Fixed Income 101: Comparing yields in different currencies

Fixed income managers always want to have the flexibility to look for the best value across their investment universe, and in our view they therefore need the capacity to buy bonds in different currencies.

However, most will not want to take the associated currency risk, as exchange rates tend to be volatile and can quickly become the overriding risk in a portfolio, even having the potential to overwhelm every other investment theme.

Hedging the currency risk of a bond denominated in foreign currency can be done simply by using an FX forward. As an example, if your portfolio’s base currency is GBP and you want to buy a $1,000,000 bond denominated in USD, you would sell approximately £873,576.241 to buy the USD you need to buy the bond today. With an FX forward, you sell that same amount of USD forward one month and buy back the GBP to lock in the forward exchange rate, before simply rolling the trade every month while you hold the $1,000,000 bond.

Obviously, applying this currency hedge to every individual bond you hold often isn’t practical, so instead the hedge is typically applied at the portfolio level to cover each of the non-base currencies held. The hedges can then be adjusted daily to account for any purchases, sales or changes in market value of the portfolio’s holdings.

The forward exchange rate in this transaction will be determined by the ‘forward points’, which is shorthand for the amount that is added to, or subtracted from, today’s spot exchange rate. The forward rate will be based on the difference in interest rates between the two currencies involved (in our example the difference between US interest rates and UK interest rates), and it should more or less result in the two interest rates equating to each other.

If this was not the case, money would simply flow away from regions with lower interest rates as investors looked to collect the higher rate on offer elsewhere.

The forward points are thus a very important consideration for fixed income managers, but they are often ignored (sometimes conveniently) when observers are lauding the benefits of one region over another.

