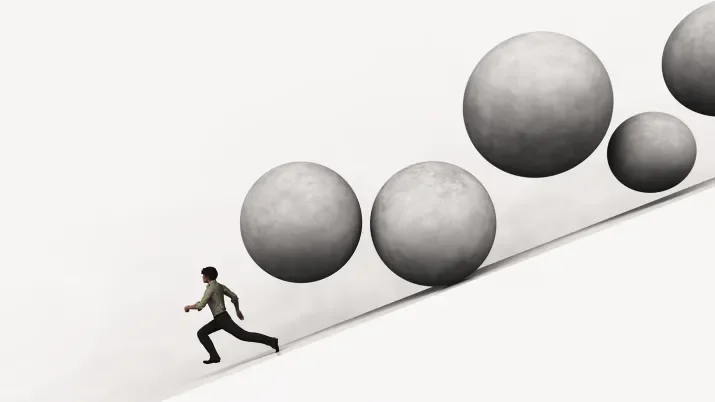

Other Recessionary Indicators

Having discussed the shape of the yield curve as a recessionary indicator already last week, we would like to elaborate on what other indicators we look at as fixed income investors to determine where we are in the economic cycle, which in turn determines how we position ourselves on the yield curve and whether we look to credit risks or government bond risks.

ECB Update On Loan Availability

Following on from Gary’s recent blog Credit Still Being Cycled, this week the ECB released their quarterly Euro Area Bank Lending Survey for the first quarter of 2018, and it paints a slightly different picture to the Bank of England’s report in one area in particular.

Yield Curve Shape and Recessions

The rapidly flattening US Treasury yield curve is prompting a lot of questions about the shape of the curve and it being a good predictor of upcoming recession.

Unreliable Boyfriend Running Late For Dinner

"One day hot, one day cold, and the people on the other side of the message are left not really knowing where they stand."

Q2 Could Be The Best For Risk in 2018

As we now are well into the Q1 earnings season we have been debating how the current quarter could well be the best for risk in 2018.

Credit Still Being Cycled

Yesterday the Bank of England released its quarterly Credit Conditions survey, which as our regular readers know, along with the Fed’s Loan Officer survey and the ECB’s Bank Lending Survey, we consider to be an important indicator on the health of the credit cycle.

Is Portugal expensive, or is Italy cheap?

When valuations in fixed income are this stretched, we must be on the lookout for overbought assets to avoid, and unloved assets offering a rare opportunity to pick up yield.

It’s Still All About The Fed

A lot has been packed into a short week but, despite all the political posturing and rhetoric surrounding trade tariffs, it is still central bank policy that ultimately drives market sentiment and this week we have seen key inputs from leading players at the most important central bank of all, the US Federal Reserve, that have been somewhat overshadowed by more sensationalist news from the political arena.

Looking at all of the Dot Plots

Last Wednesday the Fed raised interest rates in the US for the sixth time since it began this hiking cycle at the end of 2015.

Hammer Time? No it’s Politicians’ Time

On Sunday Lewis Hamilton begins his quest for a 5th Formula One World Championship.

Comparing Yields in Different Currencies

Fixed income managers always want to have the flexibility to find the best value across their investment sphere and therefore need the capacity to buy bonds in different currencies.

Roll Down explained

Several times this year we have discussed the benefits of “roll down” in an environment that for fixed income investing is particularly unfriendly. We believe roll down gains will be one of the best ways to protect portfolios in 2018 from the rising rate curves that we have been experiencing so far.