Welcome Diversity

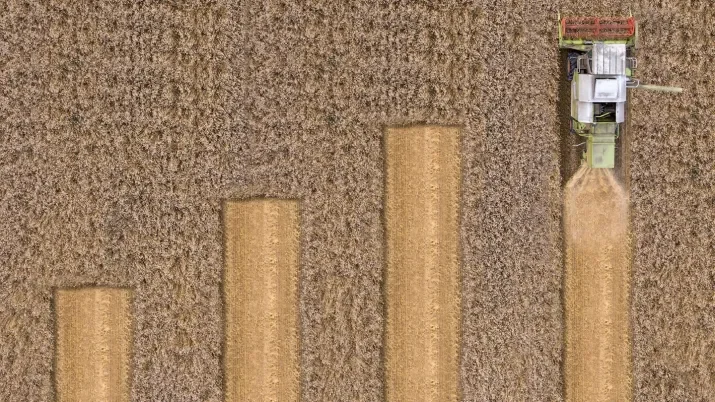

In the past two years the diversity of supply in the ABS market has been restricted by the availability of cheaper funding alternatives, both in the Eurozone through the TLTRO and in the UK, where the BoE Term Funding Scheme has suppressed issuance from the traditional banks and building societies.