Everything you need to know about CLOs

1) What are CLOs?

Collateralised Loan Obligations, or CLOs, are bond instruments issued to fund a specific pool of loans, typically senior secured or ‘leveraged’ loans, to companies. The bonds are split into tranches that can carry different ratings (and yields) according to how senior they are in the CLO’s capital structure, normally from AAA notes at the top to equity notes at the bottom.

CLOs form part of the asset-backed securities (ABS) market, which includes other securitisations such as residential mortgage-backed securities (RMBS), car loan securitisations (Auto ABS) and credit card receivables, to name just a few.

While European and US CLOs are structurally very similar, there are crucial differences between the two markets, and at TwentyFour, we have historically preferred the risk-reward profile of European CLOs when compared to their US cousins.

In Europe, CLOs represent one of the largest components of the overall ABS market, with around €180bn currently outstanding1.

However, CLOs differ from other ABS in a few important ways. For one thing, CLOs are backed by leveraged loans, which are loans that have been made to companies, rather than the consumer loans that act as collateral in consumer ABS products such as RMBS and Auto ABS. For another, most types of ABS typically invest in assets from a single geography. For example, RMBS bonds are typically backed by a pool of home loans from a single country – not surprising since banks tend to restrict mortgage lending to domestic customers. By contrast, the market for leveraged loans is pan-European, and well diversified by industry type and maturity.

Accordingly, CLOs can spread risk more effectively than if their assets were confined to a single region, and they also represent a more diversified sub-sector of the European ABS market.

2) What is a leveraged loan?

