Inflation Concerns Put ABS in Focus

While the road to recovery for the global economy in 2021 remains far from smooth, the progress made under vaccination programmes has cemented growth forecasts and brought with it further increases in inflation expectations; the US five-year breakeven rate recently touched 2.40%, up from 1.96% at the start of the year and the highest level since 2011.

The US is in the spotlight due to the circa $2tr of additional fiscal fuel to come from the Biden administration’s new stimulus package, but similarities in both Europe and the UK – strong H2 growth forecasts, loose monetary policy, pent-up consumer demand, and a healthy looking banking sector – mean this sentiment has crossed the Atlantic without any hint of actual rate rises. Ten-year Gilts, for example, have lost holders 4.73% so far in 2021[1], unwelcome capital losses for ‘risk-free’ assets.

It is not surprising then that implied policy rates have also shifted. On January 1 markets were predicting the Bank of England would cut rates; today, implied rates show stable or marginally rising UK rates are back on the menu.

There are a number of ways to hedge the risk of inflation and inflation expectations within fixed income portfolios. Aside from conventional interest rate swaps, Treasury Inflation-Protected Securities (‘TIPS’) or Index-Linked Gilts (‘Linkers’) may seem like a natural choice, but these can be less effective in protecting from changes in inflation expectations, and our experience has been insufficient liquidity to make this suitable for large scale risk mitigation. History shows that in the context of fixed rate bond allocations, avoiding long duration bonds and using shorter bonds with higher levels of spread can partially mitigate volatility and help protect total return.

An often overlooked option could of course be European ABS, an almost entirely floating rate market where interest rate duration is therefore very limited. Since ABS coupons comprise a margin over a reference rate and typically reset monthly or quarterly, they adjust as inflation expectations feed into rates curves. In a period of rising inflation expectations and rates, corresponding ABS bond yields would increase, protecting bond prices and removing a meaningful amount of volatility.

Let’s consider a simplified example using the impact of a single 50bp steepening of the curve (with the front end anchored) on the Sterling Corporate Bond Index[2], which has a yield of 1.84% in GBP and a duration of 8.6 years. The rates move would be expected to create a mark-to-market loss of 4.67% for the index, which at the current yield would take 2.54 years to return to parity. By comparison over the same period, a floating rate single-A rated UK non-conforming RMBS with an initial yield of 1.65% would not receive much outright yield benefit from the steepening of the rates curve, but would deliver a positive return of +3.84% before the Corporate Bond Index returned to parity.

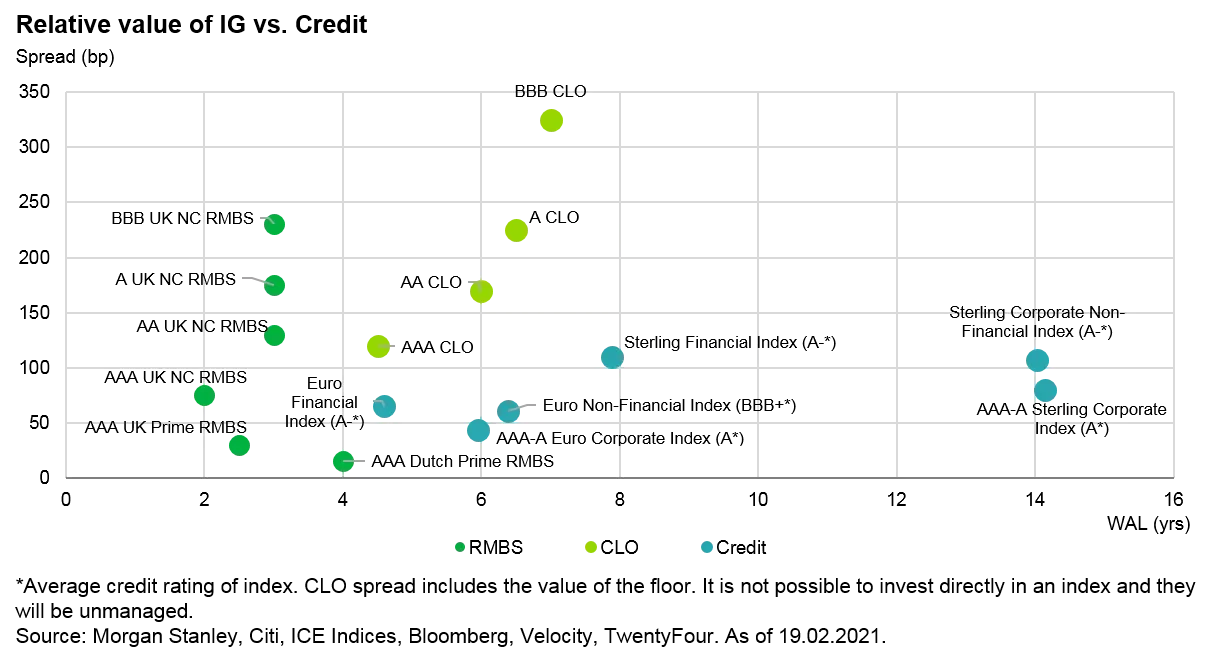

In our view the inflation protection benefits offered by the European ABS market have not been broadly acknowledged, in part because the yield shifts we have seen so far have mainly been felt at the long end of rates curves. However, the market typically provides a long term spread premium to other fixed income markets, which has been exacerbated in recent months (as the chart below demonstrates) and contributed to a positive technical backdrop in 2021.

In an economic environment where inflation and interest rates are increasing, it is also important to consider credit risk. If we look at the Dutch mortgage market, typical of Europe it is dominated by long term, fixed rate loans. We would expect borrower incomes and house prices to be broadly inflation-linked and so the net result would be an improving ability to pay, a moderating household debt-to-income ratio and lower loan-to-value (LTV) levels on an indexed basis. These are credit positive for RMBS deals. By contrast, mortgage markets like Spain or the UK, which have a greater prevalence of floating rate or short-term fixed rate loans, may see borrowers paying higher interest rates gradually over time. However, post-financial crisis reforms to lending standards introduced tougher affordability stresses for such loans which typically subject borrowers to interest rates ranging from 6-7%, so we would need to see a material shift in rates to see meaningful performance changes.

When borrowers fear increasing interest rates, we typically see periods where loan refinancing activity increases and these additional principal prepayments pay down ABS bonds more quickly. This de-leveraging reduces the overall credit risk and puts positive momentum on ratings.

The speed at which inflation has surfaced as a central consideration for investors has caught many by surprise. For fixed income investors, we think floating rate European ABS bonds could be an allocation consideration to help improve return prospects and reduce volatility.