Dollar Hedging is About to Get Cheaper

As we approach the end of Q2, a time when the price of currency hedging can typically spike, we have been reviewing the likely changes in the so-called ‘costs’ of currency hedging. I use the term so-called as these are not really costs, merely a differential in short term interest rates, which for some investors can be a gain and for others it will be a reduction in the yield or return of an asset.

Five things to consider when investing in IG credit

Fixed income investors globally face a daunting environment in 2019, with a deteriorating credit cycle, heightened political volatility and increased uncertainty around global monetary tightening.

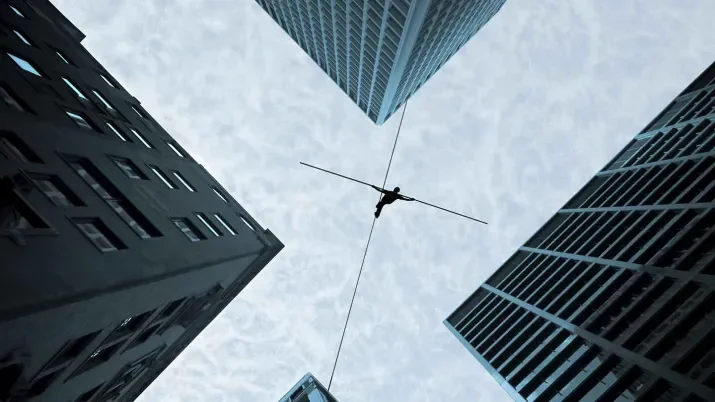

Powell’s Balancing Act

This week Jerome Powell and his fellow FOMC members sit down to determine the Fed Funds rate, and despite the expectation of no move, this meeting is going to be very closely monitored with market participants analysing every word of the subsequent comment.

Due Diligence Critical for New Cohort of ABS Issuers

As we wrote on Friday, one of our biggest takeaways from last week’s Global ABS conference was the growing number of prospective new issuers in the market.

Global ABS 2019: Issuers Out in Force

This week Asset-Backed Securities (ABS) market participants from across the globe gathered for the 23rd annual three-day Global ABS conference in Barcelona. And this year it proved more popular than ever with over 4,000 attendees (a post-crisis record) made up of issuers, arrangers, service providers, traders, analysts, market regulators, the industry press, and of course investors like ourselves. In particular, we felt the number of issuers represented was noticeably higher than we have seen in recent years.

Cashing in on the Brexit Premium

Brexit deliberations are currently at a standstill in the UK parliament, as are negotiations with EU representatives. The next steps in the exit process are clouded in uncertainty, with numerous options on the table. In this environment, it’s no surprise that investors are still demanding a spread premium for sterling denominated credit, over and above comparable euro denominated issues.

Five things to consider when investing in ABS

Despite boasting some of the lowest default rates across the global fixed income market, as well as higher yields and greater investor protections than vanilla corporate bonds of the same rating, Asset-Backed Securities (ABS) remains an under-utilised market for many pension funds.

TwentyFour partner Ben Hayward outlines five things every investor should keep in mind when looking at this compelling asset class.

What Would it Take For the Fed to Cut?

With markets now pricing in two cuts in the Fed Funds rate this year, and a 97% chance of at least one cut, once again the FOMC members are at odds with the financial markets.

A Tale of Two Bonds – Primary vs Secondary

In the ABS market we often refer to the technical around supply and demand which can influence the direction of spreads as a consequence.

Pricing a US Recession Won’t Make it Real

One of the main drivers of global markets at the moment is the exact status of the economic cycle in the United States, and on a related note, what the Federal Reserve’s next moves are likely to be. One question we are being asked more and more often by investors is whether we think a recession is coming in the US, and if so, when?

Lloyds Next Not to Call?

Earlier this year Santander became the first bank not to call its Additional Tier 1 (AT1 or ‘CoCo’) bonds at the first call date

How to Build a High Conviction Bond Portfolio

TwentyFour CEO Mark Holman explains how high conviction thinking runs right through the firm’s investment process, and why he believes a concentrated, flexible portfolio is critical to combatting the unique challenges facing fixed income markets today.

Blog updates

Stay up to date with our latest blogs and market insights delivered direct to your inbox.