but to a very transparent and defined set of assets that are easy to analyse. This means the ESG factors of those assets are easier to define.

- In addition, though not related to the structural nature of the deal, ABS deals generally feature financial assets. These loans typically don’t cover the typical ‘red lines’ of ESG such as gambling, oil or munitions, but there are other issues such as responsible lending to consider.

ABS ESG analysis in practice

These factors mean there is probably more work that we can do covering ESG for an ABS deal than for a corporate bond, but we never shy away from work – if it hardens our conviction on an investment then we are better placed to accept or reject the opportunity.

We split the work into two parts, that which covers the asset pool and the structure, and that which covers factors external to the deal. Let’s start with the latter.

External factors

Typically we are looking at external factors associated with the sponsor of a transaction. This is because an ABS deal is normally a funding tool for the issuer, and so there is an implicit link between the two, despite the bankruptcy remoteness. In other words, while it doesn’t present a credit issue, this link might take a while to establish, and the associated name risk might create market volatility in the meantime.

Past examples of such issues would include Co-op Bank’s surprise announcement of a capital shortfall in 2013, Volkswagen’s emissions cheating scandal, and the Och Ziff bribery scandal. All of these corporates were or are sponsors or managers of ABS deals, but the main focus of these negative events was not related directly to their ABS deals. For example, Och Ziff’s scandal involved an employee being accused of bribing African officials. Och Ziff is a manager of European CLOs, so the performance exposure of the CLO to the bribery scandal is zero, as the CLO can only invest in European loans rather than African assets, and it can also only invest in broadly syndicated positions rather than in anything that can be directly impacted by bribery.

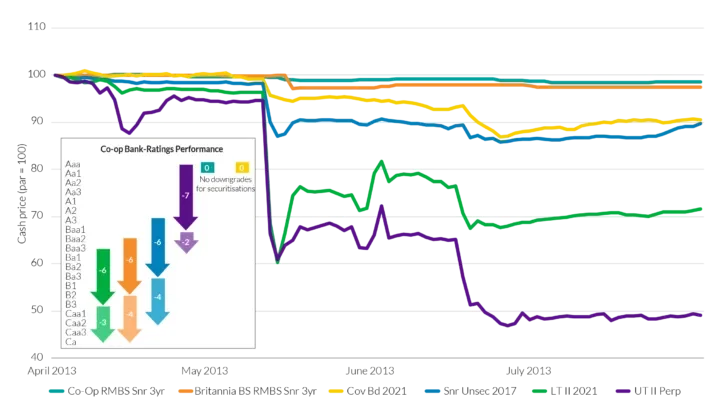

Co-op offers an example that makes the comparison of risk easy to quantify, as it also issued covered bonds and a variety of senior debt and capital. The price and rating impact of the announcement is quite telling. As can be seen in Chart 1 (overleaf), the rating impact of the problem was material for bonds issued directly by the bank, with the previously AAA-rated covered bond programme being downgraded to BBB and subsequently to a low BBB rating. All other debt was sent straight to non-investment grade, and the price impact for all non-ABS bonds was between 10 and 50 cash points.

By contrast, the ABS bonds kept their AAA rating, and moved in price by 1-3 points. While the failure of Co-op would have required its replacement as the servicer of the mortgages, for example, there is an active market for external servicing of mortgages, meaning the disruption would have been temporary. The rating and price impact reflects this material differentiation with non-ABS bonds, where their ability to pay coupons and return principal was impacted. ABS market participants could be confident the lack of capital of Co-op Bank would not lead to the ABS deal failing, so the ESG risk here (poor governance) had an associated but subdued impact.

Chart 1: Relative Performance of Co-op Bank Bond Issues

Source: Bloomberg, TwentyFour

How we quantify the impact of these external events is two-fold. We use our existing corporate bond tool to quantitatively score for ESG, then we have to size the associated link of the sponsor to the ABS deal. This is a qualitative decision based on variables including:

- The number of, and importance of, direct links to the transaction, e.g. loan servicing, origination, bank account provider

- The methodology of the sponsor in retaining risk, and size of risk retained in the transaction

- Strength of branding link to sponsor, and reliance on ABS as a funding option

Typically we see these external factors as less material than the corresponding internal factor, and often relatively transient in comparison, which is why we analyse them separately and apply a weighting to them which varies from deal to deal.

Internal factors

If we have analysed the external factors properly, then a lot of the variability of ESG factors should have been covered. The deal itself is a box of loans, with almost perfect transparency through into them. This box is administered by a couple of counterparts as mentioned before, but again the identity of these counterparts is fully disclosed. So what type of risks do we need to consider?