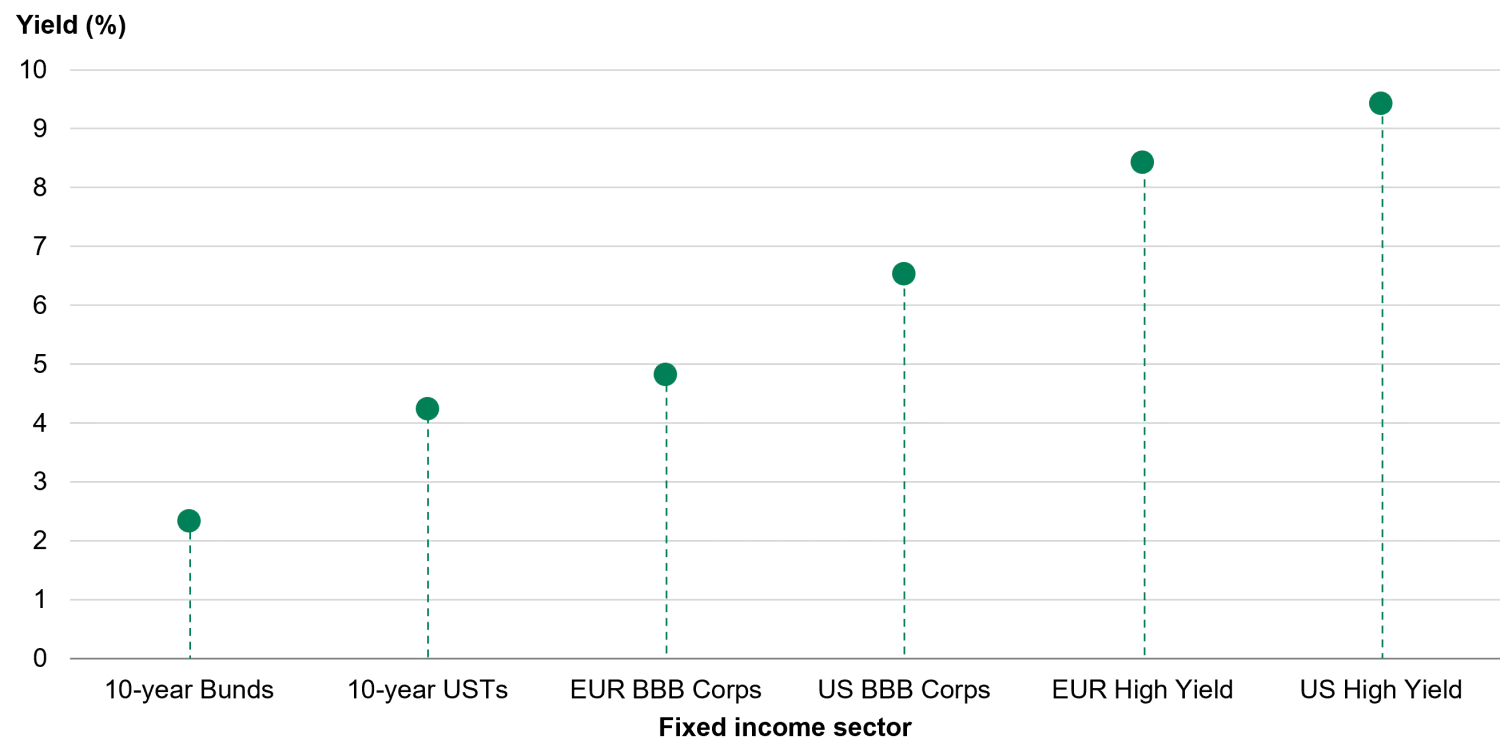

For example, the US high yield bond index has a yield of 8.9% and the European high yield index yields 7.8%2, which is the better value?

The only way to know is to convert the EUR yields to a USD yield. To do that we consider the forward points, which (using rates as of 1 November 2022) adds 275bp to the EUR yield, meaning the true USD yield on the European index is 10.55% – far more attractive than the US index. If you were to look at GBP denominated bonds, there would be a yield pick-up of around 100bp when hedging into USD.

With central banks hiking rates aggressively across 2022, interest rate differentials between regions have widened; following the US Federal Reserve and Bank of England monetary policy decisions at the start of November 2022, for example, base rates were 3.75-4.00% in the US, 3% in the UK and 2% in the Eurozone.

Changes in monetary policy and exchange rates are constantly altering the forward points for hedging bonds denominated in a portfolio’s non-base currency, which means it is important for fixed income investors to take these into account when comparing relative value across different markets.

1. Based on exchange rate as of 1 November 2022

2. ICE BofA Indices data as of 1 November 2022

Bids Wanted in Competition (or BWIC) lists are a unique characteristic of the ABS and CLO markets, where they are widely used in secondary trading when investors are looking to sell bonds.

The process differs markedly from trading in more mainstream markets such as government and corporate bonds, where dealers look to ‘make markets’ in bonds by matching buyers and sellers directly, as well as holding an inventory of various bonds on their books for providing liquidity to clients.

By contrast, a BWIC is essentially a list of ABS or CLO bonds sent by investors to dealers, who then share the list with their clients. The bonds are effectively sold via an auction process, which allows investors to receive bids from the broader market and theoretically helps them achieve better execution, as this client-to-client process supplements the liquidity provided by dealers. Colour on BWIC execution is also generally shared with the market after trading, which contributes to market transparency and overall liquidity, another marked difference from mainstream bonds where colour on trading flows is often a closely guarded commodity for dealers. ABS dealers that have executed a BWIC trade often share the second best bid price they received, for example, which can be particularly useful for holders of mezzanine bonds that don’t trade very often, as bid levels give investors an indication of where these bonds could be traded.

