Fixed income managers always want to have the flexibility to look for the best value across their investment universe, and in our view they therefore need the capacity to buy bonds in different currencies.

The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions.

Investors can get income from many sources, from bond coupons and equity dividends to other investments such as mutual funds, exchange-traded funds (ETFs) and investment trusts that make regular payments to investors based on the performance of the assets they manage.

Income is a crucial element of portfolio construction. Without bond coupons or equity dividends, investors would have to regularly sell assets that have risen in price in order to realise capital gains and generate a cash return. If a portfolio has a reliable stream of income, investors can earn a consistent return while holding assets for longer periods.

When markets are volatile, income investing can also help protect a portfolio’s overall returns, since the income keeps coming even if the assets are performing negatively on a mark-to-market basis.

Three reasons to choose bonds for income

Flexible

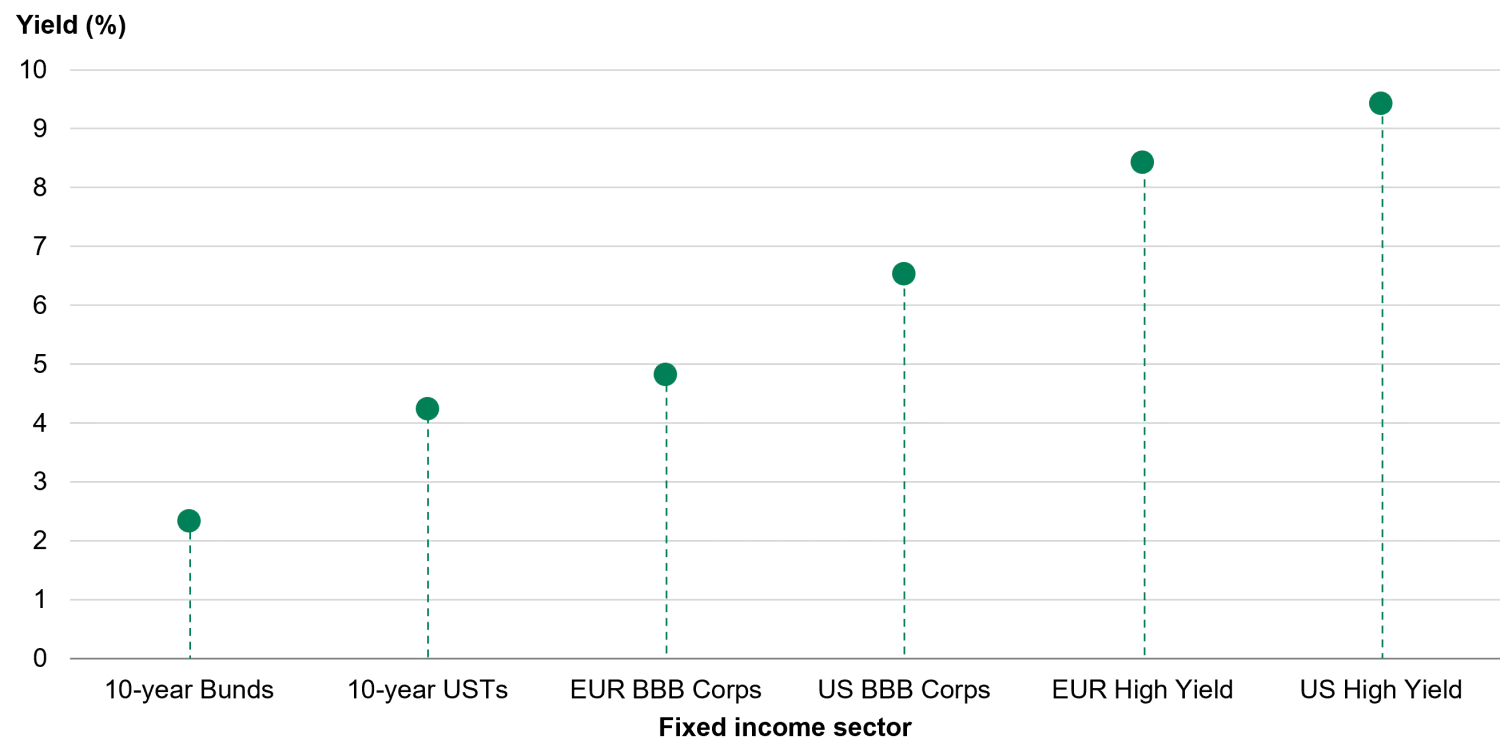

The bond markets offer a full spectrum of risk, from investment grade governments to financials and high yield corporates, across developed and emerging markets, meaning fixed income investors can build an income-producing portfolio calibrated to their desired level of risk.

In equities, investors’ income options are more limited. Not all companies are publicly listed, and it is mostly investment grade, blue-chip firms that pay consistently large dividends. Bonds allow investors to access income from firms with different characteristics, from a wider range of industries and regions.

