Opportunity Amid The Outflows

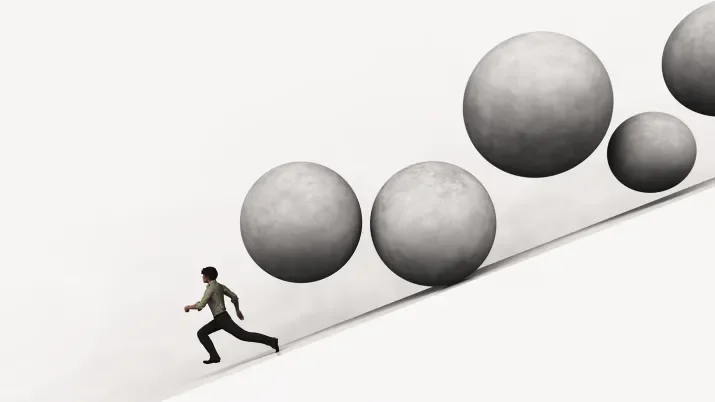

Typically in August, credit liquidity becomes a bit like my lawn this summer: patchy. Over the past few weeks there have been a few stories of large fund groups seeing significant outflows from the asset class, and even of liquidations, which begs the question: what are they selling?