CLO performance in 2023, what's next?

The focus of credit markets this year has been on the banking turmoil, starting with 2 regional US banks, then the unprecedented Credit Suisse AT1 write off and most recently the rescue of First Republic. On top of this, elevated inflation has kept investors nervous throughout the first trimester. By contrast, during these volatile months European Asset Backed Securities has been one of the few asset classes that showed positive performance, with rapidly increasing interest rates having significantly helped floating rate European ABS performance this year. Investing at the short end of the risk-free rate (SONIA or Euribor) should remain beneficial in coming months as we approach terminal rates in the UK and Europe (currently expected to occur in Q3 at around 4.9% and 3.6% respectively).

Investment Grade European ABS has delivered over (£) 4% of return to date, with High Yield ABS at around 8%, but the asset class that stands out has been European Mezzanine CLOs. Although AAAs have done what they were supposed to do (over 2% YTD), BBBs (~6%) and sub-IG (10-12%) have been the clear outperformers so far this year. Albeit this has not been without volatility as the asset class does historically show a high degree of correlation with Corporate credit spreads and this has continued to be the case YTD. This correlation and good levels of liquidity should have benefited active managers able to time their investments this year but equally will have hurt those unable to do so.

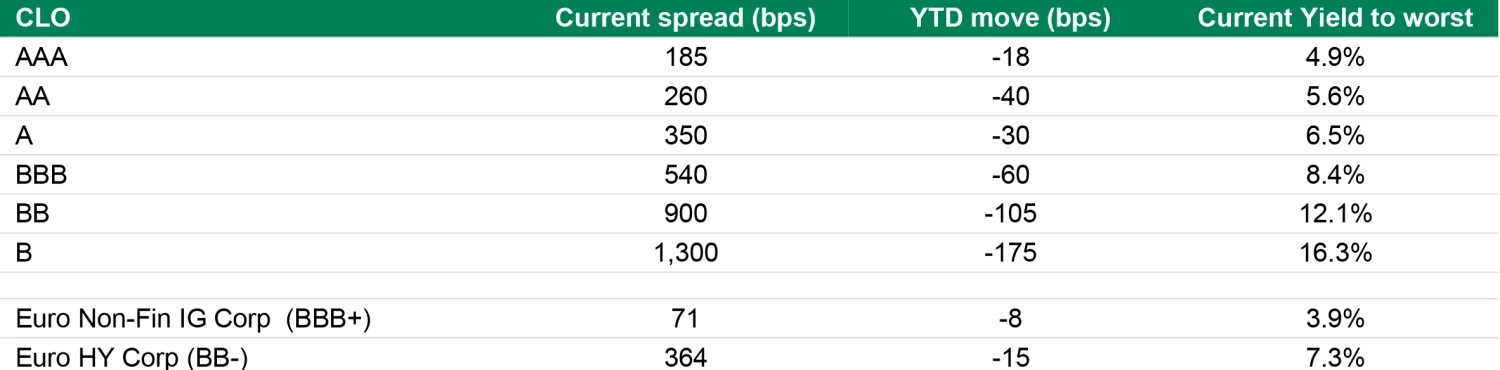

If we consider the credit spreads on CLO we can see that we are currently approaching the tightest level so far this year, but that there are still a lot of value opportunities in our opinion if you simply compare them to spreads in early 2022, pre the Russian invasion. Also, if we compare it to plain vanilla corporate credit, CLOs still look very attractive; for similar credit risk BBB corporates are typically paying less than half the income of equivalent BBB CLOs, while CLOs have always traded wide to IG credit, the basis between vanilla credit and CLOs still looks wide.

Source: Citi Velocity, ICE Indices, TwentyFour – 2/5/2023.

Source: Citi Velocity, ICE Indices, TwentyFour – 2/5/2023.

