UKML: locking in income, building in growth

UKML fact box1

Share price: 71.50p

No. of shares: 178,799,556

Total assets: £140,885,222

Net asset value (NAV): 78.80

Implied yield at share price: 6.99%

Implied yield at NAV: 6.35%

Having achieved every objective we set at December 2020’s EGM within the first six months of 2021, UKML’s portfolios are now producing a consistent level of income that is growing month by month.

- After its hugely successful securitisation in January, our first Keystone portfolio is yielding around 16% and this is locked in for three years

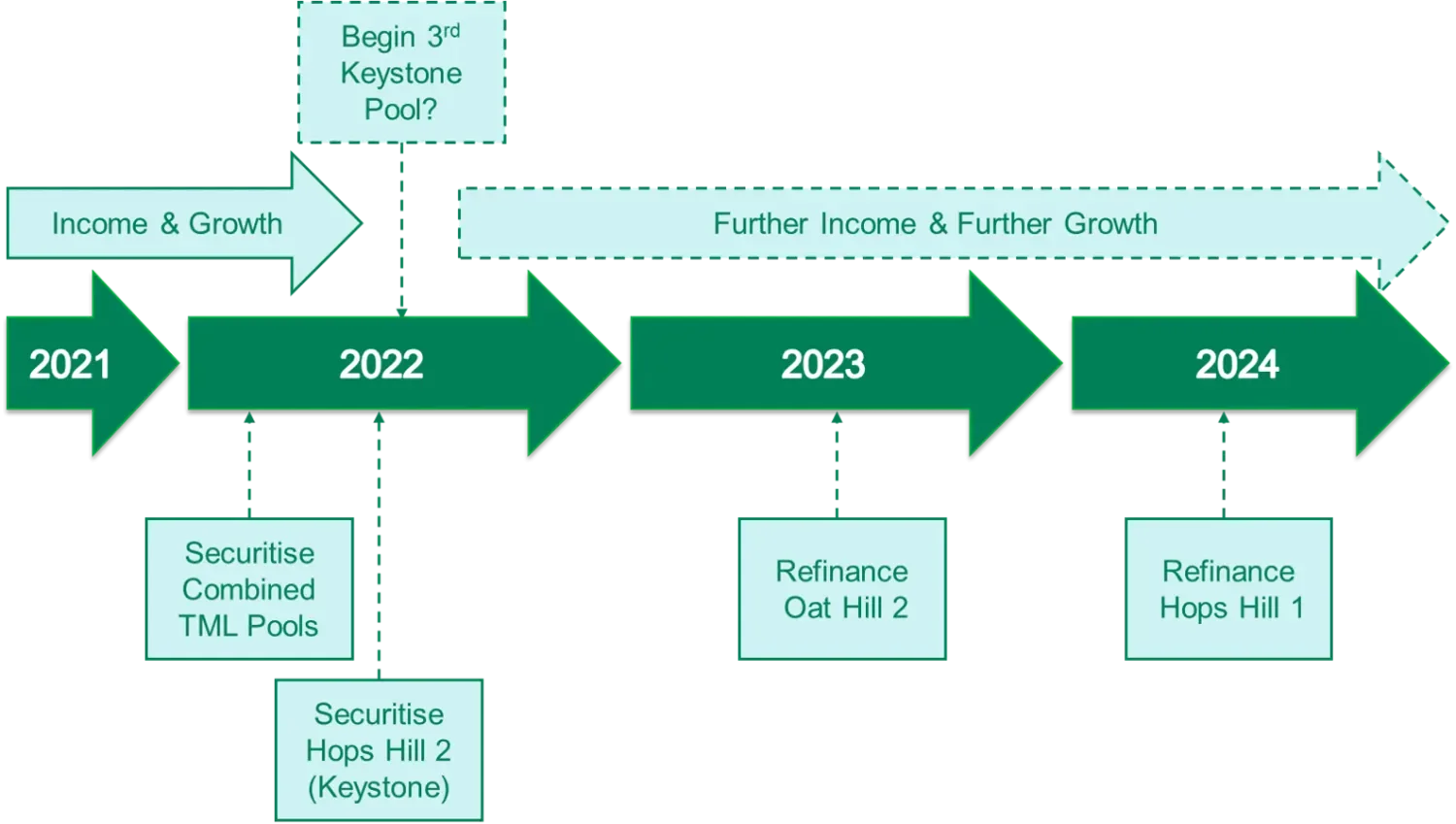

- Our second Keystone portfolio is growing strongly and adding income every month, and is on course to reach £400m by May 2022 when we can securitise to lock in a similar yield

