Fixed Income Festival 2020 – Main stage

TwentyFour CEO Mark Holman provides a macro outlook before discussing his views on a critical US presidential election and how it could impact the economy and the markets.

Fixed Income Festival 2020 – IG Breakout session

Chris Bowie and Gordon Shannon hosted a breakout session on the IG stage where they provided an update on portfolio performance and their outlook for investment grade credit markets.

Fixed Income Festival 2020 – MSB Breakout session

Gary Kirk and Eoin Walsh hosted a breakout session on the MSB stage where they provided an update on portfolio performance and their outlook for fixed income markets.

Fixed Income Festival 2020 – ABS Breakout session

Partner and Portfolio Manager Ben Hayward hosted a breakout session on the ABS stage where he provided an update on portfolio performance and his outlook for the ABS market.

Fixed Income Festival 2020 – ESG Breakout Session

Graeme Anderson hosted abreakout session in the ESG tent where he discussed TwentyFour's ESG Integration model, how company behaviour affects our ESG scoring and how our Observatory relative value system has enabled us to build ESG analysis into the investment process the portfolio managers use every day.

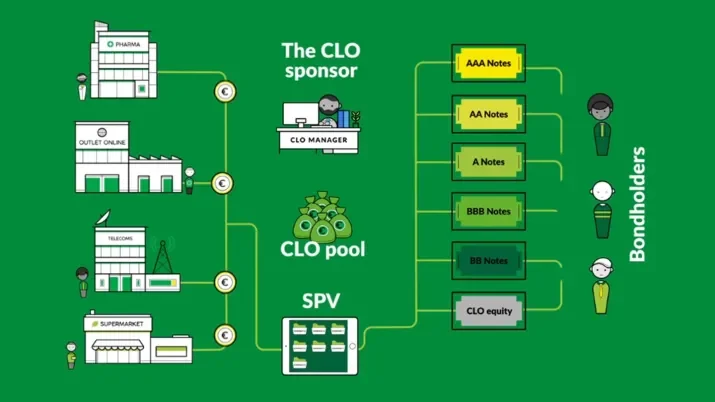

What is a European CLO, and how do they work?

European collateralised loan obligations – or CLOs – are bonds issued to fund a specific and diverse pool of corporate loans to firms of different sizes and in different industries all over Europe.

How does ESG integration work at TwentyFour?

At TwentyFour, ESG - Environmental, Social and Governance - factors, are a critical component in our investment process. This video explains our approach to ESG integration at TwentyFour.

Do green bonds deliver for fixed income investors?

As with many things ESG related, interest in, and issuance of, green bonds is growing rapidly.

Fixed Income Festival - September 2020

On Wednesday 14th September , TwentyFour Asset Management held its annual investor conference online for the first time.

Do Green Bonds Work for Investors?

Green bonds have seen dramatic growth both in terms of market size and media coverage in recent years. In 2019 we saw $237bn of issuance, a 62% increase on 2018’s $146bn, from a mixture of sovereigns, financials and corporates; and in its wake has come a proliferation of dedicated green bond funds.

The CLO Machine is Slowing Down

There are still plenty of potential bumps in the road (Brexit, the US election, COVID-19 developments and so on) but the positive technical created by dwindling supply has the potential to push spreads tighter in coming months.

Can ABS Close The Gap on Corporate Bonds?

We expect September to be relatively busy with new ABS deals, but there’s a very strong technical developing in favour of ABS and CLOs, which should help performance in the coming months.

Blog updates

Stay up to date with our latest blogs and market insights delivered direct to your inbox.