Source: TwentyFour, Bloomberg, ICE BofA Indices, 27 October 2022

Predictable

Bond markets are referred to as ‘fixed income’ for a reason. While equity dividends are discretionary – they can be adjusted up or down at the company’s discretion in line with their performance – bond coupons are fixed contractual payments where non-payment would put a company in default.

Stable

In the long term, income will likely be the major driver of returns in a bond portfolio, which means fixed income returns tend to be less volatile than other, higher risk asset classes. A global, unconstrained bond portfolio might derive around 70% of its total return from income and only 30% from capital gains.

Three income-boosting features of bonds

Maturity

Bonds possess a very simple feature that make them lower risk than many other assets – a maturity date. In addition to income from coupons over the life of the bond, investors receive their initial investment (their ‘principal’) back on the maturity date.

This means there are only two ways an investor can lose money on a bond; either the bond issuer defaults, or the investor chooses to sell the bond at some point before maturity when the bond is trading below the purchase price.

If you buy a three-year bond yielding 5% today and hold it until maturity, then as long as the company doesn’t default, in three years’ time you will make a total return of 15%, regardless of whether the market price of the bond has fluctuated in the meantime.

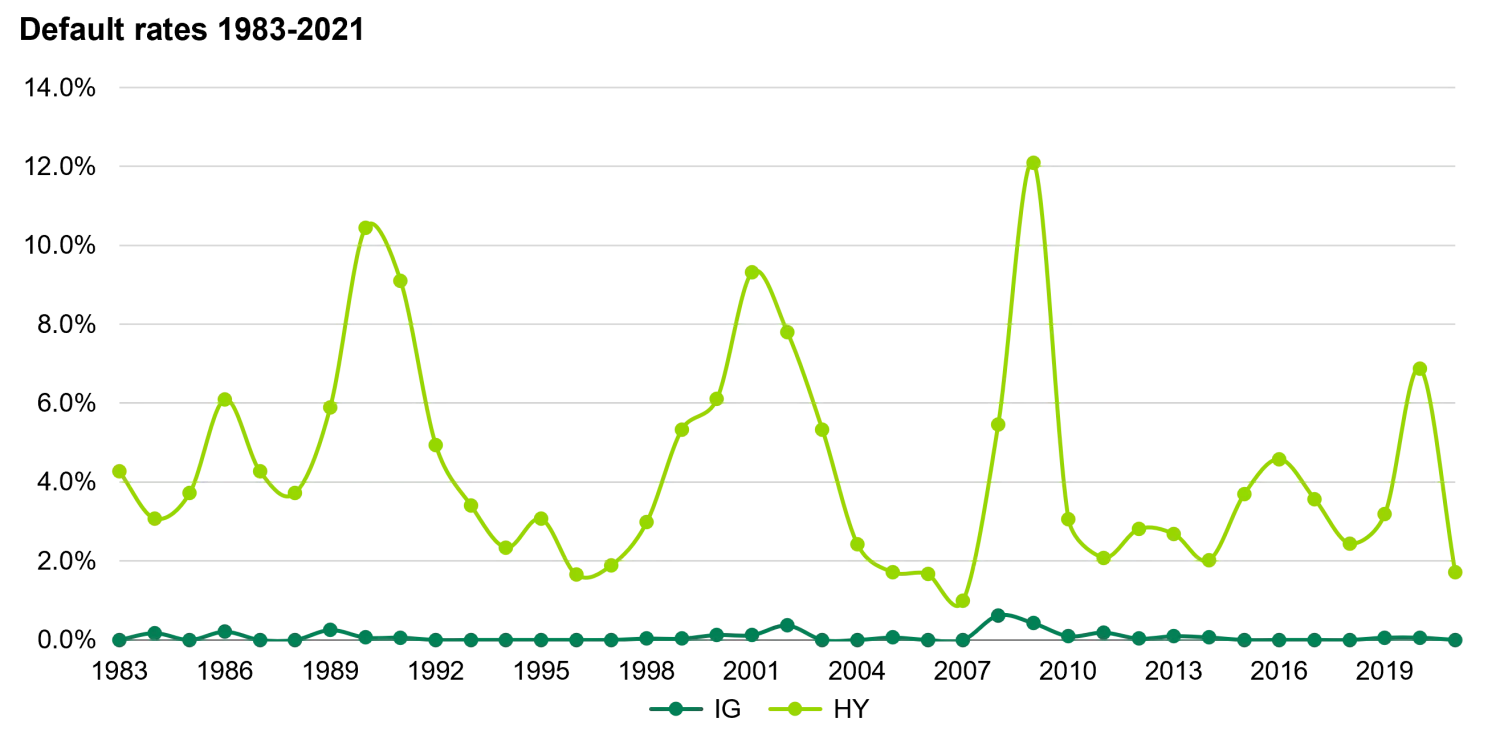

Defaults are extremely rare in investment grade bonds; the historical average is just 0.1%. As the chart below shows, in sub-investment grade bonds (also known as high yield) default rates tend to spike higher in times of severe economic distress, but the historical average default rate is again relatively low at 2.8%. The job of an active manager is to conduct detailed research on high yield bond issuers to avoid the defaults that do occur in the sector.

