Asset-Backed Securities Quarterly Update – January 2022

TwentyFour Partner and Portfolio Manager, Douglas Charleston, explains how ABS markets have performed in Q4 2021 and provides his outlook for the new year.

Asset-Backed Securities Quarterly Update – October 2021

TwentyFour Partner and Portfolio Manager, Douglas Charleston, explains how ABS markets have performed in Q3 2021 and provides his outlook for the rest of the year.

Asset-Backed Securities Quarterly Update – July 2021

TwentyFour Partner and Portfolio Manager, Douglas Charleston, explains how ABS markets have performed in Q2 2021 and provides his outlook for the year ahead.

Multi-Sector Bond Q2 2021 Update

In TwentyFour's Multi-Sector Bond update on Thursday 13th May 2021, Partner & Portfolio Manager Eoin Walsh provided an update on investment themes and positioning in the fixed income market.

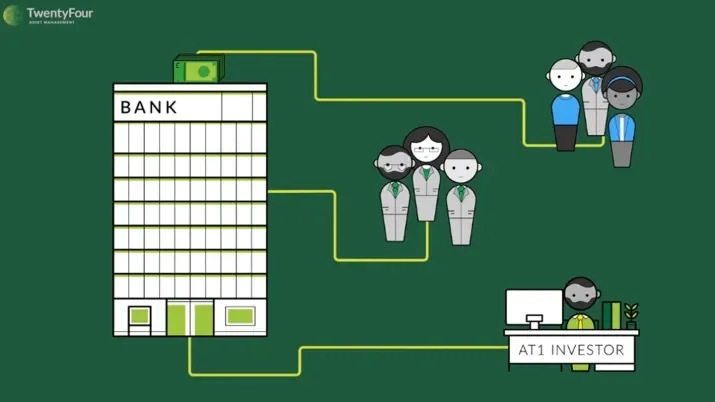

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

Investment Grade Q2 2021 Update

In TwentyFour's Investment Grade update on Wednesday 12th May 2021, Partner and Portfolio Manager Chris Bowie provided an update on investment themes and positioning in the Investment Grade market.

Asset-Backed Securities Q2 2021 Update

In TwentyFour's ABS update on Monday 10th May 2021, Aza Teeuwen provided an update on investment themes and positioning in the ABS market.

Asset-Backed Securities – Quarterly Update – April 2021

TwentyFour AM partner and portfolio manager Douglas Charleston discusses how ABS markets have performed in the first quarter of 2021 and provides his outlook for the rest of the year.

Asset-Backed Securities Update

In this update, TwentyFour Partner and Portfolio Manager Ben Hayward addresses some of the key reasons he thinks investors should consider allocating to ABS sooner rather than later.

Asset-Backed Securities Quarterly Update – January 2021

TwentyFour AM partner and portfolio manager Douglas Charleston discusses Q4 performance for ABS markets and provides his outlook for 2021.

How big a threat is inflation?

Partner and Portfolio Manager Felipe Villarroel reflects on markets in 2020 before giving his inflation outlook for 2021

Our view on high yield defaults

In his latest video, George Curtis discusses our views on high yield defaults over the last few months and what he thinks we can expect in 2021