Trade war volatility maintains grip on bonds

By now investors should be getting used to the ever more frequent hiccups in the trade negotiations between the US and the rest of the world.

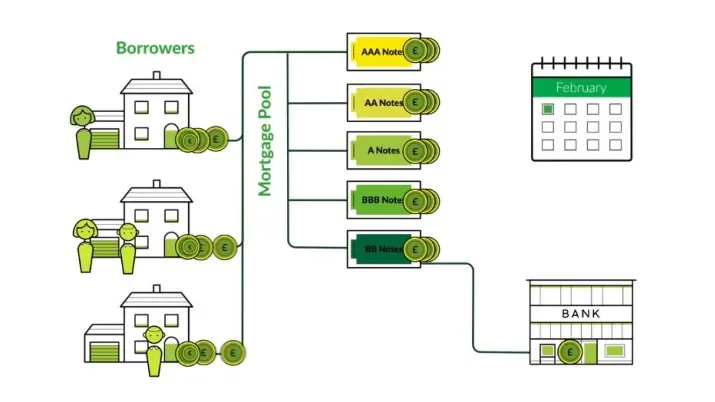

What is an RMBS, and how do they work?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.

Data decline eases for Germany and US

"In some parts of the global economy, we might be seeing a bottom in terms of low activity levels." TwentyFour's Felipe Villarroel discusses the factors behind these improving trends.

NIBC leading the way in ESG

“NIBC, has been involved in ESG/CSR focused lending in Europe for some time, and is the first manager to issue what we might call an ESG CLO." Elena Rinaldi discusses why in terms of ESG, NIBC would receive a high score from us.

Younited performance shows risks in Fintech ABS

"Younited’s funding strategy is as innovative as its business model... In May this year, the company successfully issued its first #ABS backed by French consumer loans" TwentyFour's Ben Hayward discusses.

TwentyFour UK Mortgages Limited Webinar

Douglas Charleston, Partner and Portfolio Manager of the UK Mortgages Limited Fund provides an update on the fund.

Fitch keeps AT1 investors on their toes

"We have been participants in the Additional Tier 1 (AT1) sector since its introduction in 2013, albeit with a high degree of selectivity, but the risk-reward has been obvious to us." Gary Kirk discusses the latest AT1 news from Fitch

TwentyFour Monument Bond Fund Webinar

Douglas Charleston, Partner and Portfolio Manager provides an update on the Monument Bond Fund

IG demand would be key to Walgreens buyout

At this late point in the cycle, fixed income investors are on high alert for signs of potential excess in the capital markets, and a proposal for potentially the biggest leveraged buyout (LBO) in history would certainly fall into that category.

Sustainable credit: A free lunch?

At TwentyFour Asset Management we believe Environmental, Social and Governance (ESG) factors can have an influence on the value of our investments, and we have recently formalised our approach to these risks by integrating an ESG framework throughout the firm’s investment process, across all strategies.

TwentyFour Dynamic Bond Fund Webinar

Partner and Portfolio Manager Eoin Walsh provides an update on the Dynamic Bond Fund.

TwentyFour Corporate Bond Fund Webinar

Chris Bowie, Partner and Portfolio Manager provides an update on the TwentyFour Corporate Bond Fund.

Blog updates

Stay up to date with our latest blogs and market insights delivered direct to your inbox.