Strategic Income – Quarterly update – January 2020

CEO and Portfolio Manager Mark Holman discusses Q4 performance for the Strategic Income strategy and provides his outlook for 2020.

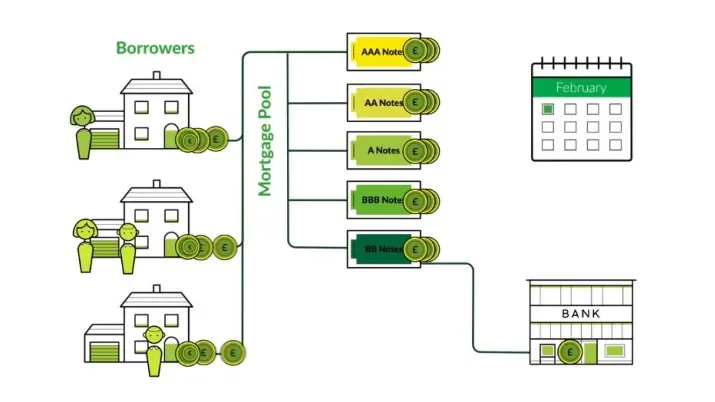

What is an RMBS, and how do they work?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.

Strategic Income – Quarterly update – October 2019

Partner and Portfolio Manager Felipe Villarroel discusses Q3 performance for the Strategic Income strategy and looks forward to the rest of the year.

Asset Backed Securities - Quarterly update - October 2019

Ben Hayward looks at the Q3 performance for Asset Backed Securities and provides an outlook for the year ahead.

Outcome Driven - Quarterly update - October 2019

Chris Bowie looks at the performance of the Outcome Driven strategy over the last quarter and provides his outlook for the rest of 2019.

Strategic Income - Quarterly update - July 2019

Eoin Walsh discusses Q2 performance for the Strategic Income strategy and looks forward to the rest of the year.

Outcome Driven - Quarterly update - July 2019

Chris Bowie looks at the performance of the Outcome Driven strategy over the last quarter and provides his outlook for the rest of 2019

Asset Backed Securities - Quarterly update - July 2019

Ben Hayward looks at the Q2 performance for Asset Backed Securities and provides an outlook for the year ahead.

ABS - Quarterly update - April 2019

Ben Hayward looks at the Q1 performance for Asset Backed Securities and provides an outlook for the year ahead.

Outcome Driven - Quarterly update - April 2019

Chris Bowie looks at the performance of the Outcome Driven strategy over the last quarter and looks forward to the rest of 2019.

Strategic Income - Quarterly update - April 2019

Felipe Villarroel discusses the Strategic Income strategy performance for Q1 and looks forward to the rest of the year.

ABS - Quarterly update - January 2019

In our latest video we hear from Partner and Portfolio Manager Ben Hayward as looks back on the performance of the ABS strategies in 2018 and looks ahead to the coming year.