TwentyFour Asset Management LLP (the “Firm”) and its group companies’ (meaning the Firm and its subsidiaries, collectively “TwentyFour”) are committed to ensuring our business is conducted in a responsible way and are committed to combating slavery and human trafficking risks in our business and supply chain.

This statement is made pursuant to section 54(1) of the Modern Slavery Act 2015 (“the Act”) and constitutes the Slavery and Human Trafficking Statement (“Statement”) for the financial year ending 31 December 2024 for TwentyFour.

It is TwentyFour’s policy not to tolerate slavery and human trafficking practices within our business and supply chains.

As a regulated investment management firm, we believe that the extent of TwentyFour’s potential exposure to slavery, human trafficking and forced labour is mainly limited to its supply chain, which is relatively low given the nature of the business and the skillset required in the supply chain.

TwentyFour relies on a supply chain of third parties to deliver services, who we expect to operate in an ethical, open and transparent way. As an asset management firm with relatively simple supply chains predominantly comprising business and professional services organisations, we believe that there is limited risk of slavery or human trafficking taking place. We undertake due diligence and ongoing monitoring of all suppliers, to include confirmation of compliance with relevant laws and regulations.

TwentyFour is a specialist fixed income investment management firm headquartered in London with an office in New York who aim to deliver the best outcomes for its clients across a variety of product offerings for both professional and institutional clients.

TwentyFour was founded in 2008 by a group of leading fixed income professionals and in the UK is structured as a Limited Liability Partnership with 16 partners: Since April 2015, Vontobel Holding AG (“Vontobel”) has been a majority (60%) stake holder of TwentyFour Asset Management LLP. The remaining 40% stake of TwentyFour was held by the Firm’s working Partners. On 30 June 2021 Vontobel acquired the remaining 40% stake making TwentyFour Asset Management a wholly owned subsidiary of Vontobel.

Vontobel has a multi-boutique business structure which comprises six investment boutiques, including TwentyFour. Vontobel Asset Management UK Holdings Ltd is a wholly-owned subsidiary of Vontobel. The registered shares of Vontobel are listed on the SIX Swiss Exchange. Vontobel has a strong core of shareholders; the majority of votes and capital are held by the Vontobel families, 50.9% of the votes and capital are tied in a shareholder pooling agreement (as at 01.01.2025).

TwentyFour is committed to respecting human rights in all its operations and external business interactions and to complying with its obligations under the Act. It is the policy of the Firm not to tolerate slavery and human trafficking practices within its business and supply chains. Consistent with its obligations under the Act, TwentyFour is committed to ensuring there is transparency in its own business and in its approach to tackling modern slavery throughout its supply chains. TwentyFour expects and requests the same standards from its contractors, suppliers and other business partners; the Firm will take appropriate and reasonable measures to minimise the risk of slavery and human trafficking practices taking place.

The Firm’s workforce is predominantly made up of professionally qualified and skilled employees and we consider the risk of modern slavery occurring within our business to be low.

We are a living wage employer and have committed to meeting the living wage for all our employees, which includes FTEs, PTEs, Contractors, Secondees, Interns, and Graduates. Where applicable, we expect our suppliers to adopt the same principle.

All employees are required to comply with the Firm’s staff handbook, compliance manual, code of ethics and policies and procedures to fulfil their obligation to comply with applicable rules and regulations, put our clients’ interests first and treat each other with respect and consideration.

At TwentyFour we encourage open communication such that employees are able to securely inform us of any wrongdoing in the work place. The Whistleblowing Policy gives employees the option to raise matters directly with the Firm’s Chief Compliance Officer or the regulator without fear of reprisal.

TwentyFour considers training as a fundamental tool for raising awareness of the Act and this Statement. Through the Firm’s annual compliance training we provide training on modern slavery and human trafficking to all employees.

TwentyFour has a relatively simple supply chain model that is built around supporting its core asset management practice. Broadly there are five categories:

The Firm adopts a risk-based approach for selecting and managing its supply chain to minimise the risk of slavery and human trafficking practices and to ensure that risk is appropriately identified, assessed and mitigated. Furthermore our commercial terms and standard conditions require all suppliers to comply with applicable laws and regulations, including the Act.

If any issues are identified within the supply chain in relation to modern slavery, these will be immediately reported to the Chief Operating Officer who will raise any concerns with TwentyFour’s Executive Committee and/or Boards.

In line with the Firm’s Outsourcing Policy, due diligence on TwentyFour’s outsource providers is conducted at the start of the outsource relationship and then on a periodic basis, which includes desk based reviews and/or onsite due diligence visits. Modern slavery is examined as part of such due diligence visits and includes key performance indicators such as training on modern slavery and contractual provisions that will be reported to TwentyFour’s Boards.