- Our The Mortgage Lender (TML) portfolios are producing steady income and can also be re-securitised at the appropriate point to potentially generate higher yields

- Our Capital Home Loans (CHL) portfolios were bought at a discount and so generate most of their income from pull-to-par which is realised through our amortised cost accounting model

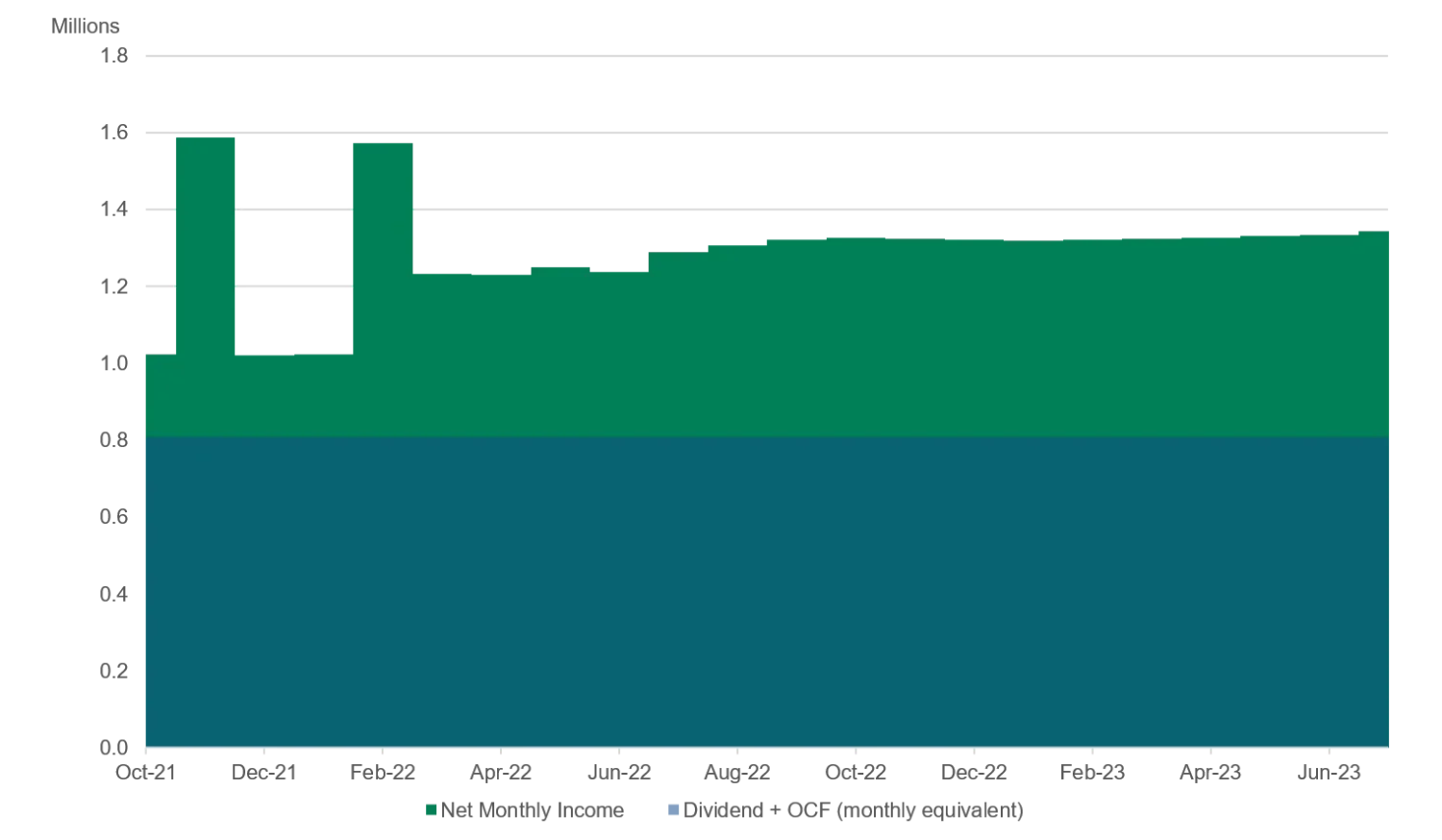

The current 1.125p quarterly dividend is being consistently and healthily covered; income was 0.67p per share for September 2021, following income of 0.54p in August and 0.45p in July.

