Opportunities within European credit

Positioning and fixed income markets have remained quite tricky this year, however credit markets have continued to perform very strongly. TwentyFour Asset Management's Eoin Walsh, discusses why he thinks there is opportunity within European credit despite the rate headwinds and pull back on some of the aggressive rate cutting expectations markets had at the start of the year.

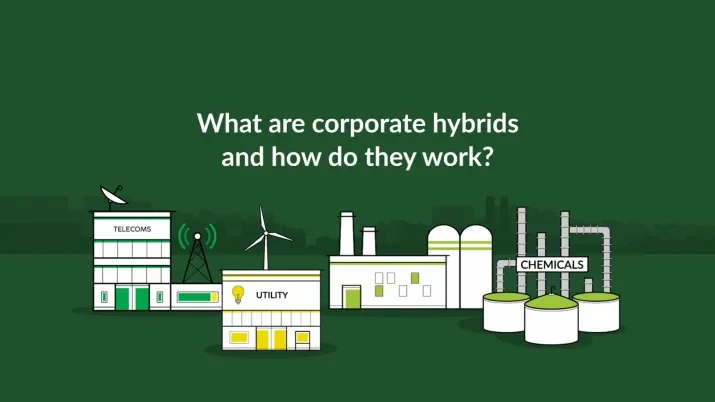

Back to Basics: Corporate hybrids

In this Back to Basics webinar, Gordon Shannon (Partner, Co-Head of Investment Grade) and Johnathan Owen (Portfolio Management) from our Investment grade team provided a comprehensive understanding of the key aspects of corporate hybrids.

Back to Basics: Bank capital

In this Back to Basics webinar, Jakub Lichwa (Portfolio Management) from our Multi-Sector Bond team gave their valuable insights into the importance of maintaining sufficient levels of bank capital to uphold financial stability.

What are corporate hybrids and how do they work?

Corporate hybrids are bonds issued by companies that combine characteristics of both debt and equity.

Back to Basics: CLOs

In this Back to Basics webinar, Aza Teeuwen (Partner, Co-Head of ABS) and Elena Rinaldi (Portfolio Management), provided a comprehensive understanding of the key aspects and trends within the European CLO market.

Back to Basics: RMBS

In this Back to Basics webinar, Aza Teeuwen (Partner, Co-Head of ABS) and Douglas Charleston, (Partner, Co-Head of ABS) provided a comprehensive understanding of the key aspects and trends within the European RMBS market.

Strategic Income Quarterly Update – April 2023

Following a busy quarter in bond markets, a member of our Multi-Sector Bond team reflects on macro events and discusses how our Multi-Sector Bond team have responded.

Asset-Backed Securities Quarterly Update – January 2023

TwentyFour Partner and Portfolio Manager, Douglas Charleston, describes the developments of the ABS market in Q4 2022.

Asset-Backed Securities Quarterly Update – October 2022

TwentyFour Partner and Portfolio Manager, Douglas Charleston, explains how ABS markets have performed in Q3 2022 and provides his outlook for the rest of the year.

Where and when will US Treasuries peak?

Rates volatility has done plenty of damage to portfolios in 2022. Where, and when, will US Treasury yields peak? Mark Holman shares his views in his latest video.

Asset-Backed Securities Quarterly Update – July 2022

Douglas Charleston looks at the development of the European ABS market in the second quarter of 2022 and explains what this could mean for investors going forward.

Asset-Backed Securities Quarterly Update – April 2022

TwentyFour Portfolio Manager, Elena Rinaldi, explains how European ABS markets behaved in Q1 2022 and provides her outlook for the year ahead.