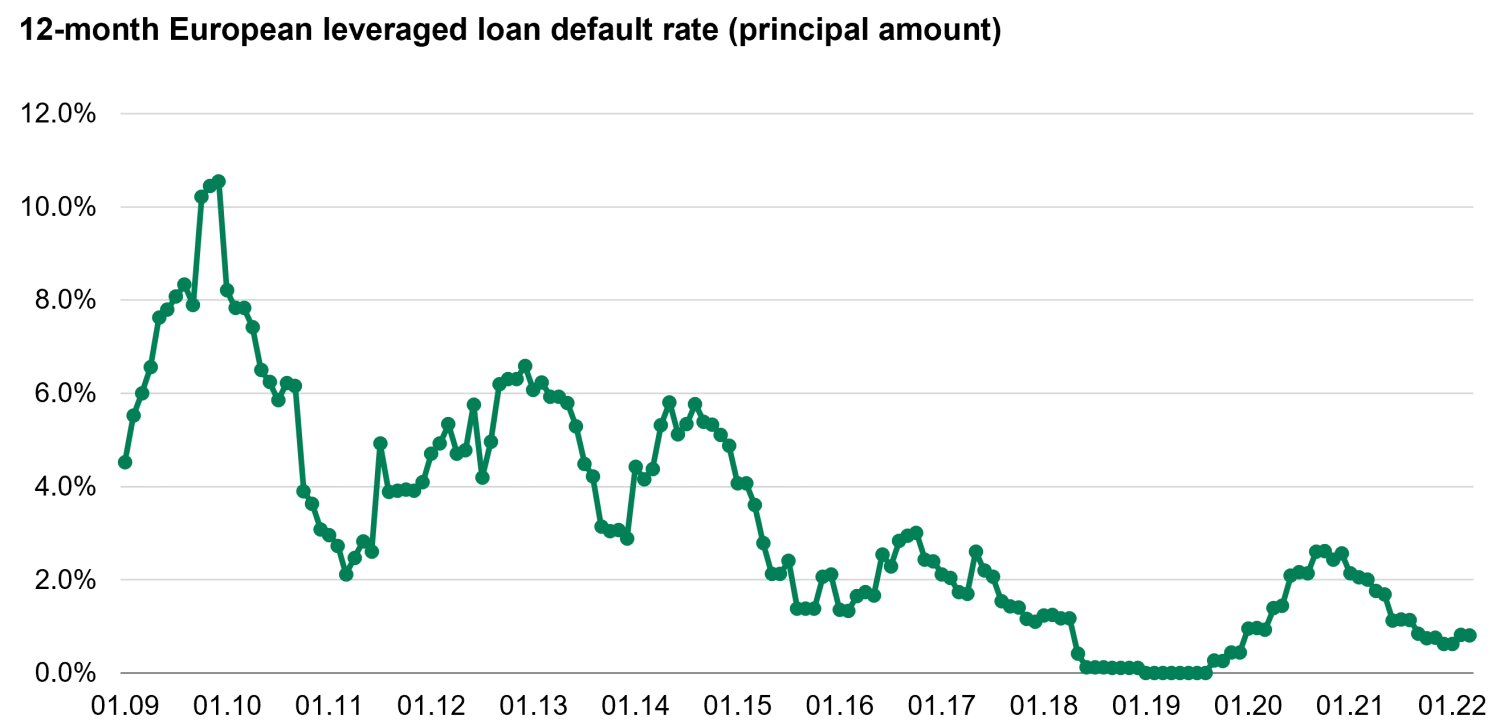

Leveraged loans are essentially loans made to companies rated below investment grade. Leveraged loans can be thought of as the raw material in CLOs; it is the payments on these loans that pay coupons and principal to the CLO’s bondholders. The leveraged loans included in European CLO portfolios are normally ‘senior secured’ loans; as the name suggests, they enjoy the highest claim on a company’s assets in the event of a bankruptcy. Therefore, they are considered the least risky investment in non-investment grade corporates.

A typical loan included in a CLO portfolio generally has a rating between BB+ and B-, possesses a maturity of around five to seven years, and has floating rate interest payments indexed to Libor or Euribor.

3) How are CLOs managed?

CLOs are actively managed by an asset manager. The CLO manager selects a large number of loans from companies of different sizes, geographies and industries to build as diverse a portfolio of corporate loans as possible. The CLO manager can acquire or dispose of loans in an effort to optimise returns, but they are subject to several limitations regarding the asset type, quality and underlying features.

These loans are placed into a special purpose vehicle (SPV) which houses the assets so they can be administered by the CLO manager. The purpose of the SPV for European CLOs is to hold the assets and distribute interest and principal to bondholders. This also means that CLOs, like other types of ABS, are bankruptcy remote and there is no corporate risk on the lender.

Additionally, the SPV provides investors in the CLO with complete transparency, and they can see the exact details of every company in the portfolio, from its credit rating and management to the specific terms of the loan.

As a result, CLO bondholders can continually analyse the companies to which they are exposed and assess the performance of the CLO manager. They can also stress test the portfolio and run adverse scenarios in order to understand what might happen to the CLO’s returns under changing economic and market conditions.

Finally, to align the interests of a CLO sponsor with bondholders, the sponsor is required to retain a 5% minimum economic stake in the CLO.

4) How are CLOs structured?

The pool of loans is the ‘collateral’ for the CLO bonds being issued. Like other forms of ABS, the bonds issued by a CLO are structured into layers, known as tranches, which typically carry different credit ratings, coupons and investor protections based on their position in the structure.

As the loans in the CLO pool pay interest and principal, this pays interest and principal on the bonds, in order of seniority. A typical CLO structure consists of different classes of rated debt; from top to bottom this is usually AAA, AA, A, BBB, BB and B rated bonds and a class of unrated equity.

The AAA note tranche at the top is the first in line for payment, while the equity note tranche at the bottom is the first to suffer any losses, which – on the rare occasion they occur – flow up the layers in the same way as payments feed down (the distribution of cash flows down the capital stack is often referred to as a ‘waterfall’). To compensate holders of the more subordinated debt, the yields offered by each tranche increase as we move down the capital stack.

The equity tranche meanwhile is not rated, and does not have a set coupon. Instead, the equity tranche represents a claim on all excess cash flows once the obligations for each debt tranche have been met.

5) What can CLOs offer investors?

Investors who include CLOs in their fixed income portfolio can benefit from several unique characteristics of the asset class.

Firstly, the floating rate nature of CLO tranches reduces an investor’s exposure to short-term interest rate risk, effectively a hedge against inflation. Moreover, CLO bondholders are also protected from the consequences of rate cuts as Euribor is typically floored at 0%.