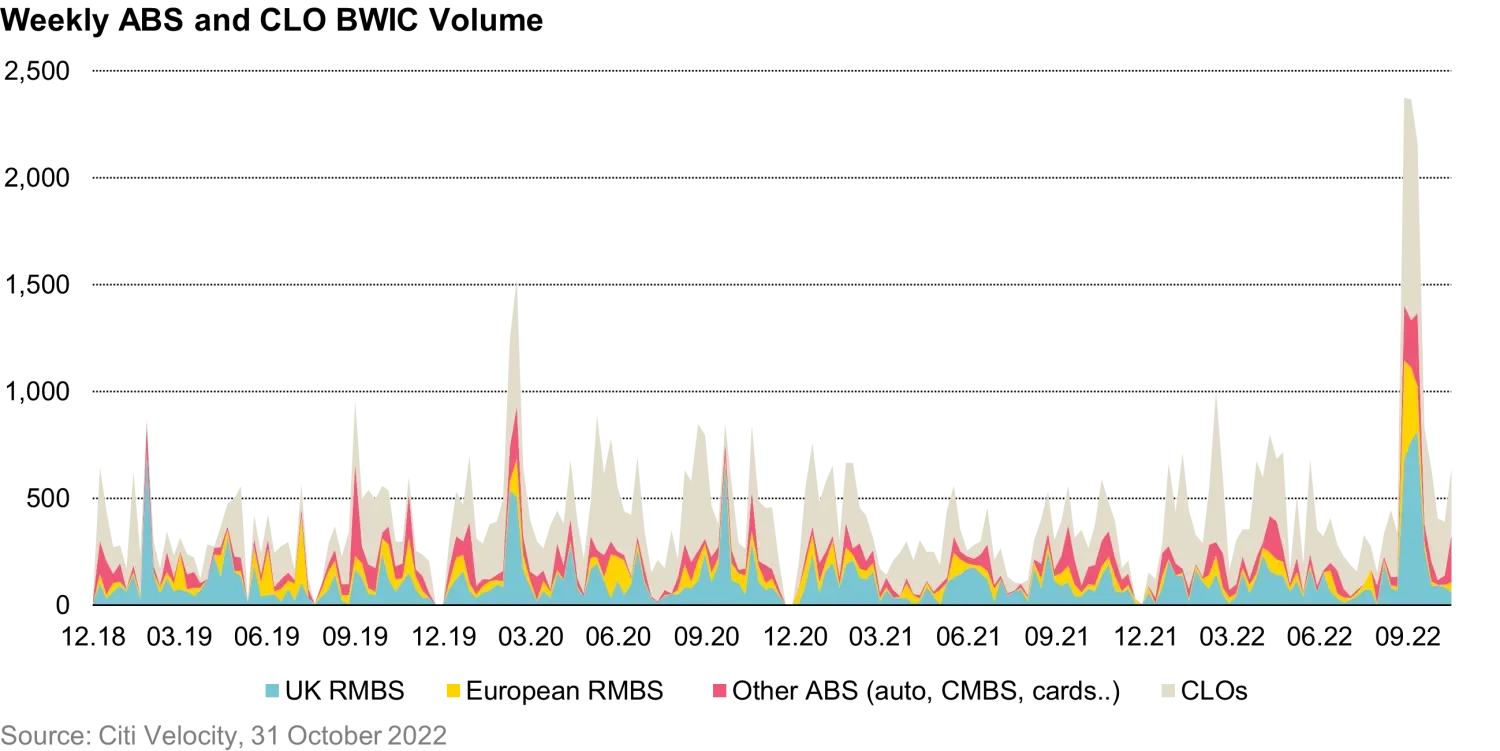

Looking at changes in BWIC trading volume can give us a good idea of the trading dynamics in the ABS or CLO market at any given moment. Generally, volume has increased in recent years in line with the overall size of the European ABS market, with annual BWIC volume having more than doubled from around €10bn in 2017 to just under €21bn in 2021.

Contrary to what one might assume, BWIC volume actually tends to increase in periods of greater volatility, which gives ABS and CLO investors access to a wider base of market participants at a time when they might need it most. Again this is slightly different to secondary trading in more mainstream bond markets, where dealers’ appetite for making markets tends to decrease in volatile periods as there is an increased risk to holding bonds on their balance sheets.

As the chart above shows, BWIC volume has jumped during two key periods of volatility in recent years. The first was the onset of the COVID-19 crisis in H1 2020, when asset managers were facing redemptions and hedge funds were hitting margin calls. As the COVID-19 panic hit the market, asset prices dropped sharply and due to the lack of appetite from investment bank trading desks, investors were forced to increase BWICs to in search for liquidity.