This Statement has been approved by the executive committee and board of TwentyFour and will be reviewed annually, and updated where necessary to reflect changes in circumstances and actual practice. The latest Statement will be published on our website.

Ben Hayward

Chief Executive Officer

TwentyFour Asset Management LLP

30 June 2025

TwentyFour Asset Management LLP (“TwentyFour”, the “Firm”) is committed to responsible environmental practices and operating in a sustainable manner.

The Firm monitors all corporate travel, seeking to minimise unnecessary trips and supporting this with investment in video conferencing capability as well as greater use of webcasts and video content for client engagement. TwentyFour’s support of the Cycle to Work Scheme, as well as the provision of secure cycle parking and changing facilities further promotes greener commuting.

Carbon Neutrality

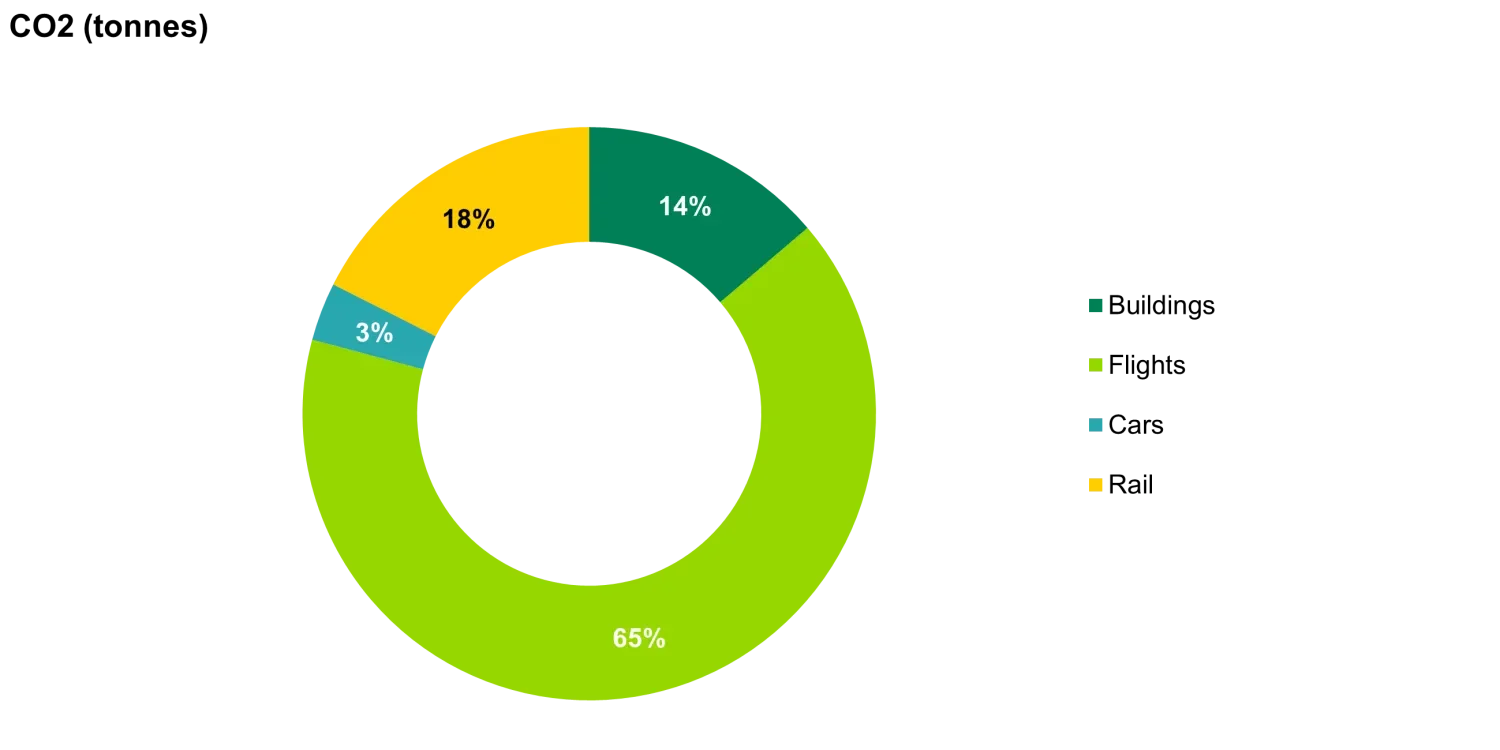

Surveying staff commutes, corporate travel and building energy usage, TwentyFour has identified its total carbon emissions to be 186.9 tonnes CO₂ emissions per annum. This equates to a carbon intensity of 3.1 tonnes per employee (at the lower end of the range for an office based organisation).

