Two pieces of good news for investors on inflation

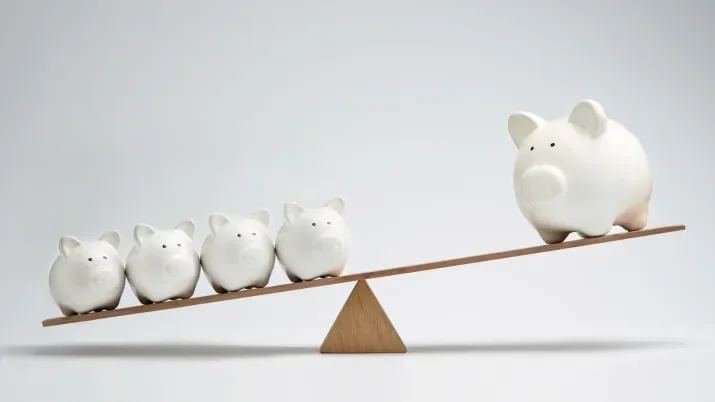

With investors seemingly unwilling to put money to work until they see clear evidence of the inflation trend reversing, Felipe Villarroel looks at two developments that tentatively suggest central banks’ delicate balancing act is actually working.