The second was the liquidity crisis among UK pension funds in late September 2022, which was triggered by an extreme sell-off in UK government bonds in response to the government’s disastrous ‘mini-Budget’ announcement. The Gilt sell-off sent pension funds running liability driven investment (LDI) strategies scrambling to raise cash to cover margin calls, which sparked heavy selling of liquidity assets like UK RMBS and higher rate CLOs.

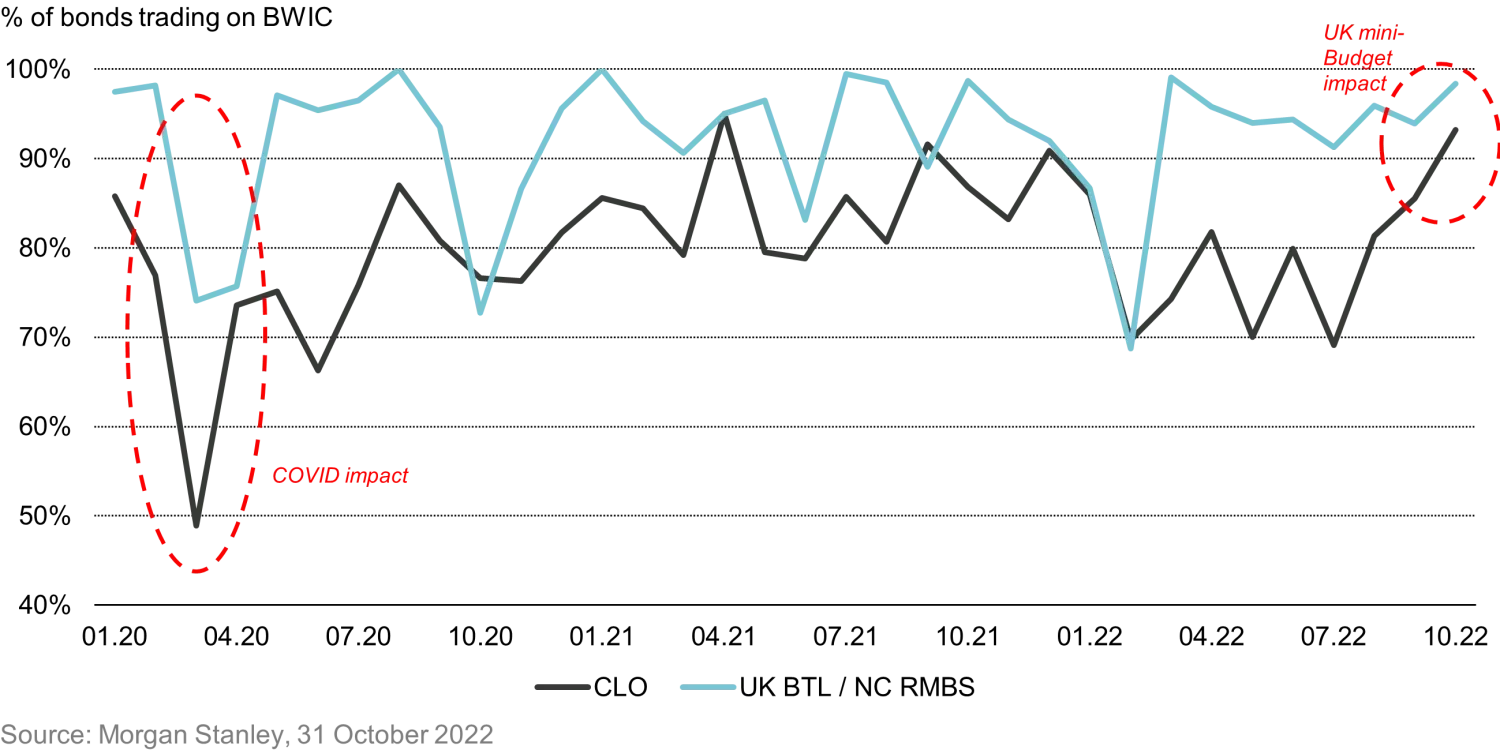

As shown in the chart below, the proportion of CLO bonds listed on BWICs in September and October that were ultimately traded was between 85% and 93%, broadly in line with the ratio across 2021, but clearly much higher than a low of 49% during the COVID-19 sell-off in March 2020.

