CoreCivic Shows ESG Will Take No Prisoners

"One group of issuers that appears vulnerable to us as we move into a new decade is those facing increased investor scrutiny due to Environmental, Social and Governance (ESG) factors. The case of CoreCivic, a listed REIT in the US, is a good example"

What Next For Sterling Bonds?

Overnight markets have had significant news to digest, with two of the major geopolitical hurdles that had been worrying investors being removed.

European HY Default Rates Doubling No Reason to Panic

"Where defaults get to exactly depends on a few things, but we can certainly analyse where we think the problem areas could be, whether cracks are already starting to appear, and what investors might do to protect themselves."

Fixed Income 2020: A Brave Old World

Twelve months ago, as we wrote our annual review and forecast for 2019, backing 10-year German government bonds that were yielding just 0.24% at the time to perform would have been a brave call.

Trade war volatility maintains grip on bonds

By now investors should be getting used to the ever more frequent hiccups in the trade negotiations between the US and the rest of the world.

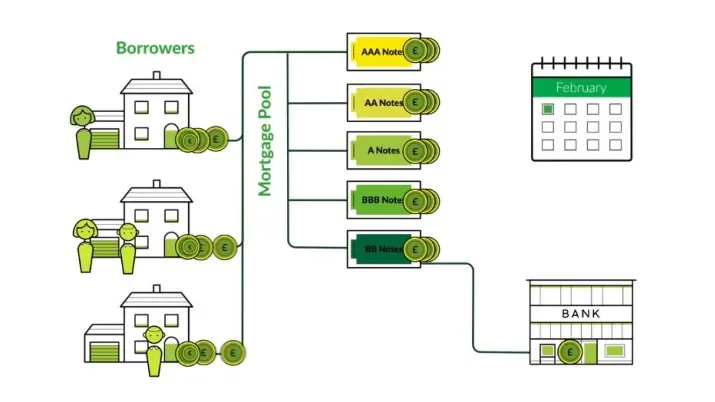

What is an RMBS, and how do they work?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.

Data decline eases for Germany and US

"In some parts of the global economy, we might be seeing a bottom in terms of low activity levels." TwentyFour's Felipe Villarroel discusses the factors behind these improving trends.

NIBC leading the way in ESG

“NIBC, has been involved in ESG/CSR focused lending in Europe for some time, and is the first manager to issue what we might call an ESG CLO." Elena Rinaldi discusses why in terms of ESG, NIBC would receive a high score from us.

Fitch keeps AT1 investors on their toes

"We have been participants in the Additional Tier 1 (AT1) sector since its introduction in 2013, albeit with a high degree of selectivity, but the risk-reward has been obvious to us." Gary Kirk discusses the latest AT1 news from Fitch

IG demand would be key to Walgreens buyout

At this late point in the cycle, fixed income investors are on high alert for signs of potential excess in the capital markets, and a proposal for potentially the biggest leveraged buyout (LBO) in history would certainly fall into that category.

US corporate credit demand slows again

The Senior Loan Officer Opinion Survey, combined with financial results from the banks, is probably still the most useful tool we have for gauging the cycle’s life expectancy.

Risk well underpinned going into year-end

A number of threats to risk assets have dissipated and could become positive tail risks for markets moving into 2020.