The Comeback of Corporate Hybrids

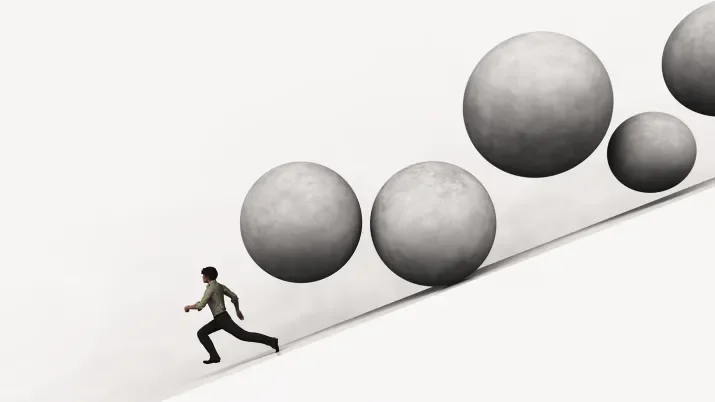

With September now behind us, colder mornings and darker nights approaching it seems an opportune time to take stock of how the primary market reopened this year after its traditional summer lull.