Bumps in the road but CLOs delivered in Q1

After delivering a stunning 2023, collateralised loan obligations (CLOs) were once again one of the top performers in Q1. That leaves us with the question, where do we go from here? As always, tighter spreads leave less room for error, but we think some good pockets of value remain. Let’s start with what’s happened so far. AAA indices have tightened by about 15-20 basis points (bps), investment grade mezzanine debt (IG Mezz) by around 30-50 bps, but in BB and Bs we’ve seen secondary spreads around 100 bps tighter year-to-date, making high yield (HY) CLOs a top performer so far for 2024 with around 7-8% of return (vs. ~2% and 4-5% respectively for AAAs and BBBs).

There have been a few dynamics at play in the European CLO market. To start with, the primary market supply has certainly been higher than we anticipated despite the still muted M&A pipeline. As equity arbitrage remained challenging, over €10bn of new supply hit the screens, a post GFC record start of the year. What we’ve seen with this primary supply was that there was a lot of demand for bonds, especially in (both IG and HY) mezzanine bonds, reportedly mostly coming from yield hungry European investors. The part of the capital structure that surprised us were the AAAs, which haven’t moved much at around cash + 1.5%, which still look particularly attractive vs. IG corporate bonds (BBB average) in our view, given they are at around cash + 1.1%. Additionally the market witnessed a number of repricing’s of expensive 2022 CLOs, as well as some refinancings and liquidations of older CLOs that had started amortising quicker than expected.

We’ve mentioned “CLO arbitrage” before, which is the difference in what the loans pay and the liabilities cost – in other words it’s the equity’s income - and what we’ve noticed is that CLO managers that have dedicated capital to deploy (either through risk retention vehicles or from their own balance sheets) have been the most active CLO managers in recent months. This means that the more traditional CLO equity investors have tended to either sit on the sidelines because the returns aren’t appealing enough or are seeing better value opportunities in older CLOs (with cheaper funding).

CLO liquidations and early calls have been a big driver of performance this year; it’s a trade we flagged a number of times in 2023 as many bonds were still trading at low cash prices. Most of the 2019 and earlier vintage deals are now out of their reinvestment periods, and while able to do some refinancings for some time still, loan amortisations have started to bite CLO equity returns as leverage has been dropping quickly in these deals, making a call the most optimal outcome in most cases (especially considering the rally in the loan market). And CLO amortisations have indeed picked up dramatically as loan refinancings have increased significantly in recent months. Virtually every CFO has been looking to extend his/her maturity profile, in fact now less than 10% of the European loan market has maturities coming up in the next 24 months! It’s not surprising therefore that older CLOs have resulted in better performance than primary investments so far this year. How many CLOs will get liquidated or called will depend on how the loan and CLO markets develop from here, but we can see over 15 notices out now for “potential” early amortisations.

