Four Lessons for Bond Investors

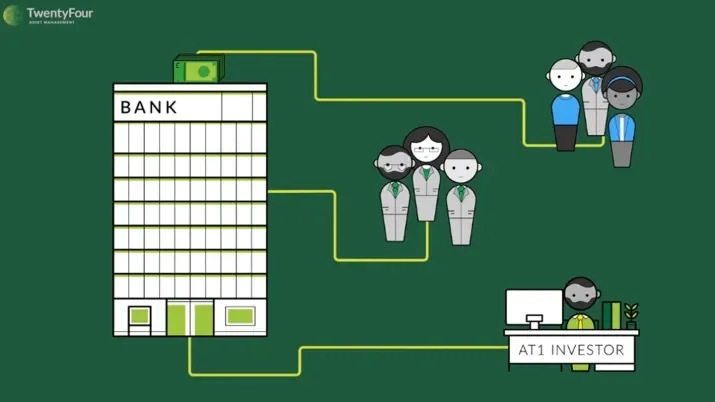

If we suppose a bond investor views an upcoming event as a potential threat to their positioning, they may attempt to hedge their portfolio with another position. The event passes, and the hedge works, but to the investor maintaining the hedge seems like a good idea in the aftermath. Do you maintain the position or remove it?