Inflation and Fixed Income: Threat and Opportunity

TwentyFour partners Gordon Shannon, Doug Charleston and Felipe Villarroel sat down to debate the potential impact of inflation on the fixed income universe, from government bonds and investment grade credit through to ABS and high yield.

What’s Really Going On With US Jobs?

At 8.1m, the number of job openings as of March 31 was the highest it has been since the data series began some 20 years ago.

Multi-Sector Bond Q2 2021 Update

In TwentyFour's Multi-Sector Bond update on Thursday 13th May 2021, Partner & Portfolio Manager Eoin Walsh provided an update on investment themes and positioning in the fixed income market.

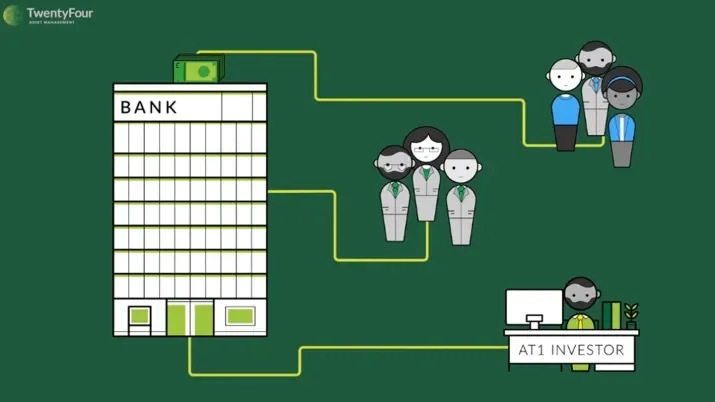

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

Investment Grade Q2 2021 Update

In TwentyFour's Investment Grade update on Wednesday 12th May 2021, Partner and Portfolio Manager Chris Bowie provided an update on investment themes and positioning in the Investment Grade market.

Sustainable Short Term Bond Income Q2 2021 Update

In TwentyFour's Vontobel Fund - Short Term Bond Income update on Tuesday 11th May 2021, Partner and Portfolio Manager, Chris Bowie provided an update on investment themes and positioning for Vontobel Fund - TwentyFour Sustainable Short Term Bond Income.

Classic Late-cycle Issuance…in Mid-cycle

Markets can often be tricky for investors in May as bond issuers take advantage of a window of opportunity following the Q1 earnings season and ahead of the typical summer lull. This often results in heavy supply in late April and early May, hence the old trader adage of “sell in May and go away”.

Asset-Backed Securities Q2 2021 Update

In TwentyFour's ABS update on Monday 10th May 2021, Aza Teeuwen provided an update on investment themes and positioning in the ABS market.

Is Shunning Coal a Good Policy for Capital Markets?

As long as coal usage is not illegal, a private buyer of any origin will be able to purchase these assets cheaper and run them for as long as possible with no regard for ESG matters.

What's Happened to the Brexit Premium?

There has been a lot of focus on the performance of the high yield markets since the start of the year, particularly in Q1 when many rates markets were selling off aggressively.

Beware a Second Wave of Treasury Selling

Crucially while the Fed may wait to see the evidence, markets won’t, and we therefore expect a ‘second wave’ of Treasury selling to happen well before then.

Q2 2021 Investor Update

In TwentyFour's quarterly update, Mark Holman discussed his outlook for the bellwether US Treasury curve, and explained how he thinks investors can still look to pick up yield while avoiding traditionally more rate-sensitive markets.

Blog updates

Stay up to date with our latest blogs and market insights delivered direct to your inbox.