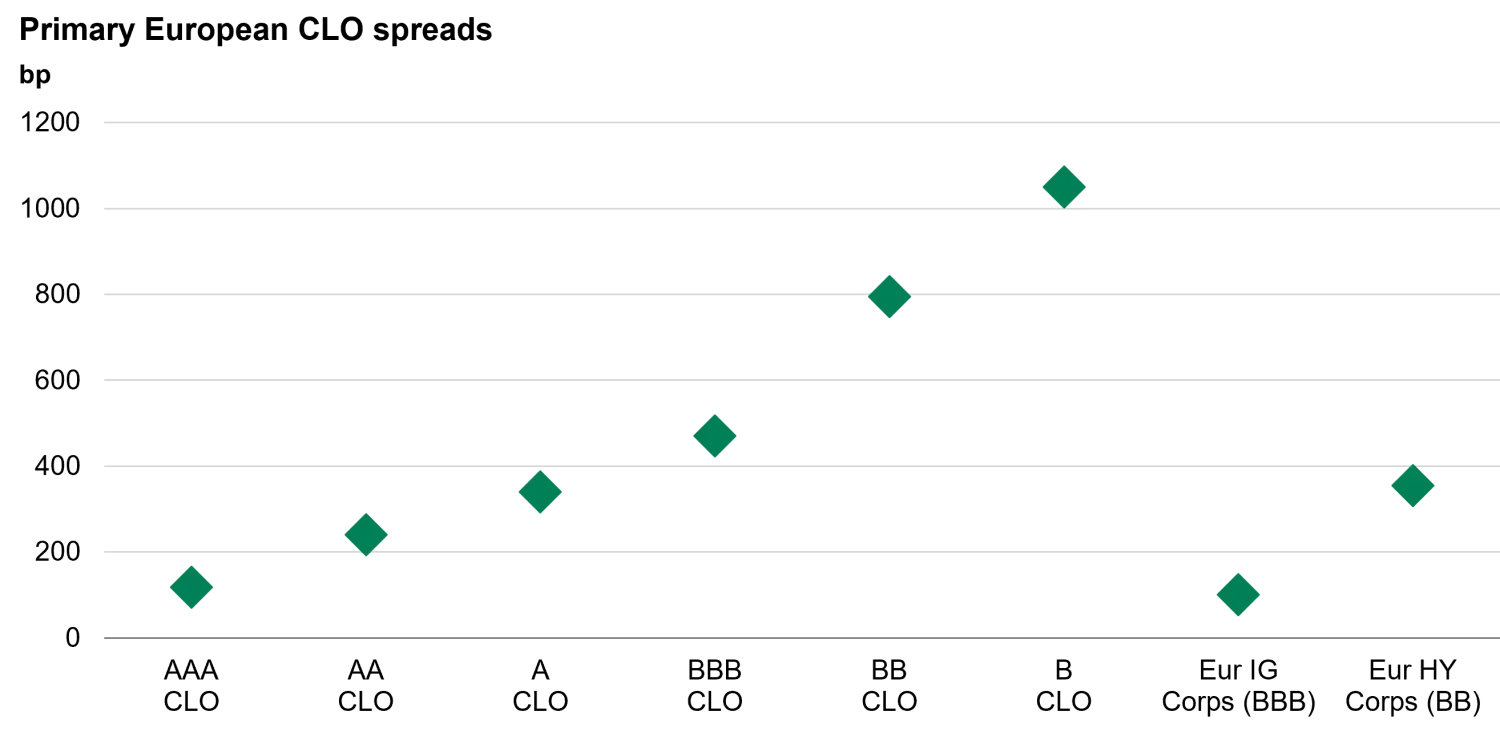

Secondly, the specialism of CLOs as an asset class means they have historically shown a material spread premium over more mainstream corporate bond markets for a given rating, an attractive trait in the increasingly yield starved world of fixed income.

Thirdly, investors holding CLOs obtain a portfolio diversification benefit, with the asset class exhibiting low correlations to investment-grade credit and equities, as well as a historically negative correlation to US Treasuries.

Finally – but perhaps most importantly – CLOs can offer far greater flexibility than regular corporate bonds, particularly when income is scarce and investors are looking to boost portfolio yield. In high yield bonds, an investor looking for more spread would normally have to buy lower rated bonds, which might mean taking exposure to a new company where the investor may not like the credit story. By contrast, all tranches of bonds in a CLO are backed by the same pool of loans, with the same performance data and the same CLO manager – if you like the BBB bonds of a CLO, our experience tells us you are likely to find buying the more junior B notes more comfortable than making the same move down the credit spectrum in high yield.

6) How do CLOs incorporate ESG factors?

In common with most investment products, burgeoning client demand and regulatory impetus has propelled environmental, social and governance factors to the fore of CLO markets. While the overall ESG journey for CLOs might be in its infancy, the trend is undeniable and CLO managers are adapting investment practices to factor ESG considerations in their investment decisions.

Accordingly, negative screening remains the most common mechanism utilised by ESG-conscious CLO managers, with restrictions precluding managers from investing in loans from firms engaged in specific sectors, such as tobacco, arms manufacturers and fossil fuels a common feature. According to Moody's, ESG exclusion criteria were present in 85% of EU CLOs issued since 2020. The list of exclusion is not standardised yet however more CLOs are coming with assets compliant to the UNGC principles.

