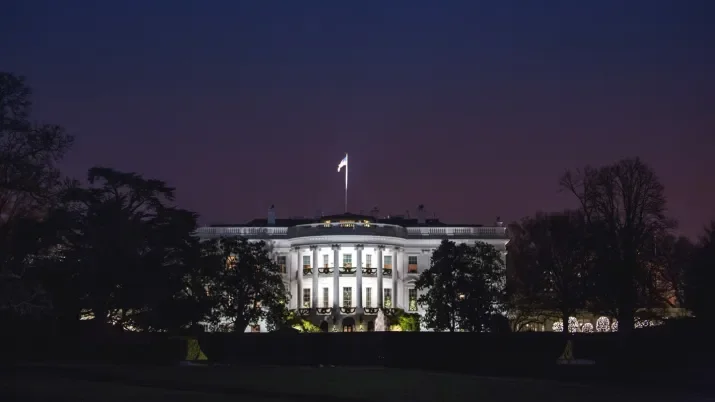

Politics won’t trump data for the Fed

The last few weeks have seen former President Donald Trump establish a lead over current President Joe Biden across polls in the run-up to November’s US election. Even though it is early days and a lot can change before November (including the Democrat candidate), it is worth considering what a second Trump term might mean for the world economy and for fixed income markets.