Mind the Gap

With September set to be the first negative month for most risk asset markets since March, it is worth analysing what has been driving the reversal.

Absolute Return Credit (ARC) is Five

Five years ago we launched a simple strategy with a complicated name. The goal sounded simple: to return 2.5% more than cash, after fees, from a long-only, unlevered credit fund. And to do that with as little volatility as possible (but never being allowed to have more than 3% volatility).

CLOs Outperform Gloomy Forecasts

Overall CLO and loan performance have exceeded our expectations, though there are still plenty of headwinds for the market, chief among which is the prospect of further lockdowns and more economic disruption as Europe battles a second wave of COVID-19 cases.

Will The Latest Dip Be Bought?

Overall, in our view there may be some temporary volatility ahead which investors can try to sidestep or even take advantage of, but it’s probably not worth trying to be too cute as our medium term outlook is still constructive.

If Anyone Cuts, It Could Be the ECB

A cut by the Fed or the BoE from here would mean negative rates, while the ECB already has its deposit rate deeply negative at -0.5%.

BoE Buying Dampens Volatility in GBP Credit

The Bank’s ability to dampen market volatility has certainly been a comfort to fixed income investors; over the last month £ IG spreads have moved in a range of just 4bp and ended tighter than they started, which compares rather favourably to the 5% peak-to-trough swing in GBP-USD over the same period.

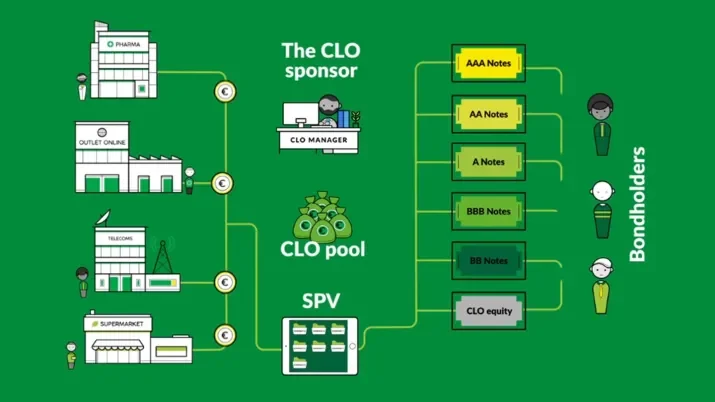

What is a European CLO, and how do they work?

European collateralised loan obligations – or CLOs – are bonds issued to fund a specific and diverse pool of corporate loans to firms of different sizes and in different industries all over Europe.

Do green bonds deliver for fixed income investors?

As with many things ESG related, interest in, and issuance of, green bonds is growing rapidly.

Fixed Income Festival - September 2020

On Wednesday 14th September , TwentyFour Asset Management held its annual investor conference online for the first time.

Do Green Bonds Work for Investors?

Green bonds have seen dramatic growth both in terms of market size and media coverage in recent years. In 2019 we saw $237bn of issuance, a 62% increase on 2018’s $146bn, from a mixture of sovereigns, financials and corporates; and in its wake has come a proliferation of dedicated green bond funds.

The CLO Machine is Slowing Down

There are still plenty of potential bumps in the road (Brexit, the US election, COVID-19 developments and so on) but the positive technical created by dwindling supply has the potential to push spreads tighter in coming months.

Can ABS Close The Gap on Corporate Bonds?

We expect September to be relatively busy with new ABS deals, but there’s a very strong technical developing in favour of ABS and CLOs, which should help performance in the coming months.