That said, other approaches to ESG incorporation are becoming more common. Indeed in recent months, several well-known issuers brought ESG securitisations to market containing ESG-compliant assets and covenants referencing the UN’s Sustainable Development Goals. Furthermore, the European Leveraged Finance Association (ELFA) and Loan Market Association (LMA) have recently published best practice guides on ESG provisions in loan agreements pushing the loan market towards enhanced disclosure and standardisation.

Lastly, in addition to negative screening, some CLO managers have recently gone a step further and introduced internal scoring methodologies in order to create positive screening.

European CLOs by numbers

+ How big is the market?

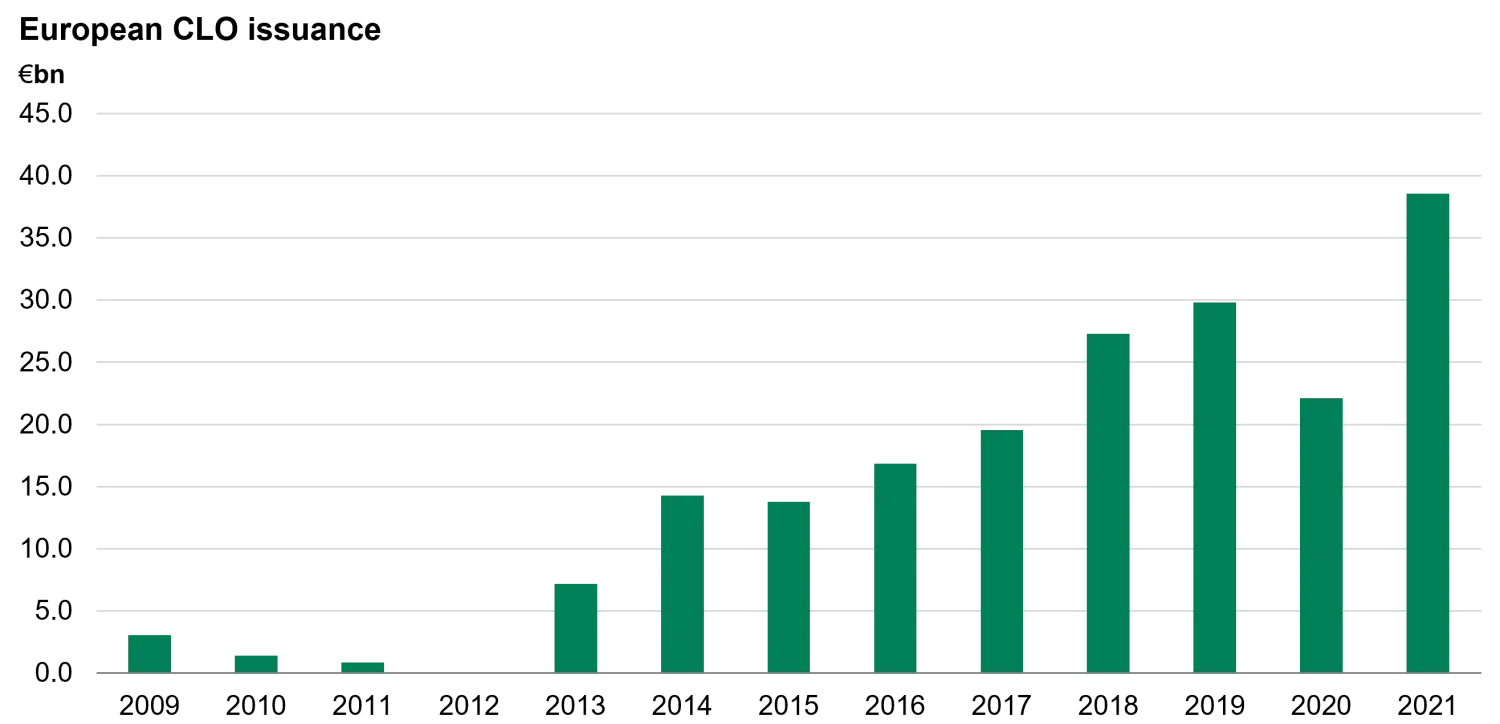

+ How active is the primary market?

+ What kind of spreads do CLOs offer?