However, a lower proportion of listed bonds trading doesn’t necessarily mean there are bonds that cannot be sold. In fact, it is more likely that during this period of significant broader market turmoil investors were looking for optionality. In other words, they were likely listing bonds from a more diverse range of sectors and ratings than they ever intended to sell in order to see which would attract the best bids. In a period as volatile as March 2020, 60% of listed bonds trading was widely regarded as a strong sign of liquidity for the ABS market, though liquidity was notably better for AAA RMBS and AAA CLOs.

Another difference between these two periods was that in the UK mini-Budget sell-off, dealers were more willing to put balance sheet to work as they were able to rotate their books given the high level of appetite from investors. Some dealers also took the opportunity to increase the balance sheet they committed to trading, as opposed to reducing their risk limits as many did during the COVID-19 sell-off. Bank treasuries, for example, stepped in to buy large volumes of UK RMBS from pensions funds. In both crisis periods, the dislocated trading levels also attracted hedge funds and private equity buyers as they saw an opportunity to buy high quality bonds at wider levels.

March 2020 and September/October 2022 are two examples of BWICs generating additional liquidity for ABS and CLO investors when they most needed it, but the BWIC auction process is widely used during less volatile markets as well. In a lower volatility environment, BWIC volume tends to drop in line with lower selling pressure and stronger general liquidity, as well as investors’ ability to get strong bids directly from traders. BWIC volume is also generally positively correlated to primary ABS issuance, since investors often look to fund purchases of new deals by selling assets to free up cash, but it also tends to be inversely correlated to general demand for the asset class. BWIC activity slowed materially in 2021, for example, as the floating rate format and extra yield opportunities available in European ABS compared to government and corporate bonds made the market more attractive to investors.

In short, in our view BWIC lists have proved to be an efficient process in periods of market disruption, which in turn helps to lower the risk of liquidity squeezes in ABS and CLO markets.

Inflation is widely understood to be bad for bonds.

Fundamentally, this is because inflation erodes the value of the coupon and principal payments that fixed rate bondholders receive in the future. If you buy a $100 five-year bond today with an annual coupon of 5% at par, then when the bond matures in five years’ time you will have $127.62 (this assumes your coupons are reinvested at the purchase yield). However, if annual inflation has been running at 3% over that five-year period, then the purchasing power of your $127.62 has been reduced to $110.09 at current prices.

From a portfolio management perspective, the more pertinent challenge of high inflation is that it tends to provoke interest rate hikes, which can lead to poor performance in all kinds of fixed rate assets, from US Treasuries to high yield bonds.

On the face of it, inflation-linked bonds would appear to be a simple solution to this problem. As the name suggests, inflation-linked bonds, such as Treasury Inflation Protected Securities (TIPS) in the US or Index-linked Gilts (or ‘linkers’) in the UK, are designed to protect bondholders from inflation by adjusting the principal value of the bond to account for the prevailing inflation rate.

If our $100 five-year bond above was inflation-linked, then both its principal value and coupons would be adjusted upwards by 3% per year, resulting in a real return of 5%. This would be the same as saying a total return of inflation plus 5%.

However, inflation-linked bonds are no silver bullet.

Inflation-linked bonds are still bonds, which means just like conventional US Treasuries, TIPS prices tend to fall as interest rates rise. TIPS have the advantage of their inflation-adjusted principal, but when inflation expectations are high, a fall in price can more than cancel out the positive impact of the principal adjustment.

