Outcome Driven - Quarterly update - January 2020

Chris Bowie looks at the performance of the Outcome Driven strategy over the last quarter and provides his outlook for 2020.

Strategic Income – Quarterly update – January 2020

CEO and Portfolio Manager Mark Holman discusses Q4 performance for the Strategic Income strategy and provides his outlook for 2020.

Margin For Error in Credit Selection Narrows

We have talked regularly about avoiding ‘next year’s skeletons’, and this is now more pertinent given the strength of the current technical backdrop, combined with spread levels that are significantly tighter relative to this time last year.

ABS Primary Slips Into Gear

We have already highlighted the blistering pace of bond sales in both Europe and the US, and this being met with apparently insatiable demand from fixed income investors. Since European ABS markets tend to lag broader fixed income, it seems fitting that we have had to wait another week before seeing that primary machine start to accelerate.

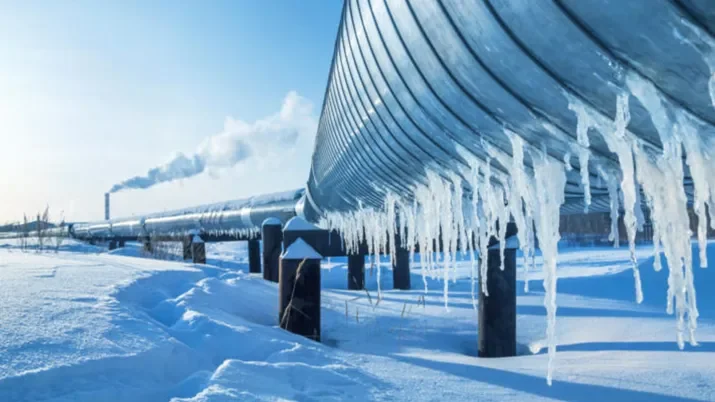

Record Inflows Give New Energy to US Bond Market

While the European bond market was setting records last week, the US market has also begun 2020 with a flurry of transactions backed up by record inflows.

Heavy Supply Meets Heavy Demand

Kicking off the new year, we expected the new issue market to be very active and we certainly haven’t been disappointed, with the good momentum created at the end of last year – thanks to the US and China reaching a ‘phase one’ agreement and the resounding victory by the Conservatives paving the way for Brexit negotiations to move forward – allowing pent-up borrowing demand to hit the market.

Newell: Fallen Angel to Rising Star?

Fixed income investors are well versed in the risks of ‘fallen angels’, investment grade companies whose bonds tumble in value once they are downgraded to high yield.

New Regulation Likely to Hurt HY Liquidity

The regulations governing market activity have been constantly evolving, but the ESMA directive implementing the Central Securities Depositories Regulation (CSDR) will potentially have quite an impact on traded credit.

Carney to Leave UK Banks on Solid Ground

The Bank of England (BoE) on Monday published its latest financial stability report and the results of its 2019 bank stress tests, and declared that the UK financial system is well prepared for even a worst-case Brexit and consequent trade war.

CoreCivic Shows ESG Will Take No Prisoners

"One group of issuers that appears vulnerable to us as we move into a new decade is those facing increased investor scrutiny due to Environmental, Social and Governance (ESG) factors. The case of CoreCivic, a listed REIT in the US, is a good example"

What Next For Sterling Bonds?

Overnight markets have had significant news to digest, with two of the major geopolitical hurdles that had been worrying investors being removed.

European HY Default Rates Doubling No Reason to Panic

"Where defaults get to exactly depends on a few things, but we can certainly analyse where we think the problem areas could be, whether cracks are already starting to appear, and what investors might do to protect themselves."

Blog updates

Stay up to date with our latest blogs and market insights delivered direct to your inbox.