Source: TwentyFour Asset Management

TwentyFour feels it is important to achieve a carbon neutral position and has achieved this by offsetting these emissions with an investment in a PAS 2060 Carbon Neutrality Offset Project.

Reduce & Recycle

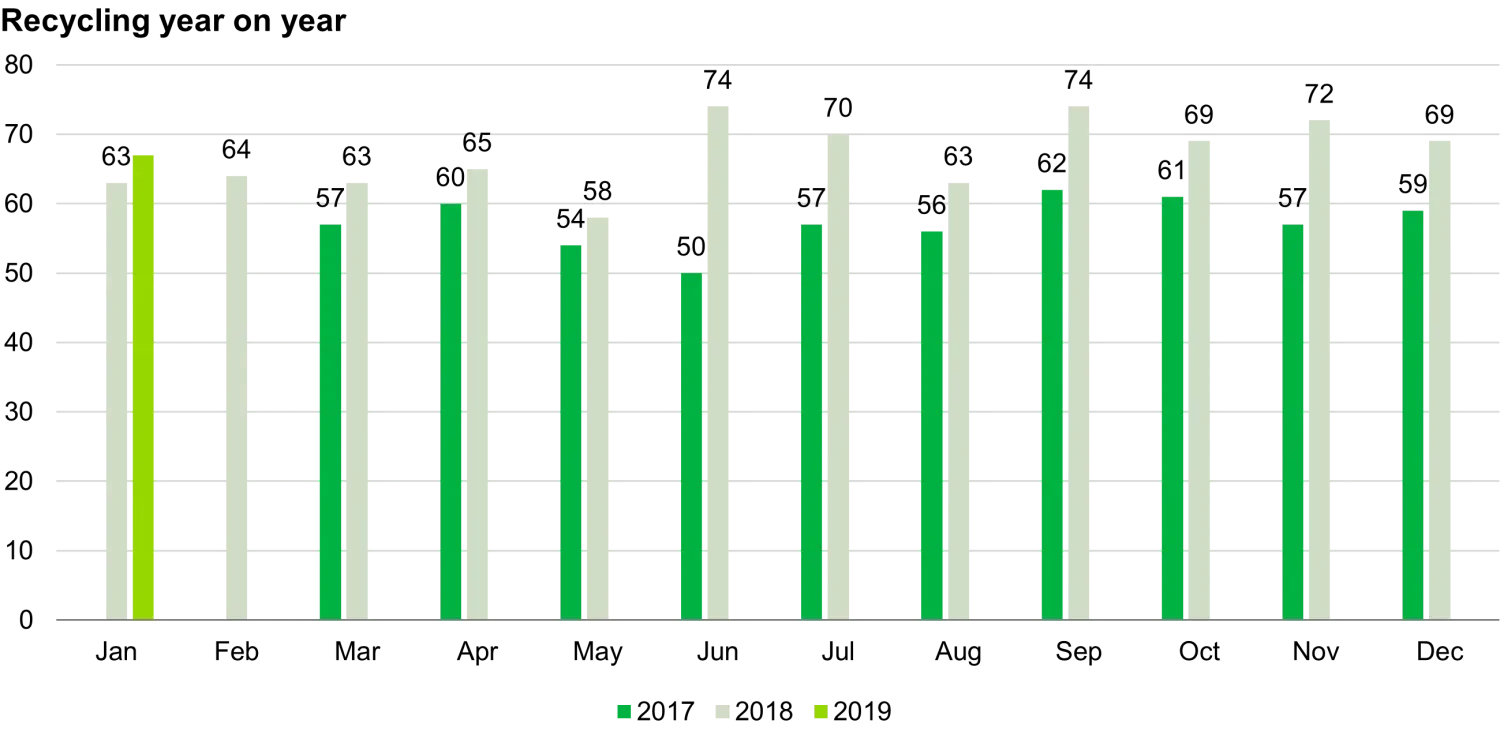

TwentyFour works with its building management to track and reduce landfill waste. Recycling levels are tracked monthly with the aim of recycling over 95% of the office’s waste products, currently achieving 67%. TwentyFour is pleased to operate from premises which meet the BREEAM excellent environment standard with a green roof, solar panels and an intelligent lighting control system.

Source: TwentyFour Asset Management

A core tenet of our invest philosophy is that “diversity of experience ensures a wide range of views to capture returns and mitigate risks”. TwentyFour thus seeks to attract and promote a diverse workforce. Our long term focus is a competitive advantage and encourages an emphasis on retaining and developing our staff, offering benefits and policies which support their wellbeing, career development and promote equality across the Firm.