As an example, in the 12 months to August 2022 US inflation was 8.3%. As you’d expect, conventional US Treasuries performed pretty poorly against that backdrop, with 2022 year-to-date total returns of -10.10% as of August 311. However, TIPS didn’t perform much better over the same period, with YTD returns of -7.14%2. Like most fixed income instruments in 2022, TIPS prices tumbled as investors began to expect increasingly aggressive rate hikes from the Fed; the inflation protection helped TIPS holders versus conventional USTs, but the duration component of TIPS was still enough to ensure negative total returns.

That said, in a developed economy such as the US, rising inflation expectations are usually accompanied by a bear steepening of the government bond yield curve (where long end yields rise faster than short end yields). If the nominal yield curve is bear steepening, then shorter dated TIPS can deliver positive returns as the inflation adjustment is more likely to outweigh the price impact at the short end of the curve.

In general, then, there is no guarantee that the total return on TIPS will be positive in an inflationary environment; they should merely exhibit a positive return relative to the corresponding Treasury note. However, even this statement is not guaranteed as total returns will depend to a large extent on the inflation expectations component at both the beginning and the end of the period in question.

1. ICE BofA US Treasury Index, 31 August 2022

2. ICE US Treasury Inflation Linked Bond Index, 31 August 2022

The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions.

Investors can get income from many sources, from bond coupons and equity dividends to other investments such as mutual funds, exchange-traded funds (ETFs) and investment trusts that make regular payments to investors based on the performance of the assets they manage.

Income is a crucial element of portfolio construction. Without bond coupons or equity dividends, investors would have to regularly sell assets that have risen in price in order to realise capital gains and generate a cash return. If a portfolio has a reliable stream of income, investors can earn a consistent return while holding assets for longer periods.

When markets are volatile, income investing can also help protect a portfolio’s overall returns, since the income keeps coming even if the assets are performing negatively on a mark-to-market basis.

The bond markets offer a full spectrum of risk, from investment grade governments to financials and high yield corporates, across developed and emerging markets, meaning fixed income investors can build an income-producing portfolio calibrated to their desired level of risk.

In equities, investors’ income options are more limited. Not all companies are publicly listed, and it is mostly investment grade, blue-chip firms that pay consistently large dividends. Bonds allow investors to access income from firms with different characteristics, from a wider range of industries and regions.

Source: TwentyFour, Bloomberg, ICE BofA Indices, 27 October 2022

Bond markets are referred to as ‘fixed income’ for a reason. While equity dividends are discretionary – they can be adjusted up or down at the company’s discretion in line with their performance – bond coupons are fixed contractual payments where non-payment would put a company in default.

In the long term, income will likely be the major driver of returns in a bond portfolio, which means fixed income returns tend to be less volatile than other, higher risk asset classes. A global, unconstrained bond portfolio might derive around 70% of its total return from income and only 30% from capital gains.

Bonds possess a very simple feature that make them lower risk than many other assets – a maturity date. In addition to income from coupons over the life of the bond, investors receive their initial investment (their ‘principal’) back on the maturity date.

This means there are only two ways an investor can lose money on a bond; either the bond issuer defaults, or the investor chooses to sell the bond at some point before maturity when the bond is trading below the purchase price.

If you buy a three-year bond yielding 5% today and hold it until maturity, then as long as the company doesn’t default, in three years’ time you will make a total return of 15%, regardless of whether the market price of the bond has fluctuated in the meantime.