Considering this strong performance backdrop, the Board intends to increase the dividend to 1.25p per share for the remaining three quarters of the financial year ending 30 June 2022, and given our outlook for asset performance, we expect further progression in the dividend per share will be possible at that point.

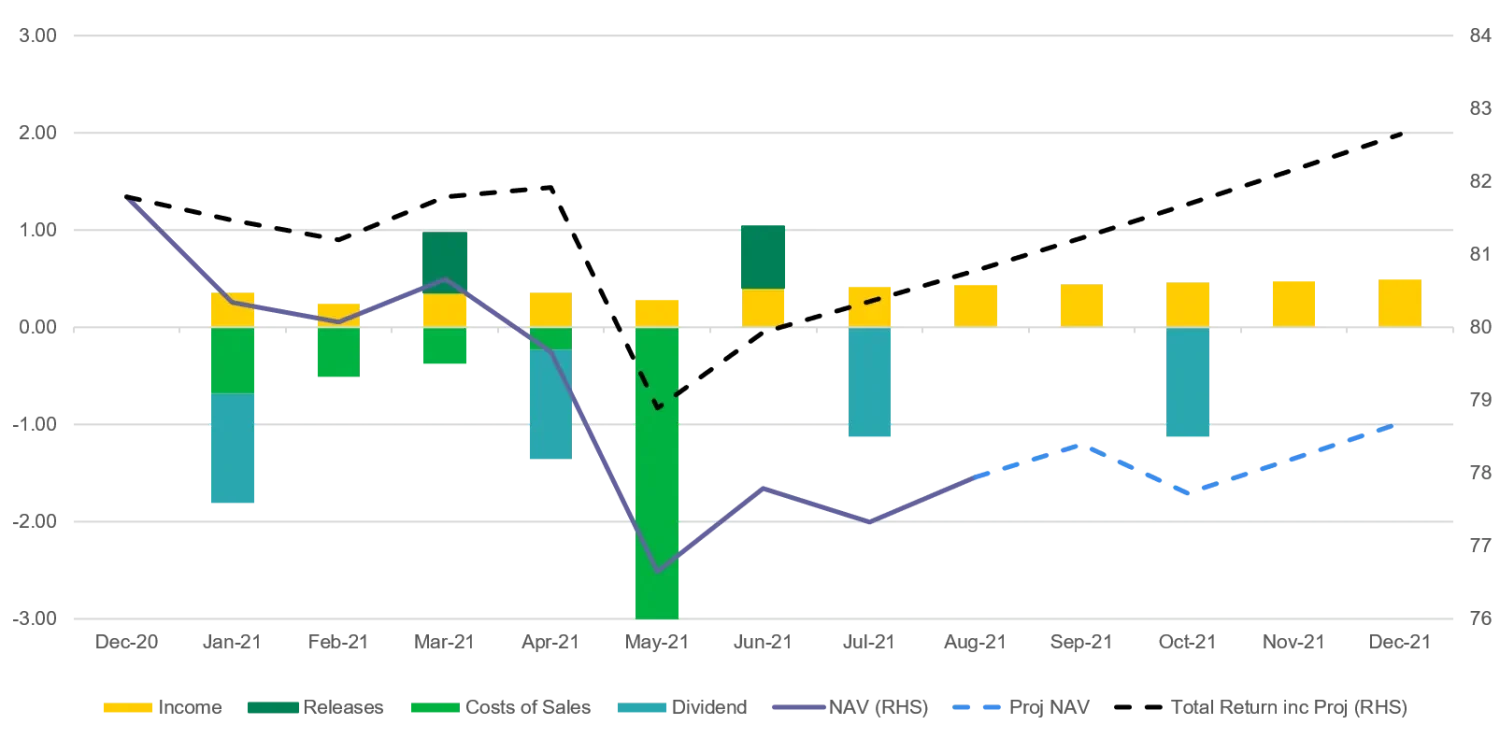

Our primary goal for the next several months remains consistent NAV growth. As each month passes we are able to reap the benefit of selling our lower yielding Coventry portfolios and growing our higher yielding Keystone pools, which will now flow into net asset value (NAV).