Source: Moody’s Annual Default Study, 8 February 2022

Pull-to-par

Another natural advantage of bonds, particularly short term bonds, is ‘pull-to-par’. Pull-to-par reflects the reality that as a bond approaches its maturity date, it will begin to ‘pull’ to its par value as default risk becomes increasingly negligible and the cash price of the bond amortises to 100. Pull-to-par occurs whether a bond has risen or fallen in price since the investor’s purchase, as in both instances the bond would repay at 100 regardless.

Roll-down

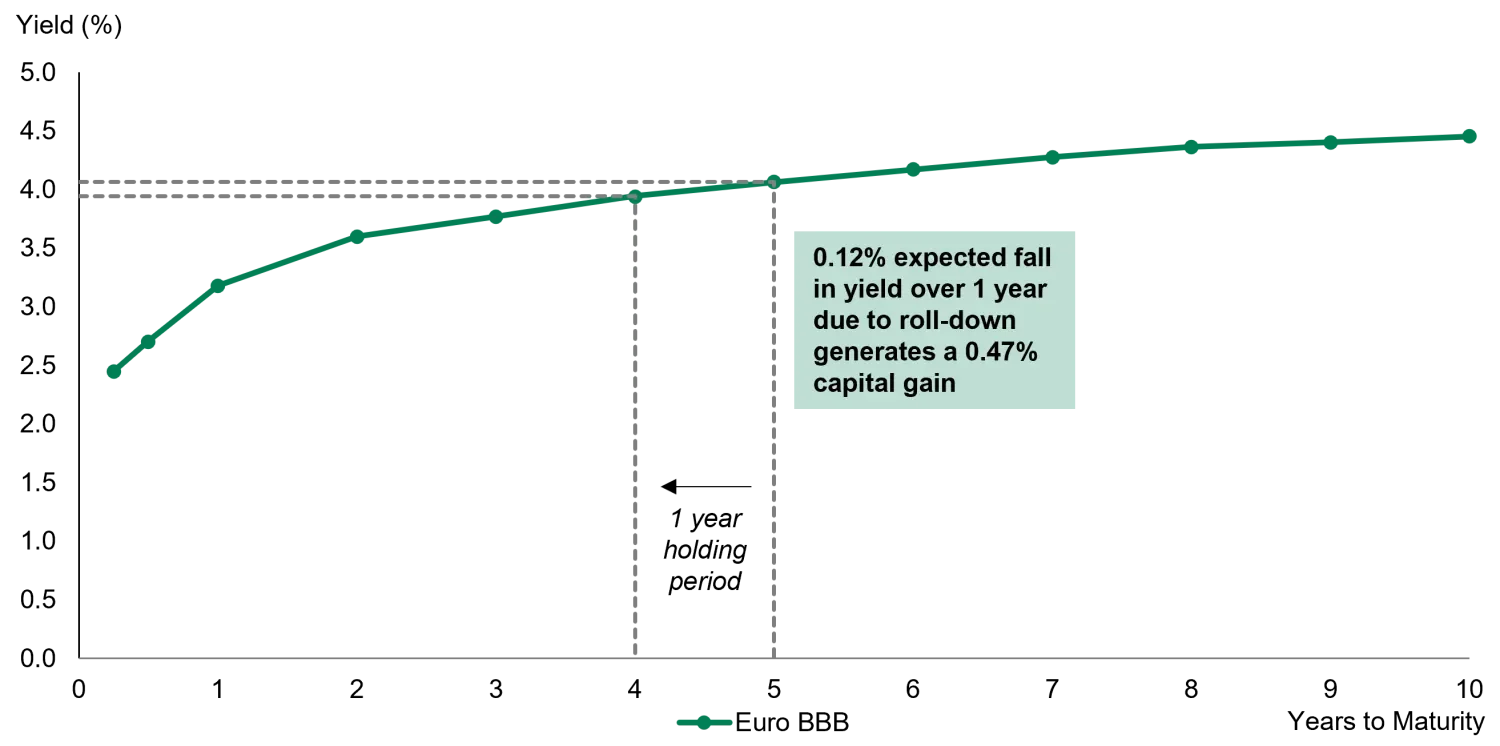

Roll-down is the capital gain created by the natural fall in a bond’s yield as it approaches maturity. The steeper the curve, the bigger the potential for roll-down gains, since the bond’s yield has further to fall (generating a bigger capital gain) with each passing year of maturity. Roll-down potential is generally much larger in short term bonds than in longer maturities because yield curves tend to be much steeper at the short end.

Source: TwentyFour, Bloomberg, 27 October 2022

Fixed Income 101: Comparing yields in different currencies

Fixed Income 101: Roll-down

Fixed Income 101: Inflation-linked bonds

Fixed Income 101: Trading ABS and CLOs

Fixed Income 101: Hedging currency risk

Hedging currency or foreign exchange (FX) risk is a key decision for any manager running a diversified fixed income portfolio. Currencies are inherently volatile, so whether and how FX risk is managed can have a material impact on a portfolio’s risk and return profile.