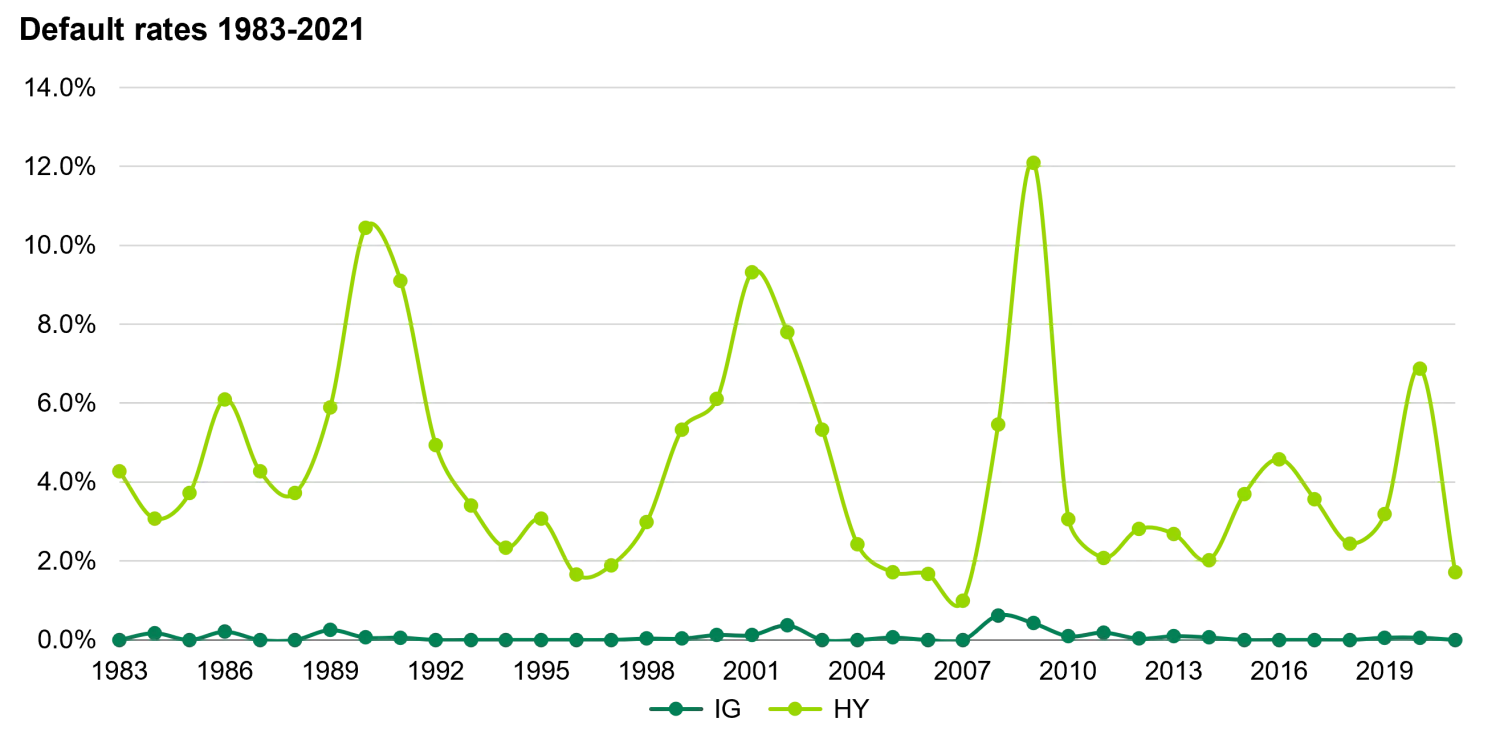

Defaults are extremely rare in investment grade bonds; the historical average is just 0.1%. As the chart below shows, in sub-investment grade bonds (also known as high yield) default rates tend to spike higher in times of severe economic distress, but the historical average default rate is again relatively low at 2.8%. The job of an active manager is to conduct detailed research on high yield bond issuers to avoid the defaults that do occur in the sector.

Source: Moody’s Annual Default Study, 8 February 2022

Another natural advantage of bonds, particularly short term bonds, is ‘pull-to-par’. Pull-to-par reflects the reality that as a bond approaches its maturity date, it will begin to ‘pull’ to its par value as default risk becomes increasingly negligible and the cash price of the bond amortises to 100. Pull-to-par occurs whether a bond has risen or fallen in price since the investor’s purchase, as in both instances the bond would repay at 100 regardless.