Our credit process looks at four central pillars – the asset pool, the structure, counterparties and modelling. The majority of our ESG work is covered under the counterparties review – primarily related to the originator and servicer of the loan pool, however we must consider governance issues in the structure of the deal and regulation of the market, and any environmental factors included in the underlying lending.

Loan origination in the European market has typically been done well, as evidenced by low levels of defaults and losses. However the type of product, the underwriting methodology, underwriter experience levels, remuneration, affordability calculations, exceptions policy and other considerations are key to making sure that the bondholder’s expectations of loan performance are accurate, and thus minimising the risk of loss, as well as reducing the potential for any regulatory censure.

Similarly the servicing of accounts that are experiencing payment problems is important to find a way of improving the payment profile of the loan, and thus helping to minimise the risk of loss, as well as fulfilling the required regulatory obligations protecting the borrower.

There is a clear social impact in originating loans that have a high probability of performance and servicing those that don’t perform appropriately, given the largely consumer nature of European securitisations. This is reflected in the quantity of regulation protecting consumers when they take out finance.

Governance issues in securitisations are primarily dealt with at the point of structuring, given the typically static nature of the special purpose vehicle. We spend a significant amount of time working with issuers/sponsors at this point, and often before a deal is announced publicly, to engage with governance issues in a way that is beneficial for our investors and aligns interests with the issuer. With capacity to invest across the whole capital structure, TwentyFour can engage in a very flexible manner to help issuers complete their transaction, whether it is a publicly syndicated transaction from a repeat issuer, or whether it is a private, non-rated transaction. Three team members have experience structuring ABS transactions at large investment banks and this helps drive our capacity to engage in this way.

At times issues do arise after a deal has launched, for example a number of existing deals are currently contemplating changing the coupon structure from referencing Libor to Sonia - not an event that could have been considered at launch. Any issues arising post-launch will typically result in further engagement, however this tends to be limited. There have been a number of relevant regulatory changes across the market and other initiatives to engage with as well. Given the previously unconsidered nature of all these issues, they have to be dealt with on a bespoke basis as and when they arise.

Environmental factors of securitisations are principally related to the purpose of the underlying loans. There is a large auto loan securitisation market, with obvious questions to ask around vehicle age and engine type. The environmental impact of properties, particularly in the commercial property space is also relevant. In general however the more common environmental focus on fossil fuels, fracking, aviation and others are not relevant to European ABS.

Looking for positives

Fixed income investors are often accused of being miserable pessimists, and to some extent this is a fair assessment. When your first priority is the return of your principal, you tend to spend a lot of time finding and highlighting the negatives attached to any potential investment – in other words, anything that could make that return of principal not happen.

However, a key part of our ESG process is promoting a number of overlooked factors we believe can have a positive influence on price and liquidity.

For example, supporting lenders that extend finance in a sensible way to poorly served sections of society can have a positive impact further down the line. One example would be RMBS backed by student housing, where the cheaper lending funded by the securitisation of loans could increase access to higher education, in time making that type of loan more popular and growing the market.

Engagement

We are keenly aware that as one of the most prominent investors in the European ABS market, and one of the very few that invests across the entire spectrum of asset types and ratings, TwentyFour as a firm is a significant stakeholder in the market for the long term.

For this reason, we believe we have a responsibility to engage with all market participants, from our own clients and deal sponsors through to other investors, industry bodies and regulators.

TwentyFour has been at the heart of the ABS industry in Europe for over a decade, advocating a greater understanding of the asset class and its importance to the real economy. We have worked closely with numerous major central banks, finance ministries and the various regulatory bodies across Europe and in the UK to help improve investors’ and regulators’ understanding of ABS, and to help shape and promote the better functioning of the market as new regulations have been introduced for both investors and issuers post-crisis. We have also helped form new industry standards through senior representation on the AFME Securitisation Board and the Prime Collateralised Securities initiative.

In addition to this ‘top-down’ engagement at the industry level, we dedicate a huge amount of time and resources to ‘bottom-up’ engagement on behalf of ourselves and our clients. Our ongoing due diligence is key to understanding the evolution of risks in the markets we invest in, rather than just in relation to evaluating a specific transaction.

Conclusion

While the main elements of ESG investing have formed part of our investment process at TwentyFour for several years, the focus over the last couple of years of codifying these issues into a coherent market focus has driven us to do the same.

This has helped us create a uniform process across our business, but with the flexibility to recognise the unique nature of some of the asset classes we invest in, not least ABS. To date this has remained part of our process, rather than being a driver for new products, however we remain open to exploring product opportunities should investor demand move in that direction.

[1] Global Sustainable Investment Alliance Report 2018