6 Reasons Government Bonds Yields To Rise Further

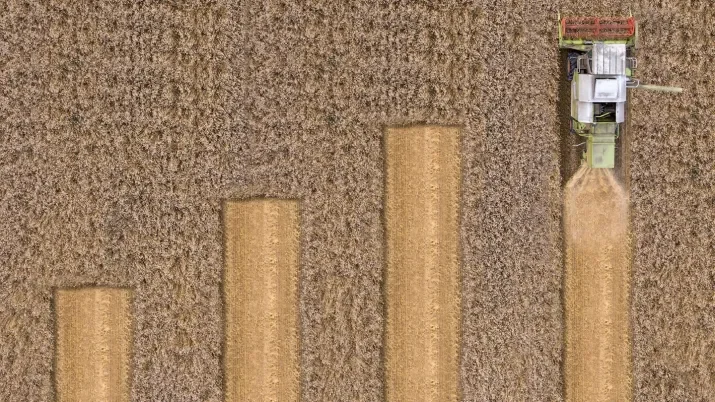

Our base case for rates markets is a gradual shift higher, but there are reasons to consider why even our forecast is too constructive and the move higher could be more substantial.