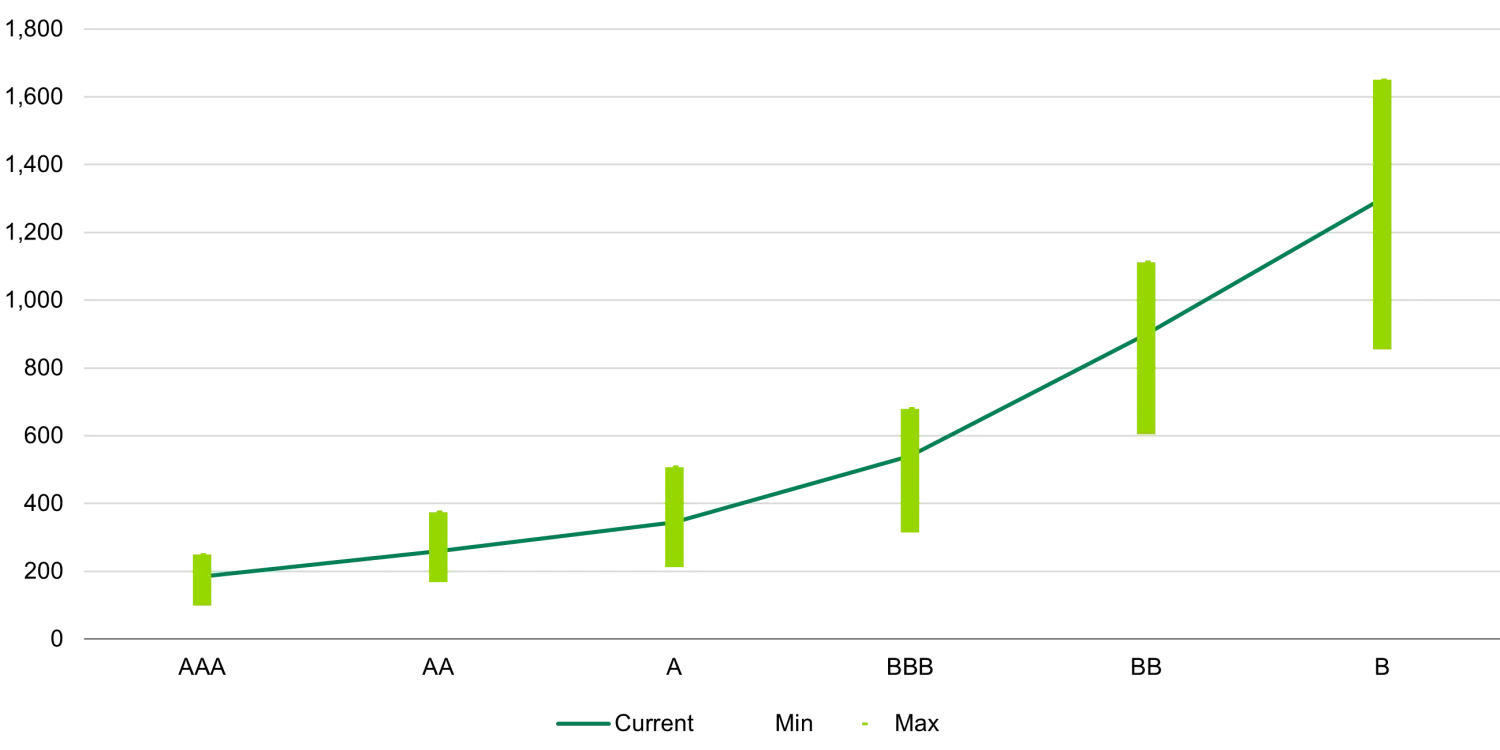

The grey bars below show the spread range from Jan 2022 to today’s levels and it shows what we already knew….. a lot of volatility has taken place in the last 16 months, which isn’t too dissimilar if you compare it to corporate or bank debt (particularly as predominantly those have fixed coupons). But if you then consider the yield and where the liquidity is then for me AAA, BBB and BBs stand out. For example, single A and BBBs have got very similar credit risk when subjected to our stress tests, and the price volatility we’ve seen has been broadly similar, yet the yield in BBBs is almost 2% higher. In high yield, we continue to think the best relative value opportunities are in BBs, especially if you consider the extra credit support and consistently deep liquidity associated with those bonds. This does not mean we think there aren’t value opportunities in single-Bs, but similar to CLO equity, they are more at risk of income deferrals if performance deteriorates, and considering a likely pending recession, picking the right bonds could be more important than it’s been for over a decade.

Given the steepness of the current spread curve (from AAA to B) we think that CLOs are adequately pricing in the likelihood of a recession, but as we can see from the spread ranges below, markets can change their minds quickly on how deep this recession could be! What this graph doesn’t show is the fact that the spread differential between the best and worst quality BBB and BB could be as much as 200bps and 400bps; the CLO market seems to be much better at pricing credit risk than it did a few years ago, historically this risk premium was close to 25bp and 50bps.

European CLO spread range

Source: Citi Velocity, TwentyFour – 1/1/2022 to 2/5/2023.

Source: Citi Velocity, TwentyFour – 1/1/2022 to 2/5/2023.

And that brings us to the million dollar question, how do you position for this? We have changed positioning in CLOs a number of times already in 2023, especially in Investment Grade. For example, in February we thought the market looked to have gotten ahead of itself, with spreads tightening rapidly, so we saw this as a good time to be selling BBB rated bonds in favour of AAA RMBS and short dated AAA rated German Auto ABS, but following the banking turmoil BBBs looked particularly cheap vs other ABS; for context, today they’re really somewhere in the middle. 2023 will likely remain volatile and there are still plenty of economic uncertainties, so we prefer to remain liquid and own shorter maturities, something we think CLO investors can afford with current yields. In HY CLOs the focus has been on credit improvement and this year we’ve been replacing underperforming CLO managers with those that we think are better positioned to deal with a recession and selectively swapping single-Bs for BBs.

European CLOs has been one of the best performing asset classes this year (and in general European ABS has outperformed vanilla credit in the last 2 years due to its lack of duration) and we think the current positive supply-demand technical (there’s been very little primary issuance) should help keep spreads stable. As CLO investors we think we can afford to take our foot off the gas, pick our spots and enjoy the current income. There will be more times to be aggressive.