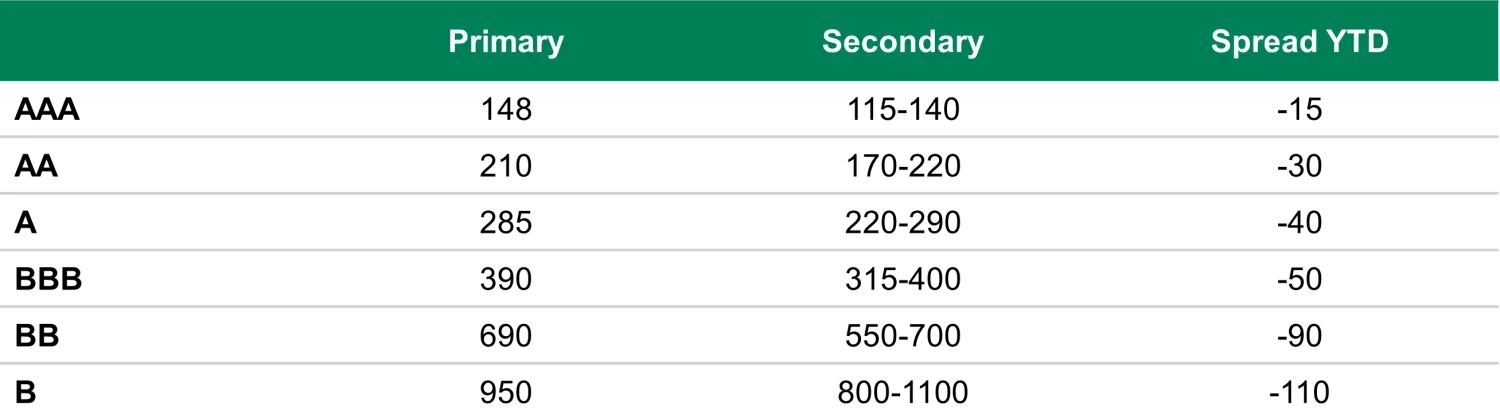

As CLOs have gotten shorter and investors are sitting on decent profits already (especially if you include those from 2023), we’ve certainly seen elevated volumes of trading in the secondary markets. CLO bids wanted in competition (BWICs), essentially auction lists, are up significantly YoY (especially in non-AAAs) as investors looked to replace shorter bonds with primary bonds (reducing reinvestment risk) and hedge funds looked to take profits on bonds they bought at deep discounts during the LDI crisis in late 2022. This secondary volume was absorbed by the market without too many problems however, as demand outstripped supply by some margin. The table below shows where we currently see spreads over cash (Euribor) levels for both new and older CLOs, especially in older CLOs where there’s a lot of tiering based on managers, vintages and quality of the loan pools.

Spreads over Euribor (bps)

Source: TwentyFour 2 April 2024

So volumes were good, spreads tightened, liquidity improved further and we saw some positive surprises with older, still discounted, bonds getting called at par, and as loan defaults remained low, you’d almost forget that there were also negative events in the market. And the biggest one in our view was the noise around Altice France/SFR (one of the biggest names in the Euro loan and bond markets), where the sponsor called for the need of a restructuring of the company’s debt and said that the high interest burden was unsustainable. Management stated that assets that were up for sale to decrease leverage “will only be contributed to deleveraging efforts to the extent the return on such contribution is appropriate”. In other words, bond and loan holders will need to contribute by means of a haircut of their principal in order for those asset sale proceeds to aid the deleveraging efforts. With over €20bn of debt outstanding over various instruments, and with different levels of seniority, this is one of the most complex debt structures we’ve come across in HY and loan markets so the situation remains fluid. The majority of CLOs have some sort of exposure to Altice, and while we think unsecured bonds are at risk the ultimate recovery on senior secured loans should be manageable in our view. Unsurprisingly the name was downgraded to CCC, but we don’t see this as a problem for CLOs (they aren’t forced sellers, and typically own the secured loans meaning they are the most senior lenders). This is especially the case for rated bond holders so we see it as mostly an equity “problem”.

While Altice is incredibly interesting and should give us a lot of data for analysing CLO manager behaviour, ultimately we have to conclude that loan performance has been better than expected (CLOs typically lend to 150+ different companies) and the CLO structures are doing what they’re designed for in protecting rated bonds holders. Generally we can only conclude that Q1 was very positive for CLO investors, who have also continued to benefit from the high interest rates. Whenever we’ve seen a period of such positive performance we think about future value opportunities and positioning, and that has changed somewhat over the recent weeks. Convexity has been our trade in the last 18 months, but lately our focus has switched to income, increasing our allocations to primary CLOs with new collateral. We’ve been rotating out of older CLOs that already trade at par, picking up around 30 bps in AAAs, 50-75 bps in BBBs and over 100 bps in HY CLOs. In the older vintages we continue to like single Bs (as most are still trading at discounts), but we also like the lack of volatility that generally comes from short bonds with high coupons. We expect the spread technical to remain strong for some time, especially as it’s one of the few asset classes that is not yet trading close to historic tights. Primary volumes are also unlikely to drop if the expected pipeline comes through, also helped by the reported renewed Japanese interest for AAAs, but we can’t ignore the increasing geopolitical risks facing fixed income markets. The level of income available in CLOs can be very valuable to help mitigate this, and that means they continue to be a top pick for us for 2024.