Five lessons we've learned from sustainable bond investing

TwentyFour Asset Management launched its first sustainable fund in January 2020 and I would like to share some of the lessons we have learned from our first year of sustainable bond investing.

Inflation and Fixed Income: Threat and Opportunity

TwentyFour partners Gordon Shannon, Doug Charleston and Felipe Villarroel sat down to debate the potential impact of inflation on the fixed income universe, from government bonds and investment grade credit through to ABS and high yield.

Multi-Sector Bond Q2 2021 Update

In TwentyFour's Multi-Sector Bond update on Thursday 13th May 2021, Partner & Portfolio Manager Eoin Walsh provided an update on investment themes and positioning in the fixed income market.

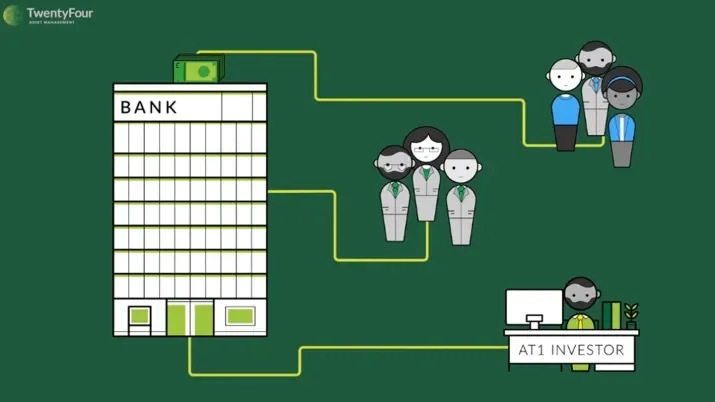

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

Investment Grade Q2 2021 Update

In TwentyFour's Investment Grade update on Wednesday 12th May 2021, Partner and Portfolio Manager Chris Bowie provided an update on investment themes and positioning in the Investment Grade market.

Sustainable Short Term Bond Income Q2 2021 Update

In TwentyFour's Vontobel Fund - Short Term Bond Income update on Tuesday 11th May 2021, Partner and Portfolio Manager, Chris Bowie provided an update on investment themes and positioning for Vontobel Fund - TwentyFour Sustainable Short Term Bond Income.

Asset-Backed Securities Q2 2021 Update

In TwentyFour's ABS update on Monday 10th May 2021, Aza Teeuwen provided an update on investment themes and positioning in the ABS market.

Q2 2021 Investor Update

In TwentyFour's quarterly update, Mark Holman discussed his outlook for the bellwether US Treasury curve, and explained how he thinks investors can still look to pick up yield while avoiding traditionally more rate-sensitive markets.

Where Buffett and Dalio are wrong on bonds

Mark Holman explains why the likes of Warren Buffett and Ray Dalio are warning investors away from fixed income, and points out where he thinks they’re wrong.

Asset-Backed Securities – Quarterly Update – April 2021

TwentyFour AM partner and portfolio manager Douglas Charleston discusses how ABS markets have performed in the first quarter of 2021 and provides his outlook for the rest of the year.

How bond managers can invest responsibly

TwentyFour Asset Management partner and portfolio manager, Chris Bowie, looks at the specific challenges faced by investors wanting to invest sustainably in the bond markets and considers two controversial examples in Tesla and Coca-Cola.

Letter to Investors

Clearly 2021 has brought a change in narrative around long duration assets and the risks of further yield curve steepening.