As such, we feel the current share price does not reflect the locked-in income and potential for future growth we have built into UKML in recent months, and there are three reasons we believe it can represent an attractive opportunity for investors today.

1) New focus on higher yielding assets

UKML’s strategy has been refocused on delivering consistently healthy returns from high quality, higher yielding assets. To that end, we took a number of important steps in the first six months of 2021.

> First Keystone securitisation

- The £400m Hops Hill No.1 securitisation in January was larger than originally planned and drew huge demand, with senior notes 3.4x subscribed and mezzanine notes 6-8x

- Senior note pricing tightened by 15bp to Sonia+95bp, mezz tightened by over 25bp

- Lower funding costs combined with more appropriate leverage meant an attractive return profile for UKML investors with a net yield of around 16%

- The securitisation locks in income of £4.5-5m per year until May 2024, meeting nearly 50% of UKML’s current dividend requirement on its own

> Coventry portfolio sales

- The two portfolios were sold at better than expected prices in February and May

- The Coventry assets were very high quality but at 5-6% were relatively low yielding when compared to our Keystone and The Mortgage Lender pools

- Short term mark-to-market costs associated with the sales led to NAV volatility, some months in the first half of the year, but that impact is over and we hope we will now see the benefit of switching focus to higher yielding assets

> Share buybacks

- Two £20m share tenders in March and June for a total of £40m (53.3m shares)

- These buybacks reduced UKML’s dividend requirement by around 23%

2) Income generation and growth

With the above actions completed, after the sales-related NAV volatility in H1 we have entered an uninterrupted period of income generation and subsequent NAV growth until early 2022, at which point we can look to securitise our combined TML portfolios to lock in further returns.

Chart: UKML 2021 NAV performance & income generation

Source: TwentyFour, November 2021

Our second Keystone buy-to-let portfolio is key to this objective, and it has had a flying start. We anticipated adding £25m-£30m of mortgages per month across 2021, but with a resurgent UK housing market driving higher growth we had reached £210m by the end of October and the pool is on course to hit £240m by year-end.

One of the beauties of mortgage portfolios is they add income as they grow; with a net interest margin of around 1% on the Keystone loans, at £210m the portfolio is throwing off around £175k of pure income every month. We expect Keystone 2 to reach securitisable size in Q2 2022, at which point we can look to lock in a similar yield to the Hops Hill No.1 securitisation (c.16%).

3) Strong cashflows and dividend cover

With this income engine running smoothly, UKML’s dividends are fully covered and income is growing with each passing month. We forecast that the growth of the Keystone 2 portfolio, for example, has the capability to add around £20-25k per month to net income and steadily expand the dividend cover.

UKML’s primary target in the next several months is consistent NAV growth, which we believe will create room for further dividend policy progression in mid-2022.

Chart: UKML income vs. dividends

Source: TwentyFour, November 2021

UKML – more income and growth

Our plan for UKML’s future is very simple – income and growth.

With no other events due in the near term we anticipate stable income growth between now and February 2022, which is when we can look to refinance existing portfolios.

We believe we have built a strong track record of UKML securitisations and mortgage warehousing facilities, which will allow us to potentially grow new high quality, high yielding portfolios well into the future.

What’s more, we see UKML’s portfolio value continue to grow. Its assets are performing strongly and the technical drivers in RMBS funding markets look set to remain favourable for our needs, giving us a tried and tested route to getting maximum value from these assets and potentially locking in further returns for investors.

In our view, the new strategy built around our higher yielding assets and the revaluation of these portfolios is still not recognised in the share price, and we believe UKML’s implied yield at the share price of 6.99% (or 6.35% at the NAV)2 is very attractive in what continues to be a low yield world.

Having completed the portfolio goals we set out to achieve at the end of 2020 ahead of schedule and delivered an increased dividend, we can now train our efforts on delivering consistent, sustainable income and growth into the future.

Chart: UKML expected timeline

Source: TwentyFour, November 2021

1 = TwentyFour, 26th November 2021; 2 = TwentyFour, 26th November 2021