Operating in a dynamic marketplace it is essential we continually update our skills and knowledge. TwentyFour provides regular internal training to help achieve this, keeping employee engagement and satisfaction high. Staff across the organisation also have the opportunity to attend external training courses to support their work. The Firm invests in its human capital by encouraging staff to take professional qualifications, paying for tutoring and materials as well as providing time off for study.

TwentyFour recognises the importance of work-life balance and seeks to build a culture to support this. The Firm offers benefits that are enhanced above statutory requirements for both maternal and paternal leave. By doing this, TwentyFour seeks to encourage all forms of parental leave and help support the careers of our own staff and their partners. Staff are able to keep in touch over the course of their leave and are assisted in their return.

TwentyFour appreciates the gains both to individual staff and the Firm that come from flexible working practices and we are committed to supporting, wherever possible, a flexible work environment for our employees. Our flexible working policy gives eligible employees an opportunity to formally request a change to their working pattern. No-one who makes a request for flexible working will be subjected to any detriment or lose any career development opportunities as a result. Flexible working can take several forms including: a reduction or variation in working hours; reduction of the number of days worked each week; and/or working from a different location (for example, from home).

TwentyFour is committed to ensuring that all employees and workers are treated fairly, and with dignity and respect. It is TwentyFour’s policy that no employee should be treated less favourably on the grounds of sex, race, nationality, marital or civil partnership status, religion or belief, sexual orientation, gender reassignment, pregnancy/maternity, disability, age, or any other grounds. This policy applies to recruitment, promotion, training, placement, transfer, dismissal as well as remuneration, grievance and disciplinary procedures and decisions. This policy also applies to workers (who are not employees) and to the treatment of contract workers. Whether discrimination is direct, indirect or takes the form of harassment or victimisation it is unacceptable. TwentyFour will recruit employees and make other employment decisions concerning promotion, training, dismissal etc. on the basis of objective criteria.

In-Kind Initiatives

TwentyFour acknowledges the community at large as one of its stakeholders and seeks to make a positive impact beyond its investing activities. The Firm places an emphasis on in-kind support, and our staff are keen to put their skills to work directly benefiting the wider community.

One of the major challenges in the financial industry is the disproportionately low representation of women in senior positions. While we acknowledge that the cause of this is complex and multivariate we believe that a major contributory factor is that historically the financial industry has both not appealed to female candidates as a career choice nor done enough to encourage participation. Consequently the pool of women in our industry does not reflect society as a whole.

There are no easy short cuts to what is a time horizon problem. At TwentyFour we are proud to have teamed up with Queen Mary University of London’s (QMUL) mentoring scheme with the aim of specifically providing female undergraduates less familiar with the workings of the City with advice, guidance and encouragement.

There are several additional reasons why the QMUL QMentor scheme is a natural fit for our Firm. Firstly, it is our closest neighbouring University, being situated in Tower Hamlets just east of the City. Secondly, 90% of its undergraduate intake derive from state schools, a significant number from the local area. Finally, QMUL has an extensive bursary scheme aimed at supporting the brightest and best students from less privileged backgrounds.

We participate in a rolling mentoring programme and are exploring other avenues with the University to help increase students’ understanding of the opportunities working in the City presents.

Should anyone in our industry wish to explore QMUL QMentoring for themselves or their firm you can learn more using the following link, https://profdev.qmul.ac.uk/what-we-offer-/coaching-and-mentoring/

or contact l.chastney@qmul.ac.uk

Community – Direct Giving

We also support a number of charities through direct donations. Recognising that charitable giving is very personal and most successful when that passion is harnessed, we are led by our staff’s choices of which causes to support. We regularly run staff events to generate funds for the specific causes, rotating through those that have been championed by our people.

TwentyFour supports its staff in fund-raising for individual charities by matching any sums raised, thereby doubling the amount raised by staff for their chosen charity and encouraging greater levels of charitable endeavour.

Strong corporate governance is essential for TwentyFour to continue serving its customers and other stakeholders to the very highest standard while accurately identifying, reducing and mitigating financial and non-financial risks. TwentyFour is structured through a series of committees and steering groups with appropriate levels of independence to ensure our mission is translated into effective strategies and these are implemented as expected.

Committees

Executive Committee

Made up of the Chairman, CEO, COO and a founding partner – TwentyFour’s Executive Committee is responsible for the day-to-day management of the firm and has over 120 years combined experience from investment banking, asset management and legal backgrounds.

Risk & Compliance Committee

Made up of the Chief Risk Officer, Chief Compliance Officer and Head of Operations – the Committee is responsible for oversight of the Risk Management Framework of the Firm and specifically the effectiveness of risk management and compliance activity within the Firm.

