After unleashing the strongest combined emergency package we have ever seen in 2020, central banks are now entering perhaps the most challenging phase of their COVID-19 response, trying to balance the economic recovery while at the same time having to reassure the markets they can control the threat of runaway inflation.

Central Banks Get Ready to Talk Tapering

Your Lufthansa Coupon Has Been Delayed, But Not Cancelled

Last week there was a rare occurrence in the high yield market as German airline Lufthansa announced it would be deferring the coupon on a hybrid bond issued in 2015.

What Does US Wage Data Say About Inflation?

From our perspective, the potential wage pressures we see make us uncomfortable with 10-year Treasury yields at current levels, despite their significant rise since the start of the year.

Reaching For The Risk Dial as Valuations Stretch

Having witnessed the most remarkable turnaround in risk markets over the last 14 months, it makes sense to take stock as fundamentals look to us to be approaching optimal levels. Credit spreads have ground into levels not far from the prior cycle’s tights, and while we remain confident in the underlying fundamentals and a good technical backdrop, recent developments mean that despite this constructive view, our risk appetite has ticked down slightly.

Three tips for bond issuers on ESG data

The inexorable growth of sustainable investing during the last decade is likely to continue without interruption given the experience of COVID-19 has only intensified investor and regulatory focus on environmental, social and governance (ESG) issues globally.

Five lessons we've learned from sustainable bond investing

TwentyFour Asset Management launched its first sustainable fund in January 2020 and I would like to share some of the lessons we have learned from our first year of sustainable bond investing.

What’s Really Going On With US Jobs?

At 8.1m, the number of job openings as of March 31 was the highest it has been since the data series began some 20 years ago.

Multi-Sector Bond Q2 2021 Update

In TwentyFour's Multi-Sector Bond update on Thursday 13th May 2021, Partner & Portfolio Manager Eoin Walsh provided an update on investment themes and positioning in the fixed income market.

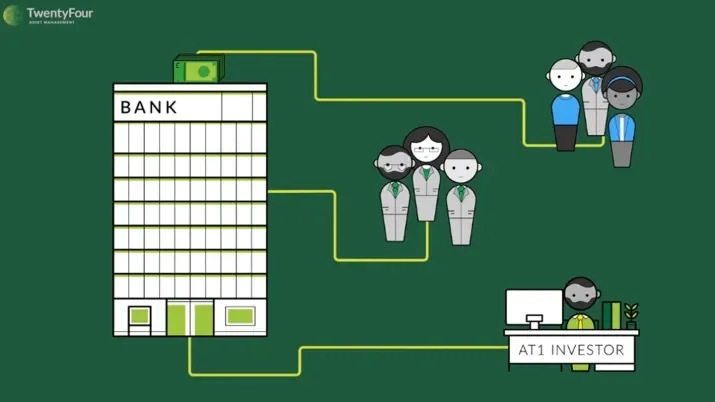

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

Investment Grade Q2 2021 Update

In TwentyFour's Investment Grade update on Wednesday 12th May 2021, Partner and Portfolio Manager Chris Bowie provided an update on investment themes and positioning in the Investment Grade market.

Classic Late-cycle Issuance…in Mid-cycle

Markets can often be tricky for investors in May as bond issuers take advantage of a window of opportunity following the Q1 earnings season and ahead of the typical summer lull. This often results in heavy supply in late April and early May, hence the old trader adage of “sell in May and go away”.

Asset-Backed Securities Q2 2021 Update

In TwentyFour's ABS update on Monday 10th May 2021, Aza Teeuwen provided an update on investment themes and positioning in the ABS market.