Is there a case for Italian RMBS?

At TwentyFour our Italian ABS holdings are fairly moderate, and in general our peripheral ABS exposure has been steadily decreasing for some time. This has nothing to do with credit quality, but everything to do with relative value.

For a period between 2013 and 2015, we were a big holder of well-seasoned Spanish and Italian mezzanine ABS and senior Portuguese RMBS in particular. These products were largely characterised by low LTVs, long and strong performance history and at that time had the yield to justify their lower liquidity. Then along came quantitative easing (QE), and the world changed. Spreads wound tighter and a lot of the old deals that we loved were redeemed at par, leaving a fairly unattractive product.

More recently, we have seen Dutch and UK Prime RMBS spreads widen by around 10bp-20bp. As supply picked up in 2018 the market experienced a negative technical backdrop as investors couldn’t keep up (deals were still oversubscribed, just at more realistic spread levels). While Italian government bonds have sold off heavily this year for obvious reasons, Italian Prime RMBS and southern European RMBS in general have been remarkably stable. In fact, Italian RMBS has been so stable that since the summer it has outperformed Dutch and UK Prime RMBS, which are more highly rated than their Italian equivalent because RMBS ratings are capped at a defined level above the respective sovereign.

This resilience has been helped in part by a lack of Italian supply; there have been a handful of previously retained Italian RMBS deals sold to investors in recent years, which have been supported by domestic buyers, though nothing we would count as fresh primary supply. But that resilience is also not particularly surprising – RMBS credit performance shouldn’t be impacted significantly when the Italian government decides to spend more money. Even in Greece, where government bonds took a material haircut, most senior RMBS bonds were fine from a credit point of view, despite their prices falling as market sentiment turned against Greek assets.

So given the evolution of spreads this year, can we now make a case for Italian RMBS again?

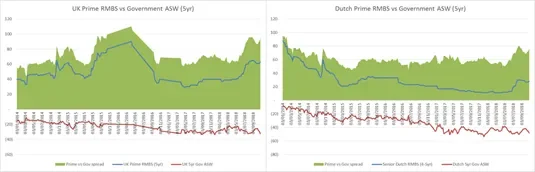

First, let’s take a look at Dutch and UK RMBS spreads relative to government bonds with the same credit spread. Triple-A Dutch and UK RMBS are typically 3yr-5yr floating rate bonds, so we compared the 5yr discount margin (DM) of the AAAs to the Asset-Swap Spread (ASW) of their corresponding 5yr govies to eliminate duration. From this we can see that RMBS today pays you 75bp-80bp over Dutch govies and around 95bp over UK govies (the difference is explained by Brexit, but that’s another story altogether). These are pretty healthy levels, and in the primary market you could probably pick up an additional 10bp of new issue premium. The RMBS and government bond spreads show a certain degree of correlation around events like the Brexit referendum and the Dutch elections, as you might expect.

Source: Citi Velocity, TwentyFour Asset Management (30 Oct 2018)

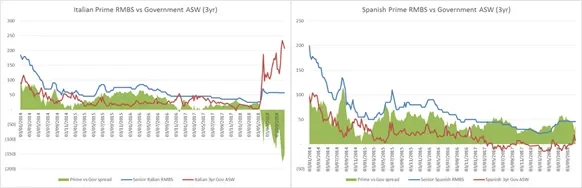

Looking at Italian RMBS (for clarity we’re including all ECB/BoE repo eligible bonds), the first thing that strikes us is that not only is the spread of the RMBS relative to govies less than in the UK and the Netherlands, in Italy it is actually negative. The latter makes no sense, and though we know Italian RMBS has enjoyed strong support from its domestic buyer base, we don’t see the rationale for buying Italian RMBS at these levels, especially considering the potential pick up in supply and the end of QE, with banks reverting to a normal funding model.

Source: Citi Velocity, TwentyFour Asset Management (30 Oct 2018)

So, a case for Italian RMBS? Not really. In fact, we’d be cautious with Spanish and Portuguese RMBS as well, given their potential correlation to Italian bonds if spreads do gap out. This doesn’t mean that there aren’t specific bonds out there that offer value, but overall I prefer staying close to home with a relatively low credit duration!