The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions.

Fixed Income 101

Our Fixed Income 101 series covers common fixed income investment themes and some more technical portfolio management techniques.

Fixed Income 101: Income investing

Fixed Income 101: Comparing yields in different currencies

Fixed income managers always want to have the flexibility to look for the best value across their investment universe, and in our view they therefore need the capacity to buy bonds in different currencies.

Fixed Income 101: Roll-down

Fixed Income 101: Inflation-linked bonds

Fixed Income 101: Trading ABS and CLOs

Fixed Income 101: Hedging currency risk

Hedging currency or foreign exchange (FX) risk is a key decision for any manager running a diversified fixed income portfolio. Currencies are inherently volatile, so whether and how FX risk is managed can have a material impact on a portfolio’s risk and return profile.

Fixed Income 101: Understanding bond yields and prices

Bond prices and yields move inversely to each other – as a bond’s price falls, its yield rises, and vice versa.

Fixed Income 101: Understanding bond duration

Duration is often said to measure a bond’s sensitivity to changes in interest rates, because it describes what is likely to happen to a bond’s price for a given change in the bond’s yield.

Everything you need to know about…

Our Everything you need to know about… series outlines the key features of more specialist fixed income markets, such as subordinated bank bonds and asset-backed securities (ABS).

Everything you need to know about corporate hybrids

Corporate hybrids are a type of bond issued by companies – they are known as hybrids because they combine certain features of debt and equity.

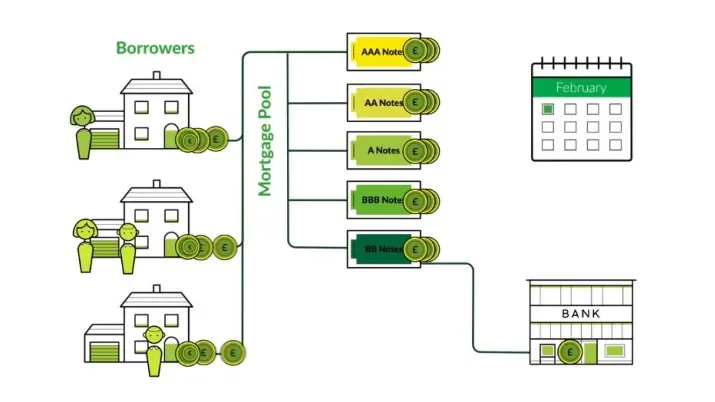

Everything you need to know about ABS

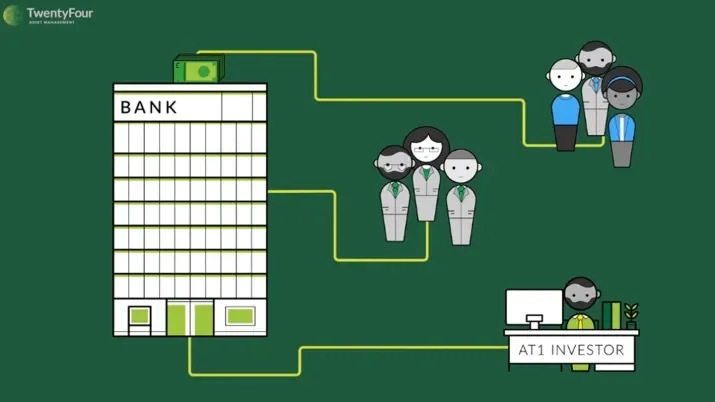

Everything you need to know about AT1s

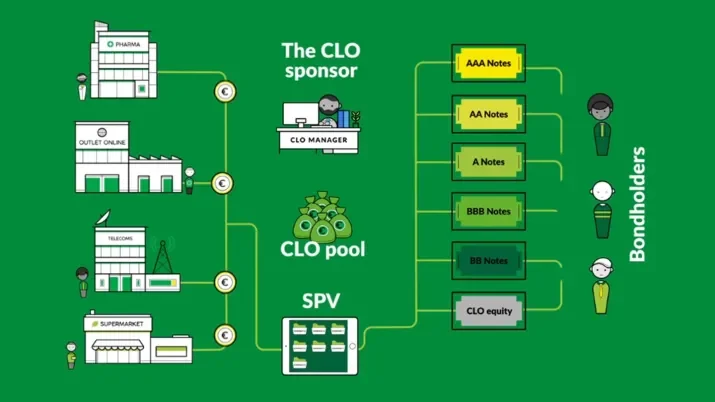

Everything you need to know about CLOs

Everything you need to know about Significant Risk Transfer (SRT)

Significant Risk Transfer (SRT) transactions enable banks to reduce their regulatory capital requirements by transferring some of the credit risk attached to certain assets to third-party investors.

Animated explainers

Our animated explainers are a complete visual guide to some of the more complex fixed income assets to feature in TwentyFour portfolios.

What are corporate hybrids and how do they work?

What are AT1 bonds, and how do they work?

What is a European CLO, and how do they work?

What is an RMBS, and how do they work?

Back to Basics

Back to Basics is a series of recorded educational sessions with TwentyFour portfolio managers aimed at simplifying key markets and concepts.

Back to Basics: Yield curves

Back to Basics: Significant risk transfer

Back to Basics: Corporate hybrids

Back to Basics: Bank capital

Back to Basics: CLOs