Investment Committee

Day-to-day portfolio management is the responsibility of the portfolio management team, which is drawn from both trading and portfolio management backgrounds.

Product Governance Committee

Chaired by the Deputy COO and made up of representatives of the Executive Committee, Compliance, Legal and Transaction Management and Risk, the Committee assists the Executive Committee to meet product governance requirements and to ensure that the products and services TwentyFour offers are in the best interest of the Firm’s clients.

Legal & Regulatory Committee

Made up of the Chief Operating Officer, Chief Compliance Officer and Legal and Transaction Management, the Committee’s responsibilities include monitoring new legislation and regulation, assessing the impact of these on TwentyFour and, if required, implementing such legal and regulatory changes.

Counterparty Review Committee

Made up of the Chief Risk Officer and Chief Compliance Officer, the Risk and Compliance teams are responsible for the due diligence before on-boarding and subsequent daily monitoring of all trading counterparties.

Steering Groups

Environmental Social Governance Steering Group

The ESG steering group is led by TwentyFour’s Chairman and contains representatives from across the Firm. It meets to determine our ESG goals and methodology – both internally and with regards to our investment policy. The group helps ensure its strategies are effectively implemented across the Firm.

Information Technology Steering Group

The IT steering group led by Operations with representatives from Risk, Portfolio Management, and Compliance ensures TwentyFour is making most effective use of its information technology resources, efficiently and responsibly handling data while identifying risks in its processes.

Standards

GIPS

Global Investment Performance Standards (GIPS) are a set of voluntary standards used by investment managers throughout the world to ensure the full disclosure and fair representation of their investment performance. TwentyFour is GIPS compliant and fully committed to remaining so.

ISAE3402

TwentyFour has achieved the ISAE3402 assurance standard on its Internal Control Framework over Financial Reporting. This standard documents that TwentyFour has adequate internal controls from a financial reporting perspective.

Policies

Below are summary descriptions of some of TwentyFour’s relevant governance policies.

Modern Slavery

Modern slavery is a crime and a violation of fundamental human rights. It takes various forms, such as slavery, servitude, forced and compulsory labour and human trafficking, all of which have in common the deprivation of a person’s liberty by another in order to exploit them for personal or commercial gain.

It is TwentyFour’s policy not to tolerate slavery and human trafficking practices within our business and supply chains. TwentyFour will take appropriate and reasonable measures to minimise the risk of this taking place in line with the nature of services provided to either Firm.

Human Rights

TwentyFour is committed to respecting international standards for human rights with policies and processes in place to identify and prevent human rights risks. TwentyFour relies on a supply chain of third parties to deliver services, who we expect to operate in an ethical, open and transparent way. As an asset management firm with relatively simple supply chains predominantly comprising business and professional services organisations, we believe that there is limited risk of human rights violations taking place. We undertake due diligence and ongoing monitoring of all suppliers, to include confirmation of compliance with relevant laws and regulations.

Diversity & Inclusion

TwentyFour is committed to ensuring that all employees and workers are treated fairly and with dignity and respect. It is TwentyFour’s policy that no employee should be treated less favourably on the grounds of sex, race, nationality, marital or civil partnership status, religion or belief, sexual orientation, gender reassignment, pregnancy/maternity, disability, age, or any other ground on which it is or becomes unlawful to discriminate under the laws of England and Wales (each one being a “protected characteristic” under this policy). This policy applies to recruitment, promotion, training, placement, transfer, dismissal as well as remuneration, grievance and disciplinary procedures and decisions. This policy also applies to workers (who are not employees) and to the treatment of contract workers.

Cyber Security and Data

TwentyFour recognises the need for vigilance in protecting its IT infrastructure, the Firm and its clients’ data. We have a thorough Cyber Security Policy to inform Firm users: employees, contractors and other authorised users of their obligatory requirements for protecting the technology and information assets of the Firm. The Cyber Security Policy describes the technology and information assets that must be protected and identifies many of the threats to those assets.

The Firm also has a comprehensive set of policies on the data it collects, how it is stored, processed and shared. We respect the privacy rights of individuals and are committed to handling personal information responsibly and in accordance with applicable law.

Anti-Financial Crime

TwentyFour recognises that financial crime in all its forms is a threat to the Firm, its subsidiaries and the financial services community. TwentyFour is committed to the prevention of financial crime such as money laundering, the funding of terrorist activity, bribery and corruption, fraud and market abuse and through risk-based internal procedures, policies and systems and controls strives to ensure that high standards of crime prevention and awareness are maintained by all Partners, Directors, employees and consultants, whether under a contract of employment or a contract of service or otherwise. Through our financial crime policies and procedures we aim to prevent, deter, detect and investigate all forms of financial crime.