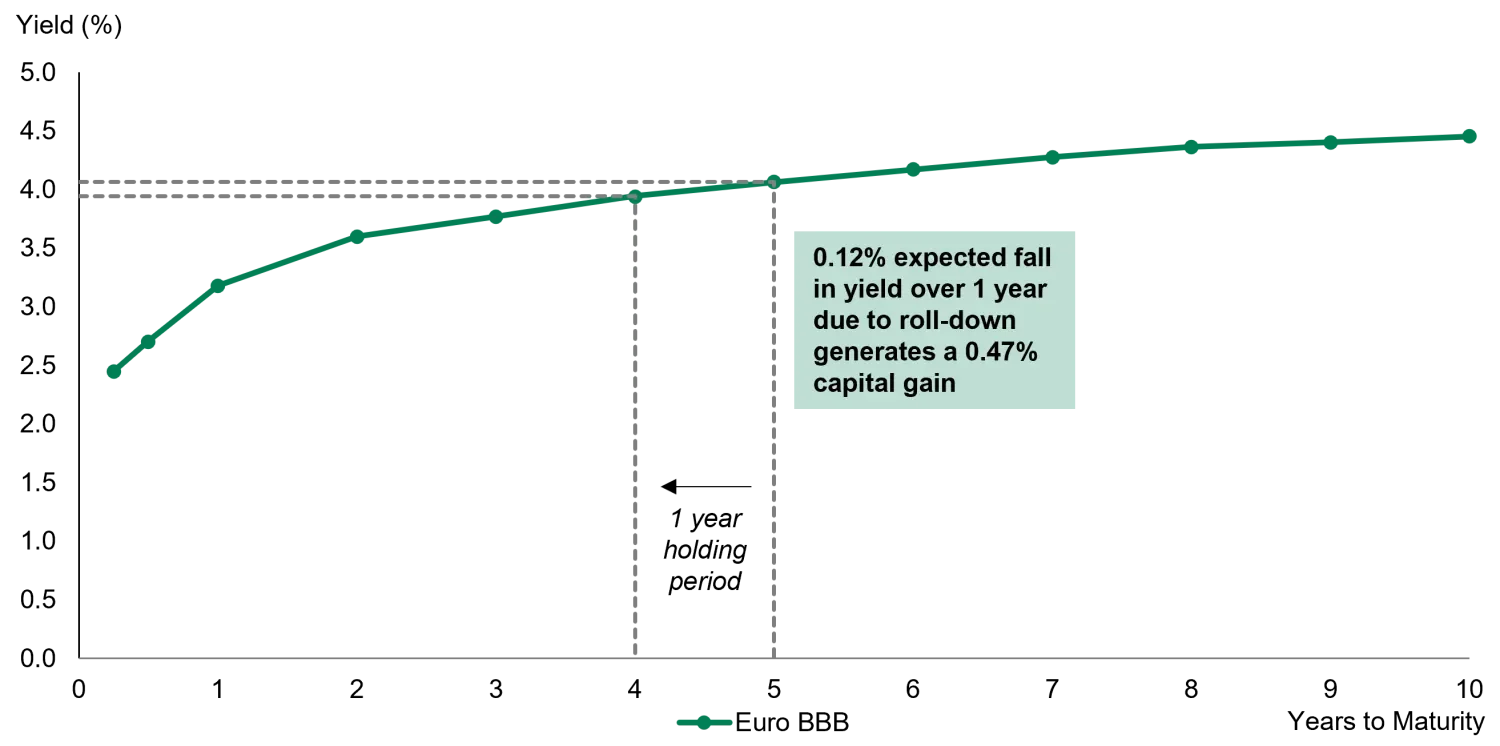

Roll-down is the capital gain created by the natural fall in a bond’s yield as it approaches maturity. The steeper the curve, the bigger the potential for roll-down gains, since the bond’s yield has further to fall (generating a bigger capital gain) with each passing year of maturity. Roll-down potential is generally much larger in short term bonds than in longer maturities because yield curves tend to be much steeper at the short end.

Source: TwentyFour, Bloomberg, 27 October 2022