Slim Premiums a Signal for Caution in High Yield

Over the past few weeks there has been a noticeable increase in high yield new issuance, bringing a welcome flurry of activity to what has so far been a relatively benign year.

Is Bank Tightening Ammo For ECB Stimulus?

The euro area bank lending survey for the second quarter of 2019, released yesterday, suggests European banks are becoming more cautious and beginning to tighten lending criteria to various parts of the economy.

PIC’s RT1: The Brexit Premium in Practice

The UK’s political situation, and in particular the harder Brexit stance of the frontrunner for next prime minister, Boris Johnson, has provided the market with a steady stream of headlines over the past few weeks. As a direct consequence sterling is close to 6% off recent highs and domestic credit spreads have also underperformed their European and US peers.

What Can Q2 Earnings Tell Us About The Fed?

One of the market’s chief obsessions in 2019 has understandably been the shifting stance of the US Federal Reserve in relation to the path for interest rates, with investors now pricing in a 100% chance of a rate cut at the end of this month. Now that the June FOMC minutes, Nonfarm payrolls, Jerome Powell’s testimony to Congress, the June CPI and PPI numbers and the Trump-Xi meeting at the G20 in Osaka are behind us, what is the next set of data that may shed some light on the Fed’s next policy move?

Powell: The Bigger Picture

Yesterday we heard from US Federal Reserve Chairman, Jerome Powell, as he testified at the House Committee on Financial Services. Obviously the main focus for markets was to glean any additional information regarding the future timing and path of the Fed Funds rate. However, as important for fixed income investors as the future path for rates is, listening carefully to central bankers can also provide insight into the bigger picture economic environment. My ears pricked up in particular at two important and related topics Mr Powell discussed.

Bond Market Relief at Change of Lagarde

European bond markets can breathe a sigh of relief this morning as Christine Lagarde is poised to be the new president of the European Central Bank, succeeding Mario Draghi in October.

Dollar Hedging is About to Get Cheaper

As we approach the end of Q2, a time when the price of currency hedging can typically spike, we have been reviewing the likely changes in the so-called ‘costs’ of currency hedging. I use the term so-called as these are not really costs, merely a differential in short term interest rates, which for some investors can be a gain and for others it will be a reduction in the yield or return of an asset.

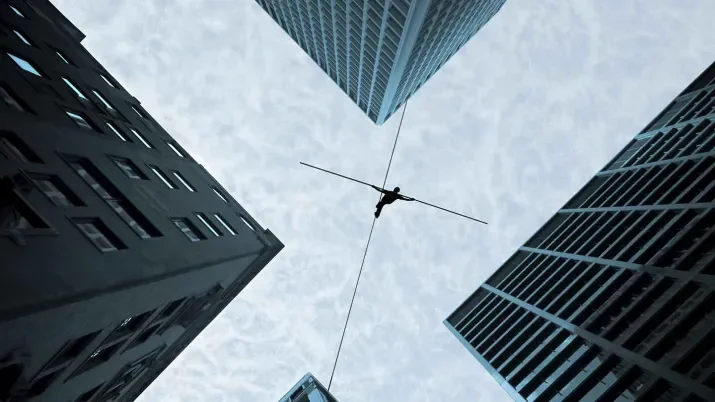

Powell’s Balancing Act

This week Jerome Powell and his fellow FOMC members sit down to determine the Fed Funds rate, and despite the expectation of no move, this meeting is going to be very closely monitored with market participants analysing every word of the subsequent comment.

Due Diligence Critical for New Cohort of ABS Issuers

As we wrote on Friday, one of our biggest takeaways from last week’s Global ABS conference was the growing number of prospective new issuers in the market.

Global ABS 2019: Issuers Out in Force

This week Asset-Backed Securities (ABS) market participants from across the globe gathered for the 23rd annual three-day Global ABS conference in Barcelona. And this year it proved more popular than ever with over 4,000 attendees (a post-crisis record) made up of issuers, arrangers, service providers, traders, analysts, market regulators, the industry press, and of course investors like ourselves. In particular, we felt the number of issuers represented was noticeably higher than we have seen in recent years.

Cashing in on the Brexit Premium

Brexit deliberations are currently at a standstill in the UK parliament, as are negotiations with EU representatives. The next steps in the exit process are clouded in uncertainty, with numerous options on the table. In this environment, it’s no surprise that investors are still demanding a spread premium for sterling denominated credit, over and above comparable euro denominated issues.

What Would it Take For the Fed to Cut?

With markets now pricing in two cuts in the Fed Funds rate this year, and a 97% chance of at least one cut, once again the FOMC members are at odds with the financial markets.