Graeme Anderson

Chairman

Nick Knight-Evans

COO

Last updated: September 2024

TwentyFour Asset Management LLP and any of its subsidiaries (“TwentyFour”, “us” or “we”) respect your right to privacy. This Privacy Notice explains how we collect, share and use personal data about you, and how you can exercise your privacy rights.

The Privacy Notice applies to the processing of personal data when you visit our website at twentyfouram.com, when you sign up to an account, when you visit our offices, register for events, fill out surveys or other promotional activity, or when you correspond with us or interact with us on social media platforms including but not limited to LinkedIn. You should read this Privacy Notice carefully so that you are fully aware of how and why we are using your personal information.

If you have any questions or concerns about our use of your personal data, then please contact us using the contact details provided at the bottom of this Privacy Notice.

The personal data that we may collect about you generally falls into the following categories:

Information that you provide voluntarily

| Purpose | Data types | Legal basis |

|---|---|---|

| Provide access to customer section of the website. | Name, contact details (e.g. business mailing address, phone number, current and prospect e-mail address). Employment details (e.g., your employer, job title), account details (e.g. login names, passwords), and public postings | Contractual necessity |

| To respond to any enquiries, provide product or service updates | Name, contact details (e.g. mailing address, phone number, current and prospect e-mail address) | Contractual necessity Legitimate interest |

| To provide promotional activities | Name, contact details (e.g. mailing address, phone number, current and prospect e-mail address) | Consent Legitimate interest |

| Liaise with you and maintain a correspondence record. | Name, contact details (e.g. mailing address, phone number, current and prospect e-mail address). Employment details (e.g. your employer, job title) | Legitimate interest |

| Website activity information including how your device interacted with our website to provide customers with superior service and to provide all visitors a smooth, efficient, and personalized experience while using our website. We use this information for our internal analytics purposes and to improve the content of our website and to make our website easier to use. | Language and geographic location, website visits, time and activity, browser-type information from your device through cookies (see our cookie notice) | Legitimate interest Consent |

| Ensure the security of our premises and website | Visitor logs for our premises Device information as outlined above | Legitimate interest |

Certain parts of our website may ask you to provide personal data voluntarily which include your name and contact details (e.g. mailing address, phone number, current and prospect e-mail address), employment details (e.g., your employer, job title), account details (e.g. login names, passwords), and public postings. We may ask you to provide personal data voluntarily when you subscribe for a product or service, subscribe for certain promotional activities, fill out surveys, and correspond with us.

From time to time, we may receive personal information about you from third party sources (including event sponsors or individuals who have asked us on your behalf) to provide information to you, but only where we have checked that these third parties either have your consent or are otherwise legally permitted or required to disclose your personal information to us.

TwentyFour understands the importance of protecting children's privacy, especially in an online environment. Therefore, TwentyFour’s services are not directed to or intended for children under the age of 16 and we do not knowingly collect any personal information from such users, except when a child is taking part in an educational event. In these cases we only collect participants names.

We may disclose your personal data to the following categories of recipients:

Where personal data is shared we will have appropriate contractual arrangements in place to protect any such data – in line with applicable data protection laws and regulation. We do not sell, trade, or rent to others the personal data we collect online.

You may have the following data protection rights:

We respond to all requests we receive from individuals wishing to exercise their data protection rights in accordance with applicable data protection laws.

A “cookie” is a small data file transferred by a website to your computer’s hard drive. We use cookies and similar tracking technology (collectively, “Cookies”) to collect and use personal data about you. For further information about the types of Cookies we use, why, and how you can control Cookies, please see our Cookie Notice here.

We use appropriate technical and organisational measures to protect the personal data that we collect and process about you. The measures we use are designed to provide a level of security appropriate to the risk of processing your personal data.

Your personal data may be transferred to, and processed in, countries other than the country in which you are resident. These countries may have data protection laws that are different to the laws of your country. If service providers in a third country are used, they are obligated to comply with the data protection levels in the UK and Europe in addition to written instructions by agreement to the EU standard contractual clauses.

The information you provide may be processed and stored on cloud servers operated by the service providers and located in data centres within the UK, Switzerland, the EU/EEA and the United States. This means that when we collect your personal data we may process it in any of these countries. Your personal data will only be transferred to countries or international organisations if such transfer is required for the fulfilment of our obligations to you, prescribed by law or where you have given us consent. Where your personal data is transferred outside the UK, Switzerland or the EU/EEA, it will only be transferred if the relevant country (or data protection framework applicable to such country) is considered to provide an adequate level of data protection by the relevant authorities or institutions, or in the absence of such adequacy decision , if the recipient guarantees adequate protection based on appropriate safeguards provided by data protection laws and regulations (for example, Standard Contractual Clauses issued by the European Commission, and adapted to local law as required), or statutory exemptions provided by data protection laws and regulations (for example, your explicit consent).