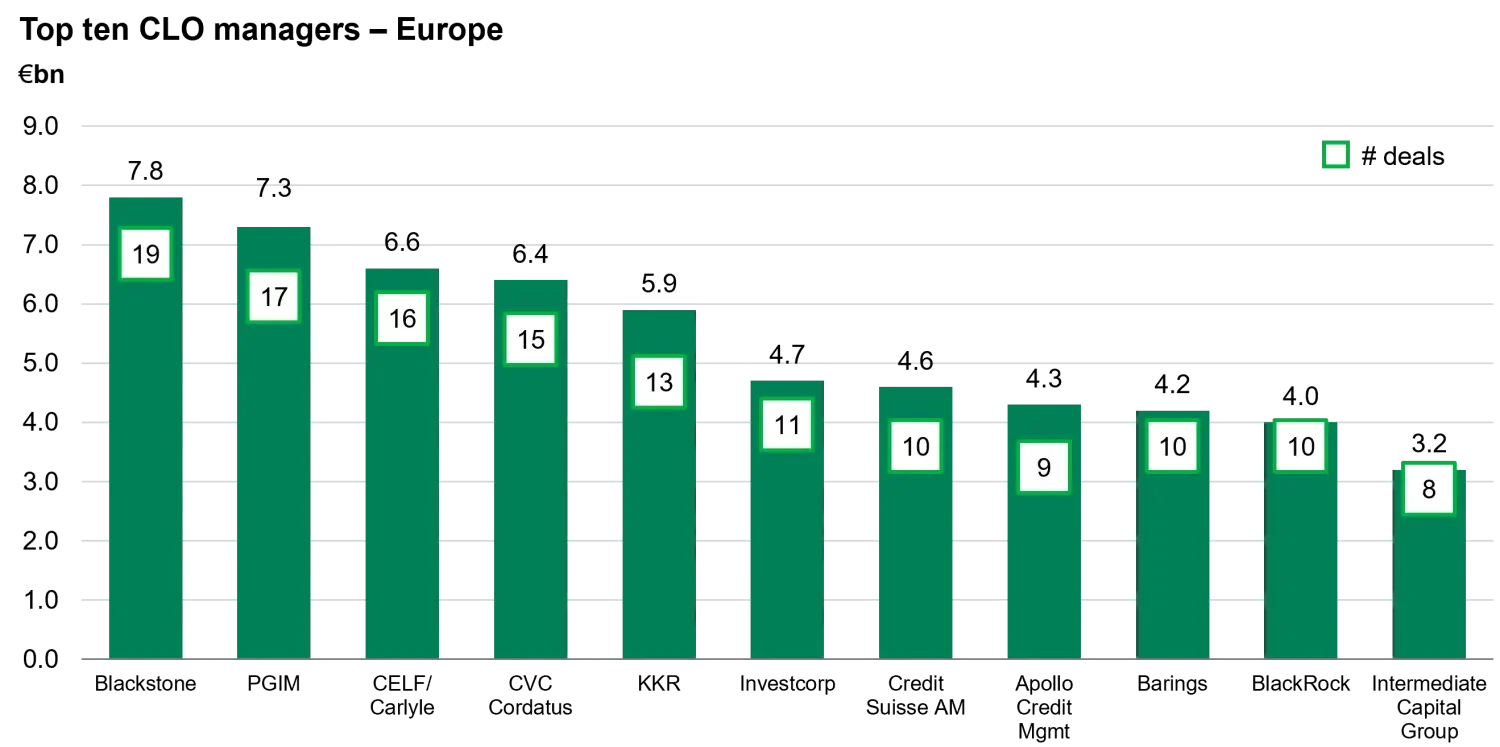

+ Who are the biggest CLO managers?

+ Which are the most-held loans in CLOs?

+ What is the leveraged loan default rate?

The lifecycle of a CLO

There are several specific phases in the lifecycle of a CLO.

The first is known as the warehouse period, which typically lasts several months. During the warehouse period the CLO managers will buy the loans needed to construct a portfolio, delving into the market where the manager sees opportunity.

The next phase is the ramp-up period. The ramp-up period lasts a further six months and the manager will use this time to make further purchases. Once the manager finishes acquiring new assets, the CLO will become live and the CLO manager will shift their attention from building the portfolio to its management.

The CLO then enters its reinvestment period. At this stage, the CLO manager is permitted to trade the portfolio actively and reinvestment using principal cash flows is permitted. The reinvestment period can last up to five years and the manager’s goal is to maximise the performance of the portfolio.

The non-call period begins at the same time as the reinvestment period. During this phase typically lasting between six months to two years, the manager cannot refinance any outstanding CLO note. Afterwards, the majority of equity noteholders have the right to refinance any outstanding notes.

Finally, the CLO enters the amortisation period, if not refinanced yet. As suggested by its name, the CLO manager cannot reinvest any principal cash flows. Rather, the cash flows are used to paydown the outstanding CLO notes.

At the end of the amortisation period a CLO is considered successful (in common with all fixed income investments) if its investors have received the value of their initial investment and the promised interest payments.

1Morgan Stanley, March 2022