We retain personal data we collect from you where we have an ongoing legitimate business need to do so (for example, to provide you with a service you have requested or to comply with applicable legal, tax or accounting requirements).

When we have no ongoing legitimate business need to process your personal data, we will either delete or anonymise it or, if this is not possible (for example, because your personal data has been stored in backup archives), then we will securely store your personal data and isolate it from any further processing until deletion is possible.

The website may link you to third party website including LinkedIn. These third party websites will have their own data protection practices. We recommend that you review their respective privacy notices before accessing the third party links.

We may communicate with you via e-mail or physical mailings containing and offering news, event information or services (“Publication & Subscription Services”), subject to any restrictions under applicable laws and regulations. If you would rather not receive Publication & Subscription Services from us, you may “opt out” by following the “opt out” instructions in each e-mail footer or by contacting us.

In order to comply with applicable laws and regulations, we may be obliged to record telephone conversations with reference to operations concluded in the performance of our services.

We may update this Privacy Notice from time to time in response to changing legal, technical or business developments. When we update our Privacy Notice, we will post those changes here so that you will always know what information we collect online, how we use it, and what rights you have. When we update our Privacy Notice, we will take appropriate measures to inform you, consistent with the significance of the changes we make.

You can see when this Privacy Notice was lasted updated by checking the "last updated" date displayed at the top of this Privacy Notice.

If you have any questions or concerns about our use of your personal data, please contact us at privacy@twentyfouram.com .

The data controller of your personal data is TwentyFour Asset Management LLP, The Monument Building, 11 Monument Street, London EC3R 8AF.

These terms of use (“Terms”) (together with the documents referred to in it) set out the terms on which you may make use of the TwentyFour Asset Management website, and any website, micro site or sub-site owned, developed or maintained by TwentyFour Asset Management LLP for itself or on behalf of its subsidiaries (‘Website’). The terms apply to all users of, and visitors to the Website.

The Website is operated by TwentyFour Asset Management LLP (“we”, “us”, “our” or “ourselves”). TwentyFour Asset Management LLP is registered in England No. OC335015, and is authorised and regulated in the UK by the Financial Conduct Authority, FRN No. 481888. Registered Office: The Monument Building, 11 Monument Street, London, EC3R 8AF.

Please read these Terms carefully. By accessing any page of the Website, you agree to be bound and abide by these Terms. If you do not agree to these Terms, you must not use the Website. We reserve the right to modify these Terms at any time without notification to you. Some of the provisions contained in these Terms may also be superseded by provisions or notices published elsewhere on the Website and such provisions and notices will automatically be binding on you.

These Terms also refer to the terms detailed on the Privacy & Cookie page of our Website, and any representations or warranties that you have given about your investor status in the entry disclaimer to the Website, which also apply to your use of the Website.

Access to our Website is permitted on a temporary basis and free of charge. You acknowledge that your access to the Website may be prevented by factors outside of our control including without limitation the unavailability, in-operation or interruption of internet services or the in-operation, inefficiency or unsuitability of the computer hardware that you use to access the Website. We shall not be liable for any loss or damage in respect of this.

You may use the Website for lawful purposes only. You may not use the Website in the following ways, including (without limitation): (a) in any way that breaches any applicable local, national or international law or regulation; (b) in any way that is unlawful or fraudulent, or has any unlawful or fraudulent purpose or effect; (c) to send, knowingly receive, upload, download, use or re-use any material which does not comply with these Terms; (d) to reproduce, duplicate, copy or re-sell any part of the Website in contravention of these Terms; (e) to transmit, or procure the sending of, any unsolicited or unauthorised advertising or promotional material or any other form of similar solicitation (spam); (f) to knowingly introducing any data, send or upload any material that contains software, viruses or other codes, or files which are malicious or designed to adversely affect the operation of any computer software or hardware; or (g) attempting to gain unauthorised access to the Website, the server on which the Website is stored or any server, computer or database connected to the Website. You must not attack the Website via a denial-of-service attack or a distributed denial-of service attack.

We are the owner or the licensee of all intellectual property rights in the Website, and in the material published on it. Those works are protected by copyright laws and treaties. All such rights are reserved. Where we publish third party intellectual property that is publically available, we will attribute it to its owner. Our status (and that of any identified contributors) as the authors of content on our Website must always be acknowledged.

You may print off copies, and may download extracts, of any page(s) from the Website. You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way, and you must not use any illustrations, including (without limitation) our logo, photographs, video or audio sequences or any graphics separately from any accompanying text. You must not use any part of the content on the Website for commercial purposes without obtaining a licence to do so from us or our licensors.

If you print off, copy or download any part of the Website in breach of these Terms, your right to use the Website will cease immediately and you must, at our option, return and/or destroy any copies of the materials you have made, and certify and/or evidence to us that you have done so to our reasonable satisfaction.

The content on our Website is provided for general information only. It is not intended to be a solicitation, an offer to buy or sell any security or amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on the Website.

We may amend, revise or modify, in part or in full, any information on the Website at any time without notification to you. Although we make reasonable efforts to update the information on the Website, we make no representations, warranties or guarantees, whether express or implied, that the content on the Website is accurate, complete or up-to-date. We do not guarantee that our Website, or any content on it, will be free from errors or omissions.

To the extent permitted by law, we exclude all conditions, warranties, representations or other terms which may apply to our Website or any content on it, whether express or implied.

We will not be liable to any user for any loss or damage, whether in contract, tort (including negligence), breach of statutory duty, or otherwise, even if foreseeable, arising under or in connection with: (a) use of, or inability to use, the Website; or (b) use of or reliance on any content displayed on the Website. Please note that in particular, we will not be liable for (a) loss of profits, sales, business, or revenue; (b) business interruption; (c) loss of anticipated savings; (d) loss of business opportunity, goodwill or reputation; or (e) any indirect or consequential loss or damage.

We do not guarantee that the Website will be secure or free from bugs or viruses and you should use your own virus protection software. We will not be liable for any loss or damage caused by any virus, distributed denial-of-service attack, or other technologically harmful material that may infect your computer equipment, computer programmes, data or other proprietary material due to your use of our Website or by your downloading of any content on it, or on any website linked to it.

Nothing in these Terms excludes or limits our liability for death or personal injury arising from our negligence, or our fraud or fraudulent misrepresentation, or any other liability that cannot be excluded or limited by English law.

You may link to and from the Website, provided; (a) you do so in a way that is fair and legal and does not cause us to breach any of our legal or regulatory obligations or damage our reputation or take advantage of it; (b) you do not establish a link in such a way as to suggest any form of association, approval or endorsement on our part where none exists; (c) you do not causes the Website to be framed on any other website. We reserve the right to withdraw linking permission without notice.

The Website may contain internet addresses, links and/or hyperlinks to other websites, which are not operated or monitored by us. The links to other websites are for your convenience and we do not accept any responsibility or liability for enabling you to link to any other website, for the contents of any other website, for the security of any other website, or for any consequence of your acting upon the contents of such website. No endorsement or approval of any third parties or their advice, opinions, information, products or services is expressed or implied by any information on the Website. It is your responsibility to check the terms and conditions and privacy policies which are applicable to such other third party websites.

No waiver by us of any provision of these Terms shall be deemed to be a waiver of any subsequent breach of that or any other provision of these Terms and any forbearance or delay by us in exercising any of our rights under these Terms shall not be construed as a waiver of such rights.

Each provision of these Terms is severable and the invalidity, illegality or unenforceability of any provision shall not affect the validity or enforceability of any other part of these Terms.

These Terms, the use of the Website and any dispute or claim arising out of or in connection with it (including non-contractual disputes or claims) shall be governed by and construed in accordance with English law. The courts of England and Wales shall have exclusive jurisdiction to settle any dispute or claim that arises out of or in connection with these Terms the use of the Website (including non-contractual disputes or claims).

If you wish to make any use of content on the Website other than that set out above, please contact sales@twentyfouram.com

We are a participant in the Financial Services Compensation Scheme. Depending upon your client classification, the circumstances of the claim and the nature of the investment service you may be entitled to compensation from the scheme if we are unable to meet our liabilities. Most types of investment business are covered in full for the first £50,000 of any eligible claim. Further information about the compensation arrangements is available from the Financial Services Compensation Scheme at https://www.fscs.org.uk.

We have an established complaints procedure which conforms to the FCA Rules for the proper handling of complaints. A copy of our current complaints handling procedure is available on the Regulatory page of our website.

TwentyFour Asset Management LLP is authorised and regulated by the Financial Conduct Authority (FRN 481888). Registered in England. Registered No OC335015. Registered Office: The Monument Building, 11 Monument Street, London EC3R 8AF

Telephone Calls: Please note that in accordance with regulatory requirements and industry practice it is TwentyFour Asset Management’s policy to record all telephone calls.

Further details of the Firm’s regulatory status can be viewed on the Financial Conduct Authority register of financial services firms: https://register.fca.org.uk/